Summary:

- Amazon remains a bargain and offers more compelling near-term upside potential than other growth tech stocks.

- Amazon is set to monetize its Prime Video service through advertising, potentially generating significant ad revenue.

- Amazon’s operational cash flows and revenue continue to climb, indicating strong double-digit total return potential.

Daria Nipot

As the market rises, attractive value is drying up.

Yet, one of the largest, most recognizable brands in the world, Amazon.com, Inc. (NASDAQ:AMZN), remains a bargain (in my humble opinion).

I named Amazon as one of my Top 3 Stock Picks of the year for 2024, citing an upside potential of 45-50%.

On a year-to-date basis, AMZN shares are up by 3.5%.

That’s a pretty good start to the year (for comparison’s sake, the S&P 500 is only up by 2.3%).

Coming into the year, Nvidia (NVDA) was my top pick.

But, those shares are now up by 24.3% on a year-to-date basis.

NVDA is still trading below my $700 fair value estimate; however, its massive rally has reduced its margin of safety. Right now, at $613/share, my fair value estimate for NVDA implies a 14% upside potential.

Today, my most conservative fair value calculation leads to a $190 fair value estimate on Amazon, pointing towards an upside potential of 21%.

A less conservative model points towards a fair value of $230 on Amazon. That implies an upside potential of approximately 46%.

Either way I slice it, Amazon now offers a more compelling near-term upside than NVDA (and every other growth stock in my coverage spectrum).

On 1/22/2024 I bought more shares at $149.48 and moving forward, AMZN is now my highest conviction buy target in the tech sector.

Amazon Is About To Pull A Huge Profit Growth Lever

I touched upon this in my Top Picks article, but at the end of January, Amazon is going to pull a major growth lever, adding advertising to its Prime Video service (and/or charging Prime Video subscribers $3/month to avoid them).

For years, Prime Members have gotten Prime Video for free (and it was a fantastic bargain).

Prime Video has one of the largest IP collections in the streaming space and owns top-shelf assets like Thursday Night NFL Football and hit shows like Reacher (I just finished season 2 and I highly recommend it).

On January 29th, AMZN is going to start monetizing this service.

Netflix (NFLX) just reported earnings, causing its shares to pop, in large part, because of its subscriber number.

Netflix had 80.3 million paid members in the US/Canada (the markets with the highest margins/ROIC).

Wall Street loved that figure… and yet, AMZN potentially dwarfs that figure.

Amazon doesn’t often specifically break out its subscriber figures. The last time that management mentioned it to my knowledge was in 2021 when the company’s CEO, Andy Jassy, said that the company has “more than 200 million” in global Prime subs.

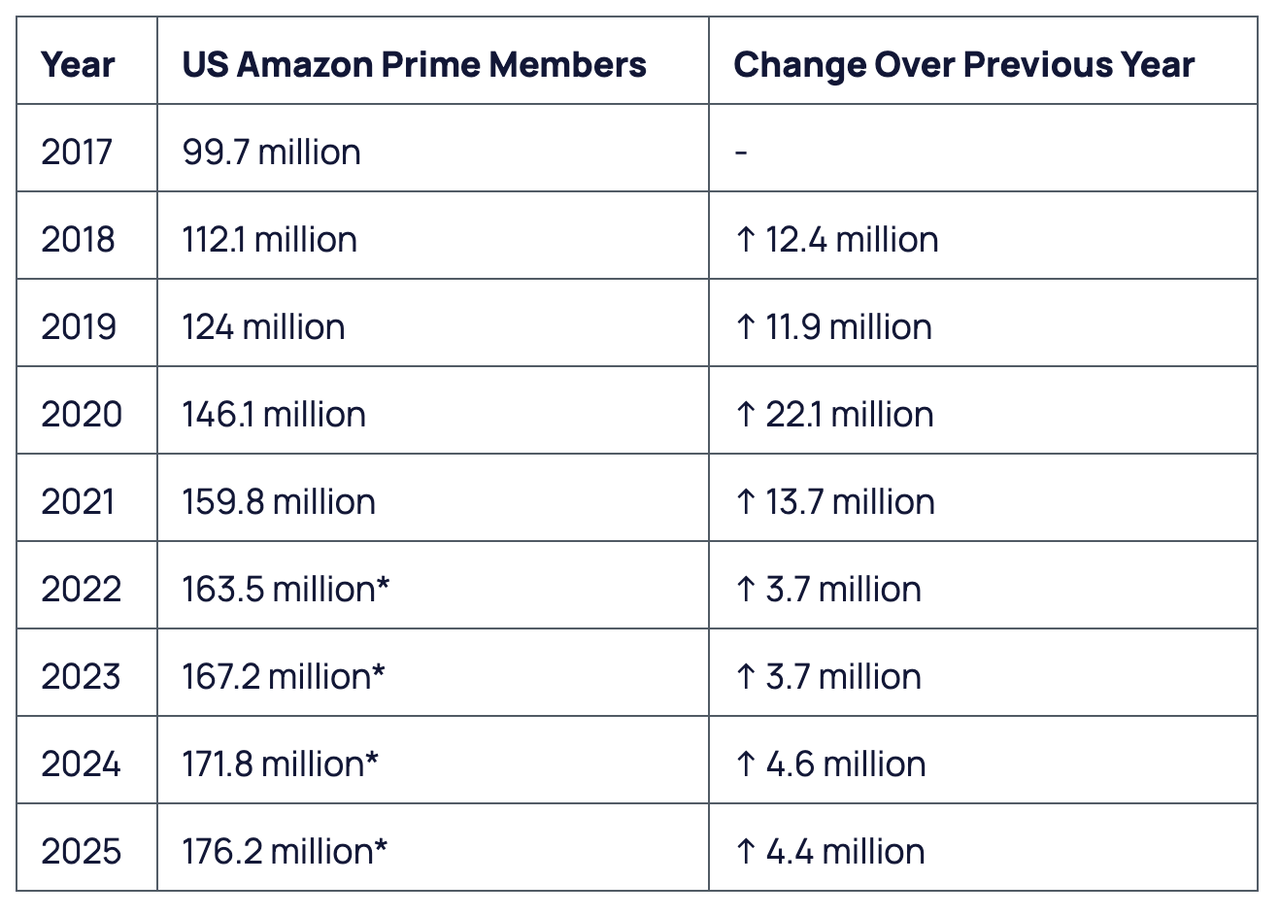

A recent article published in the Hollywood Reporter (focused on the monetization of Prime Video) stated, “Consumer Intelligence Research Partners estimates that there are about 168 million Prime subs in the U.S. alone, as of 2023.”

This estimate is in line with a recent report published by Exploding Topics, which estimated 167.2 million US Prime subs for 2024.

Exploding Topics

Sure, it’s true that many of these members pay Amazon’s annual subscription fee of $139/year for free 2-day shipping.

At first, I fell into this bucket. And honestly, I think that’s a great deal in itself.

But, AMZN has invested heavily into content in recent years and now I find myself watching Prime Video more and more.

And, if just half of the expected US Prime members watch Prime Video, then AMZN’s US sub-base is just as high as Netflix’s.

And as time moves on, I suspect that more and more Prime members will take advantage of the Prime Video offerings (especially as AMZN continues to make content IP deals).

Where AMZN and NFLX differ is the fact that the vast majority of Netflix users aren’t in the ad tier. They pay a premium to avoid ads, which reduces the attractiveness of the Netflix platform from an advertiser’s standpoint.

Amazon, on the other hand, is likely to find the vast majority of its subscribers falling into the ad tier (analysts expect that the vast majority of its subs will avoid that $3/month fee and simply watch ads).

And that’s great news for Amazon.

Netflix’s data suggests that it generates much more money on ads than it does for the relatively low subscription price of its ad-tier service subs.

I suspect that AMZN’s results will be even better because of the broader strength of its ad platform.

Amazon already offers the most compelling digital ad platform to advertisers because of its direct relationship with retailers and the immense, ‘consumeristic’ data trove that AMZN owns related to its subs.

Think about it… Amazon knows consumers’ shopping history, trends, likes, dislikes, average monthly spend, and many other very relevant data points for targeted ads because of its dominant position in the eCommerce space.

And this makes the company’s ad segment an absolute cash cow.

This business is already operating at a ~$48b annual run rate. And I think the Prime Video move will drive those sales even higher.

For instance, Bank of America analyst, Justin Post, recently stated that this Prime Video ad change will add another $3-5 billion to Amazon’s ad revenue.

And, this ad revenue is only going to grow because of the best-in-class results that AMZN’s ads generate from a profit standpoint.

The Hollywood Reporter article said, “Kevin Krim, CEO of the ad measurement firm EDO, estimates that Amazon could see a CPM (the cost per thousand consumers who see an ad) of about $50, below what Netflix sought when it got into advertising a little over a year ago, but still “a big premium to linear TV.”

Anyone who knows the ad business knows that $50 CPM is incredible.

Content creators on YouTube, for instance, are thrilled with CPM’s above $10 (and most generate much, much lower results).

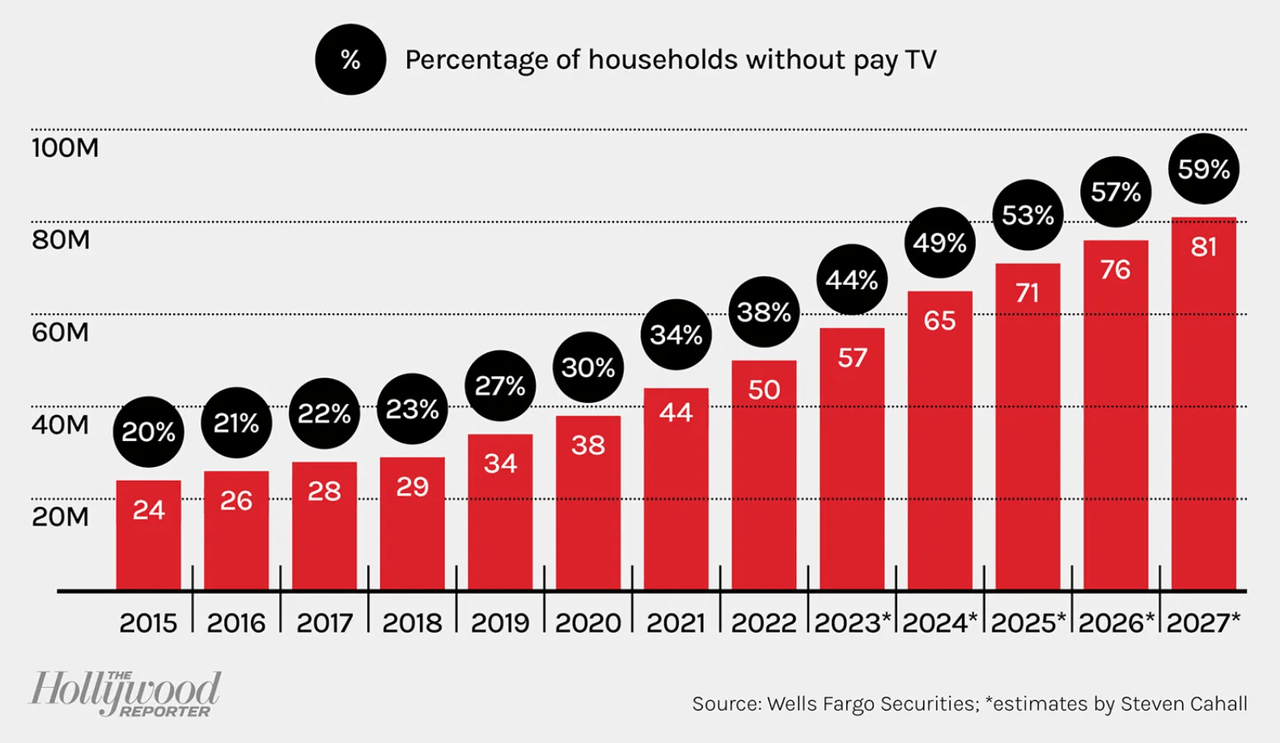

The Hollywood Reporter states that we’ve reached “the point of no return” for linear television.

Hollywood Reporter

And since ad budgets are typically fixed, that bodes well for the likes of AMZN, which offers the most attractive ROI on the digital ads shown on its platform.

The fact is, companies only have so much money to spend on advertising and as the Hollywood Reporter article points out, it’s essentially a “zero-sum game” for them.

Diversification doesn’t necessarily make sense for advertisers due to the necessity for high returns on that capex. Advertisers tend to put the majority of their budgets into their highest conviction ideas and moving forward, I think the answer to that question, for most companies, will change from linear television commercials to digital ads on platforms like Amazon.com.

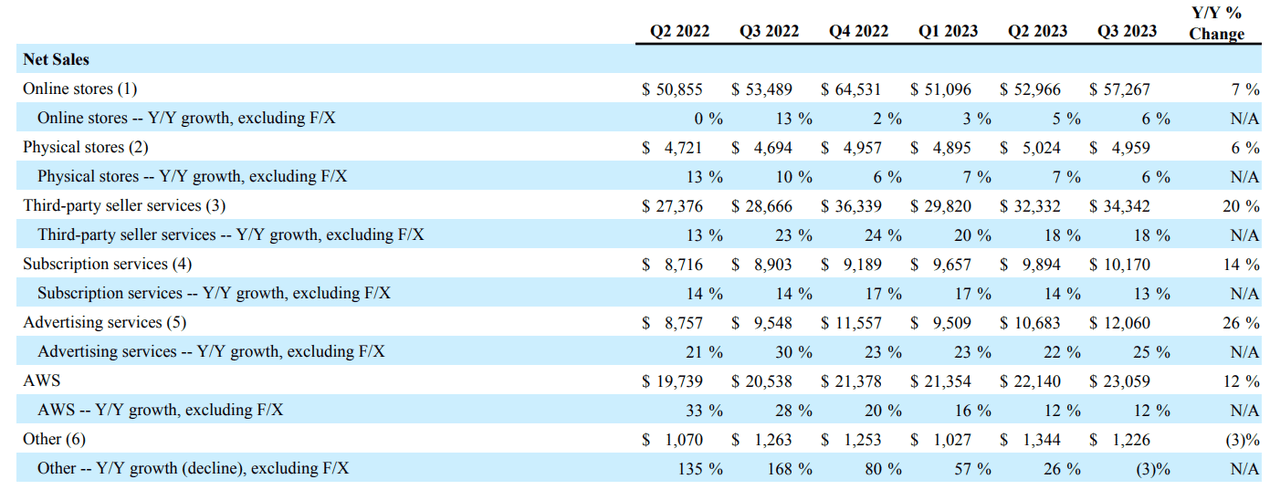

As you can see below, AMZN’s Advertising Services segment is already the fastest-growing part of its business. Looking at the potential gains that this Prime Video move could result in for 2024, I think that growth trajectory is about to accelerate higher.

AMZN Q3 ER

Amazon’s margins are rising towards record highs. And that’s largely due to the success of this segment, which probably produces margins well above 50%, according to analysts.

What This Means For Profits

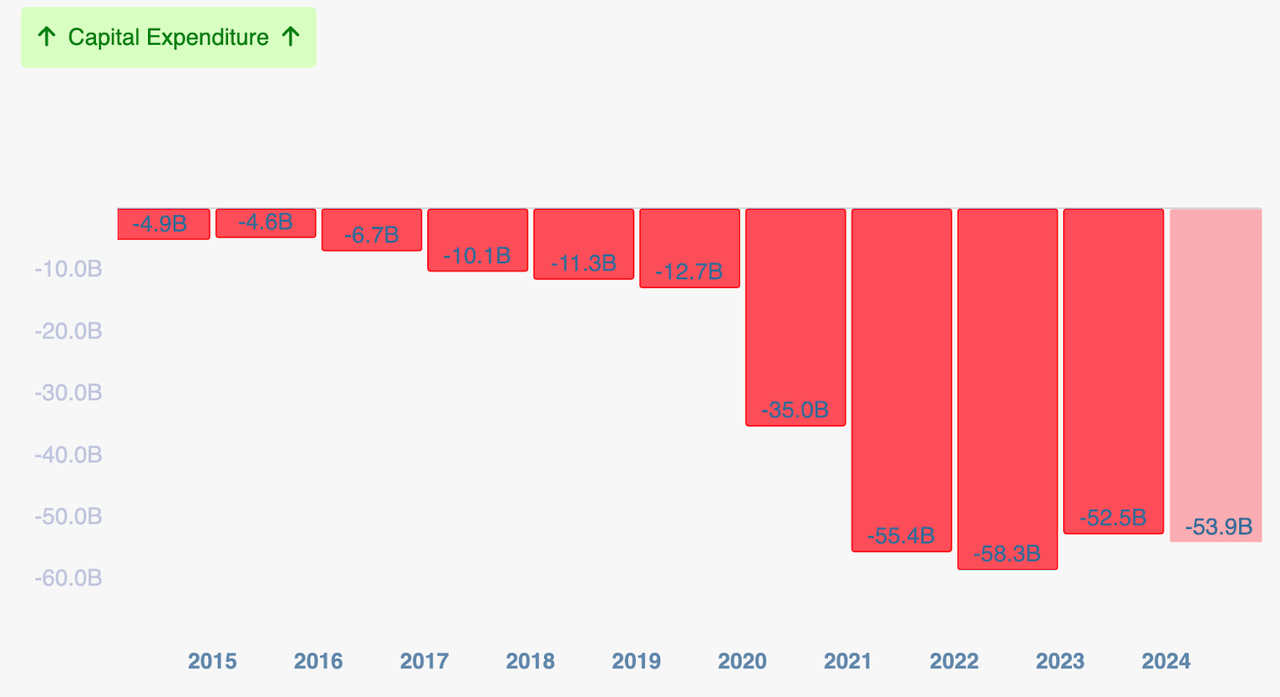

During the pandemic, Amazon went on a massive spending spree to ensure that its infrastructure could keep up with rising demand.

Macroaxis

But, as you can see, that spending has stagnated in recent years… and it appears to be trailing off.

In recent quarters, AMZN has announced measures to get SG&A expenses under control and it appears that it may be taking a page out of Mark Zuckerberg’s book with regard to the “year of efficiencies” that sent Meta (META) shares soaring by triple digits in 2023.

Despite slowing capex, Amazon’s revenue has not suffered in recent years.

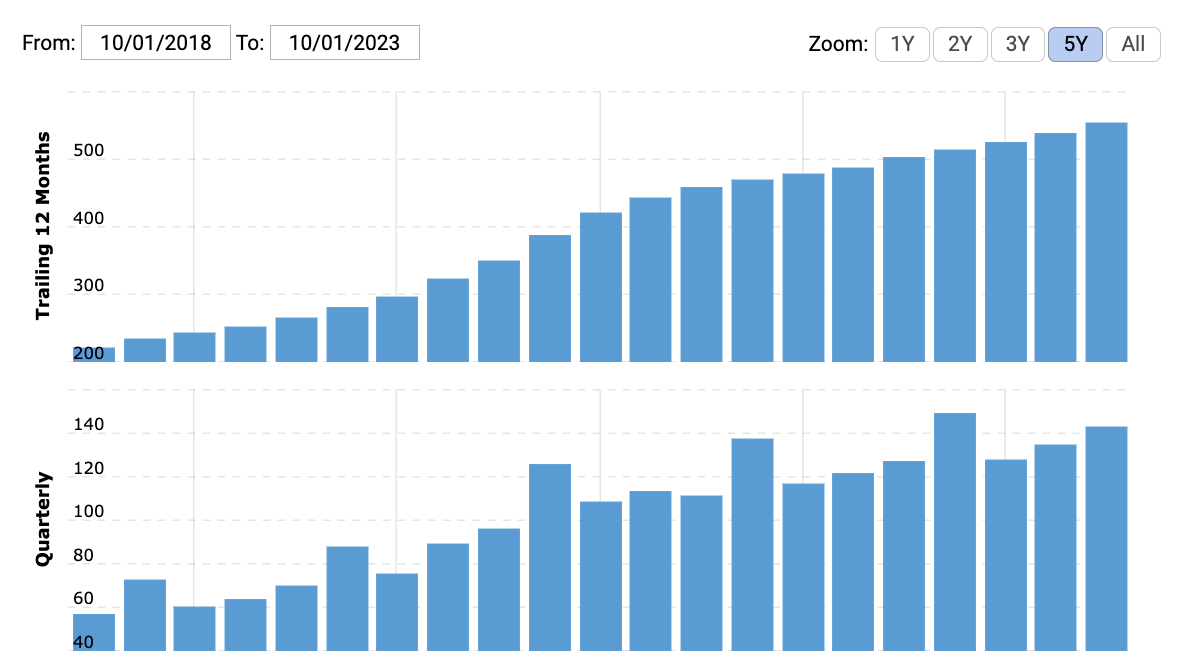

As you can see below, AMZN’s ttm revenue and quarterly revenue figures continue to climb nicely.

Macrotrends

Furthermore, Amazon’s margins gross margins haven’t suffered either.

This points to the strength of AMZN’s moat and all of this is leading to soaring cash flows.

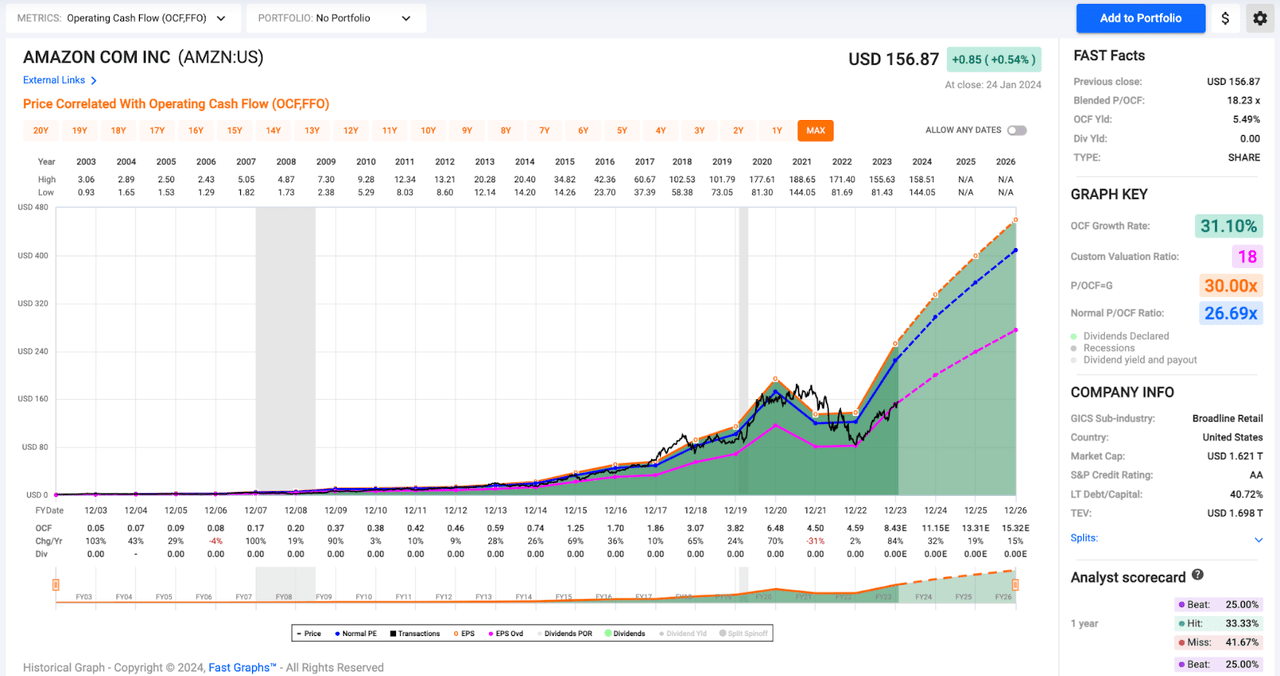

When I evaluate AMZN shares, I like to look at Operational Cash Flows (OCF).

To me, this is the metric that shares have followed most reliably throughout their history.

Below, you’ll notice that AMZN’s share price followed its long-term average OCF multiple (26x) for years.

FAST Graphs

For a decade prior to 2022, AMZN’s share price (black line) tracked that long-term average (blue line) closely.

That changed when the tech sell-off occurred in 2022; however, since AMZN’s recent rally began, it has tracked the 18x OCF/share threshold closely.

Well, 18x the current consensus for AMZN’s OCF in 2024 is $190/share.

To generate 20%+ upside, all AMZN has to do is meet analyst expectations and stay on track here (no multiple expansion).

Now, I wouldn’t be surprised to see two things happen in 2024 that are even more bullish for the stock.

One, I expect to see AMZN’s bottom-line metrics to ‘beta’ analyst expectations because of what I believe will be a massive success with the monetization of its Prime Video segment (bolstering its Ad segment’s sales/earnings).

And two, I wouldn’t be surprised to see AMZN’s P/OCF multiple expand…maybe not back up its long-term average in the 26x area, but to the ~20x area, which would result in massive upside.

20x the current analyst consensus for 2024 OCF is $223.

20x my more bullish OCF estimate of $11.50/share area is $230.

Compared to its history, I don’t think I’m being overly aggressive here with a 20x multiple.

Heck, if the market’s sentiment towards AMZN turned uber-bullish and the P/OCF multiple expanded back to 26x, we’d be talking about a $290 share price.

To be clear, that’s not my near-term expectation. But, when we consider that a $290 share price could be justified by a cash flow multiple that isn’t historically high, then price targets in the $190-$230 range seem more and more reasonable.

Thankfully, wonderful returns here don’t require earnings beats or multiple expansions.

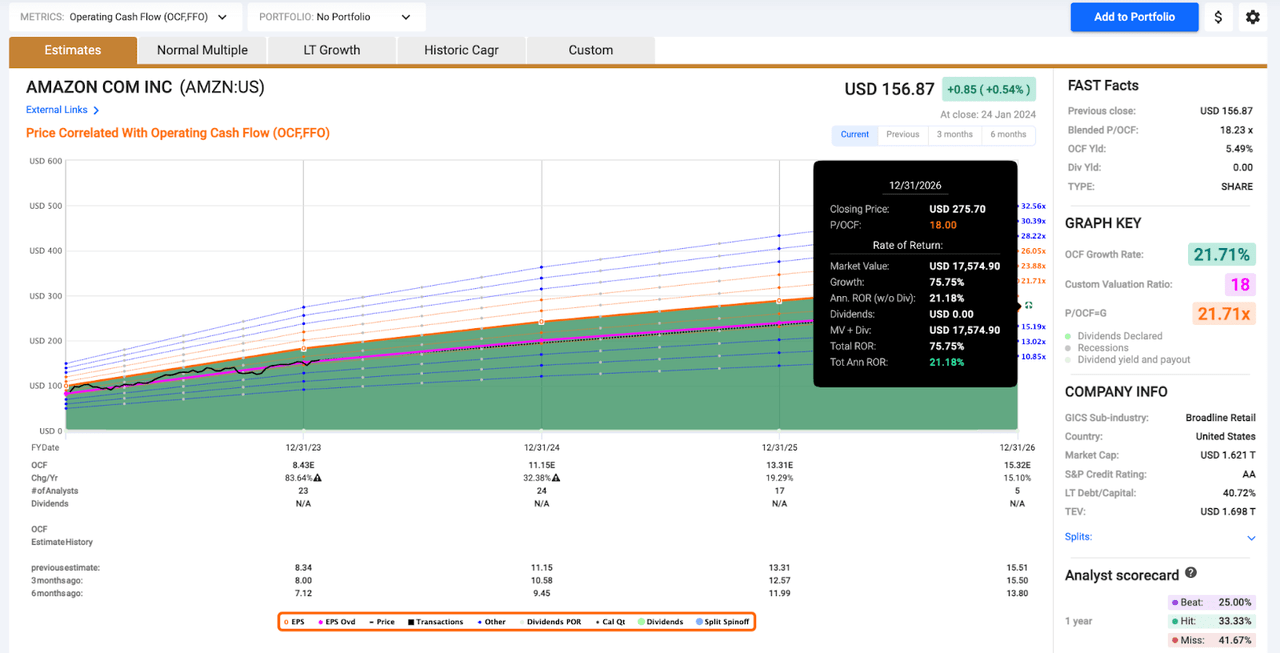

If AMZN simply meets analyst OCF expectations and continues to track that 18x multiple over the coming years, shares will generate a total return CAGR north of 21% over the next 3 years.

I have to imagine those returns will beat the market. And therefore, it’s easy for me to continue to buy AMZN shares here.

FAST Graphs

Conclusion

Anytime I look at Amazon’s profit prospects and perform my fair value analysis, I remind myself not to get carried away.

Yes, this company is immensely profitable… but its shareholder returns lag behind its big-tech peers in a major way.

Amazon doesn’t pay a rising dividend like Apple (AAPL) or Microsoft (MSFT) and it isn’t known for big buybacks like Alphabet (GOOG) (GOOGL) or Meta.

This company, more than most that I own/cover, has maintained the sort of growth-at-all-costs aggression akin to early-stage startups.

In a way, that’s great. Amazon doesn’t appear to be content to rest on its laurels, allowing competitors to overtake it in the world’s biggest growth markets.

But, this is also worrisome to someone like me, who loves passive income, because while I think it’s reasonable to assume that companies like Alphabet, Meta, or Nvidia could begin to pay growing dividends in the not-too-distant future, I don’t think that’s a likely outcome for Amazon.

Therefore, I’m stuck in a situation where I’d have to sell shares if I want to cash out, which is something that I abhor the idea of long-term.

I hate paying taxes on capital gains. And more than that, I hate parting ways with shares of wonderful companies.

Instead, I’d much rather accumulate large positions of blue chips, collect their growing dividends, and pass along my nest egg to my children upon my death.

In other words, I don’t subscribe to the “die with nothing” school of thought.

I’d prefer to die a very rich man, knowing that all of the hard work that I’ve done throughout my life can benefit future generations of Wards.

I believe that AMZN will play a major role in those future riches and the generational wealth that I hope to create throughout my lifetime.

However, the lack of shareholder returns here puts a limit on my AMZN allocation and despite my very bullish outlook, I’m going to stay diversified and not go all-in on this specific company.

Remember, every company carries risk. And there is no guarantee that AMZN will continue to track that OCF multiple. But, it has a long history of doing so.. and with that in mind, I remain bullish on shares moving forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CME, CNI, CP, CPT, CRM, CSCO, CSL, DE, DHR, ECL, ELV, ENB, ESS, FRT, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, MA, MAIN, MCD, MCO, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PFE, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, RY, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.