Summary:

- Visa’s Q1 results exceeded expectations, with net revenues growing by 9% and strong growth in payments volume and processed transactions.

- Visa announced the acquisition of Prosa in Mexico, which will expand its digital payment offerings in the country.

- The stock buyback and strong cash position demonstrate Visa’s financial strength and commitment to shareholder returns.

- What to do after shares fell after posting earnings.

Justin Sullivan

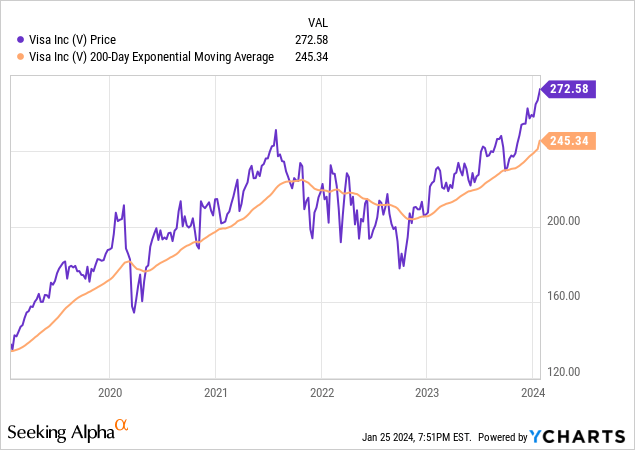

Investors priced in anticipation of strong results in the weeks preceding Visa’s (NYSE:V) fiscal first quarter earnings report. When the credit card company posted strong revenue and earnings that beat expectations, V stock fell by around 3% in after-hours trade.

Visa offered several key takeaways from the Q1 report.

Visa Q1 2024 Highlights

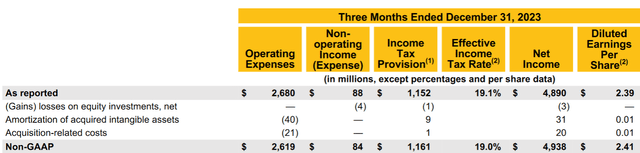

Visa reported net revenues growing by 9% Y/Y to $8.6 billion and non-GAAP earnings per share of $2.41. Astute readers may skip to page 10 on the earnings release to compare GAAP to non-GAAP. Non-GAAP excluded gains and losses from equity investments ($4 million), amortization of acquired intangible assets ($61 million), acquisition-related costs, and litigation provisions. Fortunately, the amounts for two items are small, accounting for two cents a share:

Last year, Visa’s litigation provision of $0.13 a share accounted for the biggest portion of non-GAAP results.

Visa’s Growth Areas

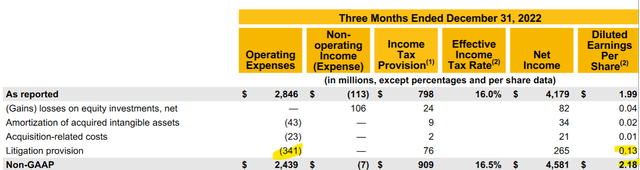

It reported growth in the high single-digit percentage for payments volume and processed transactions at 8% and 9%, respectively. Visa posted commanding strength in cross-border volumes:

Even after excluding transactions within Europe, it achieved volume growth of 16%.Visa benefited from resilient consumer spending. In future quarters, it will capitalize on opportunities across consumer payments, value-added services, and new flows.

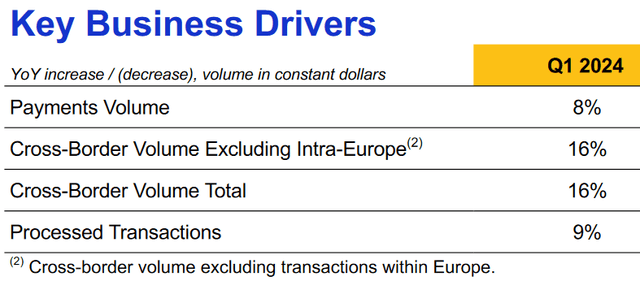

Readers who zoom out beyond last year will see that Visa’s payment volume is dramatically lower than in Q1/2022. As shown in Visa in the charts below, growth is less than half of 2022’s levels of 40%:

This is an unfair comparison because the economy benefited from very loose credit conditions, low inflation, and low interest rates. Most importantly, V stock is up from 2021-2022 levels.

Last month, Visa announced it would acquire a majority interest in Prosa. This is a leading payment process in Mexico that would “accelerate the adoption of secure and innovative digital payments in the country.” Visa will look at expanding Prosa’s product offerings with new digital solutions. The Mexican firm will also benefit from Visa’s experience and know-how in managing a global network.

Prosa will not add to Visa’s results until the deal closes during the second half of 2024. It expects lengthy regulatory approvals in Mexico.

Notable Achievements in Q1 2024

Visa bought back 14 million shares, spending $3.4 billion and paying an average price of $239.45 a share. V stock closed at $272.61 on Jan. 25. In addition, it declared a stock dividend of $0.52 a share.

The firm ended the quarter with cash, cash equivalents, and investment securities worth $21.4 billion.

Last week on January 16, 2024, Visa completed its acquisition of Pismo, paying $1 billion in cash. Pismo is a global cloud-native issuer processing and core banking platform. It will give its customers card-issuer processing capabilities through cloud-native APIs. It also supports connectivity for emerging payment schemes and RTP networks (a clearing house) for financial institution clients.

Stocks Related to Visa’s Prosa

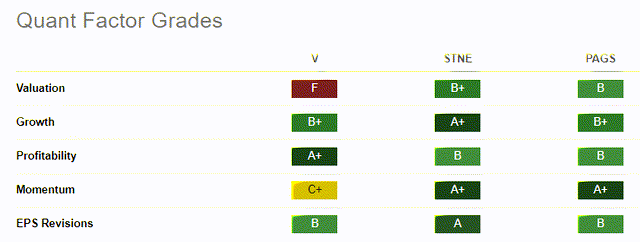

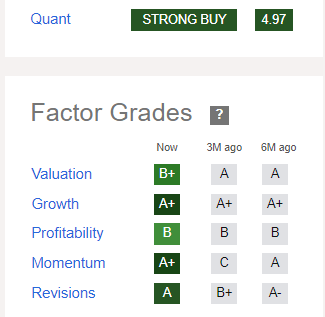

Readers may compare Visa’s Prosa acquisition to a pair of companies. First, StoneCo (STNE), a fintech that enables small businesses is based in Brazil. Second, PagSeguro (PAGS), also based in Brazil, offers payment processing software. StoneCo has one of the highest Quant scores on Seeking Alpha.

Seeking Alpha

The two firms score better than Visa stock on valuation, momentum, and EPS revisions.

Visa has the strongest profitability grade.

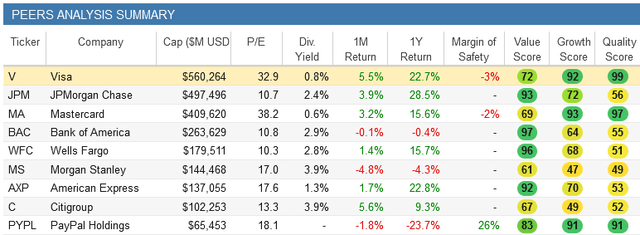

Stocks Comparable to Visa

According to Stock Rover Research, Visa’s peers include JPMorgan Chase (JPM), Mastercard (MA), PayPal (PYPL), and American Express (AXP). In the table below, PayPal has the biggest margin of safety at 26%.

Just as Visa stock rallied ahead of expected positive news, PayPal shares did, too. Last week, CEO Alex Chriss said on CNBC that we will “shock” the world. On Jan. 25, it introduced six key enhancements to improve its growth. New features include applying artificial intelligence to PayPal’s data, a faster checkout, personalized cash-back offers, and increased visibility for businesses.

PayPal shareholders holding at a paper loss want the company to prove its AI initiatives will increase TPV, account growth, and profits. Until then, PayPal might need to rely on its “refer a friend” program to reward current customers and increase its customer count.

Just as Visa benefited from continued spending strength, Mastercard will also report similar results. The Fed will meet next week to discuss its monetary policy. Its decision on when to cut rates by 25 bps will only fuel spending levels, increasing Visa and Mastercard usage.

Your Takeaway

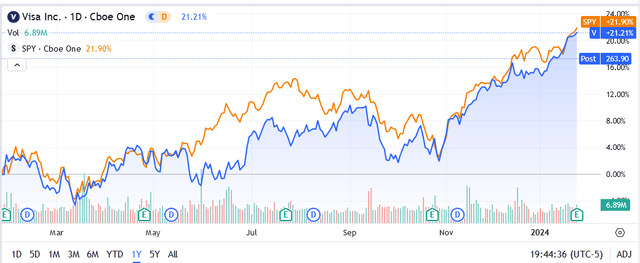

Readers should treat Visa as a dividend income champ with a modest yield of 0.77%. It makes up for the low yield with its stock rising in value. The stock matched the S&P 500’s (SP500) return in the last year.

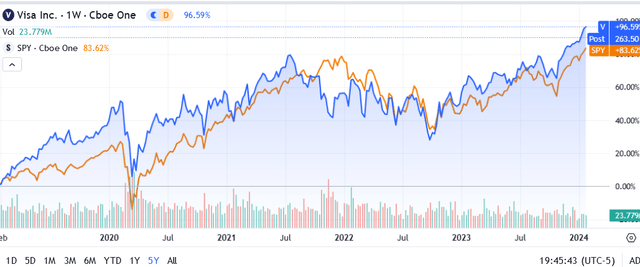

It beat the index on a five-year timeline:

The post-earnings selling will create another opportunity for fintech investors. Visa continues to innovate its business by investing in product development. It is accelerating its global network through strategic acquisitions.

Visa is a stock to buy as the share price dips.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the “follow” button beside my name. Get do-it-yourself tips and tricks for free here:

- Subscribe->[Y] Free

- Subscribe->[ ] Basic (69% off Full Service)

- Subscribe->[ ] Full Service