Summary:

- Despite a horrible year 2023 for semiconductors, Intel Corporation (and many other semiconductor stocks) performed great as the stock market is usually forward-looking.

- I remain optimistic that Intel will continue its turnaround and will surprise investors once again and beat expectations for the fourth quarter.

- With financial markets being most likely at the end of a long-term debt cycle, we should be very cautious about most assets.

- Nevertheless, Intel stock seems like a good investment, as the true intrinsic value is still not reflected by the stock price.

NurPhoto/NurPhoto via Getty Images

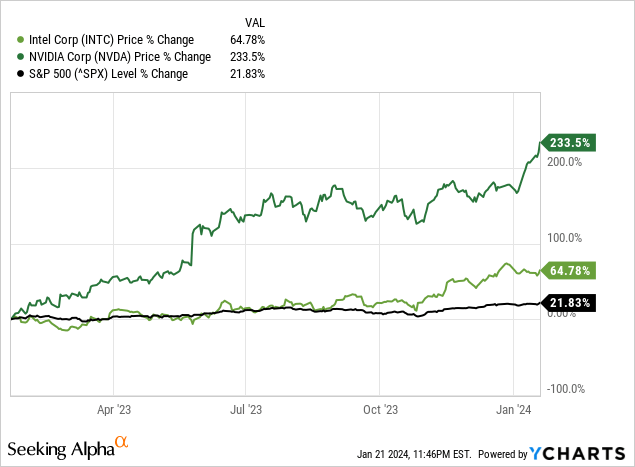

It is not like the stock market did not perform great in 2023, but especially Intel Corporation (NASDAQ:INTC) as one of the outperformers. When looking at the performance in the last 365 days, we see Intel underperforming the S&P 500 (SP500) in the first few months, but especially in the second half of 2023 the stock continued to gain and increased 65% in value in the last 12 months. Compared to the S&P 500, which increased about 22% in the same timeframe, this is a solid outperformance.

In my last article in November 2023 about Intel, I wrote that the turnaround picks up speed and I also made the prediction that the stock could double in the next few years. And although the stock did not double in the meantime, it increased 27% in the last 11 weeks, which is without doubt a great performance.

With earnings coming up this week (expected post-market on Thursday January 25th), one of the decisive questions is if the performance of Intel can continue – the fundamental as well as the stock performance.

Recapping 2023

While Intel’s stock price performed great in 2023 – as the stock price is usually anticipating the fundamental performance – from a fundamental point of view, 2023 was not a great year for semiconductor companies. According to Gartner, global semiconductor sales declined 11% worldwide, and despite all cyclicality, which is normal in the semiconductor industry, last year was one of the worst years in history for semiconductors.

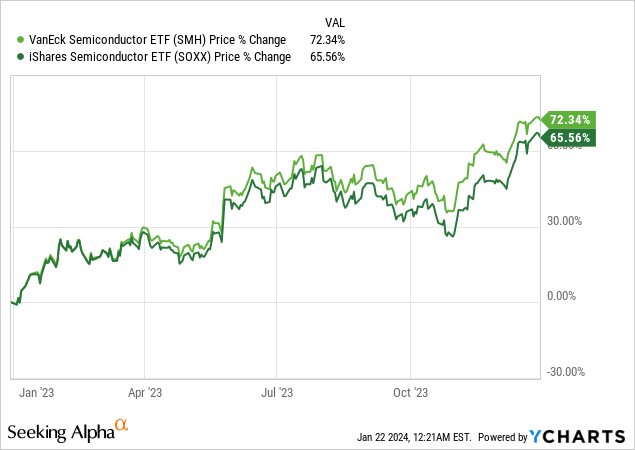

It probably did not feel that way for two different reasons. First, semiconductor headlines were often dominated by Nvidia Corporation (NVDA), and in the case of this company we saw not only an extremely impressive stock price performance (see chart above) but also revenue growing almost 56% annually. But among the top 10 semiconductor companies in the world, only three could report growing revenue in 2023 – aside from Nvidia, it was Broadcom Inc. (AVGO) and STMicroelectronics N.V. (STM). Second, as investors are usually anticipating the same fundamental performance, most semiconductor ETFS also performed great last year – for example, the iShares Semiconductor ETF (SOXX) or the VanEck Semiconductor ETF (SMH).

Gartner also pointed out that Intel regained the top spot in the semiconductor industry again and reported a market share of 9.1%. Intel was only number 2 in 2022, but despite declining revenue, the company became market leader again as Samsung’s revenue declined even steeper.

And when looking at the last quarterly results, Intel is still not reporting great results, but we see an improvement again. In my last article, I wrote:

However, Intel beating estimates should not disturb us from the fact that the business is still reporting a declining revenue. Net revenue declined from $15,338 million in the same quarter last year to $14,158 million this quarter – resulting in 7.7% year-over-year decline. And Intel still had to report an operating loss for the quarter: Although it was a small loss of only $8 million and therefore a better result than in the same quarter last year in which the company reported an operating loss of $175 million, a company like Intel should not have to report any losses. On a GAAP basis, Intel’s bottom line was profitable again (which was not always the case in the last few quarters) and reported diluted earnings per share of $0.07. Year-over-year however the company had to report a decline of 72% compared to a profit per share of $0.25 in the same quarter last year.

When looking at non-GAAP results, earnings per share grew 10.8% year-over-year from $0.37 in Q3/22 to $0.41 in Q3/23. Non-GAAP operating margin also increased from 10.8% in the same quarter last year to 13.6% this quarter. And finally, Intel also reported an adjusted free cash flow of $943 million. While this is not an impressive number for Intel it is much better than the negative $6.3 billion the company had to report in the same quarter last year.

Being Optimistic

And although looking back at history and historic data is important (learning from history is important because without understanding history we might repeat mistakes from the past), we are also looking at expectations for the coming quarters and years.

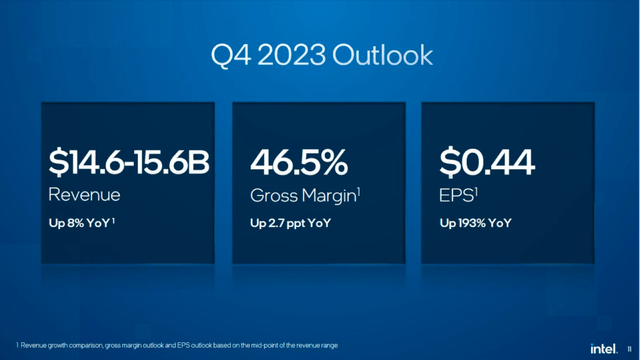

During its last earnings call, Intel issued its fourth quarter guidance, and management is expecting revenue to be in a range between $14.6 billion and $15.6 billion, with (non-GAAP) earnings per share being $0.44.

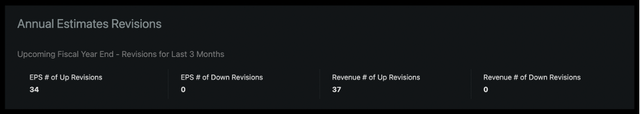

When looking at analysts’ estimates for the fourth quarter, they are in line with Intel’s own guidance, and they are expecting revenue to be $15.18 billion and earnings per share on a GAAP basis of $0.21. However, it is worth pointing out that analysts got more optimistic during the last three months, and basically every analyst revised revenue and EPS estimates to the upside – for the upcoming quarter as well as for the fiscal year.

Intel: Annual Estimates Revisions (Seeking Alpha)

And assuming that revenue as well as earnings per share are in line with expectations, Intel will grow its top- and bottom-line quarter-over-quarter as well as year-over-year.

In early January, Mobileye Global Inc. (MBLY) reported preliminary fourth quarter results and lowered its full-year guidance. This actually led to a huge selloff for the stock, and in the last few weeks Mobileye lost about one third of its value. Intel still has an 88% stake in Mobileye, and while Intel’s stock opened lower the day Mobileye reported preliminary results, the stock obviously was able to shake off the bad news quite well.

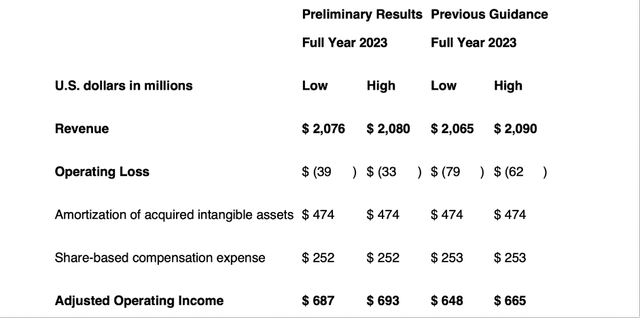

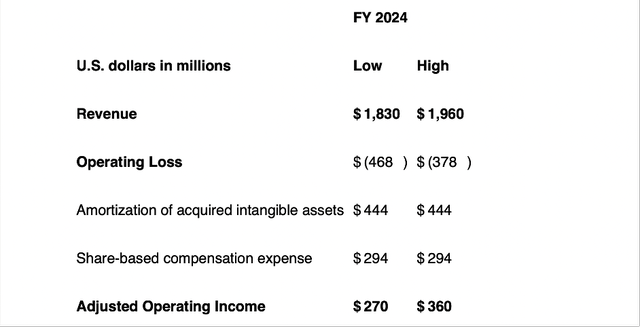

Mobileye Preliminary Earnings Release

And while results for fiscal 2023 are still acceptable, the guidance for 2024 was the main reason for investors being disappointed. For fiscal 2024, the company is expecting revenue to be in a range of $1,830 million to $1,960 million. And compared to a small operating income in fiscal 2023, the company is expecting an operating loss between $378 million and $468 million for fiscal 2024.

Mobileye Preliminary Earnings Release

Mobileye is only a small part of Intel’s business, and a lower guidance is not a great sign, but Intel investor don’t seem to concerned and the stock was holding up quite well in the weeks following.

Intel And The Big Picture

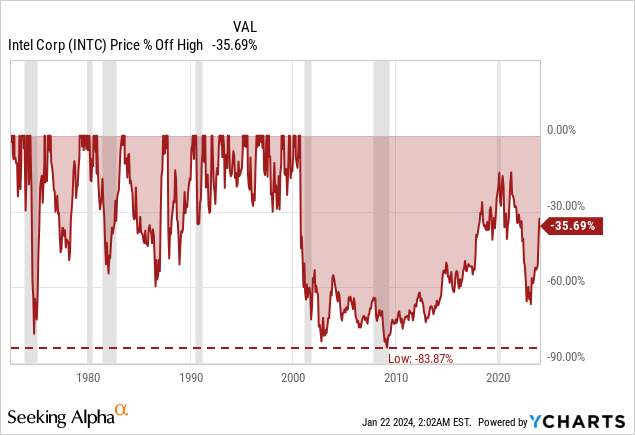

And while quarterly results can have a short-term impact on the stock price, quarterly results are not so important. The bigger picture is much more important – at least for long-term investors. And here the situation gets a bit complicated. In my last article about BASF SE (OTCQX:BASFY), I explained briefly how I see the situation right now and what stocks to avoid in the coming quarters. And for starters, the sector in which Intel is operating in – the technology sector – is among those sectors with a horrible performance during recessions and steep stock price declines (at least in the past). And when looking at the stock price in the last few decades, Intel is no exception with its stock price declining more than 50% on several occasions (not only during recessions).

It seems obvious that Intel is not the best investment when one is expecting the economy to be heading towards a recession. But not only investing in the wrong sectors seem like a problem in the coming quarters (and years). When focusing on the “big picture” – the economic and political situation in the United States and many other countries around the world (especially in Europe) – we seem to be headed for major trouble. Based on the working of Ray Dalio, we see three major forces influencing the course of events:

- External order or disorder between states

- Internal order or disorder within states

- Debt cycles (short-term and long-term).

Internal disorder

One problem is a country shifting from order to disorder, and in the United States disunity between the political groups is clearly visible, with Democrats and Republicans seeming irreconcilable at this point. This is not only true for the leading politicians but also for voters and supporters. However, in case of Intel I would assume it doesn’t matter who is leading the country. Even if Donald Trump should win, he will probably focus on “America First” and his opposition to China, which was already obvious in his first term. Keeping this in mind, he might be pleased with Intel trying to make the Western World less dependable on the Asia-Pacific region regarding semiconductors. On the other hand, building factories in Germany and Israel might not be a perfect strategy in Trump’s book, as this is in contrast to the “America First” policy.

External Disorder

When talking about external disorder, the obvious risk for everybody is China attacking Taiwan. The important role Taiwan plays for global semiconductor production is a well-known fact (otherwise see my last article about Intel) and although it sounds cynical as the horrors of war can never be balanced out by investment success, Intel will most likely profit from such a scenario. And the worst case right now is the United States and/or NATO heading for a war with Russia and/or China, and it also remains to be seen how internal conflicts within countries will play out further in case of war (as a “rally ‘round the flag” effect seems likely).

Debt Cycles

And the most important aspect – as we are talking here about stocks and financial markets – is the short-term and long-term debt cycle. At this point, we can make the argument that we are close to the end of a short-term (and probably also close to the end of a long-term) debt cycle. One of the typical signs for the end of a long-term debt cycle is the interest rate being close to zero and it has been zero for a very long time (almost 10 years) making it necessary for the FED to use other monetary policy tools (also known as quantitative easing).

One of the huge problems due to extremely low interest rates for a long time are rising asset prices. In a recent article called The Effects of Low Interest Rates, I wrote:

And as more and more people are chasing assets that promise a higher return, more and more capital is flowing towards these assets leading to rising asset prices. And other people are observing these rising asset prices – confirming that these assets are obviously a great investment. This is leading to even more people investing in these assets, leading to even higher asset prices. This is creating a feedback-loop that can push asset prices for these assets higher and higher and we are looking at a kind of self-fulfilling prophecy.

Intel: Not Fitting The Picture

And here we have the major reason why I am rather bullish about Intel despite the company operating in the information technology sector and the economy probably being close to the end of a long-term debt cycle: Intel is by no means fitting the description of a hyped company or extremely overvalued stock. And one might argue that Intel has doubled since its bottom in the spring of 2023, but that by itself is not an argument for the assumption that a stock is overvalued. Even when looking at the expectations for earnings per share in 2027, analysts are not expecting that Intel will reach its pre-crisis high again.

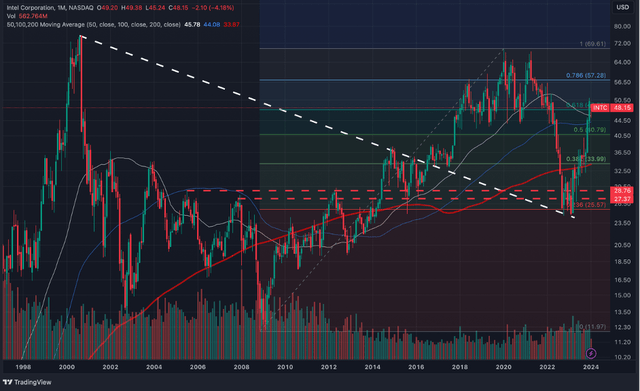

Author’s work creased with TradingView

When looking at the bigger part, we are still in the huge correction that is going on for 24 years. Intel could still not reach its Dotcom bubble peak. And when comparing the last few years (excluding 2022), Intel is generating 2-3 times the revenue as during the Dotcom bubble peak, about 2-3 times the net income, and about 3-4 times the earnings per share (due to share buybacks). But the stock price still has not reached the same levels again.

My last article was published in November 2023, and I don’t see any reasons to update the intrinsic value calculation provided in this article (maybe after earnings are released on Thursday). I would still argue that the stock is undervalued at this point and refer to the intrinsic value of $76.76 calculated in my last article. And I used very cautious assumptions in my opinion – it would take Intel until 2027 to reach pre-crisis free cash flow levels again, and following that we assume 5% growth (also a realistic assumption in my opinion).

Bottom Line

Our job right now is to identify these stocks and companies we can invest in and keep holding – although we should not ignore the risk of a steep decline. But while Intel could decline as well in the next few quarters, I see Intel trading for higher prices when using a time horizon of 5 to 10 years (compared to the stock market which is headed for a “lost decade”).

In case of Intel, two “forces” are competing. On the one side, the stock which is in a major turnaround and on its way to higher stock prices – supported by the chart as well as a company that seems undervalued at this point. Additionally, the already existing tensions between China and the United States are a powerful motivation for producing semiconductors in America (or at least in European countries) again. And Intel is going down this path right now and will profit from this shift. On the other hand, we have the major risk of the world heading towards a recession (or even depression) which is never a good environment for stocks and companies.

Overall, Intel is still a good investment in my opinion and certainly not overvalued. I am also expecting Intel to surprise investors again and beat earnings expectations on Thursday.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.