Summary:

- Visa Inc. is about to release its Q1 2024 results later this week, and there are some key aspects that deserve attention.

- The currently priced-in expectations for double-digit revenue growth will come under pressure.

- Record-high margins are expected to remain at current levels, which also poses a risk for Visa’s share price in 2024.

JIM WATSON/AFP via Getty Images

After a very strong fiscal 2023, Visa Inc. (NYSE:V) is entering a period of moderating growth and more uncertain macroeconomic environment.

In the meantime, the market sentiment around the stock is extremely optimistic, with expectations of 2024 being a repetition of the past 12-month period. Although this is certainly a possibility, it is an unlikely scenario in my opinion, and the upcoming fiscal Q1 2024 earnings release this week (expected post-market on Thursday January 25th) will set the tone for the rest of the year.

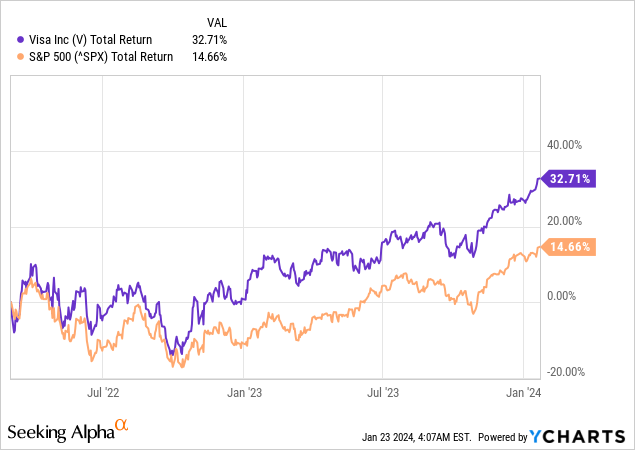

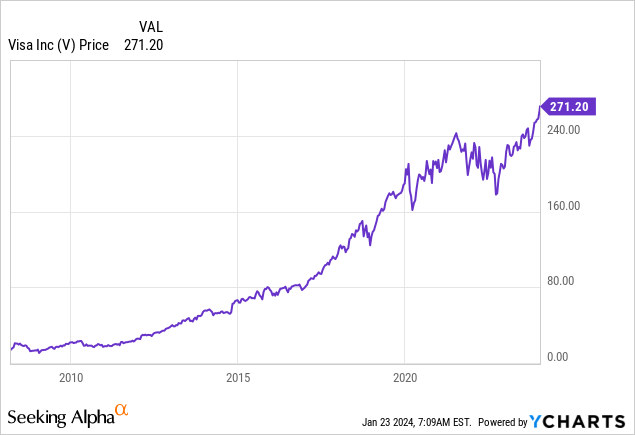

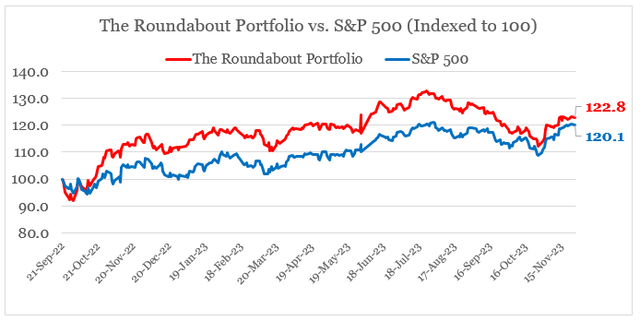

Having said that, I have been optimistic on Visa’s business model for the past 2 years or so, and during this time the stock delivered a total return of more than 30%, thus significantly outperforming the broader equity market.

The performance gap with the S&P 500 (SP500), however, has stayed constant for the most part of 2023, which is consistent with my more cautious take on the company since mid-last year. This development also highlights that Visa’s share price performance has been largely driven by broader market factors, as opposed to better-than-expected business performance.

With that in mind, there are a number of key areas that I will be closely following during the fiscal Q1 2024 earnings release. The first group relates to revenue growth drivers and Visa’s volume growth within the context of falling inflation.

Sustaining A Double-digit Revenue Growth

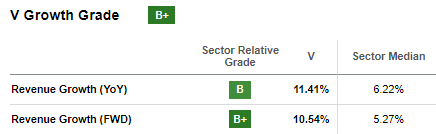

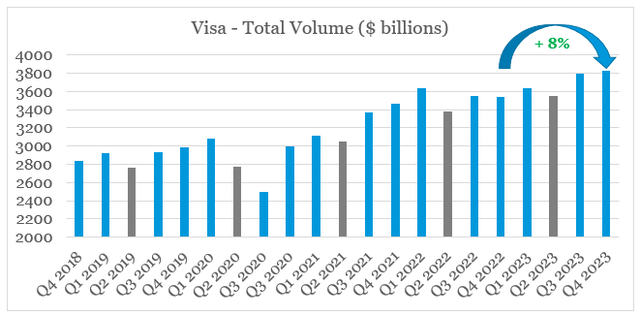

At the moment, expected revenue growth for Visa stands at almost 11%, which is not materially different from the one recorded for the past fiscal year.

Seeking Alpha

The same goes for Visa’s key competitor – Mastercard (NYSE:MA), which I recently downgraded to hold.

Seeking Alpha

Given Visa’s recent performance, the expected top line growth for 2024 seems reasonable, especially when we take a look at the company’s strong quarterly growth figure and consider recent trends in consumer spending.

prepared by the author, using data from Quarterly Earnings Releases

During the past quarter, Visa’s management has also made clear that they assume next fiscal year to be largely in-line with 2023, with expectations of no recession during the period.

(…) we are assuming no recession in our outlook

(…) For key drivers, we are assuming that the trends we saw in Q4 generally continue throughout the year.

Source: Visa Q4 2023 Earnings Transcript.

This is a very optimistic assumption in my view and deserves more scrutiny by Visa’s shareholders. I don’t mean for anyone to have a sold view on the economy for 2024, but rather investors should keep a close eye on any change in language over the coming quarters.

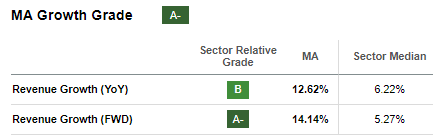

When it comes to Visa’s volume growth, we should also keep in mind that the last quarterly results were impacted a number of transitional factors.

Over the course of the quarter, we saw payments volume growth tick up from July to September, primarily driven by sequential improvement in ticket size growth that was mostly led by fuel with higher gas prices and easier year-over-year comparisons as well as a positive days mix impact.

Source: Visa Q4 2023 Earnings Transcript (emphasis added).

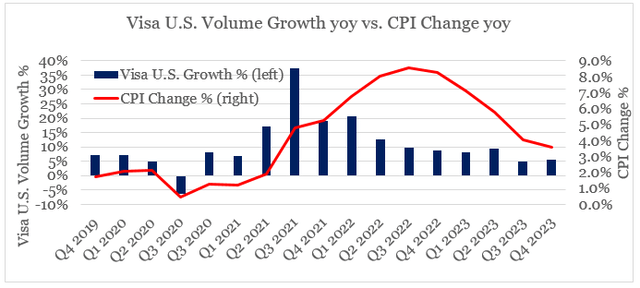

Higher inflation has also been a major tailwind for volumes over the past few years and at least in the short-run this appears to be changing. On the graph below, we could see the strong impact that the changing Consumer Price Index (CPI) had on Visa’s volumes in the United States.

prepared by the author, using data from Quarterly Earnings Releases and FRED

With the annual change of the CPI falling from 3.6% to 3.2% during the last calendar quarter of 2023, I will be expecting Visa’s volume growth in the U.S. during Q1 2024 to come under pressure and grow by less than 5.4% reported during the quarter ending in September.

Fading Margin Tailwind

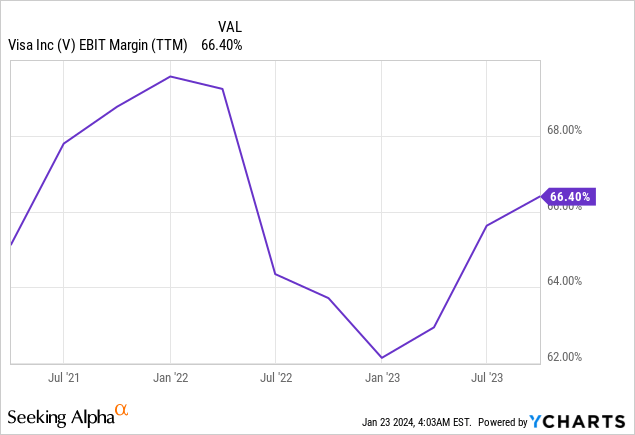

The most important area to keep a close eye on would be how Visa’s margins evolve during 2024. Even though revenue growth is in the double digits right now, profitability remains the key driver of Visa’s share price returns.

Even though operating margins fell in late 2022 and early 2023, they have stabilized in recent quarters and now stand at one of their highest levels since Visa became publicly traded company in 2008.

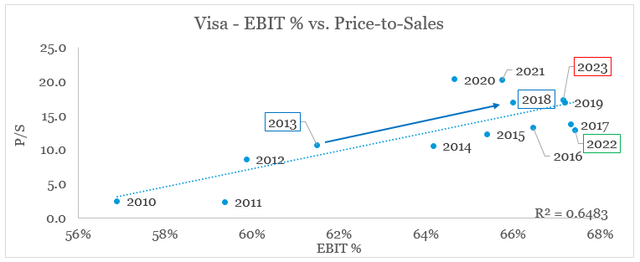

In my previous articles on Visa, I have highlighted the importance of the graph below for long-term investors in the company. On the x-axis we have Visa’s operating margin against the company’s current price/sales multiple on the y-axis. Over the long-term we see that there is a very strong relationship between the two variables and that’s the reason why profitability is by far the most important driver of shareholder returns.

prepared by the author, using data from SEC Filings and Seeking Alpha

Thus the strong share price returns during the 2013 to 2018 period (see the graph below) came as a result of the company’s EBIT margin increasing from around 62% to 66%. On the contrary, the drop in Visa’s share price in 2022 has resulted in the company’s Price/Sales multiple being below the long-term trend line on the graph above.

Right now, Visa trades in line with its current record-high margins which has largely diminished the upward multiple repricing opportunity, unless we see further margin improvements in 2024.

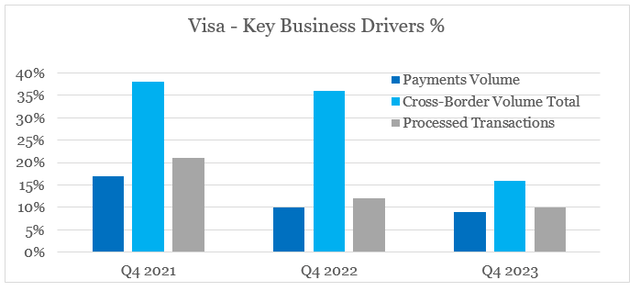

Based on the recent quarterly data, we see a trend towards Visa’s key business drivers normalizing towards their pre-pandemic trends. Most importantly, growth in the high margin cross-border volumes has stalled in the last quarter of fiscal year 2023.

prepared by the author, using data from quarterly presentations

Visa’s management has also made clear that cross-border travel volume excluding intra-Europe will moderate in the coming 12-month period.

Cross-border travel volume, excluding intra-Europe, year-over-year growth will moderate to the low 20s in constant dollars

Source: Visa Q4 2023 Earnings Transcript (emphasis added).

On a total revenue and total expenses basis, Visa’s management also implied that margins have little upside from here. Although Q1 2024 results might tell a different story, for the full fiscal year expectations are for net revenue and operating expenses to grow at similar levels.

For the full year, we expect low double-digit adjusted net revenue growth.

(…) Our current plans are to grow adjusted operating expense in the high single-digit to low double-digits

(…) On the expense side, as Ryan mentioned, this is an Olympics year, and we expect Q2 and Q3 expense to have the largest percentage increases as we ramp.

Source: Visa Q4 2023 Earnings Transcript (emphasis added).

It also appears that revenue growth will be heavily loaded towards the back-end of the year which creates additional risk for Visa not meeting its quarterly estimates for either the first or the second quarter.

(…) we expect overall adjusted net revenue growth to be lower in the first half than in the second half of FY 2024.

(…) Q1 is expected to have the lowest adjusted year-over-year net revenues growth rate with an improving trend throughout the year, and Q4 is expected to be at the highest adjusted growth rate.

Source: Visa Q4 2023 Earnings Transcript (emphasis added).

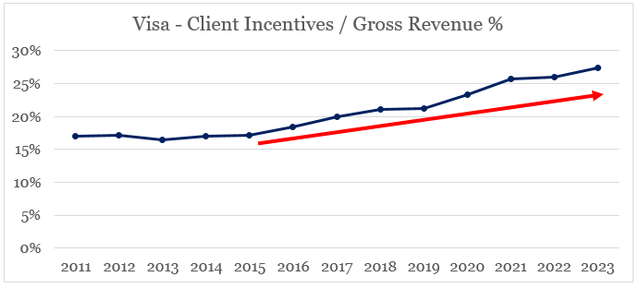

Lastly, when it comes to profitability, investors should keep a close eye on Visa’s rising client incentives relative to the company’s gross revenue figure.

prepared by the author, using data from SEC Filings

During the last quarter, Visa’s management has intentionally guided for dollar year-on-year growth in incentives, which is a signal that we are unlikely to see a drop in the incentives to gross revenue ratio.

And that guidance is on net revenue guide specifically and directional commentary about the growth in incentives, which to your specific question, it is a dollar year-over-year growth rate that we said will grow slower in 2024 relative to 2023. Importantly, this is very, very consistent and it’s aligned with how we think about the business, how we manage the business going forward. We haven’t guided on the percentage, which is the other part of your question because, again, this is consistent with how we manage the business.

Source: Visa Q4 2023 Earnings Transcript (emphasis added).

Conclusion

In a nutshell, fiscal year 2024 is likely to be far more challenging for Visa than 2023 was. From more uncertainty regarding the state of the economy to dissipating tailwinds, Visa’s top line growth over the coming year is unlikely to come in above current expectations. On top of that, margins have likely peaked which leaves little room for multiple repricing to the same extent we saw in FY 2023.

Having said that, I am currently taking a wait-and-see approach when it comes to adding Visa Inc. stock to my high conviction ideas and would be looking for clues in the upcoming earnings release that Visa’s business model could surpass the currently priced-in expectations for FY 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similar high quality businesses across a wide range of sectors?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.