Summary:

- The outlook of the online advertising industry has improved, with large events like the 2024 Paris Olympics and an elongated US presidential election cycle providing catalysts for upside.

- I show a 25% upside in 2024 EPS against consensus, providing a conservative price target of $435 based only on average historical valuations.

- While Q4 will mark an end to an important year, the Q1 and 2024 outlook provided by management on the upcoming call outweighs much of what could print for Q4.

Kira-Yan

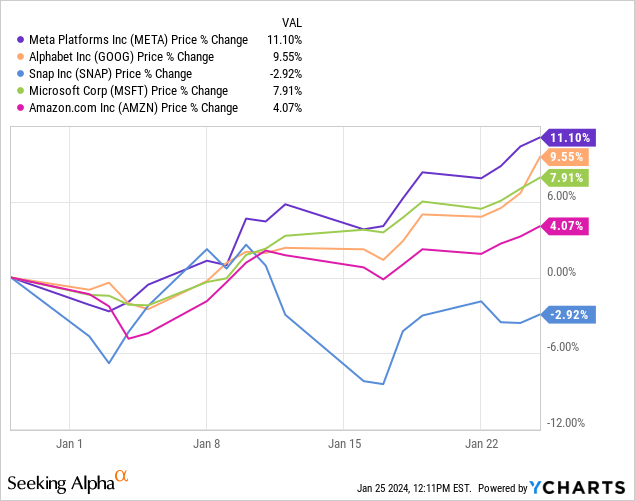

Over the last several weeks, Meta Platforms (NASDAQ:META) has more or less gone under the radar and found its way to new highs. At least until it broached the $1 trillion market cap level this week, then eyes shifted to its steady but still powerhouse move. But as Q1 has gotten underway, channel checks in the online ad market have returned quite positive and expectations have risen. This means Q4’s earnings have quite a bit for shareholders as it wil set the stage for FY24 and provide not only Q1 guidance but expense and operating guidance for all of 2024. I expect a year of outperformance for Meta Platforms on the top and bottom lines as the industry gets a boost and Meta refines its AI approach.

As I’ve discussed over the last two years, Meta Platforms understands how to utilize AI for its direct business benefit without selling a direct AI product. It, therefore, isn’t surprising that the stock has risen along with these expectations, especially heading into the “Year of AI.“

As a preview of the Q4 earnings report, I have a few points about its earnings estimates and valuation for the year ahead. You might think I’m overlooking Q4’s results, but Q1’s guidance and the roadmap for FY24 matter quite a bit since the stock has outperformed on share returns the last month against peers.

And while, according to the stock chart, I expect some consolidation and pullback later this year, the stock should continue to be a leading tech name over the next two years due to 2024’s expected outperformance.

The Pulse Of The 2024 Ad Market

The first aspect worth noting is the health of the online advertising industry. It has improved remarkably from where it was a year ago and even a quarter ago. And with 2024 full of significant events like the 2024 Paris Olympics and the US Presidential election, there are catalysts lined up to provide upside to estimates.

Analysts at Morgan Stanley see an acceleration in online ad growth in 2024 over 2023.

The analysts said their company bottom-up forecast indicates about 10% U.S. advertising growth in 2024, or 7% excluding the benefits of political and Olympic spending.

This is modestly ahead of consensus due to higher online ad estimates. They model U.S. online advertising growth to accelerate to about 12.5% in 2024 (from around 8% in 2023).

This is a good read-through for names like Google (GOOG)(GOOGL), fuboTV (FUBO), and Amazon (AMZN), but Meta Platforms is far and away my top pick for online advertising with its AI-focused ad products and user experience.

Considering the Olympics and the 2024 US Presidential election only provide a boost, Meta’s revenue and earnings should see outsized moves above and beyond analysts’ consensus at this stage of 2024. With 45% of revenue coming from the US and Canada in Q3 ’23, Meta has the upper hand with its industry-leading AI-driven ad revenue and ability to grow above the industry average.

Meta’s Growth Is Wholly Underestimated

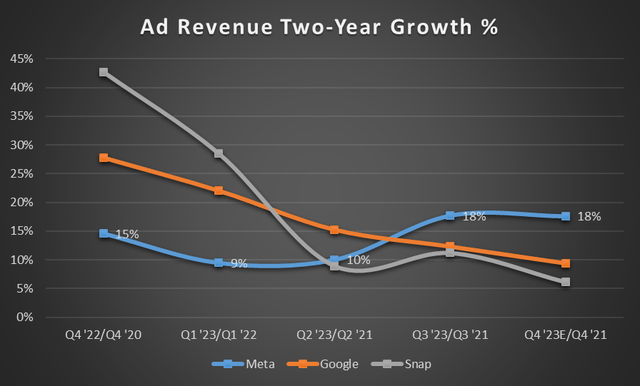

Its competitors continue to slip on a two-year basis, while Meta is expected to grow at higher levels, leading to a more risk-averse valuation (which I’ll get to shortly). Here’s how Meta has performed on a two-year basis over Google and Snap (SNAP), with estimates for Q4:

Chart mine, data from company filings

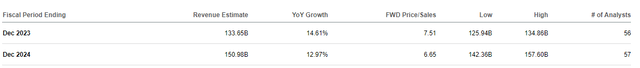

But it’s not just the US revenue I expect to see a boost. The Olympics also provide EU upside to ad revenue. Keeping in mind the room for outperformance with Q4 ’23 numbers, 2024 numbers for the year have only ticked up to 14.6% revenue growth from 13% a few weeks ago.

Seeking Alpha

When I put that against the 12.5% expected online ad growth, I question Meta coming in at average or just above average against its peers. Based on its performance in 2023 and its superior AI efficiency and ad products driving market-leading growth (read more on my AI stance for Meta here), it should outperform considerably. For example, the online ad industry grew 8% in 2023, while Meta is likely to do closer to 15% (nearly double). Therefore, 12.5% growth in the industry should bring Meta to at least 20% in 2024 – accelerating, not shrinking growth in 2024 as currently expected.

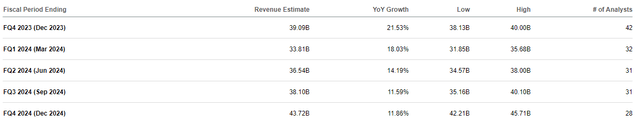

Therefore, I expect Meta’s guidance on February 1st for Q1 to outperform the consensus for $33.61B and provide something closer to $35B with room to outperform at the Q1 earnings report. With the upcoming fourth quarter containing the prime of the presidential election – not to mention a much more extended general election season due to both candidates more or less chosen – less than 12% revenue growth, even against a strong Q4 in ’23, doesn’t add up. It isn’t surprising, then, the stock has made its way back to all-time highs.

Seeking Alpha

With my 2024 revenue numbers in mind, my EPS estimate needs to come way up from the current consensus of $17.62. Considering the company has pulled way back on headcount and expenses, EPS should increase dramatically more than the 20% revenue growth I expect.

My estimates have FY24 EPS at $21.79, as broken down in the below chart. I left some room for operating margin upside as this should be conservative after the massive layoffs and continued AI usage.

| In Billions (excl. shares and EPS) | Q1 ’24E | Q2 ’24E | Q3 ’24E | Q4 ’24E | FY24 |

| Rev | $35.25 | $38.50 | $41.25 | $46.50 | $161.50 |

| Costs & Expenses | $21.15 | $22.72 | $23.93 | $26.51 | $94.30 |

| Op. Margin | 40% | 41% | 42% | 43% | 42% |

| Income From Op. | $14.10 | $15.79 | $17.33 | $20.00 | $67.21 |

| Eff. Tax Rate | 17% | 18% | 17% | 18% | – |

| Net Income | $11.70 | $12.94 | $14.38 | $16.40 | $55.42 |

| Share Out. | 2560 | 2550 | 2540 | 2530 | – |

| EPS | $4.57 | $5.08 | $5.66 | $6.48 | $ 21.79 |

Valuation

This 25% upside to estimates translates nicely to a lower forward valuation than consensus predicts. Using $21.79 as my input, at $390 per share, the 2024 forward P/E is 17.9 (call it 18). And with earnings growth of 49% for 2024 (likely, since Q4 earnings aren’t out yet), this is a PEG ratio of 0.54 (using current P/E based on $390 share price and $14.60 2023 EPS).

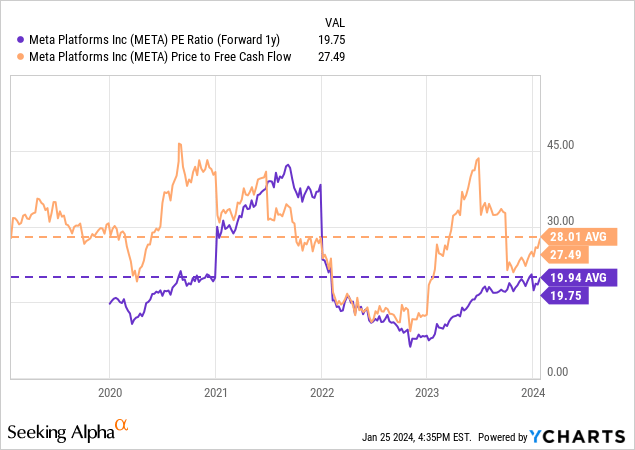

All while it trades below the historical average on both a forward P/E basis and a price-to-free-cash-flow basis over the last five years.

This is an enticing setup fundamentally from the company. Keep in mind my estimates are what I expect reported earnings to come in at – so after guidance boosts and quarter outperformance on the day of report. So, I’m about as conservative but still as realistic as possible. Given a forward P/E of 20 (merely average) on $21.79 in earnings, a fair value for the stock is $435. This is a 12% upside.

The downside estimate is 2024 estimates don’t budge but to $18 in EPS, providing a downside target of $360 at a 20 P/E, or 7.5% downside from $390. This is highly unlikely as estimates continue to tick higher over the last month, and a Q1 guide to my $35B revenue number immediately puts $18 as the new average for 2024 EPS. The company could only perform in line for the rest of the year and still achieve this valuation target.

Q4 Earnings To Tell The 2024 Tale

While I expect a nice beat from Meta next week for Q4 to top off a market-beating 2023, my focus is on Q1 and the expense roadmap for FY24. With the ad market looking to rebound quite heavily, there’s no better company to lead the pack and take market share than Meta as it employs its AI stack to users and advertisers. After a year of layoffs and leaning out the company, all revenue growth for 2024 should be of the highest operating margin, especially as AI does most of the work in scalability. The revenue and earnings upside potential are one of the best I’ve seen for Meta in quite a few years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, FUBO, SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Then sign up to be a free member of my investing group Tech Cache. You’ll get more free content from me, no paywall, and no credit card. If you want the trading strategy and technical chart analysis of the article you just read, step up to being a paid subscriber with a two-week free trial and read it immediately.