Summary:

- Home Depot has shown resilience in the face of economic challenges, making it a potential investment opportunity.

- The company has achieved significant sales and EPS growth over the past decade.

- With a P/E ratio of 24, HD is priced for perfection, and with no margin of safety, it is a Hold.

Justin Sullivan

Introduction

The current economic climate presents a unique landscape in the consumer discretionary sector. Amidst increased business uncertainty, investors often prefer less volatile and cyclical investments, leading to a general fear of consumer discretionary stocks. However, this is precisely when high-quality companies in this sector can stand out. Possible market sell-offs, driven by fears of an economic downturn, can sometimes make the stocks of fundamentally strong companies more attractive, offering potential value to long-term investors.

One such noteworthy company is Home Depot (NYSE:HD), a leading name in home improvement retail. Despite facing challenges like economic slowdowns impacting discretionary spending and higher rates, which pressure the willingness to renovate or buy new homes, Home Depot has shown resilience. The company has dealt with such challenges in the past, and if it successfully deals with them today, it could be a good investment. This article will explain my HOLD thesis regarding the company.

Seeking Alpha’s company overview shows that:

The Home Depot operates as a home improvement retailer. It sells various building materials, home improvement products, lawn and garden products, décor products, and facilities maintenance, repair, and operations products. The company also offers installation services for flooring, water heaters, baths, garage doors, cabinets, cabinet makeovers, countertops, sheds, furnaces, central air systems, and windows. In addition, it provides tool and equipment rental services. The company primarily serves homeowners, professional Renovators/ remodelers, general contractors, maintenance professionals, handymen, property managers, and building service contractors.

Fundamentals

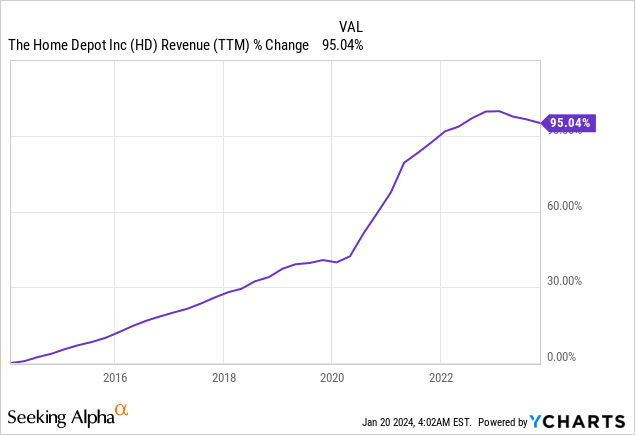

Home Depot has achieved a 95% increase in sales over the past decade. It was achieved through organic growth by adding more stores, increasing same-store sales, and targeted acquisitions, including significant names like Interline Brands and HD Supply. This growth reflects the company’s successful expansion into new markets, mainly professionals, and enhanced customer experience through digital. As seen on Seeking Alpha, analysts predict a continued upward trajectory for Home Depot, expecting a steady yet slow annual sales growth rate of around 2.5% in the medium term.

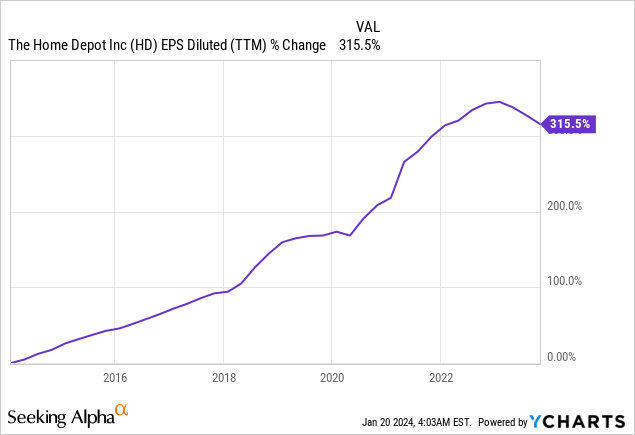

Over the last decade, Home Depot has witnessed an impressive 315% increase in its EPS (earnings per share), reflecting its operational efficiency and sales increase. This rise in EPS can be attributed to boosting profit margins and streamlining operations through its strategic focus on online and professionals. Buybacks have also helped boost EPS. As Seeking Alpha reported, industry analysts anticipate a continuation of this growth trajectory for Home Depot, projecting an average annual EPS growth rate of approximately 5.5% in the medium term.

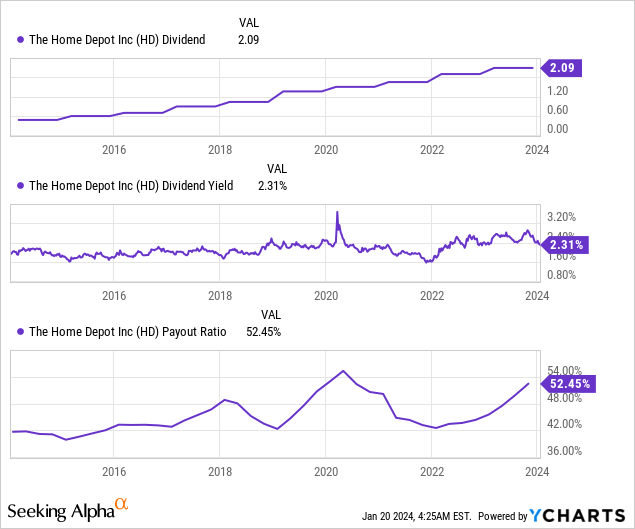

Home Depot demonstrates a consistent commitment to dividends. The company has not only paid dividends without any reduction for an impressive 35 years but has also increased its dividend annually for the last 14 years. This consistency highlights its ability to generate and sustain cash flow, even in varying market conditions. Home Depot’s dividend yield stands at a healthy 2.3%, with a payout ratio of 52%. Thus maintaining a good yield for income-focused investors while retaining enough earnings for reinvestment, growth, and margin of safety to protect the dividend in challenging times. The last increase in February 2023 was 10%. The next one is expected to be in February 2024 and will likely align with the EPS growth.

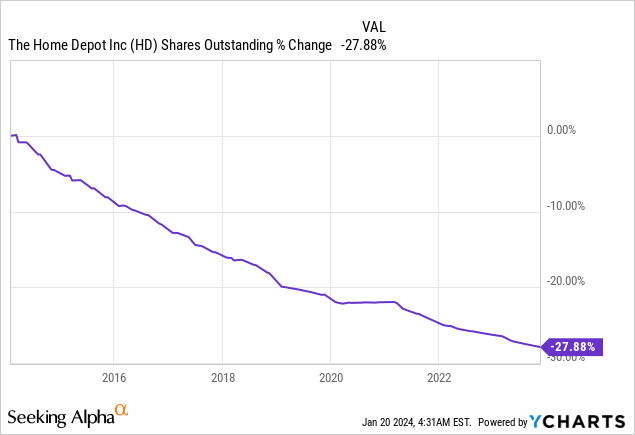

Home Depot has complemented its dividend with a robust buyback program, further enhancing shareholder value. Buybacks play a crucial role in supporting EPS growth by reducing the number of outstanding shares, thereby increasing the earnings attributable to each remaining share. Over the past decade, Home Depot has used buybacks to decrease its share count by 28%. This aggressive approach to repurchasing shares underscores the company’s strong financial position and commitment to efficiently utilizing excess cash to benefit shareholders. This approach to dividends and buybacks demonstrates dedication to returning capital to shareholders through multiple channels.

Valuation

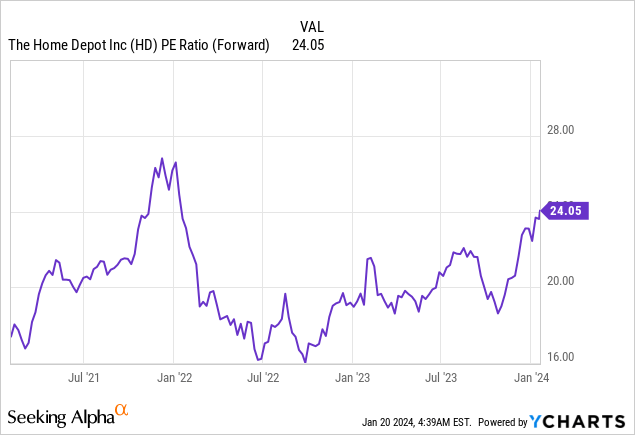

Home Depot’s forward P/E (price to earnings) ratio in the next fiscal year stands at 24, reflecting a significant increase over the last six months. This upward trend in the P/E ratio is primarily attributed to investor optimism, spurred by expectations of a Federal Reserve pivot leading to lower interest rates and more home buying and renovation. The valuation presents a challenge when considering Home Depot’s projected annual growth rate of 5.5%. The combination of a relatively high P/E ratio and moderate growth rate suggests that the company’s stock is currently priced at a premium and is not attractively priced, in my opinion.

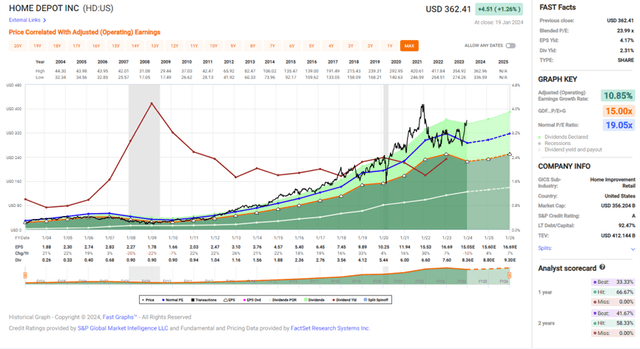

The graph below from Fast Graphs also shows that Home Depot’s shares are overvalued. The average P/E ratio of the company is 19, which is significantly lower than the current P/E ratio of 24. The average annual growth rate of the company stands at 11%, double the recent forecasted growth of 5.5%. Therefore, historically, the company has been growing slower yet trading for a premium. This combination makes it overvalued, and one must perform flawlessly to justify it.

Opportunities

The most significant growth opportunity is enhancing the experience for professional (PRO) customers. The company invests in many initiatives to create a seamless and efficient service for these customers. By focusing on their unique needs, such as the ability to reserve products, use trade credit, and have products delivered in a staged manner, Home Depot aims to build a long-term partnership with the Pro segment. This strategy is expected to capture a larger Pro market share, representing a substantial portion of the overall market. In the long term, this measure is critical as it means that the company is tapping into a new market outside the DIY, roughly the same size as the DIY ($475B).

Capturing a greater share of the Pro’s wallet is one of our largest growth opportunities. It represents roughly $475 billion in addressable market, and today, we have relatively little share.”

(Ann-Marie Campbell – Senior EVP, Q3 Conference Call)

Another growth opportunity is expanding the digital and e-commerce capabilities, recognizing the importance of an interconnected shopping experience. The company’s website and app are among the most highly rated in retail, and there is ongoing investment in reducing pain points throughout the customer journey. Enhancing the digital experience, including improvements in order communication, returns process, and order modification, is expected to drive customer engagement and sales growth. This opportunity will allow the company to increase its 17% market share in a market worth almost $500B.

We continue to invest and focus on creating a frictionless interconnected shopping experience for our customers. We are pleased with the progress we are making. The Home Depot is one of the largest retail websites in the United States, and our digital app is one of the most highly rated in all of retail.”

(Edward Decker – Chairman, President & CEO, Q3 Conference Call)

Another more tactical growth opportunity is improving store productivity and ensuring in-stock availability of products, which is a crucial growth area for Home Depot. The company has implemented various initiatives like the GSR (get stores right) program and the rollout of technologies like Sidekick and computer vision to improve on-shelf availability. These initiatives enhance customer experience by ensuring product availability and increasing operational efficiency, thereby driving value for stakeholders and supporting additional margin expansion towards 15% operating.

Using machine learning technology, computer vision helps our associates quickly find de-palletized product in the overhead and Sidekick helps direct associates to key bays where OSA is low or outs exist. Today, these tools have been deployed across all U.S. stores. And while early days, they have driven meaningful improvement in our on-shelf availability.”

(Ann-Marie Campbell – Senior EVP, Q3 Conference Call)

Risks

The most prominent risk is the economic slowdown and the higher rates. The economic downturn and higher rates that make it harder to finance home purchases and renovations have led to a decline in Home Depot’s sales, with a notable decrease in big-ticket, discretionary purchases. Customers are opting for smaller projects instead of engaging in more extensive renovations. This situation significantly risks Home Depot’s financial performance if the economic conditions worsen or continue for an extended period. With a high level of uncertainty, it is a more challenging position, and investors should seek a margin of safety when the company trades for a premium.

Sales for the third quarter were $37.7 billion, down 3% from the same period last year. Comp sales declined 3.1% from the same period last year and our U.S. stores had negative comps of 3.5%.”

(Edward Decker – Chairman, President & CEO, Q3 Conference Call)

Another risk is the fluctuations in key commodity prices. Commodity price fluctuations, particularly in core categories like lumber and copper, have adversely affected Home Depot’s revenue and margins. For example, the decrease in lumber prices has significantly impacted the average ticket growth. Such volatility in commodity prices can lead to unpredictable financial outcomes and challenges in inventory management, potentially affecting the company’s profitability. If the economy slows down and enters a recession, the demand and prices will decrease, resulting in a significant risk to the top and bottom lines.

Deflation from core commodity categories negatively impacted our average ticket growth by approximately 60 basis points during the third quarter, driven by deflation in lumber and copper.”

(William Bastek – EVP, Merchandising, Q3 Conference Call)

When looking at the EPS growth, another risk is the increase in operating expenses, which hurts margins. Home Depot’s operating expenses have increased as a percentage of sales, partly due to compensation increases for hourly associates and other investments. This rise in operating expenses, particularly declining sales, puts pressure on the company’s operating margin. The inflation and the tight job market, despite the rate increases, have pressured the company’s margins.

During the third quarter, operating expense as a percent of sales increased approximately 120 basis points to 19.4% compared to the third quarter of 2022.”

(Richard McPhail – EVP & CFO, Q3 Conference Call)

Conclusions

To conclude, Home Depot has shown remarkable resilience and growth. The company’s fundamentals are robust, evidenced by a significant increase in revenues and EPS. Its strategy of combining organic growth with strategic acquisitions has paid off, allowing it to reward shareholders through dividends and aggressive buybacks. The company is well-positioned to capitalize on growth opportunities, particularly in enhancing the “Pro” customer experience, expanding its digital footprint, and improving operational efficiency.

However, Home Depot faces notable risks, primarily on the demand side. Economic factors impact consumer spending, directly affecting Home Depot’s core business. Additionally, the current market valuation of Home Depot suggests a degree of overvaluation, with a high P/E ratio that factors in investor optimism. While the company’s fundamentals and growth opportunities are compelling, the potential challenges and current valuation lead to a more cautious outlook. Therefore, I believe the company is a HOLD and will be attractive at a P/E ratio of 17-19.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.