Summary:

- Under the leadership of new CEO Alex Chriss, PayPal has the potential to undergo a transformation, with a strong focus on profitable growth.

- Venmo has the potential for generating substantial revenue for PYPL.

- Currently, PYPL’s trading multiple is about 12x forward P/E, which provides a good entry point.

d3sign/Moment via Getty Images

Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) is well-positioned to benefit from the ongoing shift towards digital payments, which has been accelerated by the impact of COVID-19. The company is one of the largest providers of buy-now-pay-later services globally, with more than 30 million consumers and 300,000 merchants using this service since its launch. The new CEO aims to enhance efficiency and prioritize profitable growth by streamlining operations that will be accretive to EPS in the near-term. PayPal’s growth story can be fueled by its strategic positioning in China and rise of Venmo adoption. I am positive on the company given the current discounted multiple and assign a buy rating to the stock.

New CEO Focused on Improving Profitability with Growth

The growing popularity of online shopping has been a boon to online payment service providers and has led to a plethora of digital wallets. With the launch of its digital wallet around 20 years ago, PayPal is one of the online payment pioneers. Its digital wallet remains among the most popular online payment methods, but competition is increasing. As growth of the firm’s digital wallet has slowed down, it has become more dependent on its back-end payment processing services for large merchants. Consequently, the company has had to reevaluate its priorities and take steps to reduce its cost structure.

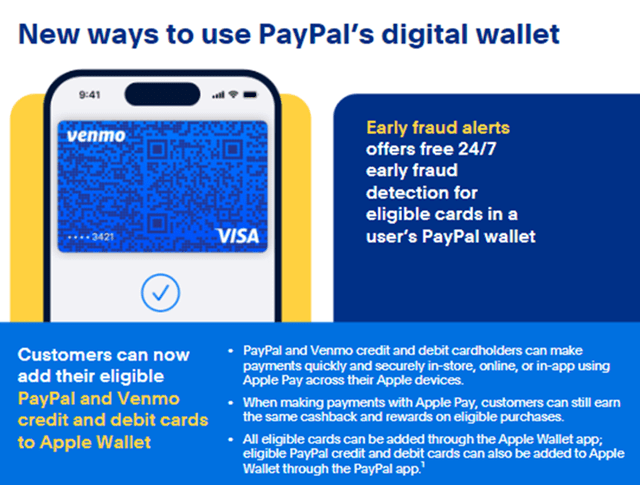

PayPal has made progress in reducing its operating expenses, but it has struggled to respond strategically to the increasing competitive pressures in its core business. The company recently appointed a new CEO, signaling a departure from its previous strategies as announced during the third-quarter results. Former CEO Schulman had focused on expanding the capabilities of the main digital wallet by continuously adding new features and acquiring other companies. However, this approach relied on the assumption of ongoing rapid growth in the number of digital wallet users, strong user loyalty, and consumers’ willingness to consolidate their financial services within the PayPal wallet. Nevertheless, user loyalty has proven to be less steadfast, and the digital wallet has faced challenges in sustaining its growth due to intensified competition, particularly from digital wallets more tightly integrated with smartphone operating systems, like Google Pay and Apple Pay.

Conversely, the unbranded backend payment processing services offered by PayPal’s Braintree unit have become the primary growth driver in recent quarters. This shift has rendered the previous strategy unsustainable, given that unbranded payment processing is less profitable for the company and emphasizes the importance of scale and cost efficiency in the market. CEO Schulman had initiated a cost-saving program in response to these challenges, but new CEO Chriss, during the third-quarter results presentation, outlined a clear shift in PayPal’s approach. The company aims to become more focused both in terms of its service offerings and its internal organization, with a primary focus on enhancing efficiency and prioritizing “profitable growth.”

I believe that under the leadership of new CEO Alex Chriss, PayPal has the potential to undergo a transformation, with a strong focus on profitable growth. This addresses a significant concern for investors and positions the company to enhance its operating performance by reducing non-transaction operating expenses. A margin expansion in 2023 could set the stage for a turnaround in the coming year, as the new management concentrates on leveraging value-added services as a driver of growth.

Venmo Remains a Wild Card

Venmo has the potential for generating substantial revenue for PYPL. Venmo’s payments using QR codes and its strong affinity with Generation Z and millennials position it as a solid PayPal defense against the imminent threat of Apple Pay. According to PYMNTS, PayPal leads mobile payments with 2.7% of all US in-store transactions. Apple Pay and Google Pay usage has dropped 50% in the past year to 1.9% and 0.8%. Venmo, mostly popular for payments between individuals, has over 62 million monthly active users vs. 55 million for Apple Pay, and is expected to expand faster than payment services from Apple Inc. (AAPL), Alphabet Inc. (GOOG) (GOOGL) and Samsung, according to Insider Intelligence. PayPal’s ability to monetize Venmo beyond cannibalizing itself is the holy grail.

Digital wallets are vaulting into the mainstream, and I expect they’ll keep taking share from direct card payments, which account for 32% of global e-commerce payments and 49% of those in stores. Most recently, the launch of Venmo Teen Account allows parents and guardians to open an account and send and receive money to and from teenagers aged 13-17 via an app and debit card.

China Can Be A Growth Catalyst

PayPal has had to grapple with Chinese sellers’ heavy reliance on Amazon (AMZN) for cross-border commerce and losing eBay’s payments business in the country to Payoneer Global Inc. (PAYO) in 2021. Yet China’s outbound and inbound e-commerce is evolving, with eBay losing cross-border share, new entrants like Walmart Inc. (WMT) and Shopify Inc. (SHOP) pursuing customers, and Chinese platform Pinduoduo’s US app Temu boosting user growth after its launch in September 2022. The cross-border ambitions of China’s Alibaba (BABA), Tencent and TikTok are gaining traction, too. The rollout of Alipay+ connected online and brick-and-mortar merchants worldwide with payment methods such as mobile wallets, as well as bank and buy-now-pay-later apps. Meanwhile, Stripe began allowing its sellers to accept UnionPay, the world’s largest card network, including for transactions in yuan.

Becoming the first global company to get a China payments license, in 2021, allowed PayPal to provide checkout services to merchants in the country and gave them access to 400 million PayPal customer accounts globally. It also allowed China’s nearly 1.5 billion people to shop at PayPal’s 35 million merchants worldwide. The company can now process Chinese taxes, customs and tariffs and clear transactions in yuan, which wasn’t possible before it received the license. China’s lead in global e-commerce, with $2.2 trillion in 2023 sales and ~35% of the market, makes it a critical peg in PayPal’s strategy.

Valuation

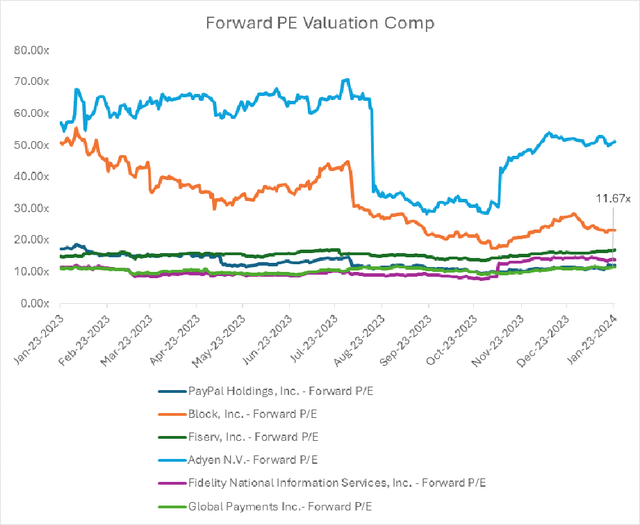

PayPal has more than doubled its active accounts, increased total payment volume to $1.5 trillion and generated about $31 billion in free cash flow since its separation from eBay in 2015, which reflects the strength of its highly scalable business. However, increasing competition and slowing growth have resulted in a decline in its stock price. PYPL shares have significantly underperformed the market over the past year, with a -14% return compared to the S&P 500’s +20%. I believe this decline is due to investors adjusting to management changes and operational shifts focused on expanding margins. Currently, PYPL’s trading multiple is about 12x forward PE, which is below the company’s 3-year historical averages of 28x. This multiple is well-below PayPal’s e-commerce merchant software and services peers, whose multiples are significantly higher, which I believe is due to PayPal’s slower growth prospects compared to its peers in the industry. That said, I see PayPal as a beneficiary of secular payment trends and its strategic initiatives, including boosting profitable user growth, are paying off and will support long-term expansion. PayPal forecasts at least $4.6 billion in free cash flow in 2023, and may return most of it to shareholders, which I believe will provide downside protection for investors. I see the current depressed multiple as an attractive entry point and assign a buy rating to the stock.

Investment Risks

PayPal operates within the highly competitive global payments industry. With an already market-leading position, PYPL must find new ways to sustain and create growth to retain its relevance with consumers/merchants. The landscape continues to get crowded with the likes of Square, Visa Inc. (V), Apple Pay, Stripe, and general bank cards all competing for payment volumes. Moreover, in the aftermath of the pandemic, the shift towards direct-to-consumer and online purchases, combined with ongoing e-commerce trends, has prompted companies to enhance their technology to facilitate smoother online transactions. As seen in a decline of P2P TPV volumes on PYPL’s platform and a decrease of net new accounts over 2023, consumers may not be looking to use PYPL as much as they have in the past. This results in decreasing engagement without significant investments to keep a ‘modern’ platform that resonates with consumers.

Conclusion

PayPal remains among the largest online digital wallets and is one of the leading online payment processors. The new management team has expressed a willingness to make substantial adjustments, and the company’s size provides a solid foundation for effective competition in the online payments industry. While there is a structural risk from smartphone-linked digital wallets, PayPal has an opportunity to enhance its financial performance by retaining its core digital wallet users and expanding its unbranded payment processing activities while improving cost efficiency. I remain positive and assign a buy rating to the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.