Summary:

- Last November, I found Pfizer cheaply valued, but I failed to identify a catalyst that could drive PFE stock higher in the foreseeable future.

- Pfizer’s priorities are changing today, with the CEO pledging to cut back on large-scale investments to focus on profitability improvements.

- Speaking at the J.P. Morgan Healthcare Conference last week, CEO Bourla acknowledged the company’s underperformance in 2023 and introduced 4 priorities for the business in 2024.

- Pfizer has avoided share buybacks since 2022, but a resumption in buybacks may be closer than many investors believe.

- Pfizer has potential blockbuster drugs in its pipeline and benefits from scale advantages.

Michael M. Santiago

It’s one thing to find a cheaply valued company and another thing to identify a lucrative investment opportunity. Pfizer Inc. (PFE) has been cheap for some time now, with the pharmaceutical giant suffering from lackluster growth in the post-pandemic era with the positive financial impact of Comirnaty and Paxlovid waning. Last November, I found Pfizer cheaply valued, but I failed to identify a catalyst that could drive PFE stock higher in the foreseeable future.

In my previous article, after digesting the reasons behind PFE stock’s lackluster recent performance and the long-term outlook for the company, I concluded:

Given that Pfizer’s revenue is continuing to fall off a cliff and that its core businesses, until recently, did not outperform market expectations, I believe Mr. Market’s reaction is justifiable. I am not saying Pfizer stock will indefinitely trade at these levels, though. The company’s recent performance, as discussed in the next segment, highlights how the core business is now trending in the right direction.

The only thing that stopped me from pulling the trigger back in November was the lack of a catalyst. I looked for a catalyst in the form of positive earnings revision trends, only to find that earnings revisions have been trending lower since April 2022. Not a good sign. Even today, earnings revisions are still trending lower – 20 negative revisions for Fiscal 2023 estimates against zero upward revisions in the last 90 days – but I believe the chances of Pfizer authorizing a share buyback program is high, which will act as a catalyst driving the stock price higher.

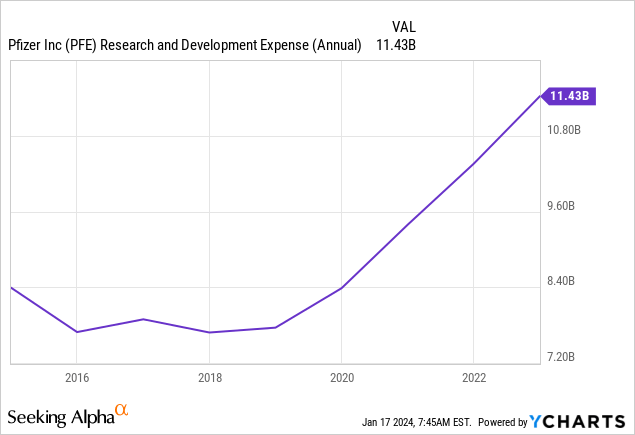

The Case For Buybacks Is Getting Stronger

Pfizer last repurchased shares in early 2022 when the company spent $2 billion on share buybacks. The company has been aggressively spending its massive cash windfall coming from Covid vaccine sales on acquisitions and R&D efforts to secure long-term earnings growth. Notable M&A deals include the $43 billion acquisition of Seagen to expand cancer research and the $11.6 billion acquisition of Biohaven to focus on calcitonin gene-related peptide receptor antagonists. R&D expenses, as illustrated below, have ballooned in recent years with Pfizer spending its massive cash pile on new drug research and development.

Exhibit 1: Pfizer’s annual R&D expenditure

As we step into 2024, Pfizer is increasingly focusing on reducing its cost base while successfully integrating recently acquired companies into its business. CEO Albert Bourla has clearly defined the company’s goals for 2024, which revolve around improving the company’s efficiency, making the most of recent investments without committing to any substantial new investments, and reducing the debt burden.

Speaking at the J.P. Morgan Healthcare Conference last week, CEO Bourla acknowledged the company’s underperformance in 2023 and introduced 4 priorities for the business in 2024.

- Integrating Seagen into Pfizer’s business.

- Maximizing the performance of new products launched recently (a record number of products were launched in 2023).

- Improving the operating margins by adjusting the cost base (a $4 billion cost base program has already been announced).

- Implementing a shareholder-friendly capital allocation decision framework.

Elaborating further on capital allocation decisions, Albert Bourla highlighted the importance of growing the dividend, de-levering, investing for the business, and buying back shares with excess capital.

Investing in the business is something Pfizer has done at an accelerated pace in the last couple of years, which suggests the stage is set for the company to focus on share buybacks. CEO Albert Bourla acknowledged this during the J.P. Morgan Healthcare Conference and said:

Our capital allocation will continue being investor-friendly capital allocation going forward. #1 priority for capital allocation, it is growing dividend. Sacred cow, that will not change. Number 2 priority, it is to delever. We are going to pay back a lot of this debt in the next 1 and 2 years. Number 3 priority, it is to allocate after we do those 2 things, the business between growing the business and buying back shares. And of course, the first periods of my tenure was always we didn’t buy back shares, was investing in the business. This is what needed to be done so that we can cover the gap of the LOEs. Now we have done it, and we are moving. So in essence, you should expect 2024, after all the changes in the setup that we did in year ’23, to be a year of execution

The CEO, in my opinion, is clearly hinting at the possibility of initiating a buyback program this year. Pfizer ended the last quarter with more than $44 billion in cash and short-term investments against long-term total debt of $62 billion. Although the debt burden seems scary, we need to remember that Pfizer has always been a cash cow. In the last 12 months alone, the company brought in more than $12 billion in operating cash flows.

Turnaround Prospects Are Not Grim

In my previous article, I discussed the company’s business and pipeline in detail. The objective of this article is to discuss the improving odds of share buybacks this year. However, I feel obliged to add some color to the company’s prospects.

The guidance for 2024 disappointed investors last month when the company announced expectations for $8 billion in Covid-related revenue, substantially below the expectations on Wall Street. Disappointing clinical data for danuglipron, Pfizer’s obesity drug, also dampened market sentiment last month with the company reporting 73% of trial participants suffering from nausea after taking the drug, which makes Pfizer’s obesity drug significantly less competitive in the market.

Amid all these negative developments, I find Pfizer attractive for a few reasons.

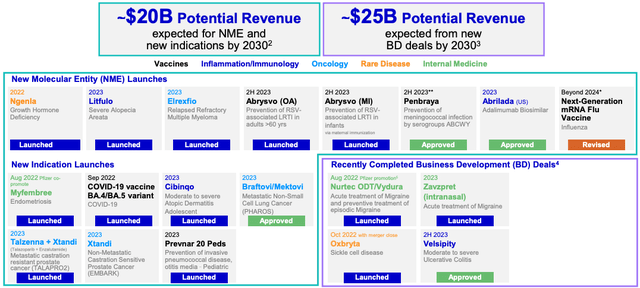

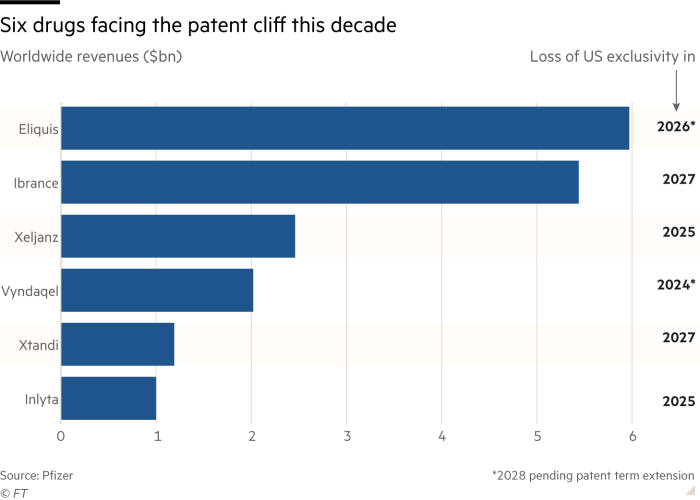

First, I believe Pfizer has a few potential blockbuster drugs in its pipeline. These include marstacimab for Hemophilia, ABRYSVO for the prevention of RSV in infants, and Elrexfio for multiple myeloma. Investors may want to keep a close eye on the upcoming patent expiries in the U.S. but I believe Pfizer is well on track to replacing some of the lost revenue from these patent expiries through the success of a few blockbuster drugs in its pipeline.

Exhibit 2: Upcoming patent expiries

Financial Times

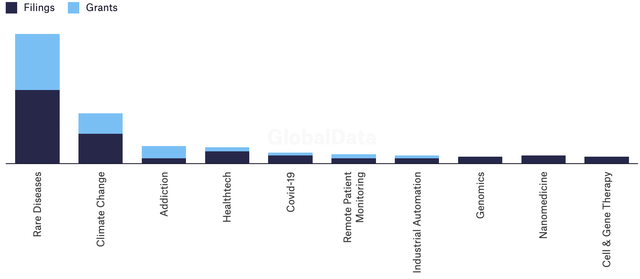

Second, I believe Pfizer benefits from scale advantages which allow the company to take many shots at the goal – a luxury many biotech companies do not enjoy. The company is well-capitalized and has a good track record of making the most of strategic acquisitions. I expect these scale advantages to help Pfizer remain ahead of many of its peers in the coming years, given that 2023 saw a record number of patent applications for new drugs and treatments.

Exhibit 3: Pfizer’s patent filings and grants by theme

Third, I suspect Pfizer’s expectations for 2024 are a bit too conservative, which is understandable as the company is coming out from a major fallout resulting from its inability to meet lofty expectations in 2023. Answering a question about expectations for Covid vaccine sales this year at the JPMorgan conference last week, CEO Bourla said:

I cannot say how it stacks internal or external expectations, but it is a guidance that we think is very reliable, very achievable and clearly will be the base case. We did speak about COVID and we spoke that we don’t think that the utilization of COVID products should be different this year in ’24 than last year. Those people that they did get a vaccine in year ’23 were people that despite the fact that there was COVID fatigue or there was anti-vax rhetoric, et cetera. They feel that there is a need, the value to vaccination. So those people will do it also, again, if not more, right, next year. Our guidance doesn’t assume that all of them will do it. It’s more conservative.

Going by recent vaccination trends and new cases of Covid-19, I believe Pfizer is on track to top the expectations for $8 billion in Covid-related revenue this year. A positive surprise should help PFE stock.

Exhibit 4: Pipeline update

Overall, I believe Pfizer is a well-managed business with the potential to win approval for several blockbuster drugs in the next 5 years. This, coupled with the improving prospects for shareholder wealth distribution in the coming years, makes Pfizer a very attractive bet at a forward P/E of 18 and a dividend yield of 6%.

The CEO Bets Big On Pfizer

Pfizer CEO Albert Bourla is putting money where his mouth is. Not only is he advocating that Pfizer is a great business with impressive turnaround prospects, but he is also betting on this outcome. Speaking to Barron’s, CEO Bourla said:

All my pension I put into Pfizer stock. I’m all in.

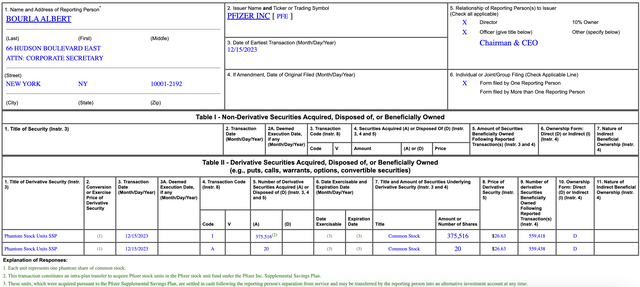

He is referring to an intra-plan transfer in his Supplemental Savings Plan pension in December for 375,536 units of phantom stock that will be settled in cash at a price of $26.63 when he leaves the company (total value of around $10 million).

Exhibit 5: Albert Bourla’s derivative transaction

Pfizer CEO’s recent transaction is an encouraging move for long-term shareholders. Under normal circumstances, I prefer investing in companies in which the management holds a meaningful stake as it helps to align shareholder interests with those of managers.

Takeaway

Pfizer has been cheaply valued for some time now, but the market has lacked a catalyst to drive the stock price higher. If Pfizer authorizes a share buyback program later this year to return excess capital to shareholders, it will prove to be a catalyst for the stock. After waiting on the sidelines for over a year, I have decided to slowly accumulate some PFE stock with a long-term investment perspective.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!