Summary:

- PayPal Holdings is one stock that has not participated in the tech rally.

- The company faces real competitive threats from the likes of Apple Pay.

- Wall Street may be underestimating the strength of PayPal Holdings’ unbranded processing engine in Braintree.

- Management is focused on generating profitable growth and returning cash to shareholders through share repurchases.

- I reiterate my strong buy rating for PayPal Holdings in spite of the boring investment thesis.

Prykhodov

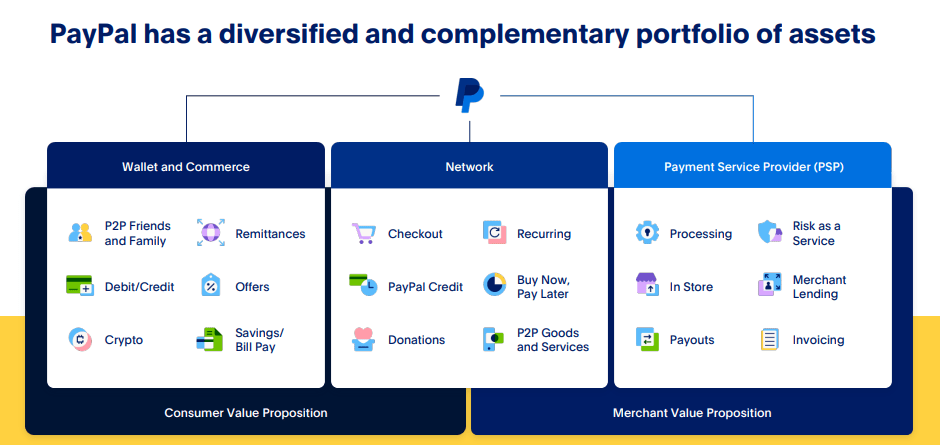

Amidst a tech sector melt-up, PayPal Holdings, Inc. (NASDAQ:PYPL) has been a dead weight. The stock continues to trade at discounted valuations in spite of the company’s net cash balance sheet and ongoing share repurchase program. I suspect that investors are wary of the highly visible competitive threats facing the company’s branded businesses, but may be underestimating the strength of the unbranded businesses like Braintree.

The digitization of payments is still a high-growth story and has enough room to help PYPL sustain growth for years to come. Not even an innovation day held by the new CEO Alex Chriss could spark the stock price. I reiterate my strong buy rating for PayPal Holdings, Inc. shares, as investors should be patient and enjoy the share repurchases as one waits for inevitable multiple expansion.

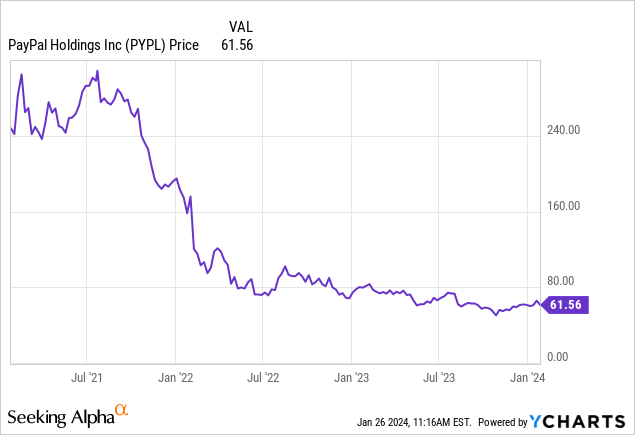

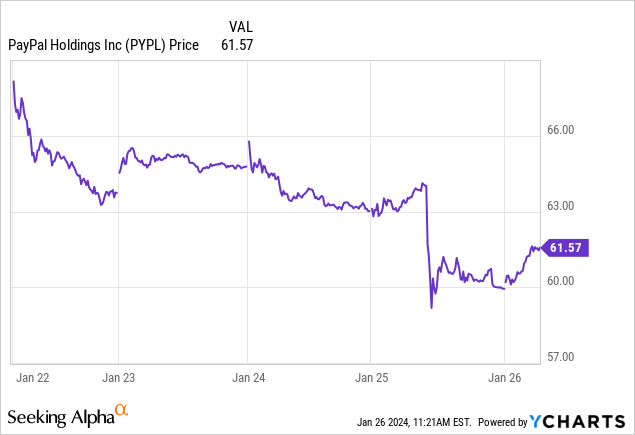

PYPL Stock Price

Many tech stocks are trading near 52-week highs. Not PYPL, which is now trading around 2017 levels.

I last covered PYPL in October, where I rated the stock a strong buy due to the attractive setup. That setup remains in place even as the company encounters some volatility in branded checkout growth. This isn’t the prettiest story, but valuations are still highly compelling.

PYPL Stock Key Metrics

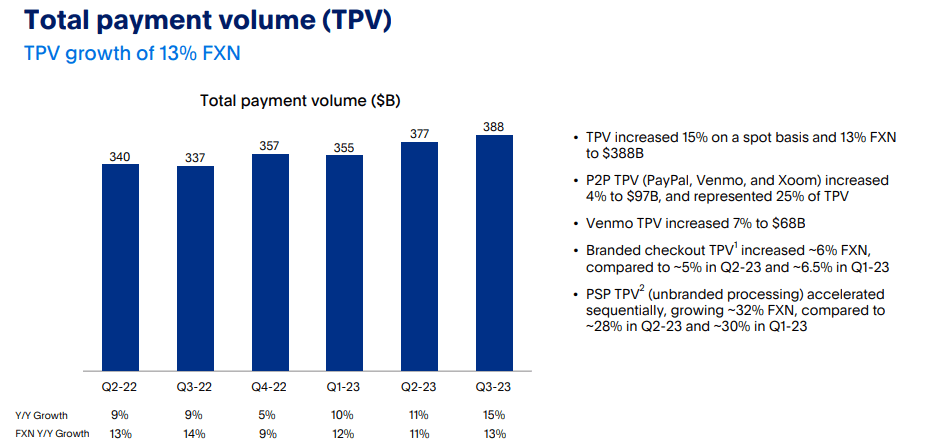

In its most recent quarter, PYPL saw total payment volume (“TPV”) grow 15% YoY (13% constant currency). While PYPL saw a respectable 6% YoY growth in branded checkout TPV, it was the unbranded processing volumes that led the way (primarily made up of Braintree), growing 32% YoY. Over time, I expect unbranded processing volumes to make up a more and more significant proportion of overall volumes and thus become a greater contributor to overall growth.

2023 Q3 Presentation

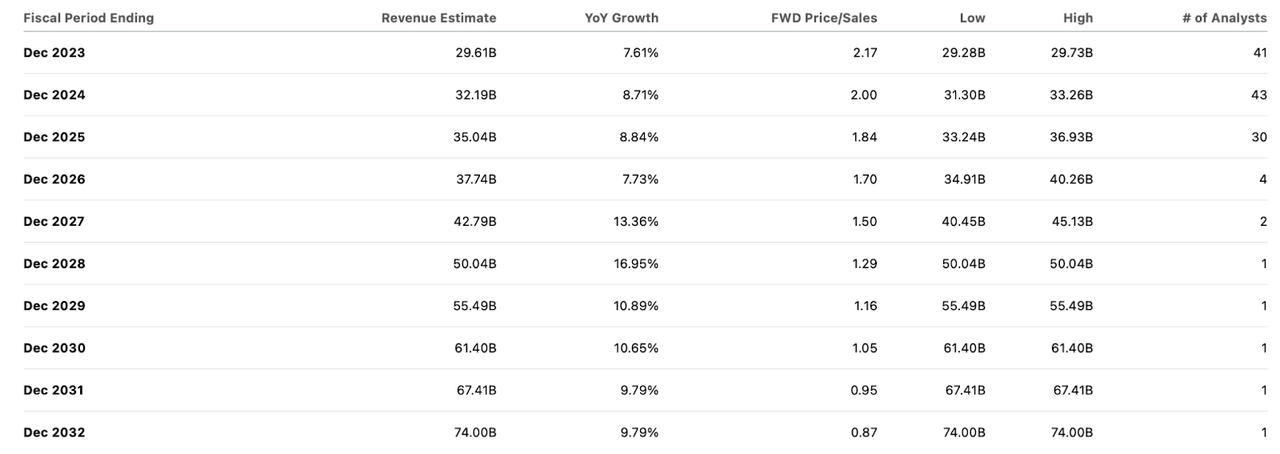

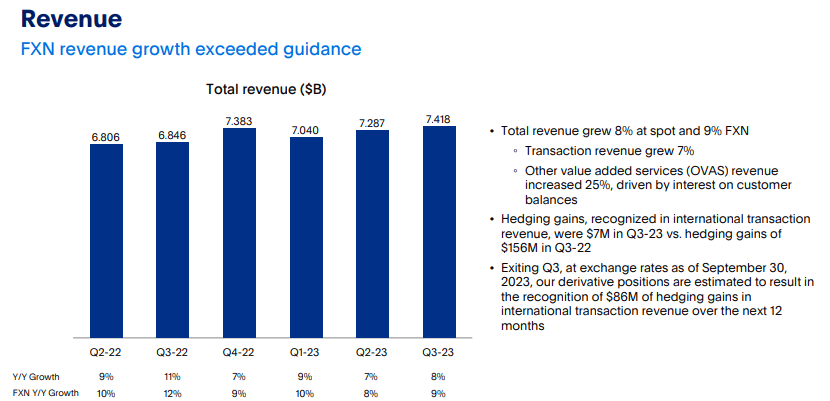

That led to PYPL growing revenues by 8% or 9% on a constant currency basis, coming in slightly ahead of guidance for 8% constant currency growth.

2023 Q3 Presentation

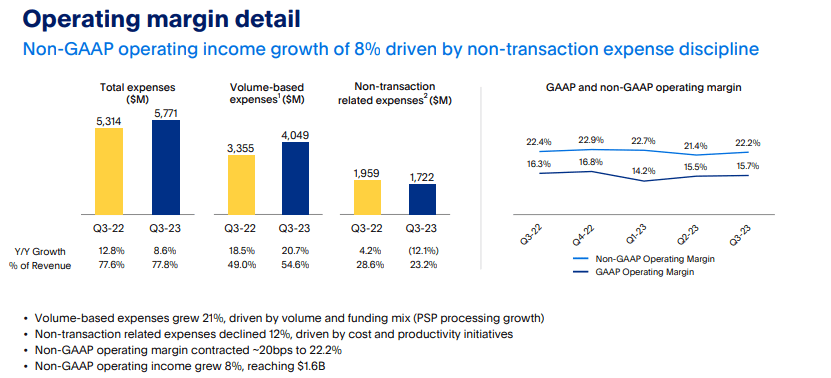

After several quarters of margin expansion, PYPL saw some margin contraction on a YoY basis, with non-GAAP operating margin retreating 20 bps. The margin contraction is mainly due to unbranded processing having lower margins – it is well known that PYPL has been seeking to take market share in unbranded checkout processing through aggressive pricing.

2023 Q3 Presentation

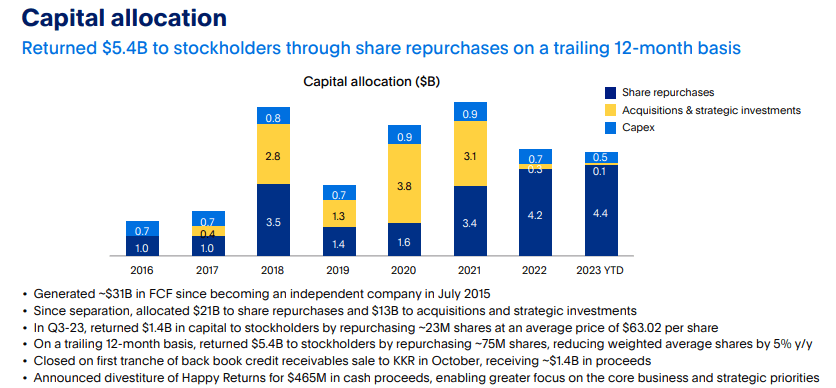

PYPL ended the quarter with $15.4 billion of cash versus $10.6 billion of debt, representing a strong net cash balance sheet. PYPL repurchased $1.4 billion of stock in the quarter as the company has in general been returning all free cash flow to shareholders through share repurchases.

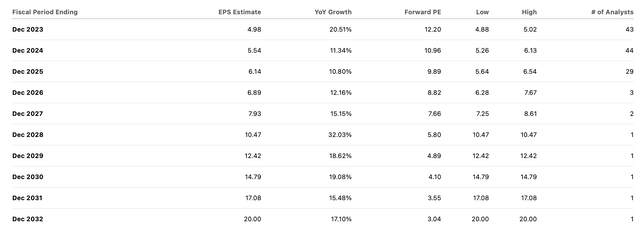

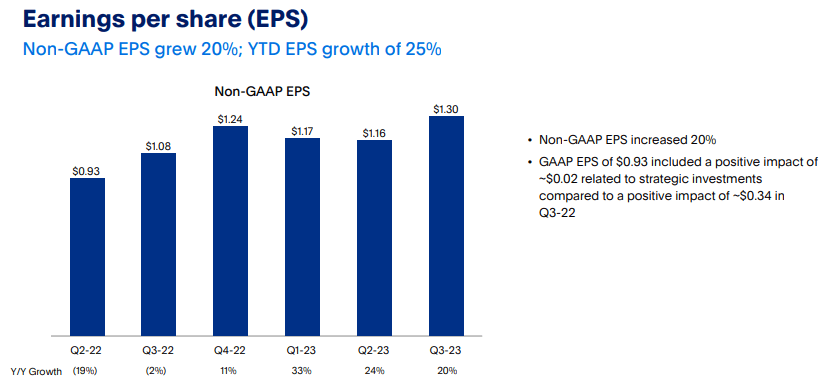

Between the resilient top-line growth and share repurchases, PYPL was able to grow non-GAAP EPS at an accelerated 20% pace to $1.30, coming ahead of guidance for $1.24 in earnings per share.

2023 Q3 Presentation

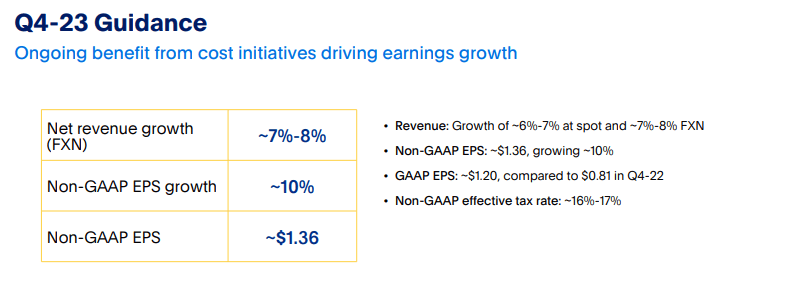

Looking forward, management has guided for up to 8% constant currency revenue growth and 10% non-GAAP EPS growth in the fourth quarter. Consensus estimates call for the company to generate $7.87 billion in revenue, representing 6.4% growth (in the middle of guidance), and $1.36 in non-GAAP EPS.

2023 Q3 Presentation

The conference call was the first for incoming CEO Alex Chriss. I felt that he did a good job reiterating the capital allocation priorities that resonate with Wall Street, indicating a focus on “high-quality customer growth and profitable revenue growth.” After the 2022 tech crash, Wall Street has shown a reluctance to reward aggressive growth strategies, and Chriss emphasized that the company only cares about “generating real profit” and that “unprofitable growth is counterproductive to the long-term prospects” of the company. These efforts make sense given that PYPL has seen top-line growth decelerate meaningfully relative to pre-pandemic years, making it more prudent to focus on earnings.

Management gave more clarity regarding their process of offloading their buy-now-pay-later (“BNPL”) loans. The company had classified these loans as held-for-sale, which reduced free cash flow by $810 million, but future sales of these assets will contribute to cash from operations. Excluding this classification detail, free cash flow would have grown by 21% YoY to $1.9 billion. Management noted that they had already received $1.4 billion in proceeds from planned sales just two weeks prior to the call and anticipate closing the rest of their $5 billion in credit receivables later. I view these financial transactions to be slightly positive for the company due to the reduced credit risk, though, it likely may come with total profits.

Management noted that branded processing, after seeing accelerated growth in the second quarter, “moderated” throughout the third quarter. Management however also indicated that in the early weeks of the fourth quarter, “branded trends have stabilized and are tracking in line with the first half of the year.” I expect this volatility to persist, given the choppy macro recovery and heightened competitive threats. The market is clearly pricing the branded processing business at low multiples.

While management did not explicitly state as much, it appears that investors should expect share repurchases to be the main use of earnings for the foreseeable future. Management noted that they “have a lot of acquisitions” from prior years that have led to “a lot of duplication.” Management aims to “build services that can be reused and leveraged across the organization” which sounds to me like there is still plenty of room for cost-cutting. PYPL had previously been highly acquisitive in past years, but share repurchases have been the main use for free cash flow over the past two years.

2023 Q3 Presentation

PayPal January 25th Innovation Day

On Thursday, January 25th, PayPal held an innovation day which was hyped by CEO Chriss to be one which would “shock the world.” It did shock the world, only negatively.

The “innovations” unleashed in the presentation include things like faster checkout and personalized offers, many of which feel more like normal enhancements or even catch-up. Investors might feel let down by this presentation if they were hoping for game-changing innovation, but they may be missing the point.

Is PYPL Stock A Buy, Sell, Or Hold?

The company appears to be doing all the obvious steps (share repurchases, focus on operating margins) needed to earn a higher valuation multiple in spite of a tough macro environment. While investor sentiment remains pessimistic, PYPL is still a prime beneficiary of the shift to cashless transactions as it operates on both the consumer and merchant sides of the value chain.

2023 Q3 Presentation

The last several years have seen PYPL deal with various headwinds like a post-pandemic slowdown, a deteriorating macro environment, and competitive threats like Apple Pay (AAPL). The stock remains 80% lower than all-time highs and in response, management has shifted their focus from rapid top-line growth in favor of durable earnings growth. At recent prices, PYPL was trading at just 12x earnings.

Consensus estimates call for some acceleration in top-line growth, which looks achievable given both the rapidly growing unbranded checkout volumes as well as the potential for an improving macro backdrop.

In terms of potential catalysts, there unfortunately do not appear to be any quick fixes here. I expect share repurchases to eventually lead to material upside – assuming that the company can continue delivering on earnings growth and remains committed to the repurchase program – but it is anyone’s guess when that upside would occur. Long-term investors might not mind waiting for this kind of catalyst to take place, but it is not clear how the company would overcome the competitive-threats-driven valuation overhang otherwise. I am still targeting a fair value multiple of around 15x to 18x earnings, justified by the long-term secular growth and net cash balance sheet – and I am of the view that the company can still deliver earnings growth in excess of top-line growth for many years from cost optimization.

What are the key risks? There are clear competitive risks that muddy the picture here. At least to my untrained eye, it isn’t clear why PYPL will be able to maintain market share for its branded processing, especially from the likes of Apple, Shopify (SHOP), or Amazon (AMZN). PYPL has benefitted from a first-mover advantage, but it is not clear if it has anything more than that. Perhaps the switching costs of re-entering new payment information may help to retain current users, but I expect the competition to have better success in gaining new users. There may be something that PYPL can do to improve retention and spark user growth, but it is not entirely clear exactly what that is (promotional activity can be easily replicated by the competition).

On the flip side, the company’s rapidly growing unbranded processing might not see its growth rates last forever. The company faces stiff competition from the likes of Adyen (OTCPK:ADYEY) and others, and it is possible that the 32% growth seen in unbranded processing this past quarter ends up being a high watermark rather than a sustainable number. While I am a long-term-minded investor, I do not view PYPL to be a high-growth company anymore, as the thesis instead focuses more on the earnings power of the business.

The near-term outlook remains murky for PYPL, as a tough macro environment and competitive pressures may limit the potential for accelerating revenue growth. Yet, with the stock trading at a low multiple of earnings and the company having a committed share repurchase program, time may be all that’s necessary for eventual upside. I reiterate my strong buy rating, as PYPL looks like a top pick in a rich market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!