Summary:

- Tesla, Inc. missed both revenue and adjusted earnings estimates for Q4.

- While automotive margins fared well, management did not provide much of a vehicle growth forecast for 2024.

- Tesla shares remain quite expensive on a P/E basis, with limited near-term growth not able to justify that premium.

jetcityimage

After the bell on Wednesday, we received fourth quarter results from Tesla, Inc. (NASDAQ:TSLA), seen in this shareholder letter. The electric vehicle giant delivered over 1.8 million vehicles last year, but achieving that sales number required a lot of price cuts. With questions surrounding the company’s near-term growth picture and margin profile, Tesla shares have been under pressure a lot recently. The company’s Q4 report featured top and bottom line misses, along with a lack of concrete guidance, sending shares further lower.

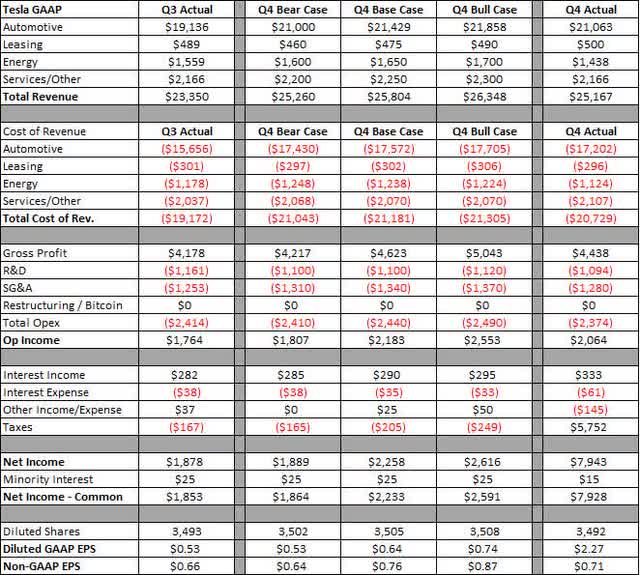

In the fourth quarter of 2023, Tesla delivered more than 484,500 vehicles, a new quarterly record. Production outpaced that figure by more than 10,000 units, also coming in at a new high. In the U.S., there were a decent amount of price cuts, along with a lot of inventory discounting, so analysts and investors have been very curious to hear how the income statement fared in the end. Below, you can see Tesla’s overall results against the usual three cases that I provide. Dollar values are in millions, except per share amounts.

Tesla Q4 2023 Results (Tesla Earnings Report, Author Estimates)

The headline numbers were both misses, as analysts were looking for around $25.76 billion in revenue and non-GAAP EPS of $0.74. About two-thirds of the revenue miss against the Street came from the non-auto segments, with the Tesla Energy segment representing more than $300 million of that amount (my estimate was a bit lower than the Street). Solar deployments continued to weaken thanks to high interest rates, while energy storage volumes fell sequentially, impacted by logistics and the global distribution of projects.

Automotive revenues fell short of my estimates, as discounts and other promotions caused a $600 sequential decline in revenue per vehicle delivered (including credits and leases). A good part of this was a fall in regulatory credit sales from Q3, whereas I thought higher deliveries could result in a sequential rise. Selling prices also seemed to be hurt a little by the regional mix, given a strong Q4 in China, where vehicles can be cheaper than their counterparts in the U.S. and in Europe.

On the margin side, Tesla showed mixed results. Energy and Services/Other margins both took a step back from their Q3 levels, which may not be a surprise given revenue pressures. However, automotive margins excluding credits came in at nearly 17.2%, about half a percentage point higher than the Street expected. The company was further able to reduce its cost of goods sold per vehicle, more than offsetting price declines, over Q3 levels. The GAAP net income picture heavily benefited from a one-time non-cash tax benefit of $5.9 billion recorded in the quarter for the release of valuation allowance on certain deferred tax assets. Tesla reported strong free cash flow of more than $2 billion for Q4, ending the period with over $29 billion in cash on the balance sheet against $5.2 billion in debt and finance leases.

In my previous article on the name, one of my biggest worries was regarding growth. Overall, electric vehicle (“EV”) hopes have come down in recent quarters thanks to high interest rates and other economic fears. While hopes were for Tesla to grow deliveries to around 2.2 million units this year, management didn’t provide a concrete forecast in the shareholder letter, only stating that “vehicle volume growth rate may be notably lower than the growth rate achieved in 2023.” Analysts have already been cutting their revenue forecasts in recent weeks, and this guidance likely won’t help. Tesla also removed the customer deposits line from its balance sheet, which will only spark questions around demand.

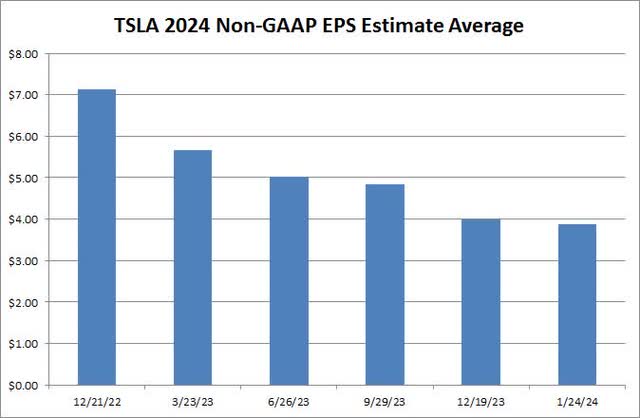

One of the main reasons why Tesla shares haven’t been able to gain any long-term traction recently is a continued decline in analyst earnings estimates. With vehicle price cuts accelerating last year, analysts were forced to take down their numbers for that year. As the chart below shows, the 2024 non-GAAP EPS average has been nearly halved over the last 13 months, and the current consensus includes a high estimate of well over $6 that seems a bit unrealistic at this point.

Tesla EPS Estimates (Seeking Alpha)

With those EPS estimates coming down considerably, even though the share price has been well, valuation has become a concern here. Tesla finished Wednesday trading at about 53 times its adjusted earnings estimate average for this year, whereas traditional automakers trade in the single digits. In the past, Tesla bulls could push for an extreme valuation given the massive growth story, but that revenue growth rate has come way down and earnings per share are basically expected to be flat over a two-year period.

Given the light revenue situation in Q4 and lack of solid guidance for 2024, I am reiterating my sell rating on Tesla stock today. I cannot recommend owning these shares until we start to see analyst estimates level off a bit, and I’m not sure this report did much to stop that process. We’ve already seen price cuts this month in China and many countries in Europe, suggesting some level of sales trouble. The Cybertruck will also take a while to ramp, so that won’t be a meaningful revenue contributor for a number of quarters. With the valuation still well over 50 times the expected earnings, I can’t move to a hold until the growth picture starts to improve, and we see a better valuation.

In the end, Tesla’s Q4 didn’t do anything to stop the stock’s recent slide. Both revenues and adjusted earnings missed Street estimates, sending the stock below $200 at times in the after-hours session. While automotive margins were better than expected, vehicle prices continue to come down, and Tesla isn’t pointing to much of a growth boom in 2024. Unless the demand picture starts to improve in the coming months, a potential further reduction in Street estimates could weigh on Tesla, Inc. sentiment for the time being.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.