Summary:

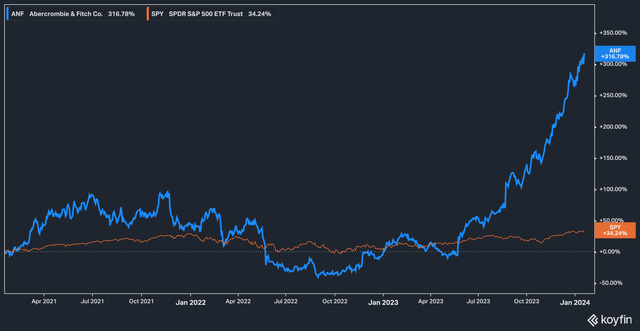

- Abercrombie stock has been on a tear, appreciated more than 300% in the last three years.

- The company’s successful turnaround has been adroitly managed by a relatively new management team.

- ANF stock has been rewarded with a premium valuation, which we think may be tough to maintain going forward.

Tim Boyle

Background

Few things in this life are more fickle by design than fashion – the very nature of the business demands that things change, and change rapidly. Things that were once cool are quickly relegated to the realm of the uncool, and so on. The same yardstick, interestingly, can be applied not just to styles but also brands: the world is littered with clothing retailers and brands that are no longer in business or just a shadow of their former selves (could you have imagined in 1995 seeing Tommy Hilfiger in Ross (ROST)?).

That is what makes the story of Abercrombie & Fitch (NYSE:ANF) all the more interesting. The brand, once known as a beacon for preppy teens armed with their parents’ money (to drive the point home, the company at one time featured shirtless young male greeters in-store), has successfully morphed into something different, something more distinctly like Gap (GPS), with a renewed focus on the basics and more broadly accessible offerings.

This turnaround at the company which began business operations in 1882, has been quite dramatic in the last two years. Under the refreshed leadership of CEO Fran Horowitz, who was appointed in 2017, the stock has given investors lots of reasons to smile lately.

In the last three years, Abercrombie has surged more than 300%, several times the 34% return delivered by the S&P 500 (SPY) during the same time frame. The biggest question now, however, is whether the run can continue – a question we’ll attempt to answer here. Let’s dive in!

By The Numbers

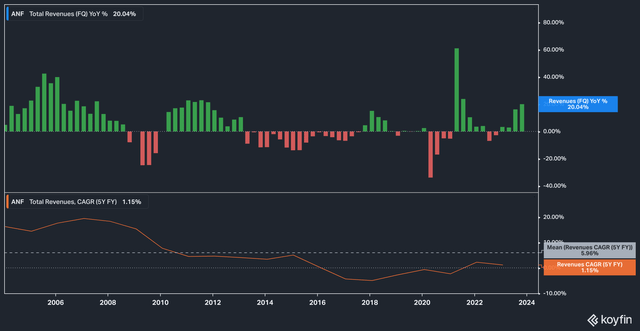

The last few quarters from Abercrombie & Fitch have been impressive, but they have not quite displayed the same level of growth as in past glory years.

The latest quarter saw 20% growth year over year, but the comps are a bit skewed by the pandemic – tough 2021 comps led to some underperformance in 2022, which in turn makes the current performance look strong. Because of this, taking a look at the 5-year CAGR offers a glimpse into the strength of the growth. The current 5-year CAGR stands at 1.15%, well below the 20-year average of 5.9%.

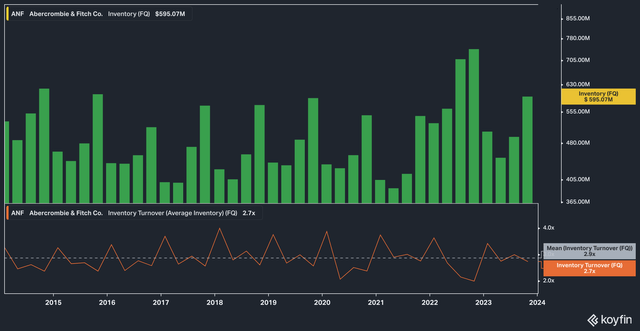

Inventory turns also give us some insight into how the business is performing – is Abercrombie’s recent growth due to an increase in volume, price, or both?

The average 10-year inventory balance for Abercrombie is $496 million, so the company has in recent quarters stocked up with the latest quarterly inventory numbers coming in at $595 million. Inventory turns for the latest quarter stood at 2.7x, just slightly below the 10-year average of 2.9x.

The fact that the company has maintained its inventory turns for the most part, coupled with the increase in inventory, tells us that the company has not been solely reliant on raising prices for growth. This is positive: the efficacy of raising prices is real but finite. Organic growth is best for long-term business health.

Building confidence further in the company and its story is the fact that on January 8th, management announced that it was raising its guidance for the quarter. Prior guidance had indicated a percentage increase for Q4 net sales in the low double digits – new guidance set expectations in the high teens. Horowitz had this to say:

Consistent with the first three quarters of 2023, our customers responded positively to compelling product assortments and engaging marketing leading us to increase our fourth quarter and full year net sales and operating margin outlook. We expect to deliver fourth quarter net sales growth across regions led by continued strength in the Americas.

Valuation & Outside Expectations

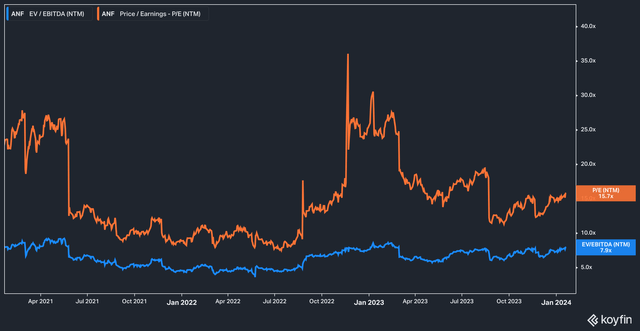

Despite this improved guidance, the response from the market was largely muted – the stock didn’t jump or fall meaningfully. In fact, even the stock’s massive run-up hasn’t affected valuations meaningfully.

ANF Forward P/E and EV/EBITDA (Koyfin)

In fact, Abercrombie’s forward P/E has actually fallen since the stock took off. Today it trades hands at close to 16x earnings. While this may not seem especially high, it is elevated against its peers. Urban Outfitters (URBN) and American Eagle Outfitters (AEO) trade at 11.8x and 12.9x earnings, respectively.

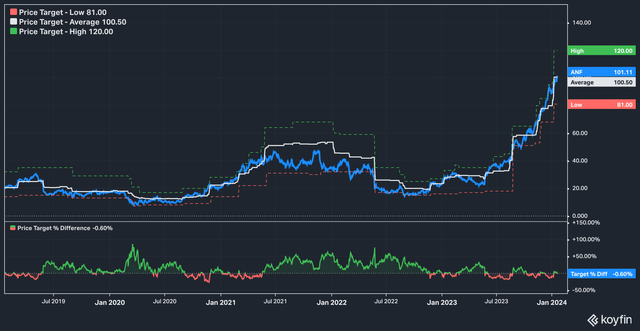

Further, while analysts remain largely positive on the stock, the 2023 rally has seen the stock essentially match price targets beat-for-beat.

ANF Analyst Price Targets (Koyfin)

With an average price target of $100, there seems to be very little wiggle room (at least in analyst expectations) for further upside.

The Bottom Line

No one can doubt that Abercrombie’s turnaround has so far been a resounding success – the recent guidance raise is also evidence that the boost in business over the last two years is ongoing. We are also heartened by the fact that management has a solid handle on inventory and hasn’t been solely reliant on price hikes for growth.

However, we are unsure that the growth can continue unabated. Recent quarters have gone up against weak comps, as mentioned previously, and maintaining that sort of growth against positive comps (which the company is about to hit) will be a challenge. Against these comps, Abercrombie also trades at a premium valuation to peers – something which may be warranted in the short term due to recent outperformance, but is not likely to be sustained for the long term (this is still the retail business, after all).

In short, we applaud Abercrombie’s management (and investors with the foresight to recognize the momentum swing as it happened), but today’s stock levels seem a bit toppy to us and keep us on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations – buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgment at the time of writing and is subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.