Summary:

- Eli Lilly and Company stock has delivered almost 5x returns in the past five years, with an almost 100% upsurge in the last 12 months alone.

- Eli Lilly’s success is attributed to its focus on obesity/diabetes drugs, with currently available blockbusters like Mounjaro and Zepbound, and pipeline products Orforglipron and Retatrutide underpinning LT share gains.

- Paired with superior efficacy demonstrated in ongoing late-stage trials for oncology and neurodegeneration drugs, Eli Lilly demonstrates an adequately diversified portfolio for replicating its success in recent years.

jetcityimage/iStock Editorial via Getty Images

Eli Lilly and Company (NYSE:LLY) has become the key beneficiary of the rally in weight loss drug stocks, which has gained momentum over the past year. Specifically, LLY has appreciated almost 5x in value over the past five years. The upsurge picked up in pace in 2023 with almost a two-fold return.

The results indicate how LLY has shed its old reputation as the laggard of the industry due to inherent sensitivities to drug patent cliffs and an inefficient R&D spend management. As the company’s chief scientific and medical officer, Daniel Skovronsky, has recently noted, the cyclical “boom-and-bust nature” of big pharma is akin to kitchen economics:

When a company has a mega blockbuster drug that is doing really well, every investment on the margin goes towards that instead of towards something that’s untested and unproven…And that drug overshadows the rest of the portfolio and everything else is starved for people, money and attention. Once the big blockbuster runs out…, they find out their cupboard is bare, and there’s nothing else coming…We think about that as going to the grocery store when you’re hungry. You end up buying things you don’t really need.

Source: “Can a Big Pharma Ever Be Worth $1 Trillion?”, WSJ.

But now at LLY, the cupboard is full.

The company is well positioned to ramp up on market share gains with its obesity and diabetes indication drugs, which are currently one of the fastest growing segments. Currently, Trulicity and Mounjaro – two of LLY’s blockbusters in the segment – represent close to a third (3Q23 combined sales: $3.1 billion) of company revenues (3Q23: $9.5 billion). And that is not even counting the recent go-to-market of Zepbound, indicated for obesity, which received FDA approval in early November. LLY also has a few other alternatives in its internal pipeline that are expected to receive regulatory approval near mid-decade. This is likely to further reinforce its momentum in the high-growth drug segment, and extend the recent success that has been propelling the stock’s upsurge.

And to prevent “overstocking” on items “you don’t really need,” LLY has also been actively engaging in innovative areas of medicine. These include non-obesity products in the pipeline aimed at other high demand drug segments, such as oncology and neuroscience – particularly in treating Alzheimer’s. The ongoing endeavor is further corroborated by LLY’s recent string of small acquisitions, which include forays in antibody-drug conjugates (“ADC”) for treating urothelial cancer (Emergence Therapeutics), and immunology (DICE Therapeutics).

Taken together, we believe LLY is well positioned to take on the inherent sensitivities facing big pharma. LLY’s diversified portfolio in both high-growth and emerging drug segments reinforces its strength in overcoming risks of patent cliffs/LOEs, fluctuations in drug pricing, and intensifying competition. Although the stock now trades at a “great, but expensive” narrative, we believe it remains well positioned for a sustained uptrend underpinned by a quality growth trajectory ahead.

The Obesity Epidemic

Diabetes represents one of the most common chronic illnesses in the world, and is often linked with other health complications such as heart and kidney problems. Obesity is another closely linked epidemic, with the cohort facing “7x greater risks” of diabetes compared to their healthier-weight counterparts.

The recent sensation on the use of the GLP-1 (or “glucagon-like peptide-1”) class of drugs in treating type 2 diabetes has received incremental demand from the weight loss community. And the proposition is simple. GLP-1 drugs work by increasing insulin release in the body, which helps to stabilize blood sugar levels, while also limiting appetite by slowing the digestion process.

Common GLP-1 drugs currently available in the market include semaglutide (e.g. Novo Nordisk’s (NVO) Ozempic / Wegovy), tirzepatide (e.g., LLY’s Mounjaro / Zepbound), and dulaglutide (e.g., LLY’s Trulicity), which are typically injectables. There are also currently oral alternatives in the works, including LLY’s Orforglipron and rival Pfizer’s (PFE) danuglipron, which are targeting indications for type 2 diabetes, and weight loss. NVO is currently one of the first to have obtained FDA approval for its oral GLP-1 alternative, Rybelsus, which is indicated for type 2 diabetes. Rybelsus has not obtained indication for weight loss, but has shown to help users lose weight.

In addition to type 2 diabetes, the weight loss opportunity for GLP-1 drugs is vast. A recent industry survey continued late 2023 shows 43% of respondents are currently using GLP-1 drugs for weight loss, rather than for treating type 2 diabetes. This compares to 10% observed in October 2022.

Demographics and affluence are key demand consideration factors. GLP-1 drug demand for weight loss is much more common amongst millennials, which also represent the strongest spending cohort to take on the drug segment’s high costs. GLP-1 drugs indicated for weight loss can be more expensive than its type 2 diabetes equivalent. For instance, LLY’s Zepbound for obesity has a current list price of $1,059.87 per dose. This compares with the equivalent for treating type 2 diabetes, Mounjaro’s $1,023 before its 4.5% price hike to $1,069.08 this week. A similar premium is observed at rival NVO, which prices Wegovy (weight loss) at $1,349.02 per dose, representing a 44% premium to Ozempic’s (type 2 diabetes) $935.77 per dose.

LLY’s Immediately Monetizable Opportunities in Obesity

LLY’s top type 2 diabetes formulas currently account for about a third of its quarterly revenues. Not counting Zepbound, which has FDA approval for its weight loss indication, the combination of Mounjaro and Trulicity quarterly sales topped $3 billion in Q3. And their prospects remain intact, considering both Mounjaro and Trulicity’s growth remains a function of supply availability. Coupled with Zepbound’s go-to-market in December, the cohort of drugs’ early ramp-up, and the substantial opportunities ahead in the segment, LLY benefits from reinforcement to its growth trajectory.

Mounjaro

Mounjaro is a tirzepatide GLP-1 drug indicated for type 2 diabetes. It received FDA approval in 2022, and has accounted for almost $3 billion of LLY’s sales in the first nine months of 2023. Mounjaro remains one of the company’s best-selling drugs, with 40%+ sequential revenue growth in Q3, underpinned by both volume and pricing tailwinds.

Specifically, on pricing, LLY has begun phasing out impact from savings card program for Mounjaro, which expired on June 30. This accordingly allows higher realization of its listing price going forward, which is beneficial to the top line. As mentioned in the earlier section, LLY has also recently increased Mounjaro’s listing price by 4.5% to $1,069.08 per dose, which further complements the anticipated increase of paid prescriptions.

Although volumes have been constrained due to the imbalance between significant demand and limited supplies, impending alleviations are on the way. In addition to its ongoing build-out of expanded manufacturing capacity, LLY is also retooling how the drug is administered to improve supply efficiency. Specifically, Mounjaro is primarily administered via single dose vials right now. But the company is currently in the process of introducing multi-dose injectors for the drug later this year. This will allow LLY to tap into existing manufacturing systems and capacity, and alleviate pressure on single-dose vial supply availability. The company also has a diversified string of third-party agreements in support of additional multi-dose injector supplies, underscoring more streamlined availability to address impending demand through 2024.

This flexibility is expected to complement additional manufacturing capacity coming online both later this year and over the longer-term. Taken together, continued acceleration in Mounjaro sales is expected to be back-end weighted in 2024. This is also in line with recent disclosures from the Australia Government’s Department of Health and Aged Care, which anticipates limited Mounjaro supply through August 2024 for all doses.

Trulicity

Trulicity is a dulaglutide GLP-1 drug also indicated for type 2 diabetes. It currently accounts for close to a quarterly of LLY’s sales alone, representing the company’s best-selling drug.

While volumes continue to be backed by robust uptake, Trulicity faces the ongoing impact of lower realized prices. Specifically, Trulicity’s current list price is $977.42 per month. But with improved access to the drug in recent years, Trulicity continues to face the inherent impact of growing rebated volumes. The impending expiry of its data protection patent later this year in Europe is also a potential risk. However, we expect the LOE exposure to be mitigated by limited Trulicity demand in regions outside of the U.S. (< 5% revenue exposure in Europe). Taken together, we expect continued moderation in Trulicity growth as robust volumes continue to be neutralized by lowering realized price dynamics.

Zepbound

Zepbound is LLY’s newest drug to the market. The tirzepatide GLP-1 drug is essentially Mounjaro’s equivalent, but indicated for treating obesity. Zepbound, like Mounjaro, is expected to be one of the fastest growing drugs in LLY’s portfolio. Its recent go-to-market is expected to alleviate some of the unaddressed demand for Mounjaro due to current supply constraints, and complement LLY’s continued capture of impending opportunities in the weight loss market.

As mentioned in the earlier section, Zepbound sells at a list price of about $1,060 per monthly dose. With the drug’s new introduction, there is currently a co-pay savings card program offered by LLY. The program reduces Zepbound’s access price to as low as $25 for eligible 1- or 3-month prescriptions. Meanwhile, those with “commercial drug insurance”, but without specific coverage for Zepbound, can pay as low as $550 for a 1-month prescription.

This is a similar go-to-market rebate structure as Mounjaro’s, which is expected to boost volume needed to offset lower realized prices. We expect the recent wind-down of Mounjaro’s savings card program, and resulting increase to realized prices, to offset the weaker go-to-market pricing dynamics for Zepbound in the near-term. Their combined impact is likely to become more evident and stabilized entering mid-decade, when supply improves alongside a higher realizable price structure ex-savings cards.

LLY’s Impending Opportunities in Obesity

In addition to Mounjaro and Zepbound, LLY is also working on other indications for its tirzepatide GLP-1 drug. They include indications for treating obstructive sleep apnea, mortality in obesity, cardiovascular outcomes in patients with type 2 diabetes. All of which are currently in phase 3 trial, and could be complementary to Mounjaro and Zepbound’s capabilities in capitalizing on impending opportunities in the GLP-1 drug segment.

Other than tirzepatide, Orforglipron and Retatrutide are two other highly anticipated GLP-1 drugs that LLY is working on. Both are being tested for indications in treating obesity and diabetes.

Orforglipron

Orforglipron is an oral GLP-1 drug that is currently in phase 3 trial for treating obesity and diabetes. Unlike tirzepatide, which is an injectable peptide, Orforglipron is a chemical equivalent designed for oral intake. It essentially aims at doing the same job by binding onto the GLP-1 receptor to trigger the release of insulin for regulating blood sugar levels and slowing digestion.

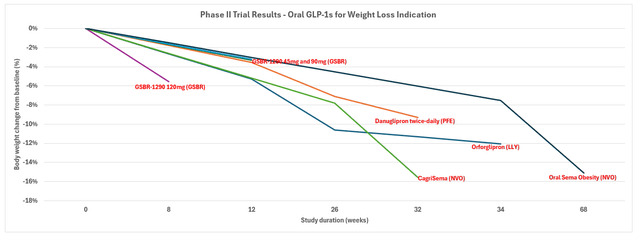

The phase 2 trial for Orforglipron concluded efficacy in the one-daily oral drug for treating obesity. The 36-week trial completed on participants with an average weight of 240 lbs (109 kg) resulted in weight reductions of up to 14.7%, compared to 2.3% for the placebo cohort. Orforglipron also demonstrated higher efficacy in reducing A1C levels in participants with type 2 diabetes compared to dulaglutide (i.e., Trulicity) during the phase 2 trial.

The anticipation for Orforglipron is high due to its prospects for ensuring persistent uptake and, inadvertently, demand preservation for LLY. While those with type 2 diabetes are typically on longer-term treatments due to the disease’s chronic nature, others using GLP-1 drugs for “anti-obesity” typically experience a shorter course of treatment. And Orforglipron represents a potential oral alternative for prolonging the persistency of treatment, particularly for obese patients. Oral drugs are typically preferred over injectables due to their convenience. It is also an easier solution for preventing typical post-tirzepatide weight gain.

Orforglipron’s approval for obesity indication would also make it one of the first oral GLP-1 drugs for weight loss. NVO’s Rybelsus is currently only FDA approved for type 2 diabetes indication, though the drug is known to help with shedding weight. But NVO currently has an oral semaglutide GLP-1 drug in phase 3 trial as well for obesity indication. Rival Pfizer is also currently working on an oral GLP-1 for weight loss, known as danuglipron, which is in phase 3 trial as well for the once-daily dosage. Specifically, Pfizer is expected to warp up its phase 3 trial for the once-daily danuglipron pill in 1H24, which will then “inform a path forward.”

Meanwhile, Orforglipron is not expected to complete its phase 3 trials for obesity and type 2 diabetes indication until 2025 to 2027. This continues to highlight intensifying competition, despite uncertainties to realization, in the oral GLP-1s market. Specifically, the materialization of oral GLP-1 drugs is viewed as critical in fully unlocking the addressable market for obesity opportunities, in particular.

In all the market research that we are doing, we see that there is a preference in the diabetic population for an oral compared to injectable. But when it comes to obese population, this is what really makes — unlocks the market. It’s significantly more important, the oral in the obese market than it is in the diabetic population. But even diabetic, there is a preference.

Source: Albert Bourla, Pfizer CEO in 2023 JPMorgan Healthcare Conference.

Author, with data from respective company disclosures

Retatrutide

In addition to Orforglipron, LLY is also working on Retatrutide for both obesity and type 2 diabetes indication. Specifically, Retatrutide for obesity indication is currently in phase 3 trial, while the equivalent for type 2 diabetes indication is in phase 2.

Retatrutide is a GLP-1 injectable, similar to Trulicity and Mounjaro. The drug is designed to “activate the body’s receptors for three hormones – glucagon, glucose-dependent insulinotropic polypeptide (“GIP”), and glucagon-like peptide-1 (“GLP-1”).” This compares to tirzepatide, which only works by activating the body’s’ receptors for GIP and GLP-1. Retatrutide is currently viewed as a potential next-generation “triagonist” for more potency in treating type 2 diabetes and obesity compared to tirzepatide (dual GLP-1/GIP agonist), and semaglutide (pure GLP-1 agonist). This next-generation drug could provide extended differentiation for LLY within the increasingly competitive weight loss and type 2 diabetes drug category, and reinforce its longer-term market share grab.

The phase 2 trial results for its use in treating obesity showed up to 17.5% in weight reductions over a 24-week treatment period. Retatrutide also demonstrated contributions to improving “cardiometabolic measures,” such as blood pressure and cholesterol levels. The phase 3 trial will extend into studying retratrutide’s impact on treating osteoarthritis and obstructive sleep apnea, in addition to obesity.

Fundamental Considerations

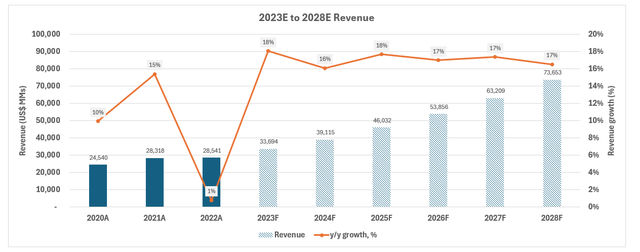

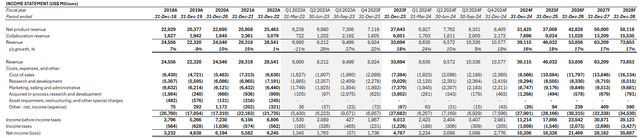

Considering LLY’s near-term prospects, particularly on its type 2 diabetes and obesity product pipeline as discussed in the foregoing analysis, our forecast estimates revenue growth of 16% y/y to $39.1 billion in 2024.

This is consistent with our understanding that the LLY’s revenue prospects remain concentrated in the high-growth drug segment, for which it currently holds a strong market share in. And its product pipeline also indicates strength in reinforcing durability of this growth trajectory. The results continue to indicate prevention of previous patent loss headwinds, particularly on Zyprexa (sold in July 2023), anti-depressant Cymbalta and insulin drug Humalog. Specifically, rolling availability of next-generation drugs in this segment are expected to provide a diversified portfolio for LLY to mitigate risks of LOE-driven revenue loss. It also compensates for the wind-down of COVID antibodies sales, which LLY has experienced a smaller exposure to relative to its peers like Pfizer.

In addition to type 2 diabetes and obesity drugs, LLY is also expanding its foray in immunology, neurodegeneration and oncology. Specifically, LLY is taking a page from rival Pfizer in expanding its expertise in ADCs, which are targeted treatments for cancer compared to traditional chemotherapy.

The company is also looking to differentiate itself in treating Alzheimer’s. Donanemab, which is currently in regulatory review for slowing degeneration from early Alzheimer’s, is a highly anticipated drug from LLY, in addition to its diabetes/obesity portfolio. Specifically, phase 3 trial results showed Donanemab’s efficacy in “significantly [slowing] cognitive and functional decline for amyloid-positive early symptomatic Alzheimer’s disease patients. Trial patients on Donanemab showed no disease progression at one year. LLY expects an FDA decision later this year, and this could represent a significant new revenue stream for the company given Donanemab’s superior effectiveness to rival products.

On the cost front, we expect LLY to maintain margin tailwinds from the wind-down of COVID antibodies sales, as well as improved realized prices on Mounjaro. We expect acquired IPR&D to remain a near-term headwind alongside associated adverse tax implications due to their non-deductible nature.

Eli_Lilly_-_Forecasted_Financial_Information.pdf.

Valuation

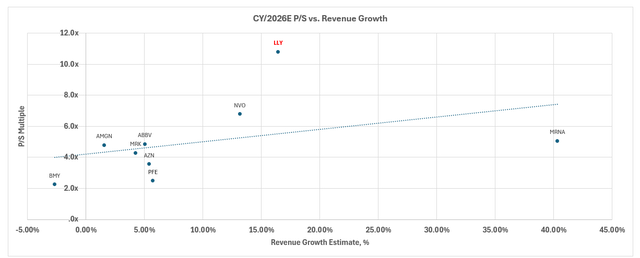

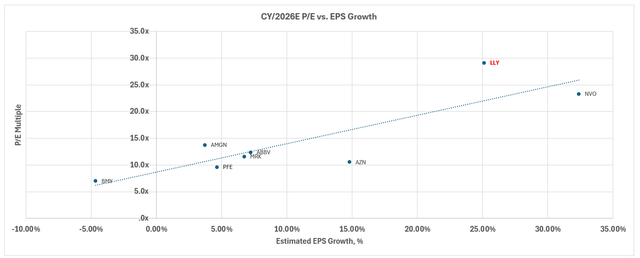

Admittedly, LLY remains an expensive stock on a relative basis to its big pharma peers under both growth and margin expansion considerations.

Author, with data from Seeking Alpha Author, with data from Seeking Alpha

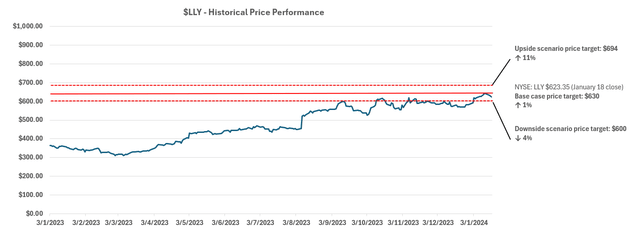

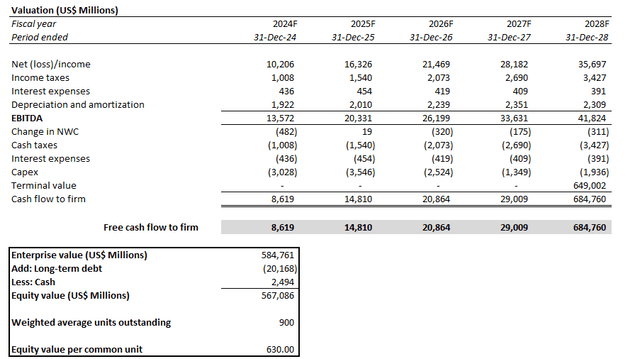

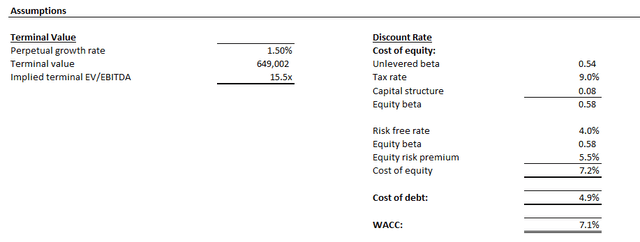

Yet under the discounted cash flow (“DCF”) approach, the results continue to underscore value attributable to the quality of LLY’s underlying prospects. Our base case price target for LLY is $630, which is largely in line with the stock’s last traded price of about $623 (January 18 close).

The analysis considers cash flow projections taken in conjunction with our fundamental forecast in the earlier section. Key valuation assumptions applied include a WACC of 7.1% in line with LLY’s capital structure and risk profile. We have also applied an estimated perpetual growth rate of 1.5%. The conservative assumption reflects LLY’s steady-state prospects in the longer-term, while also accounting for its inherent exposure to LOE / patent cliff risks.

Although our base case price targets implies limited upside potential in the near-term for LLY, we believe the company remains well-positioned for unlocking incremental value if it receives regulatory approval on products currently under late-stage trial and review. These include Donanemab for slowing progression of early Alzheimer’s Disease, and Orforglipron and Retatrutide for treating obesity and type 2 diabetes. In addition to selling into high-demand segments, all three high-prospect drugs also provide differentiation for LLY given their superior efficacy to competitive offerings currently available and/or in testing.

Our upside scenario price is set at $694. The upside scenario price considers underlying fundamental outperformance underpinned by the accretive nature of impending drugs – such as Donanemab, Orforglipron and Retatrutide – to LLY’s addressable market.

Risks to Consider

Revenue concentration from the diabetes/obesity drug segment is a potential risk to consider. Although LLY currently remains one of the market share leaders, alongside NVO, in treating diabetes and obesity, they face stiffening competition from other well-capitalized big pharma peers. Uncertainties to the regulatory approval process on next-generation innovations in this segment critical to extending LLY’s competitive advantage represent another risk factor that could derail its growth prospects.

Specifically, the obesity market alone is expected to grow into a $65 billion market over the next decade. While LLY’s currently available portfolio makes it a dominant share gainer (estimated 75% market share with NVO), Trulicity faces patent expiration in the U.S. in 2027. Although Mounjaro and Zepbound’s recent introduction to market provides compensation, further approval of next-generation drugs like Orforglipron and Retatrutide are critical to preserving LLY’s longer-term dominance.

However, with Orforglipron and Retatrutide indicated for treating obesity already in late-stage trial, it improves confidence to LLY’s pipeline for the competitive drug segment. Additional indications for tirzepatide in treating cardiovascular outcomes in diabetes, obstructive sleep apnea, mortality in obesity, and chronic heart failure are also in phase 3 trial. This accordingly improves returns prospects on LLY’s drug investment cycles in the longer-term.

The Bottom Line

Admittedly, Eli Lilly and Company is not a cheap stock on both a relative basis to peers and an intrinsic basis considering base case cash prospects. Its dividend yield is also negligible, which provides a limited margin for absorbing potential downside risks.

But LLY continues to demonstrate how it is still in the early innings of capitalizing on opportunities in high-demand drug classes over the longer-term. With its “cupboard” fully stocked with a diverse portfolio of drugs to meet the rapid changes and competitive dynamics of the industry, LLY remains well positioned for unlocking incremental upsides.

We believe LLY remains a “buy the dip” stock worthy to be kept on investors’ watchlist. There remains reasonably realizable catalysts on the horizon. These include easing supply constraints to meet pent-up demand for Mounjaro, Trulicity and Zepbound, alongside differentiated innovations already in regulatory review and/or late-stage trial.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!