Summary:

- In Q3 2023, Amazon demonstrated impressive financial performance across multiple of its business units. Q3 results showed a stabilization of AWS’ revenue growth, which is what the market really wanted.

- Over the last 4 quarters, Amazon’s EBITDA margin increased by 565 basis points, while the net profit margin increased by 672 bps.

- Forward-looking valuation multiples are still low and are not keeping pace with the recovery in margins.

- Based on my calculation, Amazon’s Q4 EPS should be 39% more than the consensus suggests today.

- For these reasons, I am upgrading Amazon stock from Neutral to Buy today.

4kodiak/iStock Unreleased via Getty Images

Introduction

I first wrote about Amazon.com, Inc. (NASDAQ:AMZN) stock here on Seeking Alpha in February 2021 and since then I have been either bullish or neutral on the stock depending on the state of the company and the market at any given time. In October 2023, I wrote a “Hold” rated earnings preview article in which I noted that I was bullish on AMNZ for the long term because of its really wide moat; however, at the time, I did not dare to recommend increasing the allocation to the stock before the Q3 earnings release because market expectations seemed relatively high to me and higher gasoline prices and falling inflation threatened to disrupt market optimism.

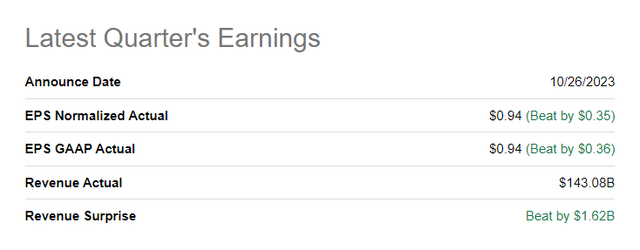

As time has shown, my fears were in vain: Amazon beat all analysts’ consensus forecasts (GAAP and non-GAAP) for both sales and earnings per share with enormous force:

Amazon’s fourth-quarter and full-year results are expected on February 1, 2024, according to Seeking Alpha. I suggest not waiting for the company’s actual data, but trying to determine the probability of success or failure of the upcoming report.

Quick Q3 Results Commentary

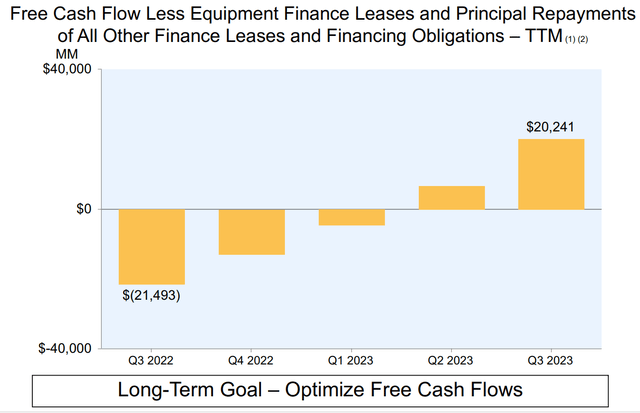

In Q3 2023, Amazon demonstrated impressive financial performance, achieving $143.1 billion in revenue (+11% YoY). Operating income saw a staggering increase of 343% YoY, reaching $11.2 billion. Additionally, the trailing 12-month free cash flow, adjusted for equipment finance leases, stood at >$20.2 billion, indicating a substantial rise from negative ~$21.5 billion in Q3 last year.

Amazon’s CEO, Andrew Jassy, emphasized the positive trajectory in lowering costs, improving customer experiences, and strategic investments for future growth. Jassy also noted significant changes to Amazon’s fulfillment network, specifically the transition from a single national network to 8 distinct regions. This transition has exceeded expectations, resulting in improved in-stock levels, optimized connections, and faster deliveries for customers. The move has not only lowered the cost to serve but also positioned Amazon on track to achieve the fastest delivery speeds for Prime customers in its 29-year history.

In terms of segment data, North American retail revenue of $87.9 billion (61% of total revenue) saw an 11% YoY increase, with an operating profit of $4.3 billion. International retail revenue grew by 16% annually to $32.1 billion, showing improved profitability compared to previous quarters. With a revenue of $23.1 billion, AWS maintained its high operating margin at 30.3%. The collaboration with Anthropic, announced in September, involves a $4 billion investment, making AWS the primary cloud provider. This strategic move is expected to advance generative AI foundations and model development.

In July 2023, Amazon held its largest-ever Prime Day, where members purchased >375 million items and subsequent Prime Big Deal Days across global markets. To support the holiday season, Amazon announced plans to hire 250,000 workers in the U.S.

The company continues diversifying revenue streams, with third-party merchant sales growing 20% YoY to $34.3 billion. Non-goods services, including subscription services, AWS, and advertising, generated $46.5 billion in revenue, growing 16% YoY.

Beyond AWS, Amazon had some progress in various business initiatives, including Prime Video, international stores, healthcare services, and Project Kuiper for satellite broadband. The management team highlighted the positive responses to emerging services such as Buy with Prime, Supply Chain by Amazon, and the evolution of the Amazon Pharmacy customer experience.

In general, I can state that the Q3 results showed a stabilization of AWS’ revenue growth, which is what the market really wanted to see. In addition, the business momentum seen in North American eCommerce margins and international business and profitability in key countries contributed to the overall strength of Amazon’s Q3 results.

But all that is the past… what do we know about the future?

Q4 FY2023 Expectations Commentary

During the earnings call, Amazon’s CFO Brian Olsavsky highlighted Amazon’s readiness for a successful holiday season, with inventory in the best position ever. Capital investments for FY2023 were expected to be ~$50 billion, down from $60 billion in the previous year, with a focus on supporting AWS growth, including generative AI and large language model efforts.

Typically, Amazon is known for being relatively conservative in its forward-looking statements, and the company’s management tends to refrain from offering specific numerical guidance for upcoming quarters. However, the results for Q3 made the market sit up and take notice and raised expectations for Q4. Based on Goldman Sachs’ October report (proprietary source), we see a striking example of how expectations for the next report (and FY2024/25 in general) have changed:

Goldman Sachs [October 27, 2023 – proprietary source], author’s notes![Goldman Sachs [October 27, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2024/1/21/49513514-17058304159981937.png)

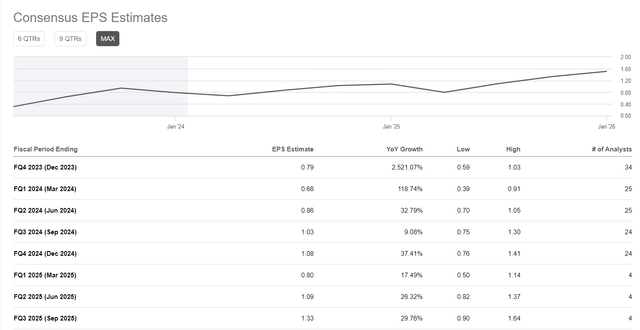

If you open Amazon’s Earnings Estimates page, provided by Seeking Alpha Premium, you’ll see the current consensus analyst forecasts for the fourth quarter: the company is expected to report an EPS of $0.79 compared to Q4 FY2022 of just ~$0.03.

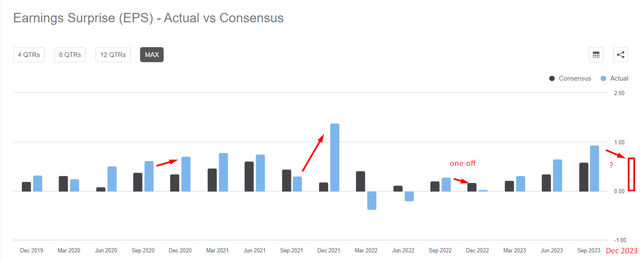

I believe that the current consensus estimate may be slightly lower than Amazon actually reports in its financial statements. I think so because Q4 is historically the strongest month for the company, except for Q4 FY2022, which was apparently a one-time event due to Rivian (RIVN):

Seeking Alpha data, author’s notes

While we primarily focus our comments on operating income, I’d point out that this net income includes a pretax valuation loss of $2.3 billion included in nonoperating income from our common stock investment in Rivian Automotive. As we’ve noted in recent quarters, this activity is not related to Amazon’s ongoing operations but rather the quarter-to-quarter fluctuations in Rivian’s stock price.

Source: AMZN’s CFO commentary, Q4 FY2022, emphasis added by the author

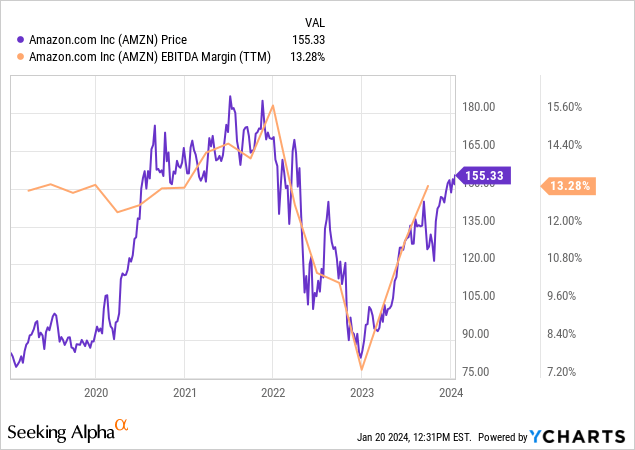

The crucial point on which the success of the company will depend in the future is its margins. This statement can easily be confirmed by a trivial comparison of the AMZN stock price with the EBITDA TTM margin over time:

I expect that the headroom at the top to maximize margins will continue to be made up through continued optimization processes in the core business as well as the continued monetization of the fast-growing AWS through AI initiatives.

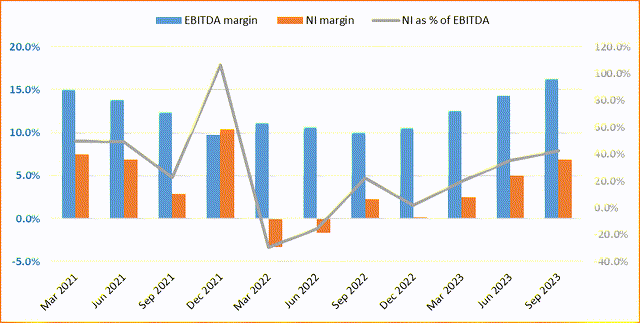

Amazon has experienced a turbulent phase of recovery in recent quarters: over the last 4 quarters, the EBITDA margin increased by 565 basis points, while the net profit margin increased by 672 bps. At the same time, the company reached its usual level of NI/EBITDA of 40%+.

Author’s work, Seeking Alpha data

I expect Q4 FY2023 NI/EBITDA of 43% (slightly higher than the previous quarter at 42.4%) and EBITDA margin in line with Q3 (16.3%). So if we take the consensus estimate for Q4 revenue of $166.14 billion, we’ll get a net profit of ~$11.65 billion. Over the last 11 quarters, the number of shares outstanding has grown at a CAGR of 0.3% (QoQ) according to Seeking Alpha data. If we assume the same growth rate for Q4, we get earnings per share of $1.1 – that’s 39% more than the consensus suggests today. Even if the dilution is greater, I think the beat is much more likely than not.

What market reaction should we expect to this potential earnings beat?

In many ways, it will all depend on management’s comments during the Q4 conference call, but I think their words should be optimistic about future growth and margin expansion: Most likely, citing the AI effect and the benefits it brings, Amazon will not give analysts a reason to lower their forecasts for this year.

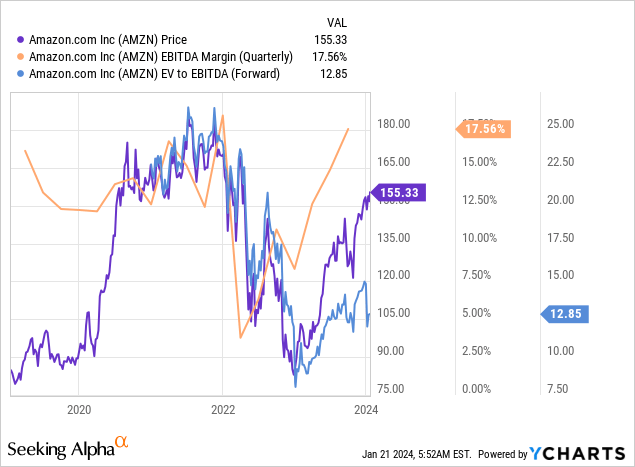

Another argument in favor of a positive market reaction: valuation multiples are still low and are not keeping pace with the recovery in margins.

Yes, compared to the consumer discretionary sector, the stock is ~64% overvalued according to Seeking Alpha’s Quant ranking system (based on next-year EV/EBITDA). However, one has to agree with me: Not every company in this sector has a product portfolio like Amazon (especially the AWS business segment and the synergy effect the company enjoys due to its leading position in various areas). Therefore, I think the existing premium on the company’s valuation seems justified today.

As for a fair valuation of the company, I think Goldman Sachs’ estimates are closest to the truth for all the positives mentioned above. Applying the 32.0x EV/FCF SBC multiple to the three FY2027 estimates, discounted at 12% over three years, yields a fair value per share of $190 (base case), which is 22.3% higher than AMZN’s stock price today.

Goldman Sachs [October 27, 2023 – proprietary source]![Goldman Sachs [October 27, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2024/1/21/49513514-17058358054653003.png)

The growth potential could be even greater, as the bank’s forecasts go back to the end of October 2023. If Amazon achieves Q4 EPS similar to what I have calculated today, the fair value of the stock should skyrocket based on the same root assumptions.

Some Risks To Consider

My reasoning today carries several important risks that need to be considered. First, AMZN operates in highly competitive markets where it competes with both traditional retailers and e-commerce businesses. Increased competition can impact market share and profit margins (the things without which my thesis cannot survive).

Second, Amazon’s reliance on a complex logistics network makes it vulnerable to rising transportation costs and operational challenges. We see what’s happening now in the Red Sea: Some experts are even saying that the current situation could be more catastrophic for the global supply chain than the one in 2021. Nothing for Amazon shareholders to like here.

Concluding Thoughts

But be that as it may, I hope for the best. Throughout 2023, the company has clearly demonstrated that it should not be written off under any circumstances. Business margins continue to recover, and to date, I see no reason to believe that this recovery will be interrupted in Q4. Yes, shipping costs are rising again, but I hope that the company has learned its lessons from the last crisis and will be better prepared for such challenges this time.

As far as the upcoming fourth quarter is concerned, I believe that the company can once again significantly exceed consensus EPS estimates, even if the dilution will be greater than usual.

As for the valuation of the company: I don’t see what the market sees (overvaluation). I look at the long-term growth, which looks very attractive. The implied P/E ratio for FY 2027 is now at ~20x, looking quite cheap. If you’re willing to hold AMZN stock for the next 3 years, it’s not too late to buy.

For these reasons, I am upgrading Amazon stock from Neutral to Buy today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!