Summary:

- NextEra Energy reported strong financial performance, with growth in revenue and EBITDA margin expansion, and expects exceptional growth in the next 3 years with 20GW of backlog capacity.

- The company plans to repower existing wind facilities, invest in solar capacity, and expand battery storage capacity.

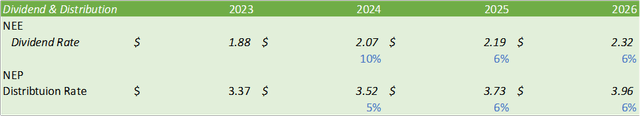

- NextEra Energy Partners expects to grow their distribution at a target rate of 6% through 2026 while the share dividend is expected to increase by 10% in 2024.

pixdeluxe

NextEra Energy (NYSE:NEE) (NEP) reported a strong end to FY23 with both strength at the top line and durable EBITDA margin expansion, with total backlog growing to 20GW. The firm anticipates exceptional growth throughout the next 3 years and anticipates to grow the NEP distribution by 6% annually through 2027 and the NEE dividend by 10% in 2024 for a forward yield of 12% and 3.5%, respectively, making each an appealing holding. I provide both NEE and NEP a BUY recommendation with a price target of $71.94/share and $34.14/unit.

Repower Plans

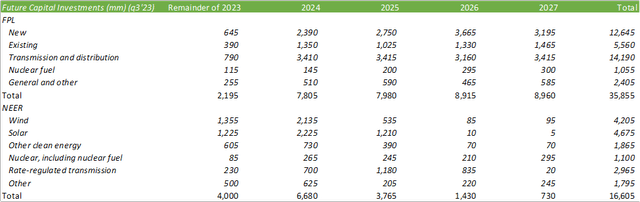

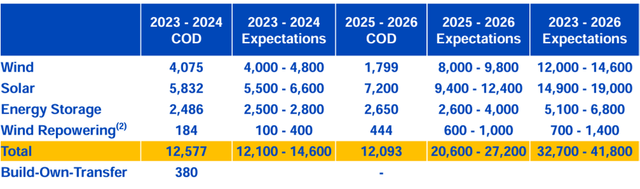

NextEra is positioned to repower 1.3GW of existing wind facilities through 2026. In q4’23, FPL invested $2b in capital projects and $9.4b for FY23. This includes adding 1,200MW in solar capacity. The firm has a significant outlay for capital investments through 2027 with a total investment by FPL of $35b and NEER of $16b. FPL anticipates adding 4,800MW of solar capacity over the term of its current rate agreement. NextEra added 9,000MW in battery storage and renewables to their backlog, increasing total backlog to more than 20GW during FY23. Additions to the backlog in q4’23 includes 1,005MW of wind, 805MW of storage, and 175MW of wind repowering.

Through 2026, NextEra anticipates to place 2,575MW of wind in the Midwest, 2,412MW in Texas, 1,403MW in the West, and 111MW in the Northeast, for a total capacity of 6,502MW. For the same period for solar, the firm is planning to add 3,332MW in the Midwest, 2,114MW in Texas, 2,416MW in the West, and 344MW in the Northeast. Total battery storage capacity is expected to grow by 5,136MW through 2026, primarily focused in the West.

NextEra placed 5,600MW into service in FY23. FPL also piloted and achieved commercial operations for their 25MW hydrogen facility in the Okeechobee Clean Energy Center in December 2023. From a macro perspective, I believe that the market for green hydrogen has a significant runway through the end of the decade and beyond. With hydrogen being used for oxygen reduction for the steel making process, in chemicals and manufacturing, and in transportation, I believe there will be substantial benefits to NextEra’s investment in the space. Though 25MW is small for commercial usage, I believe the firm will focus a portion of their capital investments towards the space to build out additional capacity.

FPL experienced strong growth in q4’23, adding 81,000 new customers to their grid. Though retail sales declined by -1.8% in q4’23, retail sales grew 60bps for FY23. With the new capacity coming online throughout 2024, the firm anticipates strong aEBITDA growth in the range of $8,145-9,935mm.

At the end of FY23, NextEra Energy Partners sold their Texas natural gas pipeline portfolio to Kinder Morgan (KMI) for $1.815b, or $1.4b net of debt extinguishment, which was comprised of 7 natural gas pipeline systems with total capacity of 4.8Bcf/d to transport gas to power producers and municipalities across South Texas and Mexico. The sale generated sufficient proceeds to address the equity buyouts of both STX Midstream and NEP Renewables II convertible equity portfolio financings. In addition to this, the partnership has identified 985MW of wind repowerings to be completed through 2026.

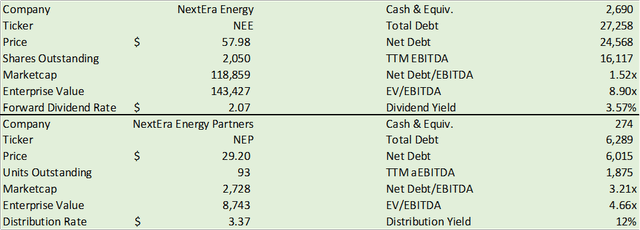

The partnership also issued $750mm 7.250% 2029 senior unsecured notes at the end of q4’23 to pay off their revolver credit. As for NextEra, management anticipates an additional $20-30b in debt issuances through 2026 to off-balance $19b in maturities and to cover project financing. This comes with the addition of $25-35b in tax equity and project financing, $3b in equity unit issuance, and $3b resulting from NEP sales. In FY24, debt servicing is expected to be in the range of $650-900mm. Overall, the firm is in a healthy debt positioning, with NextEra at 1.52x net debt/EBITDA and the partnership at 3.21x.

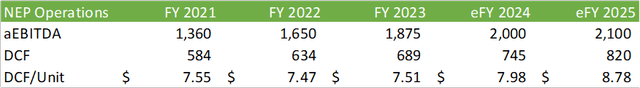

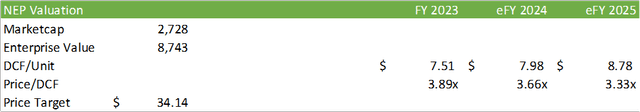

The partnership generated $1,875mm in aEBITDA and $689 in DCF. Looking ahead to FY24 & FY25, management expects the partnership to generate a run rate in the range of $1,900-2,100mm in aEBITDA and $730-820mm in DCF for each respective year. Considering the partnership’s growth in per-unit DCF, I believe the firm should be well-covered for distributions given their outlined roadmap.

Looking ahead, NextEra anticipates growing their EPS by 6-8% annually through 2026.

Valuation & Shareholder Value

NextEra distributes a robust dividend and distribution through NEE and NEP, respectively. The partnership, NEP, has increased their distribution by 6% (annualized) to $0.88/unit in q4’23 for an annualized rate of $3.52/unit. Management discerned that the firm will not need to execute an acquisition in 2024 to achieve their 6% distribution growth target and will not require growth equity until 2027. The table below presents my estimated forward dividend/distribution rates based on my growth estimates within management’s expected range.

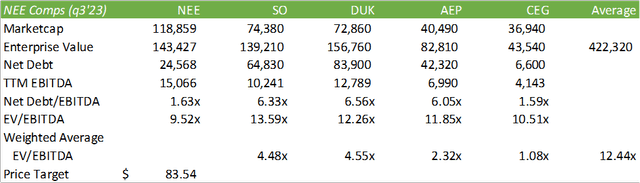

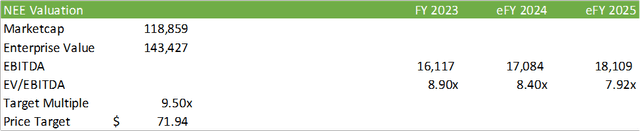

Looking at NEE shares first, the equity is valued significantly below its peer group at 9.52x EV/EBITDA at q3’23 for comparative purposes. FY23 EBITDA results in a valuation of 8.90x EBITDA.

Shares remediating to the average multiple would result in a value of $83.54/share, 44% higher than its current level. Applying their trailing q3’23 multiple of 9.5x to my forward EBITDA at 6% growth, shares can be valued at $71.94/share, a 24% upside risk to their current levels. I anticipate EBITDA to grow as NextEra builds out capacity and engages with new customers.

Though NEE may experience some downside pressure resulting from higher-for-longer interest rates, I believe when the rates markets loosens up, shares will respond with an upward trajectory. I recommend NEE shares with a BUY recommendation with a price target of $71.94/share.

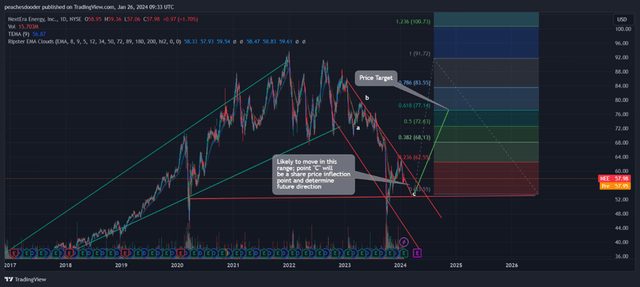

On a tactical basis, NEE shares are reaching an inflection point right around $52/53/share. Breaking through this floor may determine the future direction of the share price. If shares remain above this floor, NEE could go up to around $77/share based on Elliot Wave Theory. This also falls in the average price target between my two valuation tables above.

As for NEP, units currently trade at 3.89x its DCF. At the median 6% annual growth rate, we can value units at $34.14/unit. NEP pays out a robust distribution rate of 12%, making the LP an appealing holding. I provide NEP a BUY recommendation with a price target of $34.14/unit.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.