Summary:

- Tesla has cut prices of the Model 3 and Model Y in China, due to demand issues, which is negative for its gross margin.

- Pressure on gross margins is more structural than cyclical, impacting negatively its valuation.

- While its shares are no longer overvalued, there isn’t no margin of safety at current levels.

Xiaolu Chu

Tesla (NASDAQ:TSLA) is currently fairly valued after its share price correction suffered in recent months, but to become a buyer, a margin of safety is required and further downside may exist if gross margin continues to decrease over the coming quarters.

As I’ve covered in previous articles, I’m not particularly bullish on Tesla over the long term as its valuation seems to be too high taking into account the company’s operating struggles over recent years, with many delays regarding the release of new products, intensifying competition, and questionable technological leadership in autonomous driving.

More recently, there has been speculation that Tesla is facing some demand issues, which creates more doubts about its long-term growth path. As I’ve not covered Tesla for some months now, I think it is a good time to revisit its investment case, to see if the share price correction in recent months makes Tesla a more interesting growth play right now or not.

Supply-Demand Situation

While Tesla’s growth history is quite good and still has strong growth prospects ahead, as the company’s size becomes larger, it is more difficult to maintain its historical growth rates. Measured by units sold, Tesla’s growth in the past couple of years has been outstanding, as new factories in China, Texas and Germany enabled it to achieve much higher production levels.

In 2021, Tesla delivered slightly more than 900,000 cars, representing an increase of 81% YoY, which is much higher than its annual target of around 50% YoY. For 2022, Tesla’s guidance was to deliver some 1.5 million units, but during the first nine months of this year it only delivered 908,000 units, thus it’s likely to miss its target and deliver between 1.2-1.3 million units during 2022. At the top of this range, this represents annual growth of 45% YoY, still a very good outcome, but going forward I think Tesla is much likely to revise downwards its annual growth target.

If the company reaches some 1.3 million units delivered this year, 50% annual growth means 1.96 million in 2023, 2.94 million in 2024, and 4.4 million by 2025. This seems very unlikely, as the company has increased annual deliveries by some 400,000 units in the past couple of years, and is not likely to increase its production capacity so rapidly in the coming two years.

Moreover, a lower annual delivery target should also happen for two other reasons: first, demand is not as strong as the company was expecting in the recent past; and second, due to supply constraints.

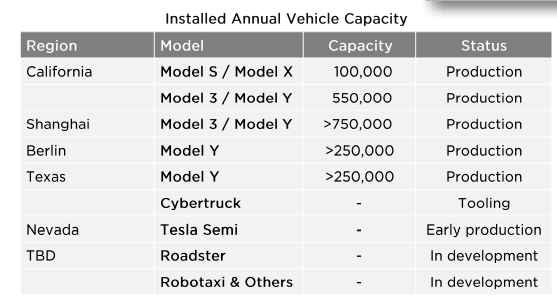

On the supply side, Tesla is somewhat constrained on its production capacity both due to some cyclical issues, such as supply chain bottlenecks, but also due to some structural issues. According to its latest quarterly report, its current annual vehicle production capacity is about 1.9 million units, but for instance, Tesla has not been able to ramp up production in Berlin and is only producing some 3,000 Model Ys per week. At this pace, it can make 156,000 units per year, way below its theoretical capacity of 250,000 units.

Production capacity (Tesla)

Moreover, the company is also facing some hurdles to expand the factory in Germany, thus it is likely that the factory will take some time to reach its planned capacity of 500,000 units per year, and will be even more difficult to reach 1 million units as Tesla desires in the future. This means that to maintain an annual volume growth of about 50%, Tesla needs new factories as the current ones aren’t likely to produce more than 2-2.5 million units over the next two to three years.

Indeed, there has been recent speculation that Tesla could announce in the short term a new factory in Mexico, in an investment that could reach about $1 billion. As factories take some two years to build, this would add capacity by 2025, but it doesn’t seem to be enough to reach 4.4 million units. Thus, Tesla is quite likely to lower its annual volume growth guidance in the next few months to a more reasonable target.

Beyond supply constraints, Tesla is reportedly also facing some demand issues, particularly in China, which has been an important growth engine for the company in the recent past. As I said in my last article, Tesla is right now in a key moment of its business development, which is to move from a ‘niche’ manufacturer to a mass-market carmaker. As the company has now four large factories in operation, its production capacity is now good enough to make it a relatively large carmaker, if demand is there for its products.

However, competition is rapidly increasing in the EV industry, making it more difficult for Tesla to maintain its historical growth path. Indeed, the company has recently cut prices for its Model 3 and Y by some 5-9% in China, as demand has been soft, and reportedly is cutting production by 30% of the Model Y in Shanghai. Given that Tesla has been ramping up production in China and Europe in recent months, these are very bad signs that demand is not that strong, at least at its current price points.

Moreover, this is not just an issue in China, given that in Europe the demand doesn’t seem to be that strong either. As I’m based in Portugal, I’ve compared the waiting times for delivery of a Volkswagen (OTCPK:VWAGY) ID.4 with a Model Y. Investors should note that usually the waiting time for car delivery in the auto industry, during normal times, is between two to four months. Due to the chip shortage, waiting times have increased a lot, and on VW’s website the expected waiting time for the ID.4, to be delivered in Portugal, is currently around ten months.

On the other hand, as can be seen in the next graph, the current expected delivery for the Model Y in Portugal is less than two months, which is a signal that Tesla’s order backlog for the Model Y in Europe (note that Gigafactory Berlin is only producing the Model Y) is not that long.

Model Y – Portuguese website (Tesla)

Valuation

This supply-demand backdrop has serious implications for Tesla’s valuation, both from expected growth ahead and also on its business margins. Note that in my last article on Tesla, my price target (pre-split) was $576 per share, or $192 per share after the share split back in May.

Considering that Tesla has recently cut the price of the Model 3 and Model Y in China, this will have a negative impact on its automotive gross margin, especially during an inflationary period that is leading to higher raw materials prices. This pressure on gross margins was already visible in the past two quarters, given that gross margin declined to 27.9% (vs. 32.9% in Q1 2022). Its overall gross margin was 25.1% in Q3 2022, a decline of 150 basis points compared to Q3 2021.

Despite this negative trend in recent quarters, the current consensus is expecting a rebound on gross margin over the coming quarters, which seems to be questionable. While Tesla is ramping up production in Berlin and Texas and can achieve efficiency gains, higher raw materials and price cuts in China should offset to a large extent those gains. And therefore, I’m not expecting much gross margin improvement in the short term.

Investors should note that Tesla’s automotive gross margin is higher than the overall gross margin because the energy segment continues to lose money, a trend that is not expected to change in the near future.

Moreover, when comparing Tesla’s automotive gross margin with other premium carmakers, such as BMW (OTCPK:BMWYY), Mercedes (OTCPK:MBGYY) or Volkswagen, Tesla has a much higher gross margin (close to 30% vs. between 15-20% for German competitors), which was possible because Tesla had a somewhat limited production capacity that led to pricing power. As the company has increased significantly its production capacity, it’s likely that pricing power will decrease going forward and Tesla may cut even further its prices to be competitive in China and Europe, leading to a decreasing gross margin in the coming years.

Therefore, in my earnings model, I’m more bearish than current consensus, which expects gross margin to be between 26.9%-28% during 2023-25, and I’m forecasting gross margin to be 25% this year and decline to 24% in 2023 and 23.6% by 2024. After that, I’m assuming that gross margin will be somewhat stable between 23 and 24% until 2031.

Regarding unit sales, as I’ve discussed previously, I don’t think that Tesla will be able to deliver its 50% annual growth target (note that it will much likely miss this target already this year). Thus, I’m assuming that Tesla can increase its annual deliveries in absolute terms, by close to 700K units during 2023-31, which is much higher than its increase of 400K both in 2021 and expected in 2022. This means that Tesla’s annual volume growth will gradually decline from 40% YoY in 2023, to a much more reasonable 10% YoY by 2030, to some 7.4 million units delivered by 2031. Note that Tesla is expected to deliver around 1.3 million units in 2022 (in my previous analysis I was expecting 1.5 million). Thus, this assumption implies almost 6x higher deliveries in nine years, which seems to be a somewhat aggressive expectation for a premium carmaker.

Based on these volume estimates and an average revenue per car that should be relatively stable over the next two to three years, but eventually decline in a gradual pace if Tesla starts to sell a cheaper car by 2025/26, my revenue estimate for 2025 is about $184 billion, while current consensus expects only $165 billion.

Regarding operating expenses, Tesla has a very good track record on cost control, even though it will continue to invest on R&D, sales and marketing and repair services, but operating expenses are likely to grow at a much slower pace than revenues. Indeed, in Q3 2022, operating expenses only increased by 2% YoY, and reportedly Tesla is planning a hiring freeze and some layoffs in 2023. Thus, operating expenses aren’t likely to increase much in the near future.

My estimate regarding Tesla’s operating margin is to improve gradually from 12% in 2021 to 17% by 2025, which implies an operating profit of $30.8 billion. This is slightly below current consensus ($33 billion), as I’m now more bearish on business margins than I was some months ago.

Nevertheless, Tesla is expected to have positive operating leverage during the next few years, which is usual in the auto industry due to high fixed costs, thus higher volumes should lead to improved operating efficiency as the company ramps up production, both at Texas and Berlin. On the bottom-line, I expect Tesla to report a net profit of $26.8 billion by 2025, leading to a net profit margin of 14.5% vs. 10.3% in 2021.

Based on my earnings model, I use the Discounted Cash Flow (DCF) valuation model to value Tesla’s share, which only requires some more assumptions regarding working capital and capital expenditures (capex).

I assume that working capital will not be much significant, as the company has shown in the past that it has good logistics, as the number of units produced and delivered each year is quite close, and its inventory levels are usually quite low (only eight days of inventory at the end of Q3 2022), thus the remaining key variable to estimate is capex.

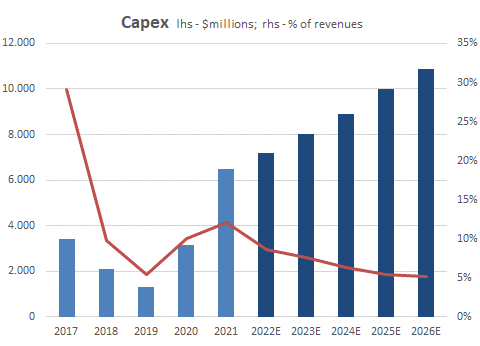

Tesla is currently spending about $1.7-1.8 billion per quarter on capex, which leads to annual capex of around $7.2 billion, or 8.7% of its expected 2022 revenue. To maintain strong volume growth in the coming years, Tesla will certainly continue to invest significantly on factories (expanding existing and building new ones), thus capex should remain quite high for many years.

For capex, I’ll use current consensus estimates, which are expecting Tesla to gradually increase capex to $10.8 billion by 2026, even though as a percentage of revenue its weight is expected to gradually decline as the company’s revenue stream increase more rapidly than capex, to a weight on revenue below 5% by 2026.

Capex (Author calculations)

Taking all these estimates into consideration, my free cash flow estimate is $9.3 billion in 2022, in line with consensus, and to grow gradually to about $28 billion by 2025. While in my previous article, Tesla’s enterprise value was close to $800 billion, it is currently just at about $420 billion. This means that while previously its free cash flow yield was just 1.5%, it is now 2.2% based on FCF expected in 2022. Based on my estimate for FCF by 2025, its FCF yield is now 6.75%, which is much more acceptable than before.

Other important variables for the DCF model are the beta, which I use the historical beta for the past five years (1.45) based on Bloomberg data, an equity risk premium of 5.5%, and a risk-free rate of 4%. This leads to a cost of equity of 12%. For the terminal value, I assume a growth rate of 4%, which is higher than usual.

Using these assumptions, my current fair value estimate for Tesla’s equity value (including cash) is around $436 billion, or $138 per share, which means that Tesla is currently fairly valued. Note that my valuation decreased by some 28% from the previous one, mainly due to lower business margins and slightly higher capex estimates, as most of the other key variables were more or less stable.

Conclusion

Tesla’s share price has declined by some 45% since my last article back in April, when I said the company was overvalued and assigned a ‘sell’ rating. Thus, its share price correction in recent months was clearly justified, but its shares are no longer trading above its intrinsic value.

However, I see its gross margin development in the next few quarters as key to its valuation and further weakness in this metric may be a worrying sign that may lead to a lower valuation in the near future. Therefore, I think Tesla is a ‘hold’ right now, and to buy its shares I would need some margin of safety, which means its share price would need to be 10-20% its current level for me to become a buyer.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments / FinTech, Semiconductors, 5G / IoT / Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.