Summary:

- After a disappointing Q3 report, Altria Group is set to release its Q4 and full-year 2023 earnings report next Thursday, on February 1.

- I share my expectations, taking into account Altria’s recent modification to the factors contributing to the cigarette industry decline – the main reason for the sharp drop in late October.

- I provide an update on Altria’s premium brand performance, discuss how well its discount segment is holding up, and what I’ll be watching for in the upcoming earnings report.

- I explain why the company’s future is not as bleak as the price of MO stock suggests – as long as management continues to execute well where it matters most.

ImagineGolf/E+ via Getty Images

Introduction

Altria Group, Inc. (NYSE:MO) will release its fourth-quarter and full-year 2023 results next Thursday, February 1. With the precipitous drop in reaction to the third-quarter results published on October 26, 2023 still on the mind of investors, it’s worth talking about what’s in store for next week’s report.

In this update, I will share my expectations, taking into account Altria’s latest modification to the factors contributing to the U.S. cigarette industry decline, which was the main reason for the sharp drop in late October. Since I have already ruled out an impairment for Altria – similar to the £25 billion charge taken by British American Tobacco p.l.c. (BTI, OTCPK:BTAFF) – in a separate article, I will not cover that topic here. Instead, I’ll provide an update on Altria’s premium brand performance, discuss how well its discount segment is holding up, and what I’ll be watching for in the upcoming earnings report. I’ll explain why I believe the company’s future is not as bleak as the share price suggests – as long as management continues to execute well where it matters most.

Did Altria Beat Earnings Before And What To Expect From Q4 Earnings?

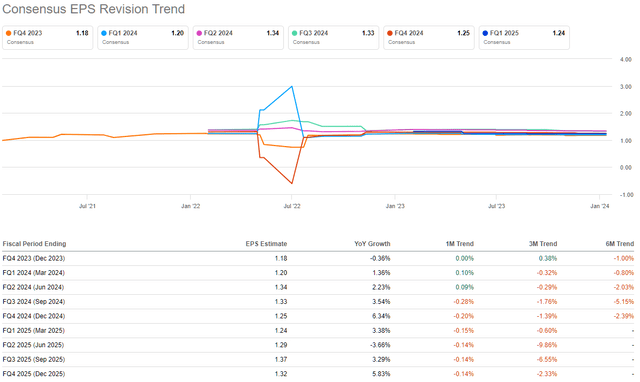

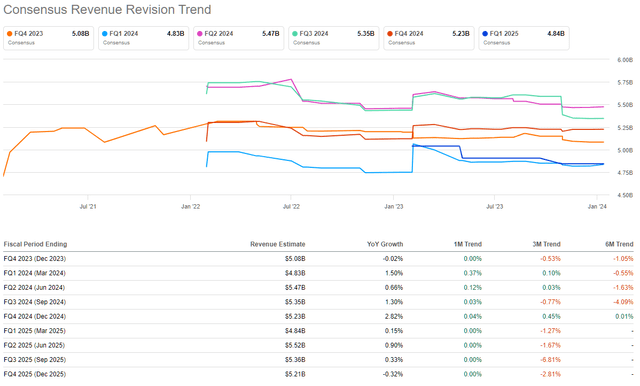

Analysts currently expect adjusted earnings per share (EPS) of $1.18 for the fourth quarter, so basically flat year-over-year. Net sales are also expected to remain largely unchanged at around $5.08 billion. For the full year, earnings per share are expected to be $4.96 (+2.5% year-over-year) and net sales are expected to come in at $20.56 billion (-0.6% year-over-year). Revisions to EPS and net sales estimates have been insignificant in recent months (Figure 1 and Figure 2, respectively), once again confirming the predictability of the business and the reliability of management’s guidance.

Figure 1: Altria Group, Inc. (MO): Consensus earnings per share estimates on a quarterly basis (Seeking Alpha) Figure 2: Altria Group, Inc. (MO): Consensus net sales estimates on a quarterly basis (Seeking Alpha)

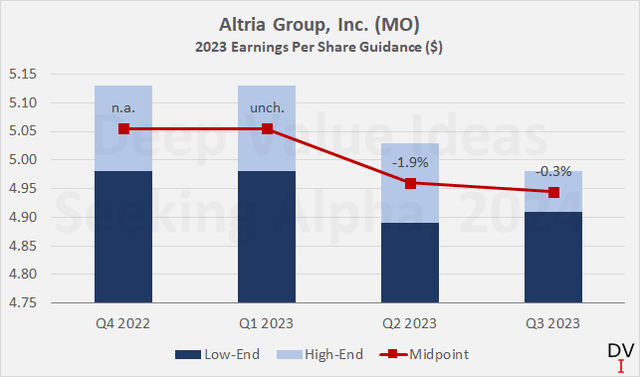

With regard to guidance, however, management’s revision at the end of October should be mentioned briefly. The change in full-year earnings outlook was communicated by management as a “narrowing of the guidance” (see Q3 2023 earnings transcript). At the risk of appearing picky here, the guidance was actually reduced – only by a small amount, but still (Figure 3). Of course, this is not really a problem, but I still don’t like it when the company management claims one thing when in reality the other is true.

Figure 3: Altria Group, Inc. (MO): 2023 earnings per share guidance, as communicated in each quarterly press release (own work, based on company filings)

However, the extent of the change in guidance since the second quarter should be taken as a sign that management generally provides reasonable and accurate guidance. Consequently, it is hardly surprising that Altria typically meets analyst estimates on a quarterly and annual basis (significant positive or negative surprises are rare).

All in all, management can be expected to meet its latest EPS and net sales targets next Thursday. However, investors should instead focus on other areas when analyzing the earnings report, such as the decline of the U.S. cigarette industry in general and Altria’s performance in particular.

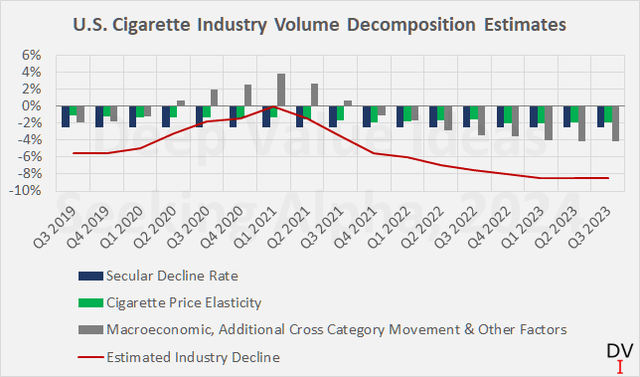

Once again, Altria’s management will save the day via price increases, as evidenced by the virtually flat net sales (see above) on sharply declining volumes (Figure 4).

Figure 4: U.S. cigarette industry decline decomposition estimates according to Altria management (own work, based on company filings)

Price elasticity of demand is working against Altria and has been increasing recently, albeit slowly (green bars in Figure 4). However, as I explained in another article, Altria’s earnings growth (and free cash flow) is also due to continued margin expansion. However, since margins can only be increased to a certain extent, the room for maneuver in this regard is increasingly limited, so Altria will have to rely more and more on cigarette price increases to maintain growth.

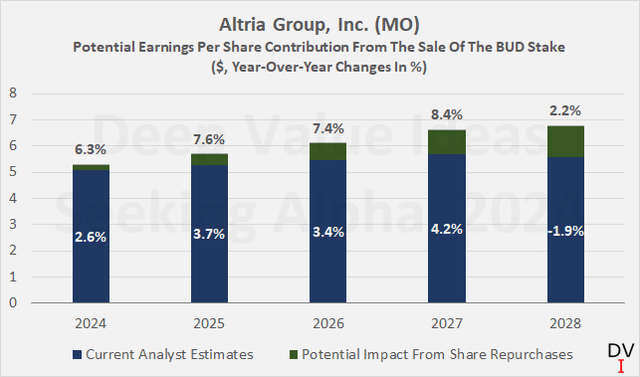

However, management has a more or less obvious ace up its sleeve – namely its stake in Anheuser-Busch InBev SA/NV (BUD) and the significant share buyback (and debt reduction) potential its monetization would bring. For example, selling the stake and using the proceeds exclusively for share buybacks could theoretically reduce Altria’s outstanding shares by approximately 17%. Not only would this greatly increase the headroom for dividend growth due to the reduction in the payout ratio (fewer shares outstanding), but it would also have a one-time positive effect of 21% on EPS.

Put differently, if Altria sells the 197 million Bud shares over the next five years and both MO and BUD maintain their current prices, the transaction would boost core EPS growth into the high single digits – a 3.9 percentage point increase in each of the five years. This potential impact of share buybacks funded by the proceeds from the sale of the BUD stake on EPS is shown in Figure 5. As a side note, the analyst estimate for 2028 is likely due to the consensus assumption that the menthol ban in the U.S. will come into effect at that time. In my previous article, I presented model scenarios for Altria’s free cash flow when the menthol ban takes effect and the potential impact on dividend safety. In a nutshell, I think the dividend is safe even after the menthol ban goes into effect – provided the overall decline rate of the U.S. cigarette industry moderates somewhat.

Figure 5: Altria Group, Inc. (MO): Potential impact of share repurchases funded by the proceeds from the sale of the BUD stake on earnings per share (own work, based on company filings)

What To Look For In Altria’s Upcoming Earnings Report Instead Of Earnings And Sales Figures

Returning to the more near-term outlook, I think it’s critical to keep an eye on cigarette volumes, in part because Altria’s smoke-free portfolio is still not meaningful and will likely take years to gain traction – especially given the fierce competition from British American (vaping products) and now also Philip Morris International Inc. (PM) (in-depth discussion in this article).

Altria continues to generate its sales and free cash flow with cigarettes and, to a very small extent, cigars and oral nicotine products (the latter of which is unlikely to be cash flow positive). With this in mind, it was not too surprising that the market reacted very negatively to the latest quarterly report, in which Altria acknowledged for the first time that cross-category movement (e.g., to oral nicotine and vaping products) is a major factor contributing to the cigarette industry decline, alongside increasing price elasticity of demand and the secular decline (which I expect to bottom out eventually).

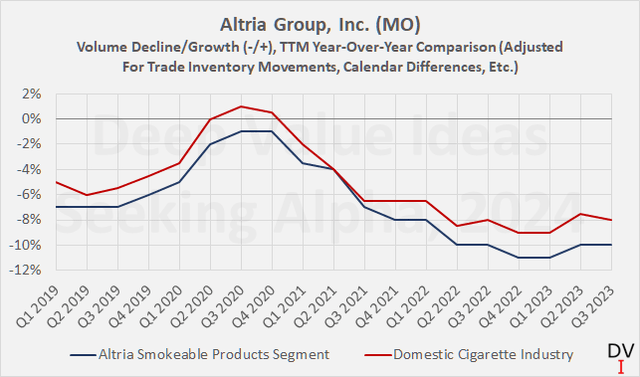

That said, a fresh look at Altria’s cigarette sales figures gives cause for cautious optimism. Since mid-2022, the rate of decline appears to have stabilized (blue curve in Figure 6), and the decline in industry-wide cigarette volume has accelerated recently, while Altria’s (arguably still more rapid) decline rate has been maintained. At the risk of coming across as too positive here, there is no denying that the post-pandemic acceleration in the cigarette industry decline rate is serious and worth keeping an eye on.

Figure 6: Altria Group, Inc. (MO): Smokeable Products segment growth/decline on a quarterly basis, compared to the domestic cigarette industry trend (own work, based on company filings)

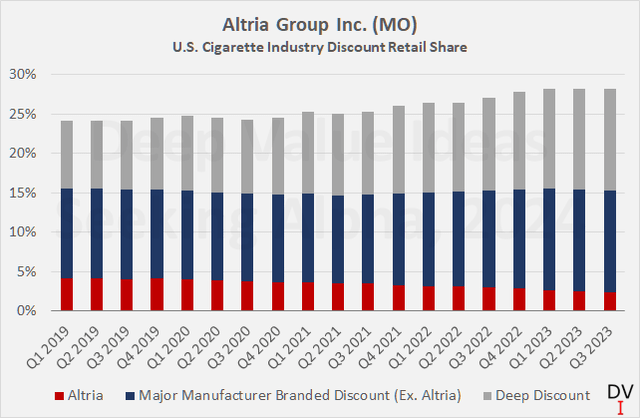

It is disappointing to see that Altria continues to lose share in the discount segment (Figure 7) – a decline of 170 basis points in absolute terms or more than 40% in relative terms since 2019. However, given the comparatively unfavorable margin profile and the company’s generally weaker position in terms of Master Settlement Agreement payments (small companies like Vector Group Ltd. (VGR) are better positioned), I would not over-interpret Altria’s poor performance in this segment. Also keep in mind that Altria’s discount segment was responsible for only 5% of cigarettes sold in the third quarter (970 million sticks out of a total of 19.3 billion, p. 8, 2023 10-Q3).

Figure 7: Altria Group, Inc. (MO): U.S. cigarette industry discount retail segment share (own work, based on company filings)

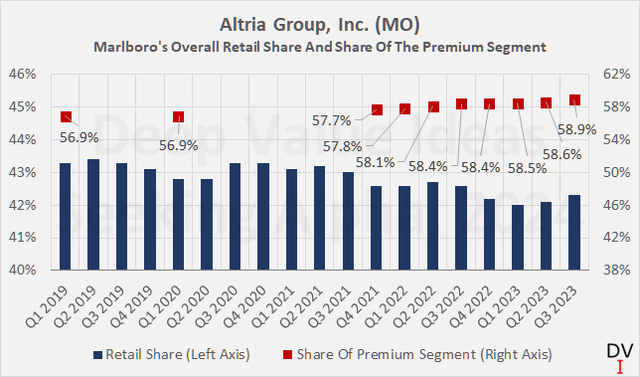

In my view, it is therefore crucial that Altria’s management executes where it matters most – its core brand Marlboro. After all, the premium brand accounted for 90% of Altria’s shipped cigarette volumes in the third quarter of 2023.

Therefore, it was reassuring to see that Marlboro continues to gain market share in the premium segment – for example, a sequential increase of 30 basis points to 58.9% in Q3 2023 (Figure 8, red squares). The percentage decline in retail share (blue bars) is, in my view, largely due to the increasing demand for discount and deep discount cigarettes in times of high inflation. However, the rebound in Q2 2023 and the further market share gain in Q3 2023 are not only a sign of lower inflationary pressure on consumers (see Figure 7 – the retail share of discount cigarettes has stagnated since Q2 2023) but also a confirmation that Marlboro is taking share from other premium brands.

Figure 8: Altria Group, Inc. (MO): Marlboro U.S. retail share and share of the premium segment (own work, based on company filings)

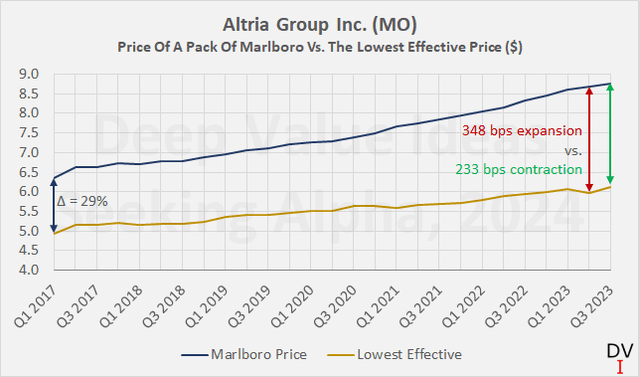

It is critical to continue to monitor Marlboro’s performance going forward and scrutinize the data for possible signs that the recent improvement in consolidated retail share may be a mere consequence of price discounting (or more accurately, below-average price increases). Recall that in Q3 2023, the Marlboro price gap contracted sharply (233 basis points quarter-over-quarter, Figure 9). Given that the price gap has been widening for several years – from 29% in early 2017 to more than 45% in mid-2023 – a decline is of course welcome against the backdrop of increasing price elasticity of demand.

However, I would not overinterpret the data for Q3 as either a positive or negative sign – if only because of the significant widening of the price gap in Q2, which points to a timing issue of price increases. Against this backdrop, it will be very important to keep an eye on the dynamics of cigarette prices and Altria’s market share in Q4 2023 and going into 2024.

Figure 9: Altria Group, Inc. (MO): Spread between the price of a pack of Marlboro and the lowest effective price in absolute and relative terms (own work, based on company filings)

Conclusion

Altria will report its fourth-quarter and full-year 2023 results on Thursday, February 1 before the bell. Management has already announced the “news” of the cross-category movement having a significant impact on the overall decline of the U.S. cigarette industry in the Q3 earnings call. Therefore, and given the narrowed (in fact slightly lowered) guidance and the generally high likelihood of meeting analyst estimates, I don’t expect any big surprises next Thursday. It is also unreasonable to fear an intangible asset impairment charge similar to the one BTI took in December. I discussed this issue at length in my last article, but the main reason is simply that Altria does not have any material cigarette-related intangible assets on its balance sheet. In that same article, I assessed the potential impact of a nationwide menthol ban and concluded that the dividend is unlikely to be at risk.

I continue to watch Altria’s combustible volumes and segment market shares like a hawk – especially the performance of Marlboro. Don’t get me wrong – the brand is performing very well and remains the dominant player in premium cigarettes. But that’s exactly why we should keep a close eye on the brand’s performance: Marlboro accounts for 90% of Altria’s cigarette volume. In addition, the continued weakness of Altria’s discount cigarette brands, the still elusive smoke-free portfolio, and the fierce and advanced competition in vaping, heated tobacco, and oral nicotine (see my peer group analysis) are the main reasons why it is critical that Marlboro continues to perform strongly.

Of course, it will also be interesting to see if management has an update on the Anheuser-Busch stake – the sale of which would allow Altria to retire a sizable number of shares and thus give a significant boost to EPS growth and increase the company’s headroom in terms of dividend growth (lower payout due to lower share count). The proceeds could also be used (in part) to reduce debt, although I maintain that Altria is already in pretty good shape from a leverage perspective. The Juul disaster is digested – further proof of the renowned profitability of tobacco companies in general and Altria in particular.

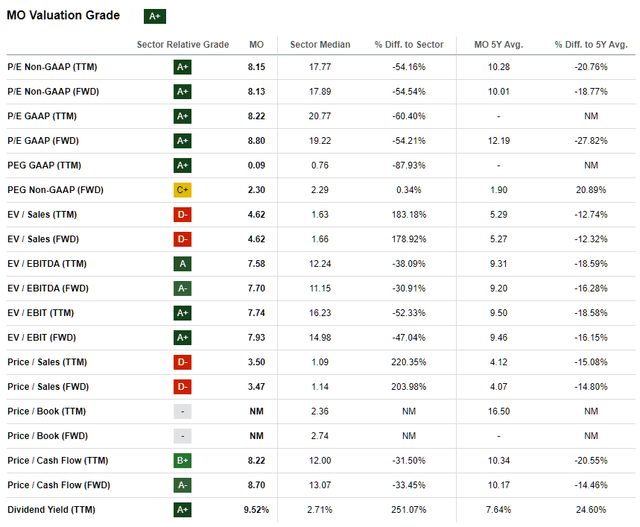

As long as Altria’s management continues to do a formidable job in its core business of marketing and selling Marlboro brand cigarettes, I remain a confident long-term investor in MO stock. As my position is already one of the larger ones in my broadly diversified portfolio (>2%) and I view the increasingly limited headroom for further margin expansion critically, I am no longer adding to my position and therefore continue to rate the stock as a “hold”. That being said, I do not believe that the favorable valuation of Altria shares (Table 1) needs to be discussed in detail. In this context, I refer you to another article in which I explain how I value tobacco stocks, at the example of the second-tier company Imperial Brands PLC (OTCQX:IMBBY, OTCQX:IMBBF) – which also lacks a meaningful smoke-free portfolio and, above all, major premium cigarette brands.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Table 1: Altria Group, Inc. (MO): Valuation metrics (Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM, BTAFF, IMBBF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.