Summary:

- Intel’s shares dropped 11% after a weak Q1 revenue forecast, but the company’s Client Computing Group showed strong growth and profitability.

- The device market has stabilized, according to Gartner, which should benefit Intel’s Client Computing Group and support its revenue trajectory.

- Despite the negative sentiment, I consider Intel to be a bargain due to strong expected earnings growth and operating income momentum in CCG.

- Negative sentiment overhang creates a long term engagement opportunity.

peshkov

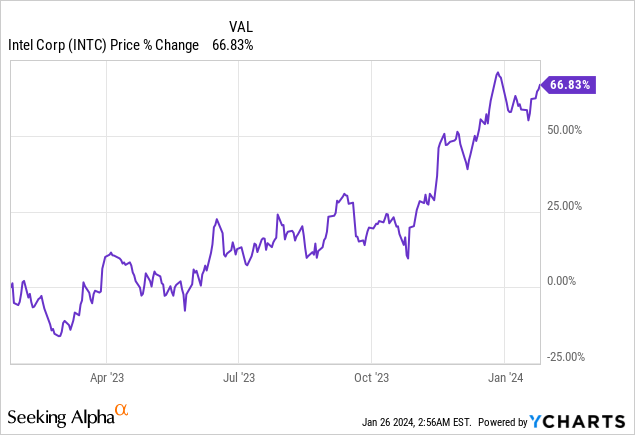

Shares of chip maker Intel (NASDAQ:INTC) tumbled 11% in extended trading after it submitted its earnings sheet for the fourth-quarter on Thursday. The company’s shares came under pressure chiefly because of a weak forecast with regard to first-quarter expected revenues which came in below expectations. While the Q1’24 outlook cast some new doubt on Intel’s comeback as a dominant chip maker, I am not yet ready to give up on the company. Fourth-quarter earnings sailed past estimated and Intel showed growing strength in its largest business segment, the Client Computing Group. This group generated solid top line momentum and saw a surge in terms of operating income profitability. At the same time, gross margins improved Q/Q. These factors, I believe, have been clouded by the poor outlook for Q1’24 and I believe the drop constitutes an attractive buying opportunity!

Previous rating

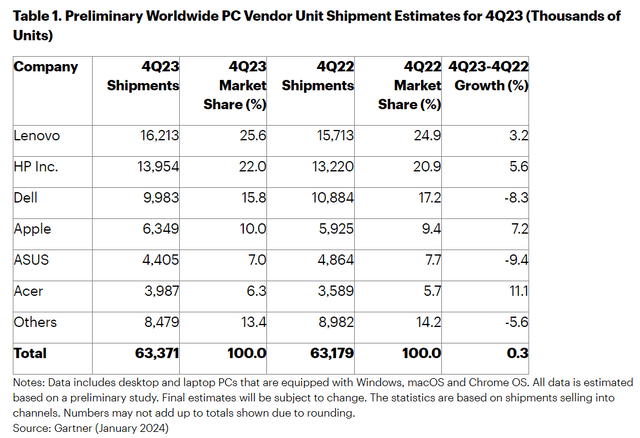

I rated Intel a buy in October — Intel Q3: The Bleeding Has Stopped (Rating upgrade) — after data from market research firm Gartner indicated that the PC market was bottoming out (the PC market downturn was a reason for me to avoid Intel). Intel’s Client Computing Group showed a lot of promise in Q4’23 and managed to deliver sequential operating margin gains. Additionally, the device market has returned to positive growth in the fourth-quarter, also according to Gartner. I believe this stabilization will benefit Intel’s Client Computing Group and support the firm’s operating income momentum.

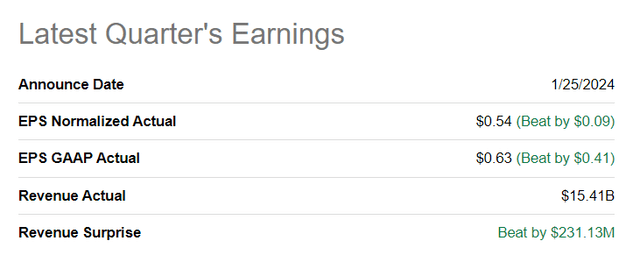

Intel sails past EPS estimates

Intel submitted better than expected Q4 earnings. Adjusted EPS came in at $0.54 per-share which was $0.09 per-share better than the consensus. Revenues also beat expectations, in part due to growing top line momentum at Intel’s Client Computing Group.

PC market stabilization and new momentum in core business, gross margin expansion

Gartner released its preliminary forecast for Q4’23 shipments earlier this month, which indicated that the device market is stabilizing. In the third-quarter of FY 2023, global device shipments declined 9% year-over-year due to inflation headwinds as well as weakness in consumer markets. According to Gartner, the PC market has now stabilized and actually returned to positive growth in Q4’23 as well. Though the growth rate is relatively small at 0.3%, it is positive growth nevertheless and it indicates that the market situation for electronics products broadly (PCs, laptops, smartphones) has broadly improved in the fourth quarter. Global device shipments declined throughout the year and Q4’23 was the only positive quarter in terms of device shipment growth which, of course, supported Intel’s recovery, especially in the Client Computing Group, as well.

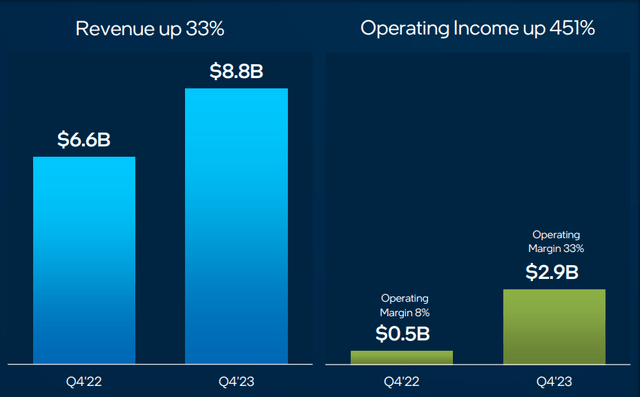

The stabilization of the device market has helped Intel’s Client Computing Group quite significantly in the second half of the year, but especially in Q4’23. This segment is chiefly focused on selling PC processors and related components and its top line grew 33% year-over-year to $8.8B while its operating income soared as massive 451% to $2.9B. CCG’s operating income margin, given the tailwinds discussed above, grew 7 PP Q/Q to 33% in Q4’23.

The recovery of Intel’s Client Computing Group was the most important take-away from the fourth-quarter earnings release and it showed that the business continued to dominate Intel’s revenue mix: the ICG had a revenue share of 57% in Q4’23 and the segment’s importance even increased compared to 56% revenue share in the previous quarter.

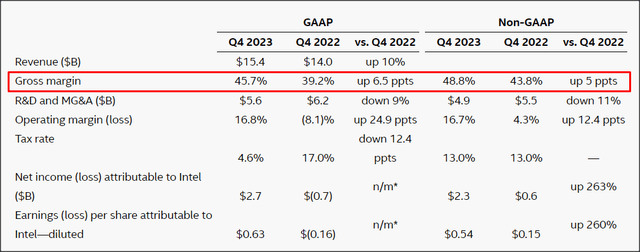

What was also an important take-away was that Intel managed to grow its gross margins on a sequential basis. Intel generated a non-GAAP gross margin to 48.8% in Q4’23, up 3 PP from the previous quarter and this gain is largely due to the recovery in Intel’s largest segment, CCG.

Outlook for Q1’24 creates new negative sentiment overhang that I want to exploit

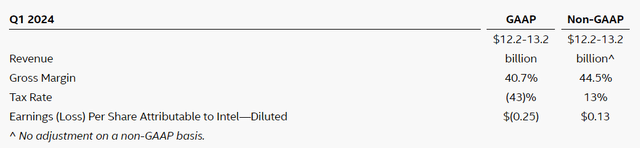

The outlook for the first-quarter of FY 2024 has created significant negative sentiment despite an otherwise decent earnings card and it was responsible for Intel’s shares sliding 11% in extended trading. Intel’s revenues are expected to fall into a range of $12.2-13.2B which implies about 8% year-over-year growth. Investors expected $14.25B in Q1’24 revenues, so Intel disappointed, but the CEO said that it expects revenue momentum in its core businesses to resume during the remainder of the year. Considering that Intel is still guiding for positive top line growth and for non-GAAP gross margins way above 40%, I believe investors are overreacting to the earnings report.

Intel’s catalysts for FY 2024

I see a number of catalysts for Intel this year, including

- Continual momentum in CCG driven by an underlying recovery in device sales

- Intel announced the launch of its full Intel Core 14th Gen mobile and desktop processor line-up in Q4’23. The Intel Core 14th Gen is the world’s fastest desktop processor, creating incremental upside for Intel’s Client Computing Group

- Intel is looking to further cut costs to improve profitability (Intel reached its cost reduction target of $3.0B in FY 2023)

- A potential dividend increase on the back of stronger CCG results is a potential catalyst for Intel’s shares as well.

Revenue, margin and earnings expectations have been lowered yesterday which is weighing on investor sentiment. If Intel can resume its top line momentum after Q1’24, which the CEO indicated, then shares do have considerable rebound potential.

Intel is a bargain, rapid EPS growth not priced into shares of Intel

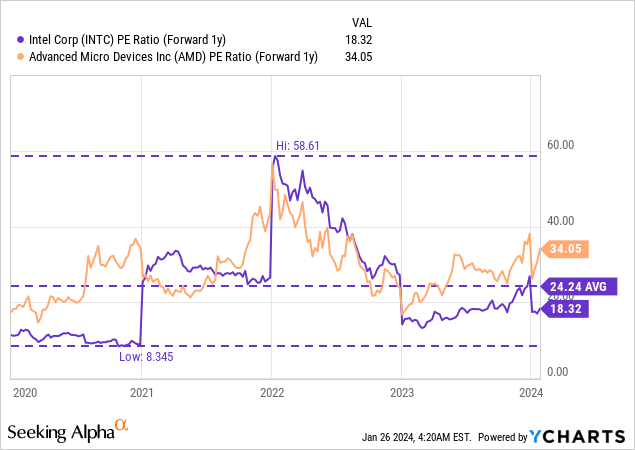

Intel is priced as a bargain in my opinion. Earnings are expected to grow in the next several years and the recovery in the PC market provides support as well. Intel is projected to grow its earnings 49% annually in the next three years and the forward P/E ratio (FY 2025) was 18.3X yesterday. Because of the 11% correction in extended trading on Thursday, shares of Intel are even cheaper: they trade at an implied 16.5X P/E ratio.

AMD (AMD), which has delivered excellent results throughout 2023, in large part due to its success with its server processor line-up, is trading at an earnings multiplier factor of 34.1X and is therefore more than twice as expensive. Intel’s low P/E ratio is due to its dependence on the personal computing market and the multi-year restructuring that the company is in. Intel also cut its dividend which has hurt investor interest in the company.

In my opinion, Intel could easily trade at 23-24X forward earnings given its very solid, double-digit earnings growth. This implies up to 31% upside revaluation potential based off of yesterday’s closing price and a fair value range $60-64, based off of FY 2025 projected earnings. I believe the stabilization in the PC market in Q4’23, operating income momentum in CCG, strong EPS growth and Intel’s gross margin expansion could justify this higher P/E multiplier. Additionally, this P/E range would also be much closer to Intel’s 5-year average P/E ratio — which includes both the upswing and downswing in the PC market before and after the pandemic — which currently stands at 24.2X.

Risks with Intel

I am monitoring a number of risks here, including shipment data from Gartner, Intel’s top line momentum as well as Intel’s gross margin trend. From a commercial point of view, there is a risk that Intel’s gross margins will contract in the short term, given the company’s soft outlook for Q1’24. There is also a risk that the PC market may dip again in terms of device shipments, although I consider this a low-risk event considering that U.S. GDP growth came in hot at 3.3% for Q4. What would change my mind about Intel is if the company’s CCG unit were to see weaker operating income growth and margins.

Final thoughts

There were way more things to like about Intel’s Q4’23 earnings report than to dislike. The outlook for Q1’24 was a bit negative which I admit. However, in the context of Gartner reporting stabilizing device shipments and the market returning to positive growth in Q4’23, I believe Intel did actually quite well: the largest segment grew its top line share 1% Q/Q, saw a massive rebound in operating income and Intel has been able to expand its gross margins, non-GAAP, 3 PP quarter-over-quarter. Overall, in my opinion, Intel’s Q4’23 earnings card was a winner. The weaker than expected outlook for Q1’24 was an excuse for investors to ditch Intel, but the price drop is not justified, in my opinion, considering that CCG has recaptured its momentum, supported by positive growth in the device market. Considering that Intel is selling for a very competitive P/E ratio relative to AMD and to its longer term history, I believe this is a great time to load up the truck and be an aggressive buyer!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.