Summary:

- VICI Properties recently touched below $30, presenting a great buying opportunity.

- REITs have made some nice gains since October but are seeing their prices retract with the surge in the 10-Year treasury bonds.

- There is also uncertainty surrounding if interest rates will be cut sometime in 2024 or not.

- However, I do think interest rates will be cut sometime this year. And if so, REITs will likely see some nice upside as investor sentiment changes.

- Bowlero is expected to continue expanding and growing for the foreseeable future which will only benefit VICI positively.

LPETTET

Introduction

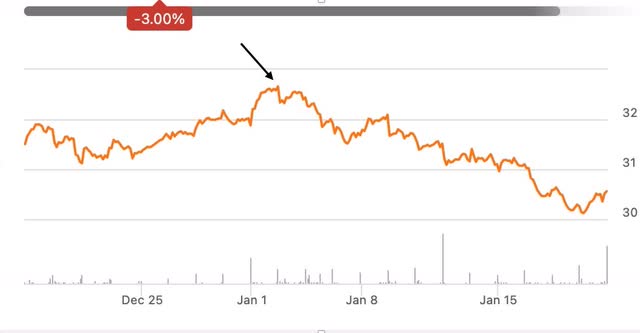

With my upcoming trip to Las Vegas in a few weeks, I felt compelled to write another article on one of my favorite REITs and biggest holdings in my portfolio, VICI Properties (NYSE:VICI). Since the beginning of the new year it seemed like the market became optimistic with hopes of interest rate cuts.

But in the last week prices have retracted, more so in the REIT sector (VNQ). I’ve been added to my REITs during this short-term volatility and with VICI touching below $30 briefly, the stock remains attractive at the current price level. In this article I give reason why I think VICI is still a buy and a stock to own for 2024 and beyond.

Previous Thesis

I last covered VICI Properties back in early October in article titled: I Pity Anyone Not Buying This REIT. It was just a play on the line from the famous Mr. T, “I Pity The Fool.” The sector was experiencing a lot of volatility then and the stock was a strong buy.

The stock was trading around $28 and even touched the $27 level before quickly bouncing back. Treasury yields had reached a level not seen in 16 years which caused REITs to sell off. At the time, Wall Street & Quant rated the stock a strong buy and I also upgraded the stock to a strong buy because of the share price decline.

What Happened?

Since that article, VICI went on to post some nice price appreciation before seeing its share price retract to roughly $31 where it currently trades at the time of writing. In the chart below you can see the stock reached near $33 in early January before retracting. One reason for the negative sentiment in the sector and overall market is the anticipation regarding interest rates. The (US10Y) has also risen to 4.13% at the time of writing since touching 3.79% briefly in late December.

Will they be cut or not? Some have said as early as March we will see the first rate cut, but I think the market is starting to second guess if they will or not. However, I do think they will cut rates sometime this year. With inflation dropping, some are now saying we will see five rate cuts starting in March. In my opinion, I don’t think REITs will see some sustainable price gains until the first rate cut.

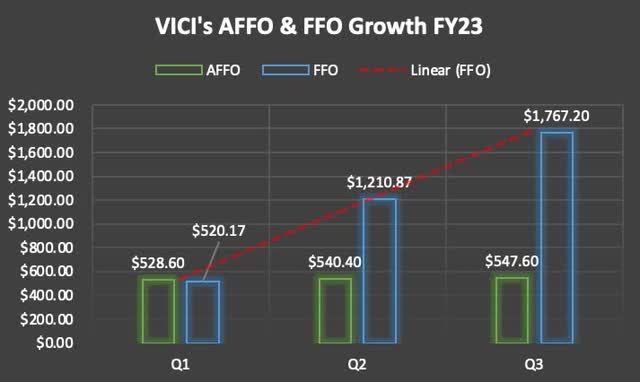

Strong FFO & AFFO Growth

VICI Properties reported Q3 earnings back in October and posted some strong growth beating both on FFO and revenue estimates. FFO of $0.54 beat estimates by $0.01 while revenue of $904.3 million also beat by a small margin. Despite the minor beat, FFO & AFFO have grown by double-digits during the fiscal year 2023. The REIT is expected to post Q4 earnings in late February and I expect AFFO in a range of $550 million to $553 million.

Since the beginning of the fiscal year VICI has more than doubled their FFO from $520 million in Q1 to roughly $1.7 billion in Q3. AFFO has also grown from $528.6 million to $547.6 million over the same period.

This growth allowed VICI to raise their full-year AFFO guidance. Management expects this to be in a range of $2.17 billion to $2.18 billion, up from $2.115 to $2.155 billion in Q1. In lieu of the headwinds REITs have faced in the past year with the rise in interest rates and the volatility, VICI Properties continued on its path to deliver 10% AFFO growth. They’ve also managed to raise the dividend while still maintaining a safe payout ratio of roughly 77%.

Bowlero’s Growth Outlook

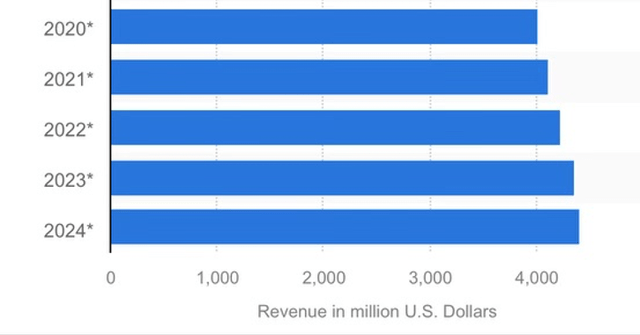

VICI also closed on its deal with Bowlero (BOWL) which is expected to be immediately accretive to their AFFO. Many readers commented they didn’t know what to think of the deal. One reader also stated that they didn’t like the deal because “bowling was dying a slow death.” And that it was too expensive for a night of entertainment now.

While things being expensive is true, the part about bowling being a dying sport is not. Since COVID, bowling has not only recovered, but is expected to grow slightly by the end of this year to $4.4 billion in revenue.

Albeit slowly, growth is still growth. This is up from $4 billion in 2022. Bowlero is also expected to continue expanding and growing for the foreseeable future. The company currently has 350 properties in diverse markets across 30 states, Canada, Puerto Rico, and Mexico.

Furthermore, they expect there is opportunity to acquire 500-1,000 additional properties, convert 150+ existing properties, and build an additional 200 properties. I know some may be worried that VICI is going down a path similar to Realty Income (O) with acquisitions seemingly out of their wheelhouse, but I think the deals with Bowlero and Canyon Ranch were attractive additions to their already stellar portfolio.

Strong Balance Sheet

The REIT has grown at a rapid pace since going public and their debt has also grown a sizable amount. But the company still maintains a healthy net-debt-to EBITDA ratio of 5.7x. This is a healthy range for REITs and management has stated that they plan to target a range of 5.0x to 5.5x for the foreseeable future. They also sport investment-grade ratings from both the S&P and Fitch. And if they can focus on deleveraging, I think the REIT may see an upgrade from Moody’s Ba1.

They do have roughly $1 billion in debt due this year and $2 billion in 2025. Both had a weighted average interest rate of 5.625%. In Q3, management entered into a swap agreement for an additional $200 million in anticipation of their upcoming debt, which gave them a total of $450 million swap protection. They also had $430 million in cash and $2.3 billion available under the revolving credit facility.

Undervalued

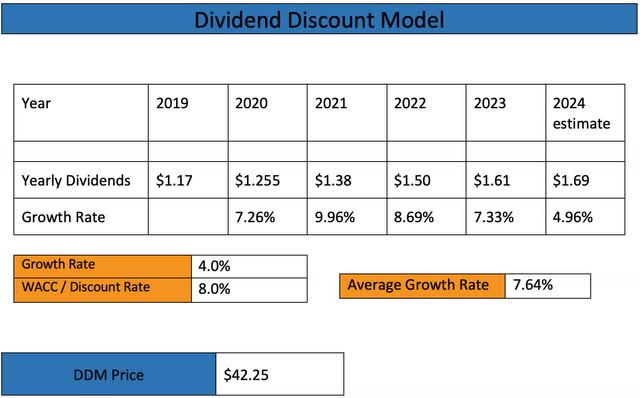

Using management’s full-year AFFO guidance midpoint of $2.145 and the current share price of $30.56 at the time of writing, this gives the REIT a P/AFFO ratio of 14.2x. Which I think is an attractive price point right now. Especially since the REIT’s 5-year average is 16.5x. Furthermore, they also offer some nice upside of nearly 18% to their price target.

Using the Dividend Discount Model and an expected growth rate of 4.0%, I have a price target above the average and closer to the high of $43. Although VICI has a higher growth rate than the typical REIT, I decided to be a bit more conservative. I do think with the fast growth rate the company has seen since its IPO that the growth will eventually start to slow.

Risks/Catalysts

Since a lot of VICI’s properties are dependent on consumer sentiment and Las Vegas being the entertainment capital of the world, a recession could suppress VICI’s profits in the coming months. Las Vegas depends on tourism and a slowdown in the economy will likely cause less foot traffic at their properties. This would also affect their deals with Canyon Ranch & Bowlero as well. Especially the former. Canyon Ranch is not necessarily cheap either so these could also see a drop in revenue.

Catalysts for the REIT are the exact opposite. If the economy manages to avoid a recession and interest rates decline, I expect VICI to see an uptick in foot traffic at its locations as consumer sentiment eases. The President also recently forgave an additional $5 billion in student loans. This coupled with lower interest rates could also help as more Americans get back to traveling with less debt to worry about.

Bottom Line

With the recent decline in share price from early January, I think VICI’s price is attractive and is poised for some double-digit upside when interest rates do decline. Furthermore, the company has impressively grown its FFO & AFFO despite headwinds the entire sector faced in the past year. The company remains committed to growth with the Bowlero deal which is expected to be immediately accretive to AFFO.

Additionally, the bowling company expects to take advantage of growth opportunities in the foreseeable future, which will only benefit VICI positively. With their strong upside potential, double-digit FFO & AFFO growth, I still think VICI is a strong buy at current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.