Summary:

- Nvidia Corporation is a great company, leading the way in chips to support the booming gaming industry and generative AI.

- The true value of this future, especially AI, is very unclear.

- Following Peter Lynch’s lessons on investing, we see that we can still lose money on fast-growing companies.

IvelinRadkov

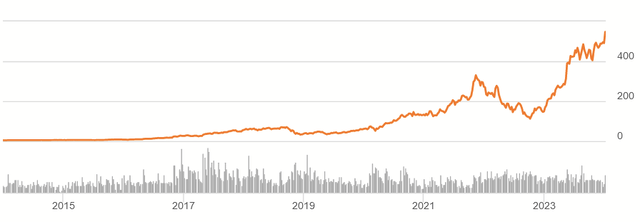

Shares of Nvidia Corporation (NASDAQ:NVDA) have been a much-loved investment for the last few years. When one looks at the historical chart, it’s not hard to see why.

Seeking Alpha

If you bought a decade ago, you ended up with the rare 100-bagger. Folks who bought more recently than that have still seen attractive returns, particularly as excitement about the company’s future brings the share price to new highs. While earnings have grown rapidly to justify some of this, there is still a limit on how much cash Nvidia as a company is capable of generating.

I will review the company’s financials and make the case the company is priced for the full upside and not anything less than that. I’ll also draw on wisdom from the famed Peter Lynch as I explore these thoughts. Ultimately, this will show why the stock is better off being sold until it can return to a more modest valuation.

Valuation

Let me start in reverse order, so that we can work back from what the market is pricing and break it down. What kind of assumptions are baked into that near-$1.4 trillion market cap?

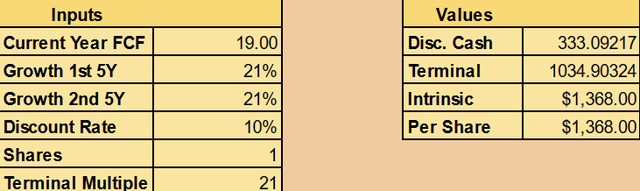

With the company’s Q3 results putting YTD free cash flow (“FCF”) over $15 billion, it seems reasonable to guess that annual FCF is currently around $19 billion.

Author’s calculation

From my Discounted Cash Flow (“DCF”) calculation, the recent market cap is implying that FCF will grow at a rate of about 21% each year for the next decade, with a high multiple of market eagerness at the end of that road as well.

Author’s calculation

Stripping it of the effect of discounting, we can see that such growth implies that Nvidia would be capable of producing about $128 billion in FCF by 2033 and a decade-long sum of about $627b.

Compare that to larger tech companies like Microsoft (MSFT), Alphabet/Google (GOOG), or Apple (AAPL). They don’t currently exceed even $100b in free cash flow. In general, even really good mega caps run into the problem finding a ceiling on their growth. Is it possible for a company with the growth assumptions of NVDA to deliver?

Reviewing the Growth

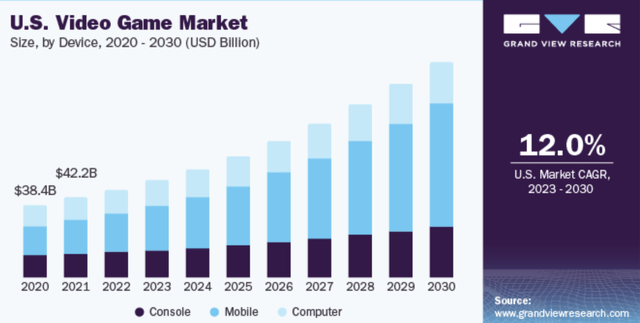

Nvidia’s bread and butter was making GPUs and riding the growth of the gaming industry. This growth was not just one of demand for better chips over time. More and more people started playing video games in society. Similarly, more time got spent on video games. Streaming communities flowered over the past decade, and this was fertile soil for the company to thrive. Grand View Research expects this to continue throughout the decade. The World Economic Forum agrees.

Grand View Research

I also think that anyone who is a gamer can just tell this is happening and not about to stop. That is certainly a case for durable cash flow for Nvidia, and even continued growth.

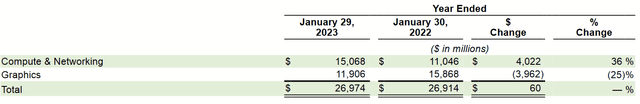

2022 Form 10K

Of course, as we saw between 2021’s and 2022’s results, a larger and larger share of the company’s revenues isn’t just on its graphics cards. It’s been widening its net. The main thing on investor minds today is how their GPUs are well positioned to support the rise of generative AI as an industry going forward, which is part of this growth narrative that drives the stock up.

Potential Dependencies and Liabilities

As Nvidia branches out, I wonder if some of this growth depends on other companies. In early 2022, CEO Jensen Huang indicated that he was open to using Intel (INTC) to manufacture their chips as an alternative/in addition to Taiwan Semiconductor (TSM). Just last fall, they announced plans to make Arm-based chips to run on Windows by 2025.

Nvidia’s relationship with other companies in these spaces is in a constant tug-and-pull between competition and partnership. After all, part of the fervor behind Nvidia’s and Advanced Micro Devices’ (AMD) bull runs has been their David-and-Goliath standing in relation to Intel. Throughout the company’s long history, it’s not always been on friendly terms with other tech giants.

In the ’90s, Microsoft (MSFT) put Nvidia under peril when it refused to support the NV1. In 2008, it had to settle with users of Apple (AAPL), Dell (DELL), and Hewlett Packard. In 2011, Nvidia won a $1.5 billion lawsuit against Intel. More recently, it’s been sued for stealing trade secrets by Valeo (OTCPK:VLEEF).

My point here is that ambitious growth in a competitive area puts a target on a company’s back. The more successful that business, the more it is seen as a Goliath and, therefore, a legitimate target. Even if it doesn’t get sued, relationships needed to make deals happen can become strained, more expensive, or fall apart.

The Unclear Future of Generative AI

More recently, NVDA has risen as investors get excited about the possibilities of generative AI. Much of 2023’s rally seems to have been influenced by the release of GPT-4 that March and Nvidia’s strategic efforts to ride the wave of AI. As fascinating as the technology is, we don’t yet know its full economic potential. We don’t know that as it concerns Nvidia specifically, either.

We do have reason to believe that it can be a viable source of earnings growth for the company, since generative AI is useful for so many things. These include Nvidia’s traditional gaming market, other forms of entertainment media, and various professional uses to optimize business efficiencies. As Adam Uzialko wrote last October:

Software programs like Salesforce and Zoho require heavy human intervention to remain current and accurate. But when you apply AI to these platforms, a normal CRM system transforms into a self-updating, auto-correcting system that stays on top of your relationship management for you.

There are other ways he noted AI can help business, but streamlining the sales process is helpful to just about everybody and thus a source of big demand.

Of course, there are other potential problems that could emerge. Even if these don’t pose immediate liabilities to Nvidia, the problems they pose to users could still reduce demand for Nvidia’s product. Storms are brewing around the legal issues pertaining to Deepfake technology. AI-generated art based on styles and patterns of existing artists are resulting in lawsuits. There are questions about how regulations might be imposed to limit its criminal uses, and these are all questions that the public has only just started to answer.

What kind of unforeseen costs or setbacks come with this? We don’t know, and that’s the point.

Price-Earnings-Growth Ratio

A lot of people know about the Price-Earnings-Growth Ratio, or PEG. You can even pull it up for a stock here on Seeking Alpha. The investor that conceived it was Peter Lynch, manager of Fidelity’s Magellan Fund from 1977 to 1990. He discusses it in his 1990 book, One Up on Wall Street. In general, he notes that he’d be willing to buy a stock if the P/E ratio and the growth rate are the same (PEG = 1). If it’s less than 1, then it becomes even more attractive.

It probably seems trite for me to bring something like this up, but my point will be clear pretty soon. I will adapt his approach to free cash flow, as he was talking about earnings as it concerned net income. (Cash flow statements weren’t standard until the ’90s, after his tenure at Magellan.) Now, let’s look at why he would cook up a ratio like this. I’ll quote his book:

What you’re asking here is what makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings. Sometimes it takes years for the stock price to catch up to a company’s value, and the down periods last so long that investors begin to doubt that will ever happen. But value always wins out—or at least in enough cases that it’s worthwhile to believe it.

Regarding high multiples, he wrote:

…wonderful companies become risky investments when people overpay, using McDonald’s as exhibit A. In 1972, the stock was bid up to a precarious 50 times earnings. With no way to “live up to these expectations,” the price fell from $75 to $25, a great buying opportunity at a “more realistic” 13 times earnings.

Later on in the book, he notes:

In the early 1970s millions of uninformed dollars chased overpriced opportunities and soon disappeared as a result. Does that make Bristol-Meyers and McDonald’s risky investments? Only because of the way people invested in them.

Regarding “Fast Growers,” he wrote:

My favorites are the ones in the 20 to 25 percent range. I’m wary of companies that seem to be growing faster than 25 percent. Those 50 percenters are usually in hot industries, and you know what that means.

For context, he means they attract competition, other unwanted attention, and saturate their markets quickly. He has several other pointers throughout his book about avoiding super-high growth, looking for small companies over big ones, not overpaying for great companies, and so on. I’ll quote one more of these (emphasis added):

Carefully consider the price-earnings ratio. If the stock is grossly overpriced, even if everything goes right, you won’t make any money.

So, let’s finally relate all of this to NVDA. Based the latest quotes, the forward P/FCF of NVDA is 48. Approaching $19 billion of annual free cash flow, it’s not a small company, and its current valuation makes it not only a mega cap but one of the most expensive companies in the world. Even companies that currently make more money and still have some growth would cost less in a takeover.

This is not a sky-is-falling sell thesis. Some companies are so bad that you need to get out as fast as you can. Instead, this a very straight, Lynchian take on the stock. I’ve had more good things to say about Nvidia than bad. All I’ve really discussed is what I see so rarely mentioned, that a company becomes a risky investment if you overpay for it.

What Is A Sensible Valuation For Nvidia?

Even if Nvidia belongs in the family of Fast Growers, I don’t think the company is undervalued with a market cap nearing $1.4t and a share price around $570. Yet, even with 2023’s rally, we can see the stock has been much lower relatively recently.

Seeking Alpha

What changed that caused investors to lose their peak optimism in 2021? Well, the acquisition of ARM failed. There was the cyberattack shortly after. Of course, Russia invaded Ukraine, and Fed Chair Jerome Powell started hiking up interest rates, too. It’s a lot to happen all at once, but these things did not significantly change Nvidia as a company.

Sure enough, once people forgot about them (the war and interest rates are still here), they stopped counting them. Then generative AI hits the collective imagination, and people seem to start double-counting the earnings potential of the company. Those who had a sense of Nvidia’s long-term value in 2022 probably bought in as low as $120. If they held long enough to get the long-term capital gains rate, $570 probably looks like a good time to rake in a 4.75x return in just over a year.

NVDA may not go that low again, so what’s a good price if we work with Lynch’s PEG ratio and the 21% growth implied in my DCF? Why, that’s $250 per share, with a market cap just over $600b.

Conclusion

Nvidia is a great company. Its balance sheet is healthy, and it is printing cash at a growing rate. My sell thesis draws on the everyman logic of Peter Lynch. You can’t make money by overpaying for something, and companies priced for growth around 50% usually struggle to deliver that. Being a larger, more mature company these days, Nvidia can be priced for growth, but it needs to be much more modest.

Gaming is the future. AI is the future. Yet, there is a finite value on the cash these things will deliver, and the value of Nvidia as a company should reflect that. Price movements of NVDA suggest that investors are double-counting good news and bad news as it comes up, leading to wild fluctuations in recent years.

Companies like Nvidia can and do run into problems, and less growth than the market is demanding can kill the valuation that is currently reflected and leave a lot of today’s buyers holding the bag. As such, I think it’s okay to sell, keep your money, and wait for Nvidia’s price or earnings to change, in order to ensure that, when you do buy, you’re getting a fair price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.