Summary:

- Adobe’s FY4Q23 earnings beat guidance and market consensus, but investors are concerned about decelerating net new annual recurring revenue (NNARR).

- The Digital Media segment saw NNARR growth in Document Cloud but a decline in Creative Cloud, impacting the company’s major growth driver.

- Adobe’s FY24E outlook is softer than expected, with flat y/y growth in Digital Media NNARR and macro headwinds in the Digital Experience side.

- Competition from generative AI offerings is likely chipping away the company’s moat surrounding image software.

Justin Sullivan/Getty Images News

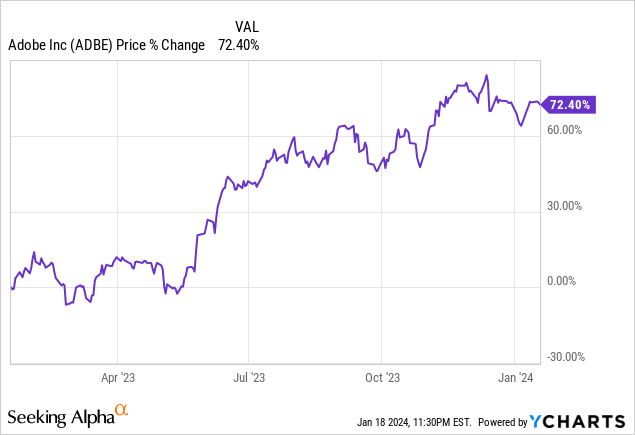

Adobe Inc. (NASDAQ:ADBE) came into FY4Q23 earnings with lofty expectations given an 85% gain in 2023 prior to earnings and hype surrounding Firefly, its generative AI solution. As of January 18, the stock is down about 5% post-earnings while the broader market is up about 1.7%.

Let’s dissect FY4Q23 earnings

Overall, total revenues reached $5.05B, growing 11.6% y/y or 12.0% y/y in constant currency. Operating income was $2.34B with a margin of 46.4%. EPS was $4.27. Headline numbers all beat guidance and market consensus.

However, investors are more focused on sequential net new annual recurring revenue (NNARR), and that is showing early signs of deceleration. In the Digital Media segment (DM), despite total NNARR of $569M beating estimates (about 9%), it is actually an increasingly smaller beat than the prior two quarters which were 11% and 13% in 3Q and 2Q, respectively.

Within the segment, Document Cloud drove the majority of the NNARR y/y growth with +39% y/y growth compared with Creative Cloud’s -12% y/y decline. Creative Cloud/Document Cloud brought in $398M/$171M in NNARR during the quarter. Creative Cloud sub-segment houses the Adobe Express and Firefly products, so a less than stellar growth rate here impacts the market’s assessment of the company’s major growth driver in FY24E.

On the Digital Experience side, total revenues grew 10% y/y or 11% y/y in constant currency to $1.27B with strong year-end bookings across solutions, with particular strength in North America. Adobe Experience Platform (AEP) topped its first ever $100M quarter of net new business and its book of business exited the quarter at $700M annualized or 60% y/y growth.

Disciplined R&D and S&M expenses helped drive operating margin to 46.4%, allowing EPS to grow ahead of revenue in the quarter.

FY24E outlook was softer than anticipated

Even though Adobe has multiple tailwinds going to FY24E with more contribution from Firefly (launched in November 2023) and pricing hikes, the management guided more conservatively than expected. Digital Media NNARR in 1Q24E is expected to be $410M, implying a flat y/y growth, while the full year guidance for NNARR is $1.9B which is also flattish y/y and most likely below market consensus.

To bridge this gap in expectations, the management offered some explanation. They mentioned that less than half of the Creative Cloud users would be affected by recent price hikes and that FY24E would not see large price improvements over FY23 despite a high single digit price growth due to Firefly. It can be interpreted that some of the growth in FY23 was partially due to larger-than-expected price changes from FY22 and not organic user growth and was not previously disclosed.

On the Digital Experience side, total revenue for FY24E is guided to $5.325B at the midpoint which implies a modest 8% y/y growth. Again, this number tails the large increase in y/y bookings growth at the end of FY23. The company stated that the multi-year contracts spread out price increases and may start to see more benefits in FY25E. Further, they think that there are headwinds from macro which culminates into down-selling pressures.

Competition from gen AI

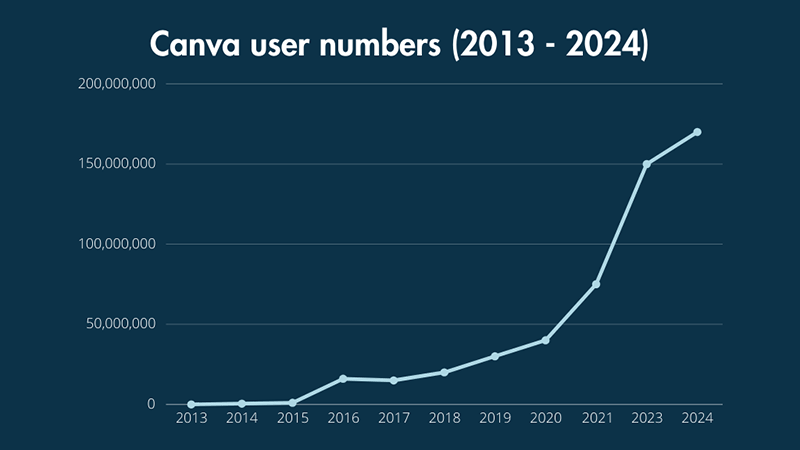

It is of no surprise that generative AI has improved how people work with image editing software. In the current market, there are a large variety of competitors that offer generative AI services or editing or certain one-off technology solution for images, most notably Canva, Figma, Dolly and Midjourney.

Generally speaking, the Adobe suite still caters to customers with a very large social presence as the sophistication in Adobe products allows for improved engagement metrics on TikTok or Instagram. Still, we see Canva as more popular in smaller teams. So, we see this market as initially fragmented but as AI compute power improves, there might be a forerunner as a go-to solution for gen AI. It is unclear if Firefly can capture the market like other Adobe products have.

MK’s Guide and Canva

Valuation

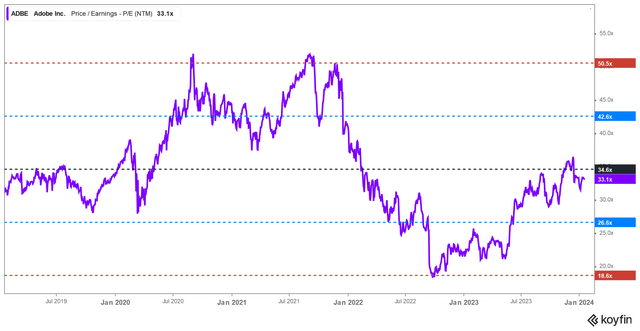

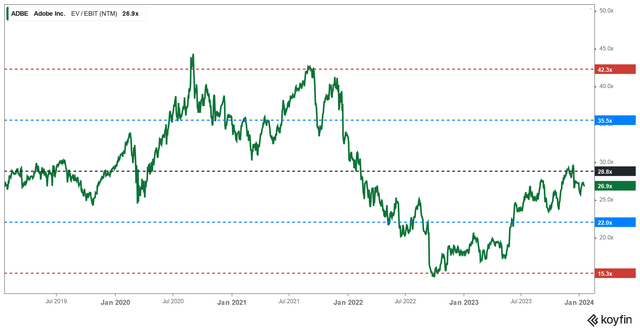

ADBE is currently trading at about 33x forward earnings or 27x EV/EBIT which are near its 5-year historical averages. But given that the forward growth rates for earnings and EBIT are about 12.5% and 11.5% on average respectively for the next two fiscal years, the current multiples do appear to be bloated. As a reference, ADBE grew earnings at 49% y/y and 23.6% y/y in FY20 and FY21, hence a much higher multiple during that time.

Competition from other generative AI offerings in the market is a potentially huge blow to the moat that Adobe products once offered. The dissolved merger with Figma may be short-term positive due to less share dilution and a signal that the management is confident in Firefly but may prove problematic for longer-term growth and innovation which Adobe needs to justify these high valuations.

We don’t think investors should hold ADBE stock until a more proven track record with Firefly/Express products can be established amidst fierce competition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: All research, figures, and interpretation are provided on a best effort basis only and may be subject to error. Any view, opinion, or analysis does not constitute as investment or trading advice, please do your own due diligence.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.