Summary:

- Johnson & Johnson is a multinational corporation in the healthcare and pharmaceutical sectors, showing indications of accelerated growth.

- J&J is currently the third largest player in the pharmaceutical industry, facing competition but with a low threat of substitutes.

- The FDA approval of Balversa and the acquisition of Ambrx Biopharma are expected to enhance sales growth and mitigate overall risk for J&J.

Mario Tama/Getty Images News

Thesis

Johnson & Johnson (NYSE:JNJ) is a multinational corporation that operates in the healthcare and pharmaceutical sectors. Founded in 1886, the company is headquartered in New Brunswick, New Jersey, USA. JNJ is one of the largest and most diversified healthcare companies globally.

Having experienced a dip in terms of its profitability and liquidity in recent years, the pharma giant has been showing indications of a major acceleration in growth with their heavy focus on the pharma segment and their success in bringing out newer drugs.

Position in the Pharmaceutical Industry

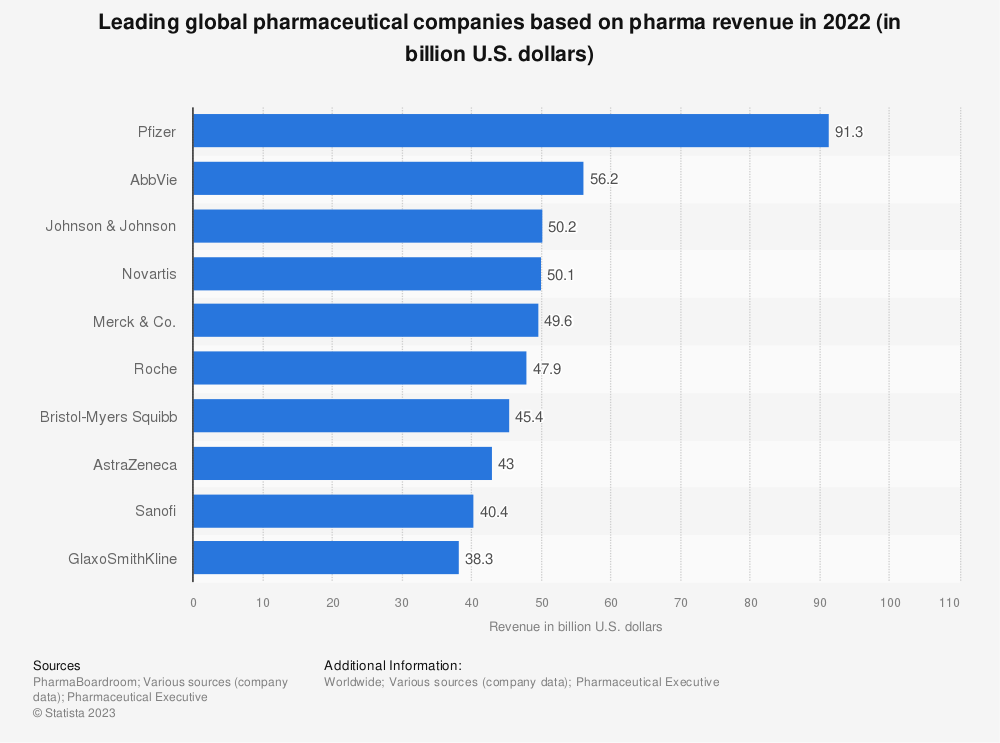

Based on the current position in terms of pharmaceutical sales, Johnson & Johnson is currently the third largest player. Here we are considering the pharmaceutical industry specifically because that is the largest source of revenue for JNJ. For example, in FY22, pharmaceuticals consisted of 55.4% of the total revenue. However, as we can see based on the graph, JNJ currently is facing steep competition from other players like AbbVie, Novartis, Merck & Co, etc. Pfizer is the only unambiguous market leader with almost 80% more sales than any other player. Therefore, we can say that based on the current situation, the fear of competitors is high for JNJ. However, given the importance of pharmaceuticals and the emergency need for them due to the demand, we can say that the threat of substitutes is low for pharmaceuticals in general and the industry should continue to have high demand going forward, positively impacting JNJ.

Statista

The figure below shows the sales figure and the corresponding expenditure on research & development. One of the unique observations about JNJ is that in spite of being the third-highest revenue earner, it spends the second-highest amount on research and development. Since in the pharmaceutical industry, the major source of growth is research and development, we can say that JNJ is well positioned to take advantage and keep a step ahead of its competitors.

Statista

Gaining FDA Approval of Key Drug

The FDA has granted full authorization for the use of the oral FGFR kinase inhibitor, Balversa, in adults with locally advanced or metastatic urothelial carcinoma that has FGFR3 genetic alterations and has progressed after at least one prior systemic therapy. Balversa’s approval is based on phase 3 THOR trial results, showing a 36% reduction in the risk of death compared to chemotherapy in patients with selected FGFR gene alterations. This approval underscores the promise of targeted therapy in treating advanced bladder cancer, according to Kiran Patel of J&J Innovative Medicine. The approval closely follows J&J’s announcement of acquiring Ambrx Biopharma for $2 billion, gaining access to antibody-drug conjugates for various cancers. This is likely to enhance sales growth by a few percent over the coming years and help mitigate JNJ’s overall risk since it provides JNJ with another product that they sell in the market and thus lessens their dependence on any one product.

Financials

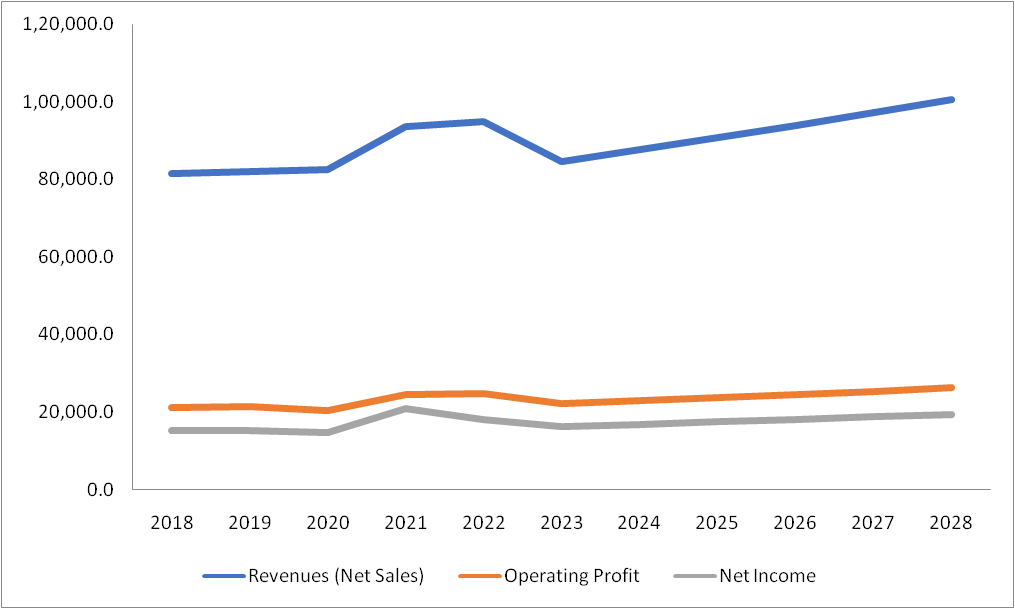

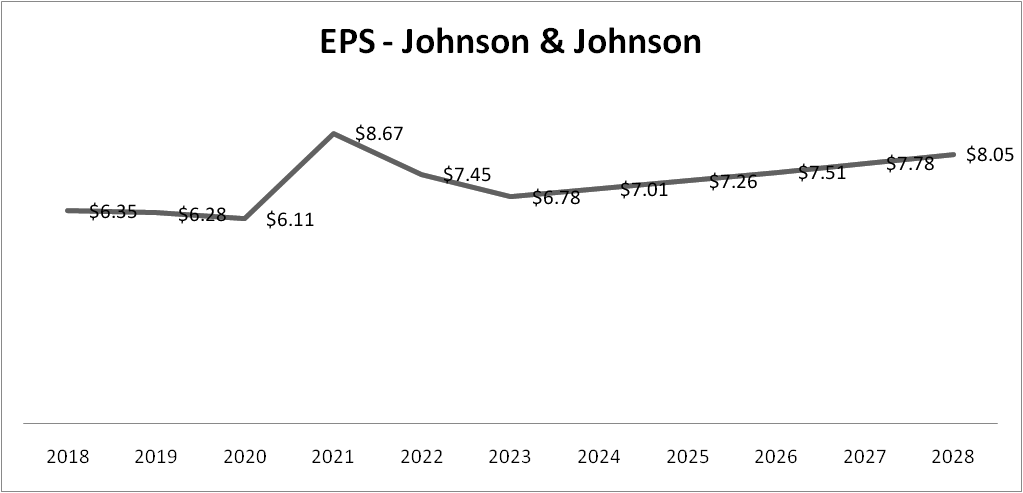

Given below are the trends of net sales, operating profit, and net income. As we can see, the revenue and profits have faced significant fluctuations since FY20. This can be explained by the Covid period, which led to a rise in the demand for vaccines, leading to a boost in the pharmaceutical sector. However, note that this was not sustainable growth because as the COVID-19 pandemic abated, the high sales figures due to vaccine sales also fizzled out. The EPS has fluctuated significantly around the same time reflecting the same picture as that of sales and net income.

Given the outcome of the most recent earnings call, the sales increased over the past year by 6.5% and the quarter sales increased by 7.3%. This reflects that in the upcoming couple of years, the sales growth is likely to continue at similar rates of around 7%. Moreover, the EPS is also expected to take off post FY23 given that the earnings had taken a hit (fell by 18.6%) during this time. However, I expect that the earnings and EPS will increase post that.

Author’s Material Author’s Material Author’s Material

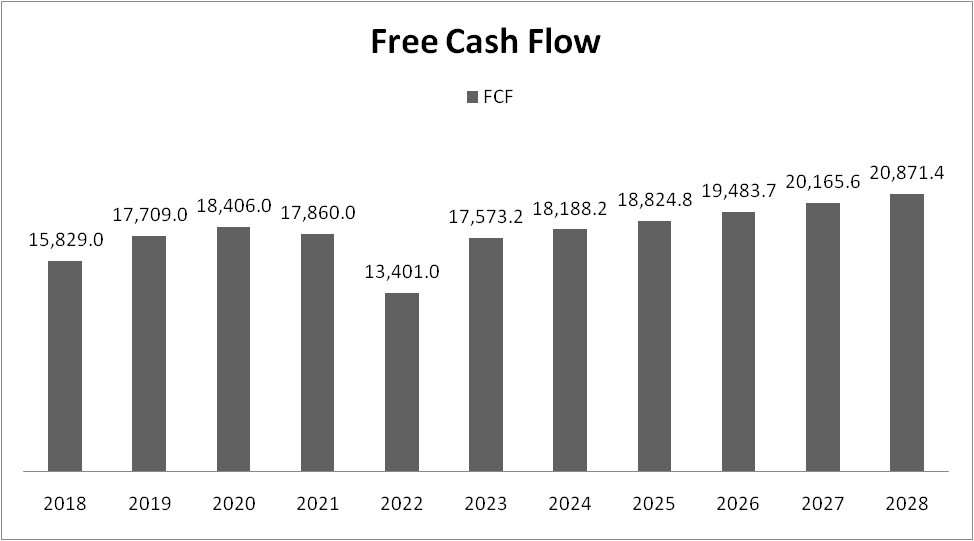

The free cash flow graph above displays a similar picture. However, it is to be noted that the free cash flow took a sharp dip in FY23. This could be explained by both the decrease in sales and also the increased spending by JNJ on research and development.

Moreover, in terms of their cash flows, their operating cash flow value has been monotonically decreasing since FY20, highlighting the fact that the earnings have reduced significantly since that time. As the earnings levels are approaching a more sustainable growth rate after the sudden spurt in growth for Johnson & Johnson, I believe the trend will only continue.

Risk

Johnson & Johnson has tentatively agreed to a $700 million settlement following a 42-state investigation into its marketing of talc-based baby powder. This settlement comes in the midst of over 50,000 personal-injury lawsuits against JNJ, some alleging that the talc-based powders contained asbestos linked to cancer. Despite this settlement, thousands of lawsuits remain unaddressed. JNJ previously proposed an $8.9+ billion settlement for personal-injury lawsuits nationwide, separate from the state settlement, but it was rejected. J&J has sought bankruptcy protection to settle lawsuits, but this has been denied by courts, leading the company to consider appealing to the U.S. Supreme Court. J&J is still in the process of resolving litigation related to its talc-based powders.

However, I believe that the potential danger of the settlement could be mitigated in the long run. Johnson & Johnson is a diversified healthcare company with a broad range of products, including pharmaceuticals, medical devices, and consumer health products. The impact of the talc-related issues might be mitigated by the overall diversity of JNJ’s business. Moreover, the article mentions that JNJ has tentatively agreed to a $700 million settlement as part of a 42-state investigation. While this settlement is substantial, it is also a step towards resolving legal issues. Settlements, even large ones, can bring clarity and certainty to investors. In addition, JNJ has taken the proactive step of undertaking a spin-off. JNJ has ceased its sale of talc-based powders and spun off a separate company called Kenvue, which now sells a version of Johnson’s Baby Powder made with cornstarch. This action indicates that JNJ is taking steps to address and separate from the problematic talc business. So, overall I believe that there would not be a major impact on the sales growth rate, given that the sales had already taken quite a dip and in my opinion, this litigation case is also included in the same. However, given that JNJ has come out clean, I believe that revenue growth will return to its original trajectory and the rate will be maintained at around 3.5% as I further elaborate in the valuation section of my report.

Valuation

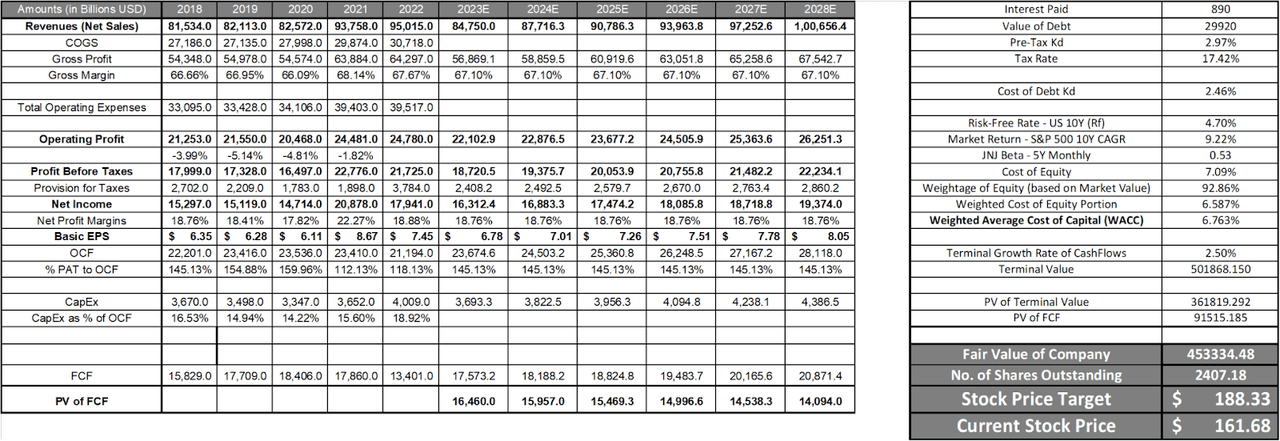

To assess the valuation of Johnson & Johnson, I have undertaken a DCF Valuation. Below is an image of a DCF Valuation performed on JNJ. I have assumed 3.50% revenue growth from 2023 to 2028 because the primary market is the USA which is a slow-growing economy. However, I have also kept in mind some of the crucial developments like the FDA approval of the new drug and the heavy investments in research & development which could potentially be a boost of growth. Moreover, it is to be noted that the sales of JNJ have fallen from the previous year which would mean that there could be a base effect in terms of the increase in earnings as well. This is why I feel that the sales growth rate from the next few years would be sustained at a higher rate of 3.50% having combined all the catalysts mentioned above along with the fact that JNJ is also servicing the emerging market economies as well.

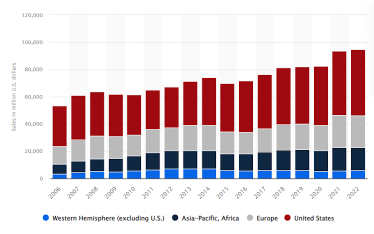

I assumed that JNJ’s net profit margins will remain at 1.4% in 2024 and beyond. Moreover, I have also assumed that the long-term growth rate will be 2.5%. This is because the majority of the sales of JNJ comes from the USA and Europe as shown in the figure below.

Statista

Since these regions are growing at 2% on average, and there is a minor section of APAC countries as well, I have kept the growth at a slightly higher value of 2.5%

Ultimately, we get a Fair Value/ Price Target of $188.33 in the base case scenario. The DCF analysis gives us a value that has an upside of 16.48%, a promising sign for investors.

Conclusion

Overall, the stock is providing a relatively optimistic picture. Johnson & Johnson’s new initiatives indicate potential for growth in these segments. Moreover, these initiatives also reflect the growing confidence in Johnson & Johnson’s future prospects, given their heavy investment into research and development, and are also strengthened by the fact that one of their key drugs received FDA approval which is likely to indicate further improvements in earnings. Therefore, we can say that in spite of a dip in sales of Johnson & Johnson, currently their prospects are bright and they are likely to improve their profitability and liquidity further. Therefore, my recommendation for Johnson & Johnson would be a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.