Summary:

- Oracle database integration is a growth catalyst for Azure adoption and usage growth; this is likely to offset cloud optimization trends.

- AI- and Copilot-related uptakes by customers can increase recurring revenues and provide Microsoft with greater pricing power, leading to an overall improvement in revenue quality and gross margin expansion.

- An analysis of guidance vs consensus estimates, the historical track record of beats/misses and commentary suggesting faster-than-expected new product commercialization suggests there is scope for beats in Q2FY24.

- A simple and conservatively-expressed DCF valuation baking in these views suggests at least 12% further upside in the stock.

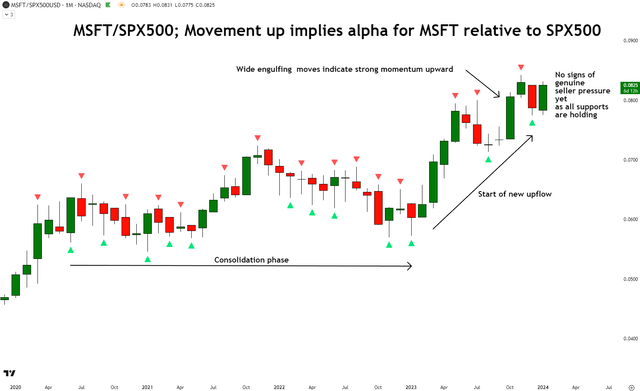

- Technical analysis also paints bullish signals with no major signs of seller pressure, indicating further outperformance of Microsoft vs S&P 500 ahead.

Stephen Brashear

Performance assessment

In my initiating coverage of Microsoft (NASDAQ:MSFT), I was bullish as I believed the company had a headstart in the AI boom. This initial thesis is playing out very strongly so far. However, I had changed my ‘Buy’ stance to one that still recognized the bullish operating momentum, but issued a ‘Neutral/Hold’ on account of valuations. Looking at the performance since then, it is clear that this assessment was correct for a quarter (see boxed consolidation in chart below). However, I missed an opportunity to publish an upgrade to a ‘Buy’ after the Q4 FY23 results, which led to some foregone alpha:

Performance since Hunting Alpha’s last coverage of Microsoft (Seeking Alpha, Author’s Highlight)

Recently, I have a new policy wherein I update my views in a pinned comment below the article so look out for that for more timely updates.

Now, with Microsoft reporting Q1 FY24 results next week, I’m sharing my thoughts on what I expect and my positioning:

Thesis

I am bullish on Microsoft ahead of Q4 FY24 earnings and beyond. These are the key drivers of the stock I think are in-play:

-

Oracle database integration is a growth catalyst for Azure adoption and usage growth

-

Consistent improvements in revenue quality and margin expansion is likely

-

Consensus views may be underestimating Microsoft’s Q1 FY24 execution, as I too did

-

A simple DCF valuation suggests modest upside ahead still

- Technical analysis paints bullish signals, indicating Microsoft outperformance vs S&P 500

A very diverse and healthy growth profile

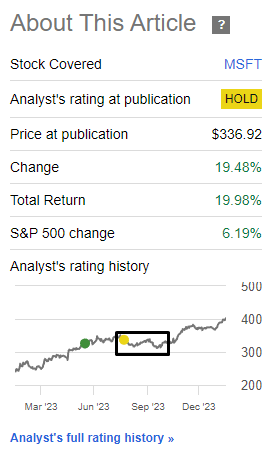

Readers familiar with my work will know that for large businesses with a lot of moving parts, I like to give a snapshot summary of what really matters by looking at the mix and growth numbers, along with helpful context in industry and management commentary:

Microsoft’s Granular Growth Profile (Company Filings and Q1 FY24 transcript, Author’s Analysis)

The first key message I want to emphasize here; Microsoft has a very diverse business. It’s largest revenue contributor is Azure Cloud, which makes up 29.4% of overall revenues. After that comes its suite of Office 365 products contributing 19.5% to the overall mix. And beyond that is a well-balanced mix of different revenue sources.

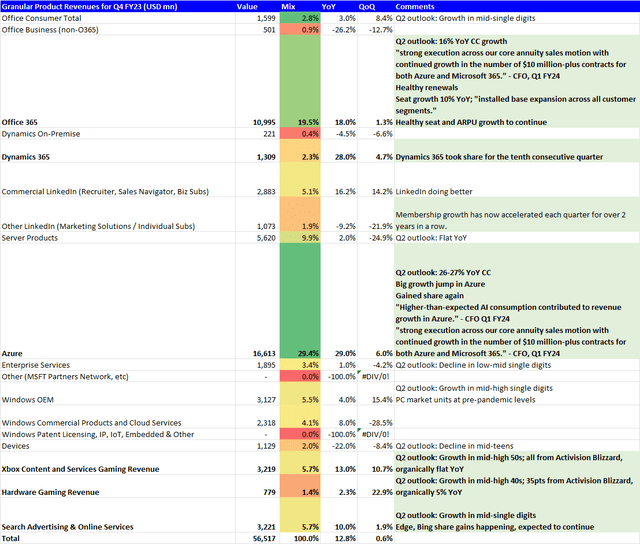

This is very unique characteristic as all the other companies in the Magnificent 7 have much higher concentration in their top revenue contributing business:

Magnificent 7 Top Revenue Source Diversification (Company Filings, Author’s Analysis)

The Magnificent 7 stocks include Apple (AAPL), Amazon (AMZN), Google (GOOGL) (GOOG), Meta (META), Microsoft (MSFT), NVIDIA (NVDA) and Tesla (TSLA)

The other key message to highlight is that the most important parts of Microsoft’s diverse business mix are all growing very strongly and gaining market share. I think these characteristics speak to the pure quality of Microsoft’s business. In my eyes, I would probably rate it the highest quality business among the Magnificent 7. With that context, let’s get into what I expect for Q2 FY24 and ahead:

Oracle database integration is a growth catalyst for Azure adoption and usage growth

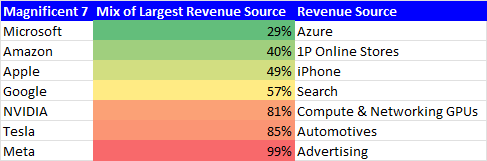

The cloud vendors have been talking about their enterprise customers optimizing (read: cutting) spends for multiple quarters now. And that has been the key headwind which has led to a moderation in growth rates. Azure has been no exception as its YoY growth rate has decelerated from 40-50% down to the mid-high 20%s (still very respectable!) over the last 2 years:

Azure YoY (Company Filings, Author’s Analysis)

The industry narratives suggest that there is no reversal of the optimization trends so far. However, I believe Microsoft’s Azure has a unique reason to still see an uptick in growth, driven by increased adoption and usage of Azure from Oracle-using enterprises yet to migrate to the Cloud:

Once we announce that the Oracle databases are going to be available on Azure, we saw a bunch of unlock from new customers who have significant Oracle estates that have not yet moved to the cloud because they needed to run the GUI with the rest of the app estate in one single cloud. And so we’re excited about that. So in some sense, even the financial services sector, for example, is a good place where there’s a lot of Oracle that still needs to move to the cloud.

– CEO Satya Nadella in the Q1 FY24 earnings call, Author’s highlights

We already saw Azure growth accelerate in Q1 FY24 after 8 straight quarters of deceleration since Q4 FY21. Given this Oracle integration catalyst, I expect this acceleration to continue in Q2 FY24 and beyond.

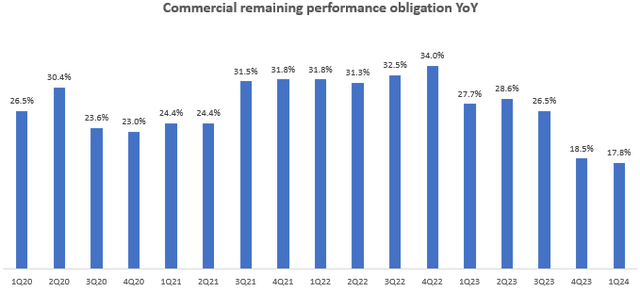

Commercial remaining performance obligations YoY (Company Filings, Author’s Analysis)

As validation of this hypothesis, in the Q2 FY24 results, I would be watching for an uptick in commercial remaining performance obligations (RPOs), which mostly represents revenue backlog growth in the Cloud business. Cloud migration projects go on for multiple months. Hence, I think it is reasonable to expect upticks in this to reflect in the RPO numbers.

Consistent improvements in revenue quality and margin expansion is likely

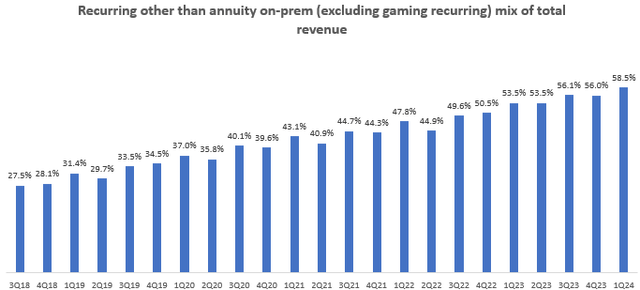

Microsoft has seen a steady increase in recurring revenues in their core B2B growth segments (so excluding the legacy on-premise businesses and also the B2C gaming revenues):

Ex-onprem, ex-gaming recurring revenue mix (Company Filings, Author’s Analysis)

In the last quarter, there was a bit of a welcome jump in this figure from 56% to 58.5%. Management attributed this to:

…strong execution across our core annuity sales motion with continued growth in the number of $10 million-plus contracts for both Azure and Microsoft 365.

– CFO Amy Hood in the Q1 FY24 earnings call

I believe this recurring revenue mix will continue ticking upwards, likely at an accelerated pace as AI and Copilot augmented products and services get used more. I encourage you to read CEO Nadella’s remarks in the last earnings call and it’ll become very clear that Microsoft is heavily incorporating AI features into virtually every single product and service in their portfolio. As the CEO himself remarked:

We are rapidly infusing every layer of the tech stack and for every role and business process to drive productivity gains for our customers… Copilot is your everyday AI assistant, helping you be more creative in Word, more analytical in Excel, more expressive in PowerPoint, more productive in Outlook and more collaborative in Teams. Tens of thousands of employees at customers like Bayer, KPMG, Mayo Clinic, Suncorp and Visa, including 40% of the Fortune 100, are using Copilot as part of our early access program

– CEO Satya Nadella in the Q1 FY24 earnings call

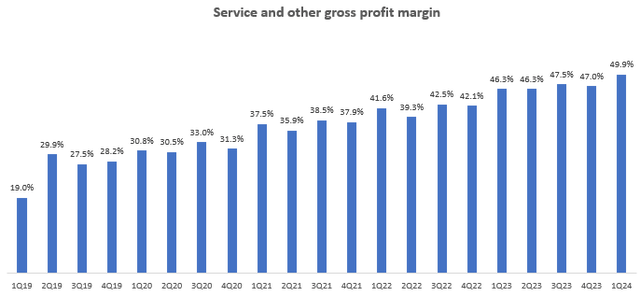

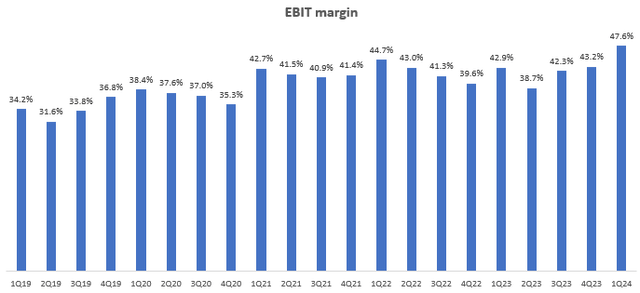

The AI and Copilot led revenue boosts are also leading to increased pricing power for Microsoft. Similar to the revenues trend, in the services gross margins as well, there was a material 290bps bump up from 47% to 49.9% QoQ. Management attributed much of this to the 2 biggest segments; better monetization in Azure Cloud and ARPU growth in Office 365.

Services and other gross profit margin (Company Filings, Author’s Analysis)

I anticipate gross margin expansion to continue in the quarters ahead due to 2 key reasons:

- The margin expansion seen in the last quarter is despite headwinds relating to the scaling up of AI infrastructure to meet growing demand. This tells me that once these scaling investments are done, more margin expansion would be visible.

- I am confident that Microsoft’s product successes come with the added advantage of increased pricing power, which they can exercise at the opportune times. Industry veterans in the enterprise software business would agree that enterprise software is a sticky business as organizations find it very hard and costly to switch and migrate over to new software vendors. And that is why after product adoption success, pricing-led margin expansion is usually smooth ride. So far, the signs point towards adoption success for Copilot:

Customers tell us that once they use Copilot, they can’t imagine work without it.

– CEO Satya Nadella in the Q1 FY24 earnings call

Consensus views may be underestimating Microsoft’s execution, as I too did

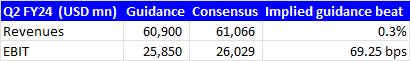

Q1 FY24 Guidance vs Consensus Estimates (Capital IQ, Author’s Analysis)

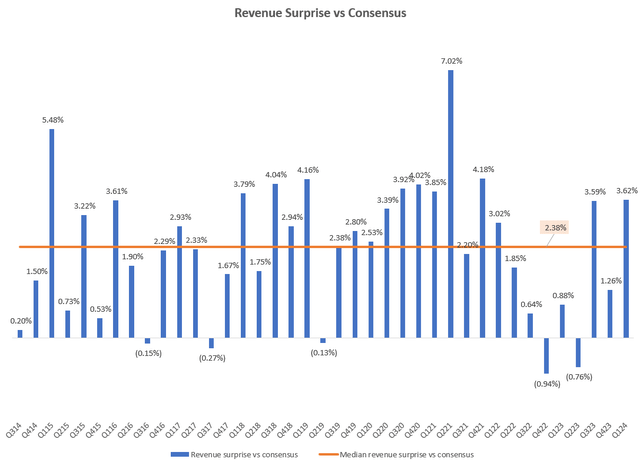

Right now, Wall St consensus is building in an implied guidance beat of 0.3% on revenues over the midpoint of management’s $60.9 billion guidance. I believe this is too conservative because this is lower than what has occurred statistically; Microsoft has a 1.98% median guidance beat on revenues since the company started to consistently issue guidance in Q1 FY18. And since Satya Nadella became CEO in February 2014, Microsoft’s quarterly results have a record of beating consensus estimates by a median of 2.38%, with only 5 out of 39 quarters showing a revenue miss (that too by less than 1% in all cases):

Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

Another reason for why I think the guidance beat is understated is because whilst everyone knew AI and Copilot adoption was coming, they all underestimated the speed of adoption. For context, Copilot adoption has 37,000 enterprises as customers already and the customer base is growing rapidly at 40% QoQ (not YoY)! Management consistently highlighted that results were better than even their expectations.

Analysts also acknowledged that the new AI-boosted product rollouts are growing faster than expected:

And new products are like garnering traction probably faster than we had expected on our side of the equation.

– Morgan Stanley Analyst Keith Weiss in the Q1 FY24 earnings call

Taking cues from management commentary, I too thought management was hinting towards a slower, gradual pace of Copilot adoption:

Excerpt from Hunting Alpha’s last article on Microsoft (Seeking Alpha, Hunting Alpha’s last article on Microsoft)

So I am recalibrating myself to estimate higher revenues for Microsoft given the record of positive surprises it has delivered over both the long term and in the recent phase of AI and Copilot product growth.

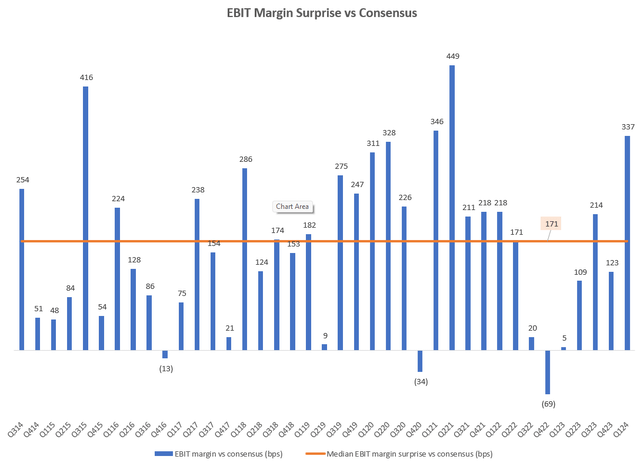

On the EBIT margins side, Wall St consensus is baking in a 69bps beat on management’s guided figures. The data shows that Microsoft is likely to post a positive surprise vs consensus on these figures as well as the median EBIT surprise vs consensus has been +171bps since Satya Nadella became CEO:

EBIT Margin Surprise vs Consensus (Capital IQ, Author’s Analysis)

A simple DCF valuation suggests modest upside ahead

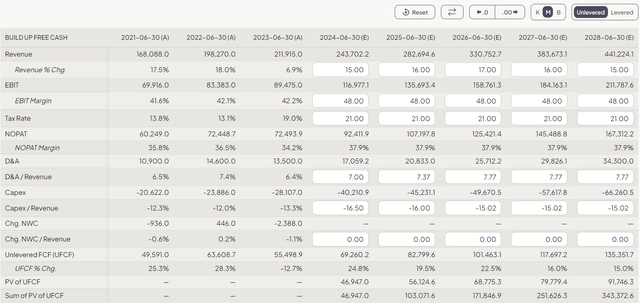

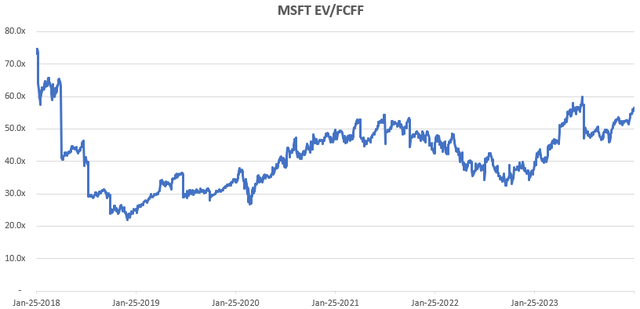

As the nature of Microsoft’s business is changing and evolving for the better, I believe looking at historical valuations is not as useful. In these circumstances, I use a simple DCF approach, with operating forecasts for the next 5 years and a EV/FCFF-based exit multiple to determine where fair value may lie:

Microsoft DCF Operating Assumptions (FinChat, Author’s Inputs)

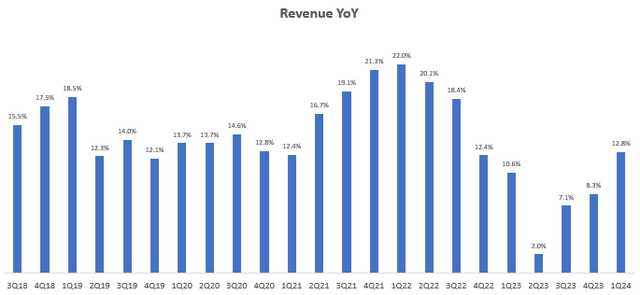

I have assumed an uptick in revenue growth to 15% up to 17% over the next 3 years and then a moderation back down to 15% over the next 2 years. This is based on my anticipation that Microsoft is entering a golden age of growth driven by its strong AI product R&D capabilities and high demand for those products and services (a litmus test of the demand health is whether the company is forced to build out capacity to meet demand, which it absolutely is).

How reasonable are these assumptions? I would argue quite reasonable as it is only assuming a moderate uptick in the revenue YoY growth rates; I am not assuming a return to 20%+ YoY growth levels, although I wouldn’t be very surprised if Microsoft manages to do that.

Total Revenue YoY (Company Filings, Author’s Analysis)

On the EBIT margin side, I am anticipating Microsoft to grow and exercise pricing power gradually and have margin expansion benefits as scaling investments are completed. Despite this, I have not assumed too much margin expansion; from the latest quarterly levels of Q1 FY24, I am only flatlining margins to reach 48%. I would say there is definitely some scope for further upside on this number.

EBIT Margin (Company Filings, Author’s Analysis)

For D&A and capex assumptions, I have baked in slightly higher than historical levels to reflect the company’s increased investments in cloud and AI infrastructure, using consensus estimates as a baseline reference point. I have assumed a simple US corporate tax rate of 21% going forward.

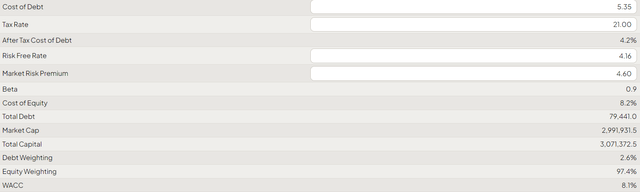

Microsoft DCF Cost of Capital Assumptions (FinChat, Author’s Inputs)

For the cost of capital assumptions, I have taken a 5.35% cost of debt and 4.60% equity risk premium based on the Dean of Valuation Ashwath Damodaran‘s datasets. The 4.16% risk free rate is based on the US 10yr treasury yield.

For the EV/FCFF exit multiple, I have assumed a 35.0x exit multiple. I believe this is quite reasonable as it is in the lower-bound of Microsoft’s historical EV/FCFF range:

Microsoft TTM EV/FCFF (Capital IQ, Author’s Analysis) Microsoft DCF Exit Multiple Assumptions and Implied Fair Value (FinChat, Author’s Inputs)

Ultimately, these assumptions yield an upside of 12.1%, with an implied fair value share price of $451.1. As I believe I have taken slightly conservative revenue and margin assumptions in the context of my overall narrative, I think practically we may see further upside as well.

Technical analysis paints bullish signals, indicating Microsoft outperformance vs S&P 500

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do.

Technical Analysis of Microsoft vs S&P500 (TradingView, Author’s Analysis)

The relative technical analysis of MSFT over the S&P 500 (SPY) (SPX) on the monthly chart shows that following a period of consolidation, a new upflow has started since 2023, indicating alpha generation. So far, there are no signs of bearish pressure as all supports are holding. In fact, the wide engulfing moves indicate strong momentum upward instead. I anticipate this trend to continue, suggesting further alpha in Microsoft ahead.

Takeaway, risks and positioning

I am bullish ahead of Microsoft’s Q2 FY24 earnings release next week. The particular items I am anticipating over the next quarter and beyond include an acceleration in Azure growth driven by increased migration from Oracle-using enterprises, following Azure’s recent integration of Oracle databases. I believe continued AI and Copilot product developments and commercialization is likely to lead to further increases in the recurring revenues profile of Microsoft’s business, thereby increasing the quality and reliability of the top-line. This is expected to come with the additional benefit of pricing power, which I think can lead to further gross margin expansion.

Looking at management’s guidance and what Wall St consensus is baking in for Q2 FY24, I think there is scope for positive surprises on both revenue and margins. This is based on the remarkably consistent positive surprises track record during the course of CEO Satya Nadella’s reign at Microsoft, and the fact that the market seems to be underestimating the speed at which AI and Copilot is being adopted by customers.

Baking in these views into a simple and arguably conservative DCF valuation, I see at least 12.1% upside in the stock. Technical analysis of Microsoft vs the S&P 500 also signals further alpha potential ahead.

On the risks and positioning side, I am personally phasing in my buys gradually over a time horizon that encompasses both before earnings and after earnings. This is because volatility in the stock is typically highest around and upon the earnings releases. In terms of thesis risk and monitorable for the Q2 FY24 earnings release, I will be looking for commentary on pricing power and whether Oracle-led migrations are indeed leading to a boost in Azure growth.

Stance: Buy

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.