Summary:

- Apple Inc. stock is up 39.5% year-over-year, but there are bearish signs that suggest the worst is yet to come. Read on to learn why.

- The demand for iPhones is expected to be low shortly, with stagnation in growth and increasing competition from Chinese rivals.

- The company’s valuation is unreasonably high, considering its lack of operational growth and innovation.

- The market seems to ignore all the risks, judging by Apple’s price action. I urge you not to follow it as the market sometimes makes mistakes.

- I’m rating Apple Inc. stock a “Sell” for the first time ever.

ozgurdonmaz

My Thesis

When we open the Apple Inc. (NASDAQ:AAPL) stock price chart, the picture that emerges today appears very rosy: the stock is up 39.5% year-over-year. It continues to feel good as long as dip buyers keep on supporting the stock through every minor correction.

However, the abundance of bearish signs gathers around the company like a snowball that is ignored by the market. Very often, such ignoring leads to disastrous consequences – companies with huge moats such as AAPL are no exception to this rule.

I have little doubt that the worst is yet to come for Apple stock, and anyone who buys now could be deep in the red for weeks, perhaps even months.

My Reasoning

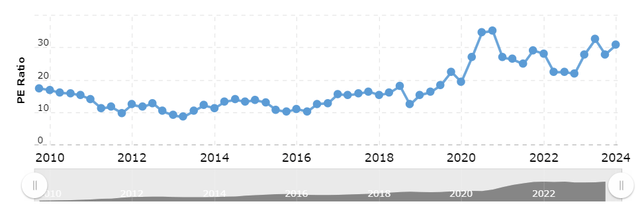

Let me first describe the backdrop against which AAPL exists. According to the Financial Times, the ten largest companies in the S&P 500 index (SP500) currently make up about 30-32% of the entire index, which is the highest level in at least the last few decades.

This happened for many reasons. First, the phenomenal amounts of cash on the balance sheets of these largest companies became a kind of magnet for those looking for an allocation to the equity asset class when everyone around them was worried about the Fed funds rate and the whole market was not doing well. With Apple or Microsoft (MSFT), there wasn’t even a hint of credit problems to begin with. Secondly, many companies from this group have become the main beneficiaries of the AI revolution due to their dominance in their end markets. So, assuming that the AI revolution is just in its infancy, the argument to sell the Magnificent 7 (or 10) stocks today just because of their huge weight in the S&P 500 Index sounds unreasonable in my opinion.

But then a logical question arises: what does Apple have to do with AI? Why is its high valuation so stubbornly defended by the market?

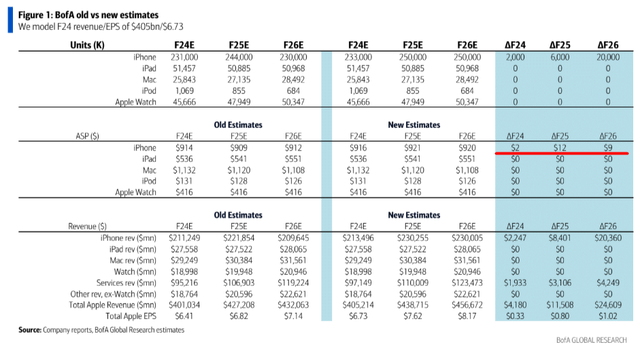

We see the answer to this question in the latest Bank of America report (January 18, 2024 – proprietary source).

BofA [proprietary source]![BofA [proprietary source]](https://static.seekingalpha.com/uploads/2024/1/19/53838465-17056479830339444.png)

As far as I can see from the descriptions of the AI things under development, Apple products will indeed undergo some quite significant changes. But basically, as a long-time iPhone user, all of these AI initiatives strike me as sort of obvious or unnecessary additions. I see myself as a very average user with an iPhone 13 (which is currently the majority in North America according to BofA) who needs to keep their phone from becoming obsolete. I think most are like me when we talk about classic user experience and not fanaticism. So I don’t think the iPhone 13 is obsolete yet. If I compare it to the iPhone 15, the feature set is not much different, in my view. And if we add all the above features to the iPhone 15, I still don’t see any difference because if I download several third-party apps (e.g., ChatGPT or other AI apps to handle what may be needed), I will no longer need to update the phone in 2024.

I am writing this with the expectation that the demand for iPhones will be quite low in the near future. Already we are seeing a kind of stagnation in growth and the company’s attempts to defend its place in the Chinese market by all means, where its share of sales is an impressive 19%.

In anticipation of the Chinese Lunar New Year, Alibaba’s (BABA) Tmall and JD.com (JD) are offering substantial discounts on iPhones, exceeding Apple’s own price reductions, the Seeking Alpha News team reported just recently. Tmall is providing discounts of up to 1,000 yuan ($140) until January 31, while JD is offering a 1,050 yuan discount on the latest iPhone 15 during the same period. This follows Apple’s recent announcement of rare discounts of up to 500 yuan ($70) on iPhones in China, a response to a reported 30% drop in Chinese iPhone sales in the first week of 2024 compared to the same period last year, amid increasing competition from Chinese rivals like Huawei and Xiaomi (OTCPK:XIACF).

Apparently, this negative trend for Apple was not reflected in BofA’s calculations: the bank’s analysts are forecasting a price increase for the company’s products in 2024, which does not match what has happened in reality so far.

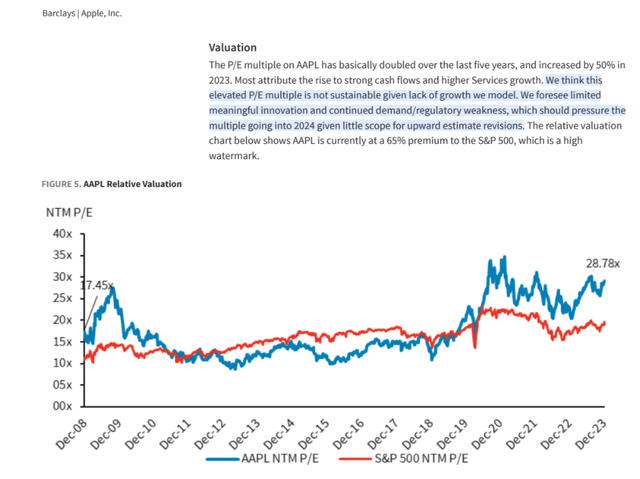

In addition to BofA, there are also banks that, in my opinion, look at things more realistically. For example, Barclays’ analysts revised their March quarter revenue estimates for iPhones and Wearables in January 2024 (proprietary source), which resulted in a low-single-digit decrease in both revenue and EPS compared to their previous projections. In terms of Services, although the App Store shows a 10% growth in the December quarter against an easy comparison, they anticipate it to decelerate to mid-single-digit growth by the September 2024 quarter. Barclays’ current March quarter estimate is MSD below the Street’s expectations for both revenue and EPS, projecting a YoY revenue decline following a flat December quarter and four consecutive quarters of declines preceding it.

Barclays [January 2, 2024 – proprietary source]![Barclays [January 2, 2024 - proprietary source]](https://static.seekingalpha.com/uploads/2024/1/19/53838465-17056573550071464.png)

At ~50% of total revenues, iPhone is still the most important product category for AAPL. And Barclays’ checks remain negative on volumes and mix for iPhone 15, and we see no features or upgrades that are likely to make the iPhone 16 more compelling.

I understand and accept that Vision Pro is likely to be a major innovation for the future of mainstream VR/AR, but I highly doubt that this product will make a significant contribution to the company’s total consolidated revenue. Demand will probably not be very high as it is a nice-to-have gadget, unlike other Apple products that we are sometimes afraid to go outside without. With the Vision Pro, we see that this technology is not quite mature yet, considering that the headset is bulky and the battery has a limited capacity. Therefore, the appearance of this product on the market does not seem to me to be a sufficient argument to justify the company’s rich valuation.

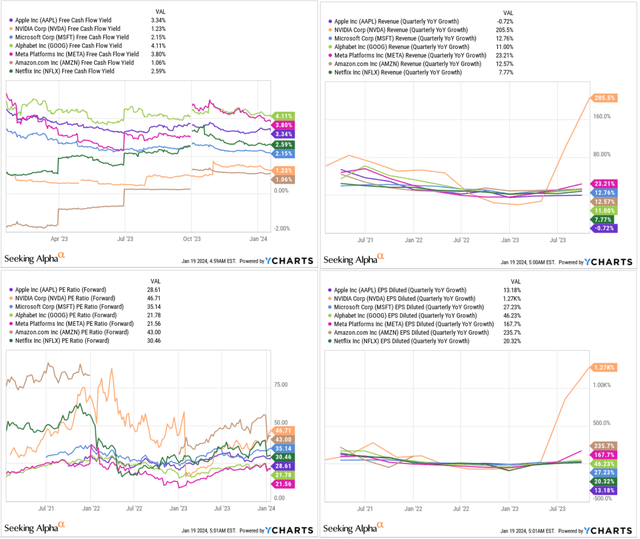

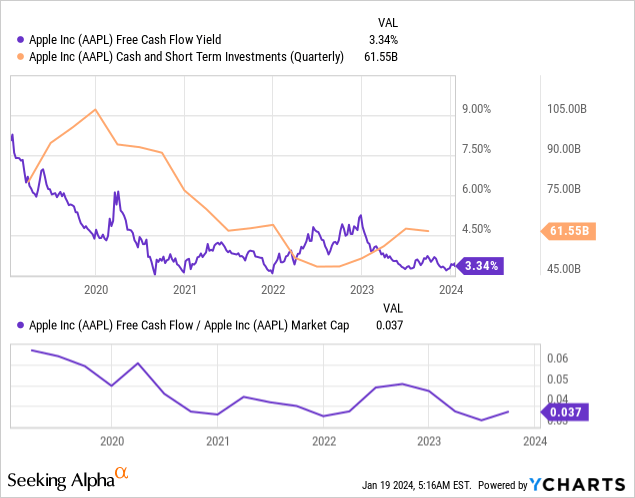

By the way, since I brought up the subject of valuation: AAPL is far from the most expensive company in the ‘Magnificent 7’ group (free cash flow, or FCF, yield and P/E ratio say so), but it is the slowest growing, which should give it a discount that doesn’t exist yet.

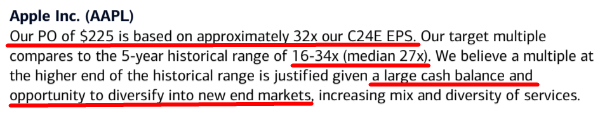

Pay attention to the premise with which the analysts at BofA justify their price target of $225:

BofA’s report, Oakoff’s notes

I don’t know about you, but I can’t accept a multiple of 32x as an assumption against the backdrop of so many problems in one of the major markets (China), while the median multi-year multiple is ~27x. BofA analysts attribute this premium to the company’s ability to diversify into new niches and to Apple using its cash balance for buybacks going forward. But as I mentioned earlier, I don’t expect Vision Pro to have a strong impact on the absolute level of the company’s earnings anytime soon. It would be too bold to assume a major shift to this new market: I find this initiative to be a pig in a poke, so to speak.

If we are talking about cash balance, then yes, $61.55 billion is a large sum. But in terms of AAPL’s market capitalization, that’s less than 4%. Moreover, this “huge cushion,” which is actually not that big, keeps shrinking.

Of course, no one rejects the “buybacks are a good alternative to dividends” argument,” but relying only on buybacks and ignoring everything else seems like an unwarranted risk to me.

Barclays’ approach to Apple’s valuation is much more in line with my view: the company’s premium to the S&P 500 seems unreasonably high if we take into account the lack of operational growth and innovation I wrote about above.

Barclays, Oakoff’s notes Barclays, Oakoff’s notes

Let’s imagine for a moment that by the end of 2024, AAPL stock will return to its long-term median P/E multiple of 27x as calculated by BofA analysts. And let’s assume that the consensus view on earnings per share, which has been revised down 20 times in the last 3 months, holds. Then at $6.59 EPS (Seeking Alpha data), the stock would end the year at ~$177.9, which is 5.7% below the stock’s current market price. My calculations do not assume risks of demand from China and other regions of our vast planet.

If we try to take into account the existing risks, then AAPL will be even more overvalued. I don’t see the point of buying AAPL at its fair value because the theory is that you should wait for undervaluation. This is exactly what I suggest to new potential investors.

Risks To My Thesis

First, I disagree with the consensus view, which includes the opinions and analysis of people who have been following Apple much longer and more intensely than I have. Therefore, I may be completely wrong about something – please consider this upside risk to my thesis.

Secondly, I think the bunch of bullish arguments BofA provides in its latest report look really solid and could destroy my conclusions if the company achieves what’s expected:

We upgrade Apple to Buy from Neutral, given the following factors: 1) a robust multi-year iPhone upgrade cycle fueled by the need for the latest hardware to enable Generative AI features set to be introduced in 2024/2025 (a substantial portion of the installed base still uses iPhone 11), 2) increased growth in Services as Apple effectively monetizes its installed base, 3) a silicon roadmap transitioning from PC to Servers to Autonomous, contributing to higher margins, 4) strong capital returns, including buybacks and dividends, even after nearing net cash neutrality, 5) stable to higher Gross Margin over time (attributed to mix, price, and vertical integration), 6) Apple’s underweighted position compared to S&P500, with anticipation of AI features possibly prompting institutional investors to increase positions, 7) manageable risks surrounding legal issues, and 8) recent relative underperformance suggesting that many risks are already factored into expectations.

I encourage everyone to do their own due diligence and look at some other Seeking Alpha articles that hold different views than the one I expressed in my article today. “Truth is born of arguments,” as Socrates said, so investors need to gather as many of these arguments as possible from different camps.

The Verdict

While the risks to my bearish thesis are significant, I cannot accept Apple’s lack of growth and the Street’s unreasonably high premium to the company’s valuation. The tremendous liquidity that has surprised many in recent years is gradually fading as AAPL’s management continues to buy back the stock from the market and also invest in innovation. In recent years, however, it seems to me that innovation has been neglected: The company has a loyal fan base, but it is necessary to offer something new to the market to keep that fan base from thinning out. Also, the “China risk” has emerged recently, which the market seems to ignore, judging by AAPL’s price action.

I urge you not to ignore all this because the market sometimes makes mistakes. I think this is one such case. I’m rating AAPL a “Sell” for the first time ever.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.