Summary:

- AT&T shares fell 3% after releasing mixed Q4 results and delivering disappointing guidance.

- The company reported strong free cash flow, user growth, and wireless service revenue.

- AT&T is working on retiring debt, building out its wireless network, and investing in open radio access network technology.

- Is the thrill of victory worth the agony of defeat?

Kittiporn Kumpang/iStock via Getty Images

This article was coproduced by Chuck Walston.

After gaining ground Monday in concert with Verizon (VZ) and that company’s better-than-expected earnings report, shares of AT&T (NYSE:T) fell 3% with the release of mixed Q4 results.

As investors mulled over the earnings call, several factors appeared to cause the tumble. Arguably, management’s guidance is what delivered the worst blow to investor sentiment, despite a number of positive trends in the business.

But overall, AT&T delivered a fairly solid quarter. Free cash flow, arguably the focal point for many of those seeking high-yield names, was strong. User growth and wireless service revenue also fared well, and the company is working at retiring debt and building out its wireless network.

Dissecting Q4 Results

AT&T’s revenue of $32.02 billion was up 2.2% for the quarter and 1.4% for the full year, beating estimates by $560 million. However, Q4 non-GAAP EPS of $0.54 missed consensus by $0.02.

Management blamed the EPS miss, down by $0.06 in Q3, to the “impact from higher non-cash pension costs, lower capitalized interest, lower equity income from DirecTV, and a higher effective tax rate.”

Nonetheless, adjusted EPS for the fiscal year landed at the lower end of management’s prior guidance of a low 2.40s range.

Adjusted EBITDA was up 3.2% for the quarter and 4.7% for the full year, due to growth in mobility, consumer wireline, and the company’s business in Mexico.

Free cash flow for the quarter was $6.4 billion, and for the full year, FCF hit $16.8 billion.

That was above AT&T’s estimates for FY23, even though in Q3 management boosted guidance for FCF from a prior $16 billion to $16.5 billion. This represented a $2.6 billion, or 19%, year over year increase in FCF.

The growth in FCF occurred despite the company receiving $750 million less in cash distributions from DirecTV as well as a $1 billion larger tax bite for the year.

Cash from operating activities grew by $1 billion year-over-year to $11.4 billion.

Capex hit $4.6 billion in Q4 with full year capex at $23.6 billion.

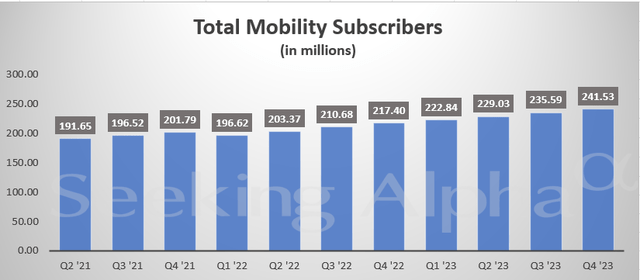

With 526,000 postpaid phone net adds for the quarter, the mobility segment revenues grew by 4% and were up 2.7% for the year. Service revenues for the segment also increased by 4% and were up 4.4% for the fiscal year.

Management attributed the growth in service revenues for the $450 million/5.6% quarterly increase in EBITDA for the segment. For FY23, mobility EBITDA increased 7.4%.

For FY 2023, the company added 1.7 million postpaid phone net additions.

Average revenue per user (ARPU) landed at $56.23, a 1.4% year over year increase.

Postpaid phone churn was 0.84%.

The company added 273,000 fiber customers in Q4 with an ARPU of $68.50, a $0.29 increase over Q3. Fiber revenue growth led to an 8% year over year increase in broadband revenue.

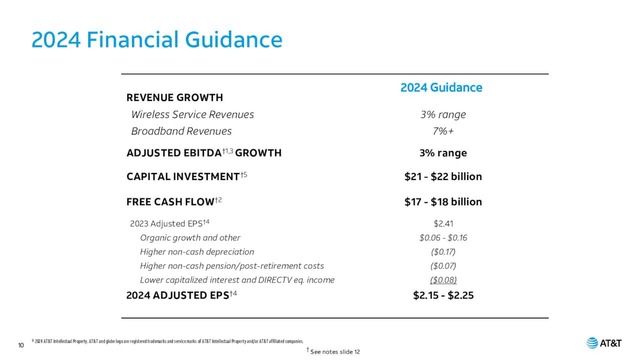

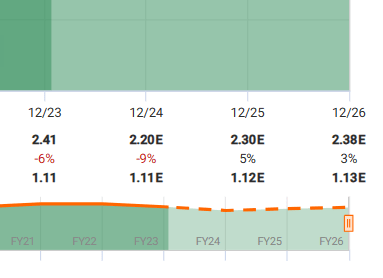

Management guides for 2024 EPS in a range of $2.15 to $2.25.

FCF is expected in a range of $17 billion to $18 billion, and capex is projected to fall to a $21 billion to $22 billion range.

AT&T

Cash distributions from DirecTV in 2023 fell from approximately $4.45 billion in 2022 to $3.7 billion, a $750 million decline. The company projects DirecTV cash distributions will continue to decline at a similar rate in 2024 and thereafter.

AT&T now has a net debt to adjusted EBITDA ratio now below 3 times. Management states the firm is on track to meet their net debt to adjusted EBITDA target range of 2.5 times in the first half of 2025.

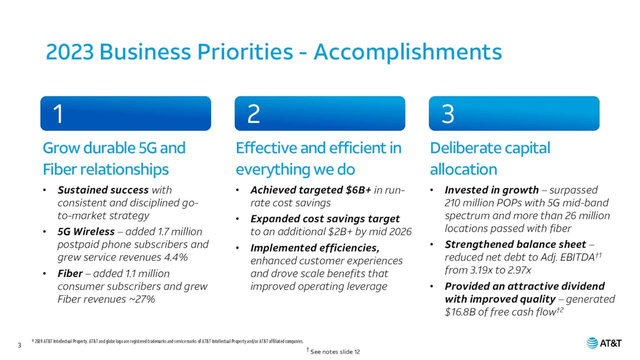

During the earnings call, the CEO highlighted several impressive trends.

Since 2021, AT&T increased its postpaid phone base by more than 10% and now has over 71.2 million subscribers. Those gains constitute the best three-year stretch of postpaid phone net additions in over a decade for AT&T.

2023 marked the sixth consecutive year that AT&T recorded a million or more fiber net additions. In the last three years, the company added 3.4 million fiber subscribers, a 70% increase in that time frame.

Since 2020, AT&T has increased fiber revenues to $6.2 billion, a figure that more than doubled during that period, and the company’s broadband average revenue per user (‘ARPU’) has grown by over 20%.

AT&T Has Lots Of Irons In The Fire

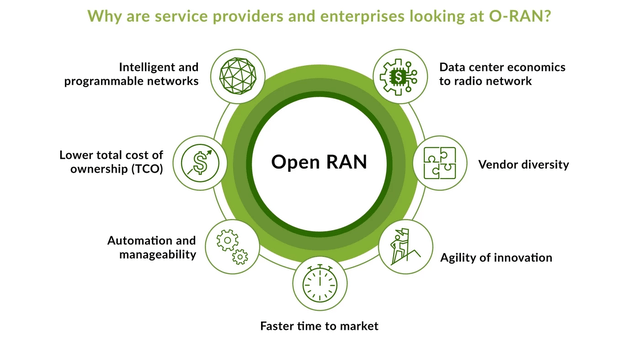

As 2023 was drawing to a close, AT&T announced a plan to team up with Ericsson (ERIC) to build a telecommunications network using an open radio access network (‘ORAN’).

ERIC has a five-year contract to build an ORAN based network covering 70% of AT&T’s U.S. wireless traffic. At a cost of up to $14 billion, work on the project is expected to last through 2026.

The investment in ORAN is intended to enhance the company’s network connections for smartphones and other internet devices.

Using the traditional Radio Access Networks (‘RAN’) technology requires telecoms to work with single suppliers across their entire network. By using ORAN, AT&T can choose the best solution providers for each component, allowing “rapid scaling and management of mixed supplier hardware at each cell site.”

In other words, developing an ORAN network gives AT&T the ability to select the best and least expensive vendors. In turn, this also provides the company with additional bargaining leverage with suppliers.

Juniper Networks

The transition to ORAN should serve to lower AT&T’s costs, boost profits, and give the company a competitive advantage over other providers.

Lest you believe AT&T has gone off the deep end with ORAN, know that DISH Network (DISH) is investing heavily in ORAN, and Verizon is “requiring suppliers to our C-Band network deployment to provide equipment that includes open RAN specifications.”

Investors should understand that AT&T’s move to ORAN does not represent a seismic shift among telecoms, it simply gives AT&T an added edge. The following is CEO John Stankey’s comment on ORAN during a recent investor event.

(open RAN)…allows us to operate our business more effectively. It’s simpler for us. It’s one network infrastructure at the core, there’s one set of systems that support it, it’s all those things that you want to do that allow us to be a more efficient business.

(For a better understanding of ORAN in layman’s terms, I refer you to this link.)

In the middle of 2023, AT&T announced a joint venture, Gigapower, LLC, with BlackRock (BLK).

Gigapower will build fiber networks in Las Vegas, Arizona, Pennsylvania, Alabama, and Florida that are currently outside AT&T’s service areas. AT&T will be Gigapower’s first customer, but other internet service providers can access Gigapower’s fiber networks on a wholesale basis.

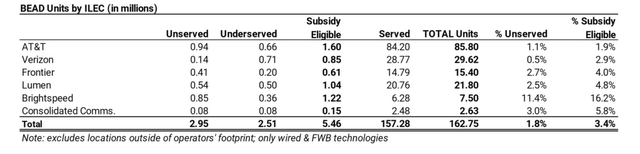

Gigapower is a move to gain access to funding through the Broadband Equity, Access, and Deployment (BEAD) Program. BEAD, a program established by the Infrastructure Investment and Jobs Act, provides $42.45 billion in funding to expand high-speed internet access to underserved areas.

Analysts at ISI Evercore view AT&T and Charter (CHTR) as the biggest winners in the race to earn BEAD funding.

The larger the presence an operator has in a state with a sizable allocation of BEAD funding, the greater the opportunity there is for it to see benefits from a build-out near its existing footprint and fill-in additional pockets across its DMAs [designated market areas] with edge-outs. In that context, we highlight that AT&T and Charter over-index to states that received the lion’s share of BEAD allocation.

Texas and California, the top two BEAD states, constitute 33% of AT&T’s residential broadband subs.

LightReading

Around the same time that AT&T announced the deal with BlackRock, the company launched its commercial entry for its fixed wireless access service, Internet Air.

The company initially opened InternetAir in 16 cities and has since expanded its reach to 33 US markets. The 5G-powered Internet Air product is designed to woo customers on aging copper infrastructure in areas where it also has fiber.

By the end of November, AT&T had 93,000 Internet Air customers. However, the company was late to the game, and its customer count in this arena pales in comparison to Verizon’s and T-Mobile’s comparable services.

Unlike the above listed initiatives, AT&T’s FirstNet has been around since December of 2017. Spanning the entire United States, FirstNet is a first responder’s network.

Subscribers use the AT&T Mobility cellular network to access FirstNet. FirstNet offers three unlimited data plans ranging in price from $39.99 to $44.99 a month.

I’ll not dwell on FirstNet for long as it’s essentially old news. However, investors should give it some weight when assessing AT&T as an investment. In a sense, FirstNet is a mini monopoly. Furthermore, its contributions to AT&T’s earnings are substantial.

To get an idea of how FirstNet can impact the company’s results, consider that FirstNet connections surpassed 5 million by the middle of last year. That was an increase from 4.4 million FirstNet connections in January of 2023.

A Quick Note About Potential Lead Liabilities

Last summer, a Wall Street Journal article revealed lead-sheathed cables used by the telecom industry caused environmental and health risks. Removal of lead cables and potential litigation expenses could result in a variety of costs.

The impact on AT&T is unclear. However, there’s a near universal belief among those following the issue that costs associated with lead cables will be manageable and will likely be spread over an extended time frame.

Debt, Dividend, And Valuation

AT&T’s debt is rated Baa2/stable by Moody’s, BBB/stable by S&P, and BBB+/s by Fitch. The company has about $128 billion in long-term debt.

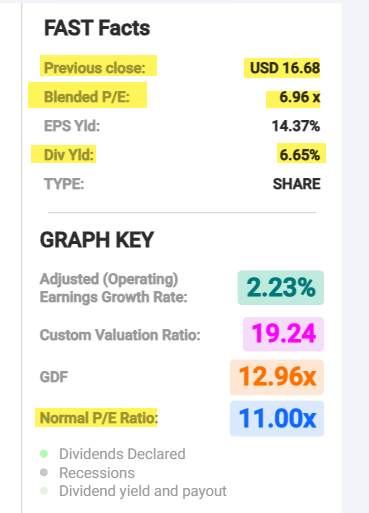

The stock yields 6.65%. The payout ratio is 42.26%, and the dividend coverage ratio is a bit over 236%.

AT&T has a forward P/E of 7.85x, well below the five-year average of 10.94x.

The stock currently trades for $16.99 per share. The 27 analysts covering AT&T have an average price target of $19.00.

FAST Graphs

Analysts estimates growth of -9% in 2024 (21 analysts), +5% in 2025 (17 analysts), and +3% in 2026 (10 analysts).

FAST Graphs

Is AT&T A Buy, Sell, Or Hold?

If you peruse investors’ comments on Seeking Alpha, you might conclude that AT&T was (or is) one of the worst run major corporations.

Many investors feel betrayed by the dividend cut in 2022, and it’s understandable that some are gun-shy when it comes to investing in this telecom.

Be that as it may, I believe AT&T is now on the right path.

Evidence of that abounds.

Last July, management announced they had achieved their targeted $6 billion plus run rate cost savings well ahead of schedule. The company now has a new target to hit an incremental $2 billion plus in run rate cost savings by mid-2026.

U.S. News and World Report rates AT&T as the Best Fiber Internet Provider of 2024.

As of the third quarter, AT&T’s fiber was available to 20.7 million consumer and about 3.3 million business customer locations. The company is on track to reach its target of 30 million plus consumer and business fiber locations by the end of 2025.

During the earnings call, management noted that fiber is more energy efficient, requires less maintenance, and leads to higher customer retention rates. In turn, this drives margin expansion.

The company’s joint venture with BlackRock (BLK) will work to expand AT&T’s services into new areas.

AT&T

While it’s true that AT&T has a fairly heavy debt load, the firm had $128 billion in long-term debt at year’s end, that’s down from $167 billion in 2018 and nearly $150 billion in 2021.

In 2023, the firm reduced net debt from 3.19x to 2.97x adjusted EBITDA, and management is confident that debt will fall to a 2.5x range by the first half of 2025.

The fundamental story for AT&T has not been altered by this quarter’s results.

Seeking Alpha

I believe the stock is undervalued, and I rate AT&T as a BUY.

I will emphasize that I do not expect the shares to provide market beating returns over the long haul. Rather, AT&T is an investment for those seeking a robust yield and a safe dividend.

I’ll add that should the share price increase by 10%, I would view the stock as in a fair value range.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Chuck Walston owns T.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!