Summary:

- Pfizer stock is popular among dividend growth investors due to its 14-year dividend growth streak and 6% yield.

- The company has strong underlying fundamentals, including an A credit rating from S&P and a proven track record of innovation.

- However, I am still not bullish on the stock despite the steep recent sell-off.

- In this article, I list several reasons why.

Oscar Wong/Moment via Getty Images

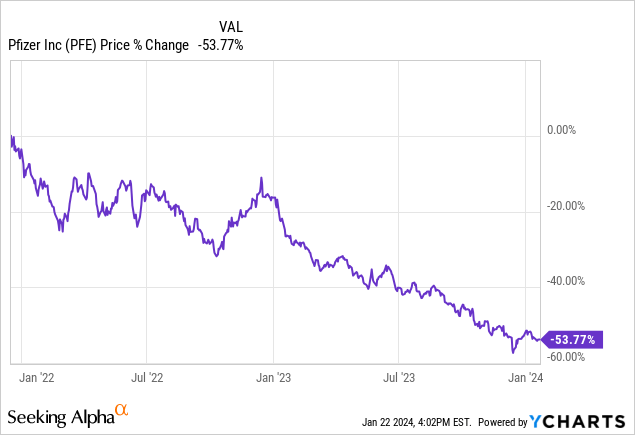

Pfizer (NYSE:PFE) stock is an increasingly popular option for dividend growth investors due to its 14-year dividend growth streak, strong balance sheet, 6% yield, and what appears to be a deeply discounted stock price after the stock’s brutal sell-off over the past two years:

However, I do not believe that PFE is attractive enough to warrant buying at this point, and in this article, I explain why.

The Bull Case For PFE Stock

Despite facing a challenging 2023 with sales underperformance – particularly in COVID-19 product sales – PFE has strong underlying fundamentals as evidenced by its A credit rating with a stable outlook from S&P, global scale, and proven track record of innovating and passing on profits to shareholders via a growing dividend.

Moreover, its immense scale and significant pool of experienced talent combine to give it a research and development competitive advantage over its smaller and less prestigious peers. This R&D strength was on display in 2023 as the company achieved a record number of FDA approvals during the year, including nine new molecular entities, pointing to future growth.

PFE also continues to invest in reigniting its growth engine through strategic acquisitions, including the recent purchase of Seagen as an important step towards establishing PFE as a global leader in oncology by doubling its oncology research resources and expanding its oncology commercial presence.

PFE is also focused on improving its operating efficiencies by cutting costs while also remaining committed to growing its dividend payout and opportunistic share repurchases. As the CEO stated at a recent healthcare conference:

I want to emphasize that a lot of investors were penalized this year with Pfizer. We were not happy. I want to make sure that they all understand, first of all, that we are very sensitive to that. Secondly, that our capital allocation will continue to be an investor-friendly capital allocation going forward. Number one priority for capital allocation, it is growing dividend. It is a sacreds cow, that will not change. Number two priority, it is to delever. We are going to pay back a lot of this debt in the next one and two years. Number three priority, it is to allocate after we do those two things between growing the business and buying back shares

Last but not least, perhaps the biggest reason to be bullish on PFE right now is its fat dividend yield of ~6% compared to its five-year average of 3.93%. In fact, based on dividend yield alone, PFE stock has ~50% upside potential.

Why PFE Stock Is Not A Buy

Despite PFE’s numerous strengths, there are several reasons why we do not believe it is a buy at the moment.

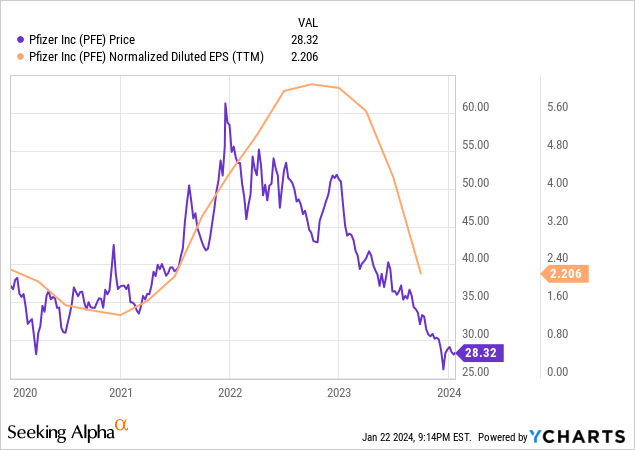

First and foremost, PFE’s earnings and stock price were artificially inflated by a major tailwind from the COVID-19 shot and related products. However, demand for COVID-19 booster shots has since declined dramatically, leading to a dramatic drop-off in earnings and the stock price:

Moreover, the headwinds from plunging COVID-19 revenues are further compounded by the fact that PFE’s international markets business is also struggling and several of PFE’s key drugs are about to have their patents expire and face growing generic competition. As a result, it is estimated that PFE may lose billions of dollars in revenue due to a wall of major patent expirations later this decade.

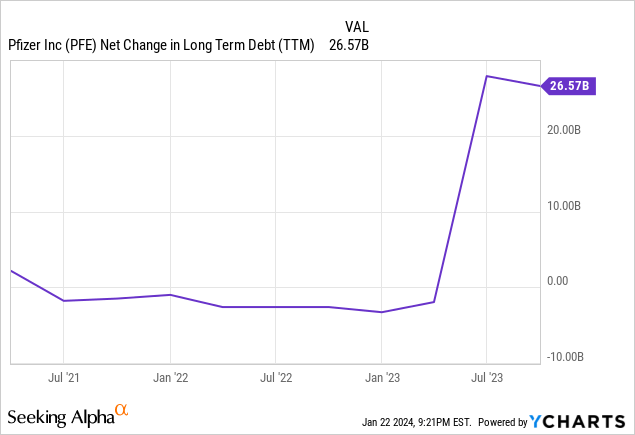

Another challenge facing the company is the significant amount of debt that it took on over the past year to finance its aggressive efforts to rev up its growth engine, including its pricey acquisition of Seagen.

As a result, PFE is going to be battling both fierce growth headwinds as well as the need to deleverage. Analysts reflect this challenging outlook for the company in their forecast for very lackluster dividend growth through 2027 with a meager 0.9% dividend per share CAGR expected. This brings to mind AT&T (T), which is also facing growth headwinds, the need to deleverage a bloated balance sheet from past acquisitions, and is expected to deliver minimal dividend growth for the foreseeable future.

On top of this, there is the risk that the Seagen acquisition will fail to deliver on its potential, as integrating a large acquisition like this is far from easy. PFE will need to effectively merge different corporate cultures as well as R&D pipelines, personnel, and processes. Given that PFE paid over 22x revenues for a company that is not yet profitable, there is a high bar for the performance of the Seagen pipeline in order to make it an accretive acquisition for PFE.

Last, but not least, the rapid decline in PFE’s earnings per share leaves it overvalued relative to its own history on an EV/EBITDA and P/E basis. Its current EV/NTM EBITDA is 13.73x and its current P/NTM Earnings are 19.11x, whereas its 10-year averages are 10x EV/EBITDA and 12.91x P/E. Yes, Seagen and the rest of its pipeline will likely have some profitable winners, which will cause its EBITDA and earnings to increase and somewhat normalize its valuation metrics, but the point here is that – despite the massive beating that the stock has taken lately – it still is far from looking inexpensive based on historical valuation multiples.

Investor Takeaway

While PFE’s yield looks attractive, the company has an impressive dividend growth track record, and the company still has the infrastructure and R&D pipeline of a world-class company, there is still far too much uncertainty, debt, and lack of margin of safety to entice us to buy any PFE stock at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join 1,700+ Subscribers…

At Just ~1/3 Of The Regular Rate!

For a Limited-Time – You can join Seeking Alpha’s #1-rated community of high-yield investors at just $25 per month

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.