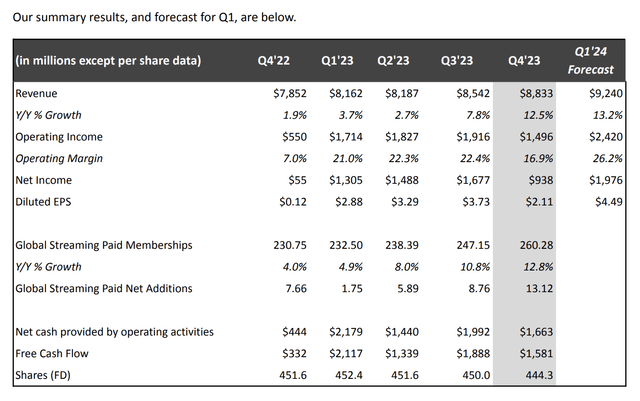

Summary:

- Netflix reported strong financial results with revenue exceeding estimates and significant user growth across all major regions.

- The company has been successful in monetizing its platform through pricing plans, advertisements, and the monetization of sharing.

- Netflix continues to invest in content and sees a $600 billion revenue opportunity in the pay TV, film, games, and branded advertising markets.

Mario Tama

Right now, things are looking very interesting for streaming giant Netflix (NASDAQ:NFLX). After the market closed on January 23rd, the management team at the business announced financial results covering the final quarter of the 2023 fiscal year. Although earnings fell short of expectations, revenue exceeded estimates. Announced a major deal and reported significant user growth across all major regions in which it operates. In response to this news, shares spiked in after-hours trading by roughly 8.7%.

Clearly, investors are optimistic right now. And I feel like they have a good reason to be. Back in October of last year, I wrote a bullish article about the firm. That article was noteworthy because it was one in which I upgraded the company from the ‘hold’ I had it at previously to a ‘buy’. My argument was that, through the successful adaptation of One Piece, as well as other initiatives, the company had successfully turned the ship around. User growth had been robust up to that point and it looked as though that trend would continue for the foreseeable future. Since then, my call has proven to be quite positive. By all the S&P 500 has jumped 12.6%, shares of the streaming giant have generated upside of 21.6%. And that excludes the after-hours move higher. With that, we are looking at upside of around 32.1%.

After such a significant move higher, it might be a good reason for investors who are risk averse to re-evaluate their positions. After all, no company can rise significantly in perpetuity. But for those who are focused on the long run and who believe in the potential of the streaming industry, I would argue that Netflix still makes for an attractive opportunity, especially when you look at the most recent cash flow data and user growth figures provided by management. Because of that, I’ve decided to keep the company rated a ‘buy’, making it one of only two streaming giants, the other being The Walt Disney Company (DIS), that I am optimistic about.

A great time for streaming

As time goes on and as I age, I notice that my memory tends to get foggy. The timing of specific events is a particular problem. If I have these kind of issues at 34 years old, I can only imagine what the future holds. What I do know, however, is at some time in the not-too-distant past, there was a lot of pessimism regarding streaming services. Large amounts of spending aimed at outcompeting one another, combined with saturation in the market, had led to concerns that the industry as a whole might not have all that much potential. I have always rejected these claims. However, I have long believed that there would be only room at the very top for one or two major players. Outside of that, I believed that all the other players would become fairly marginal.

To this day, I still believe that the best player in the market is Disney. Not only do you have Disney+. You also have Hulu and ESPN+. Two of these three services are true giants in streaming. My problem with Netflix, meanwhile, had been that while it is a behemoth in the market, it lacks the content library that traditional entertainment companies like Disney, Warner Bros. Discovery (WBD), Paramount (PARA), and others have. Even in spite of this though, the company has done well to come out with new content, some of it all original and others licensed. Though expensive, this is the only path forward for the business. And the results over the past few quarters now have been truly encouraging.

Netflix

Take, for instance, the final quarter of the 2023 fiscal year. Revenue came in strong at $8.83 billion. That’s 12.5% above the $7.85 billion generated one year earlier and it exceeded analysts’ estimates by $120 million. This growth seems to have been driven by a couple of different factors. For starters, management discussed in their quarterly report how they had been working on better monetizing the platform. They have done this in three key ways. First, they have invested in creating different types of pricing plans for customers. But this alone isn’t anything new. Second, and more recently, they have been investing in advertisements as a means of generating sales. For instance, in the final quarter of the 2023 fiscal year, the ads membership for the company came in 70% higher than what it was only one quarter earlier. In fact, that particular plan now accounts for 40% of all of the companies sign ups in the markets in which it’s offered. In fact, it is so successful that the business is planning to retire its Basic paid plan in some countries, such as Canada and the UK. If they are taking that drastic a step, that means that advertisement-based plans are more profitable than the low end paid plan is.

The third thing that management has been working on has been the monetization of sharing. As has been covered many times by other people in the not-too-distant past, the company has really cracked down on the ability to share account access. There was some concern that this would lead to customers leaving the platform. But so far, there has been no evidence of this. This doesn’t mean that it can’t happen or won’t happen at some point. But odds are, if it hasn’t already, it’s not going to.

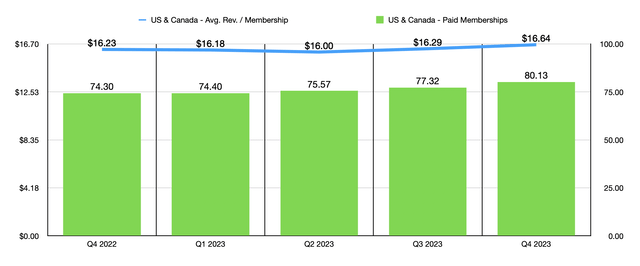

Author – Netflix Data

Perhaps more important than any of these has been continued growth in paid users. The total number of paid memberships came in at 260.28 million during the final quarter of 2023. That’s up nicely from the 247.15 million reported in the third quarter. That’s a gain of 13.13 million users in a three-month window. Year over year, the number of paid memberships has grown a remarkable 29.53 million from 230.75 million to what it is today. And what’s really great about this growth is that it is occurring across the board. Across the US and Canada, the firm reported 80.13 million paid subscribers. That’s an increase of 2.81 million from the third quarter. Considering that this is a highly developed market with intense competition, that’s an impressive showing. On top of this, average revenue per membership grew from $16.29 to $16.64.

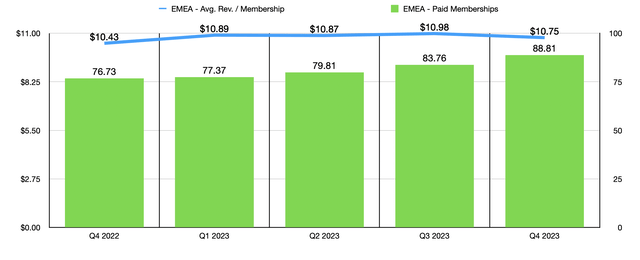

Author – Netflix Data

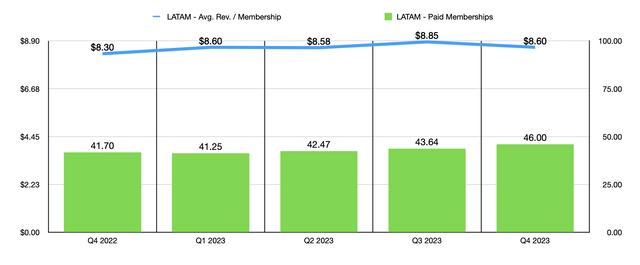

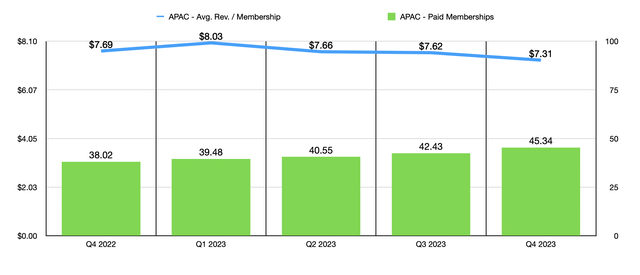

In other markets, we have seen similar results. In the EMEA (Europe, Middle East, and Africa) regions, paid memberships grew from 83.76 million in the third quarter of 2023 to 88.81 million in the final quarter of the same year. Average revenue per membership did fall slightly from $10.98 to $10.75. But that still places it above the $10.43 reported in the final quarter of 2022. In the LATAM (Latin America) segment, subscribers went from 43.65 million to 46 million. But pricing did fall slightly from $8.85 to $8.60. Year over year, however, it still grew from a low of $8.30. And lastly, in the APAC (Asia/Pacific) region, paid subscribers popped up from 42.43 million to 45.34 million. This was the only area in which average revenue per membership dropped. It fell from $7.62 in the third quarter of 2023 to $7.31 in the fourth quarter, while the year over year figure dropped from $7.69. Management has not provided any guidance for what subscriber growth should look like for the first quarter of 2024. But they did say that revenue should be around $9.24 billion. If that is what will come to pass, then it would represent a 13.2% rise compared to the $8.16 billion reported for the first quarter of 2023.

Author – Netflix Data

From a profitability perspective, things are going quite well for the business also. Earnings per share came in at $2.11. This was actually $0.11 per share lower than what analysts thought it would be. But it was still significantly above the $0.12 per share reported one year earlier. This resulted in net profits climbing from $55 million to $938 million. In addition to this, operating cash flow jumped from $444 million to $1.66 billion. And when it comes to the first quarter of 2024, the expectation is for continued growth on the bottom line. No estimates were provided when it involves operating cash flow. But management did say that profits should be about $1.98 billion, or $4.49 per share. To put this in perspective, in the same quarter of 2023, profits were $1.31 billion, which translated to $2.88 per share.

Author – Netflix Data

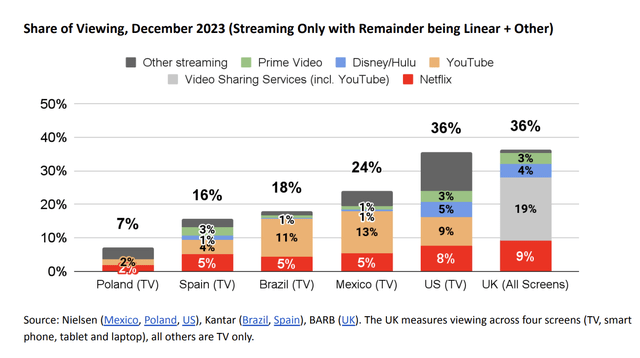

What’s really exciting is that management continues to focus on the bigger picture. Across the pay TV, film, games, and branded advertising markets, management believes that there exists a $600 billion revenue opportunity. And as things stand, the company’s revenue accounts for only 5% of this opportunity. In fact, in no country does the company account for more than 10% of all TV or streaming viewing. The closest would be the 9% share that it has in the UK, followed by the 8% in the US.

Netflix

Management also continues to invest in content. For the US market in 2023, the business had the number one original TV series 48 out of 52 weeks. In addition to this, it had the number one original film 41 out of 52 weeks. And it had the number one acquired series 44 out of 42 weeks. Examples of some of its recent successes have included One Piece, Berlin, La Casa de Papel, the Squid Game series, and more. The company has been investing more in the anime industry, which was valued at $28.6 billion in 2022 and is forecasted to grow to $41.5 billion by 2028. And as part of its earnings release for the final quarter of 2023, management announced a $5 billion deal spread over 10 years to start hosting WWE’s Raw live. That is expected to begin in January of next year. That alone is a significant win for the company when you consider that it is the number one show on USA Network with around 17.5 million unique viewers per year.

Takeaway

Based on all the data provided, I must say that I am optimistic about the future for Netflix. Management is doing a fantastic job growing both the top and bottom lines of the enterprise. Subscriber growth is strong and additional investments in content will go a long way toward drawing more users to its platform. Add all of this together, and I have no problem keeping the company rated a ‘buy’ for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!