Summary:

- The Walt Disney Company is expected to announce financial results for Q1 of its 2024 fiscal year.

- The company is showing signs of recovery, with strong performance in various areas.

- Streaming operations, including Disney+, ESPN+, and Hulu, continue to grow and present significant growth opportunities.

RomoloTavani/iStock via Getty Images

On February 7th, after the market closes, the management team at The Walt Disney Company (NYSE:DIS), the world’s largest entertainment company, is expected to announce financial results covering the first quarter of the company’s 2024 fiscal year. For a couple of years now, the business has been undergoing a major transformation. The road has been rather rocky because of influences caused by the COVID-19 pandemic and unexpected weakness when it came to the streaming ambitions that the company initially thought would grow much more rapidly than it ultimately did.

Because of these troubles, shares of the company have been trading down for most of the last two years or so. In fact, in order to reach a point below the 52 week low that the stock has seen, you would need to go back over 10 years from today. The market has come to expect continued mediocrity from the company. But based on management’s rhetoric and recent financial performance, I believe that there’s a high probability that the firm will start showing some robust results very soon. Already, the company is demonstrating that a recovery is well underway. Add on top of this the high quality of this world class brand, and I do believe that the firm warrants a ‘strong buy’ rating at this time.

Keep an eye on headline news

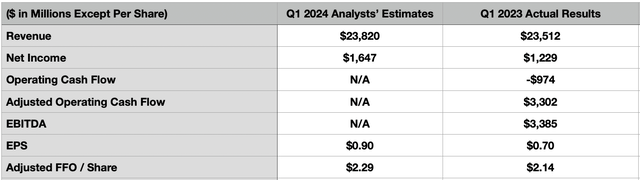

The very first thing that shareholders and market watchers of Disney should be paying attention to when management reports financial results for the first quarter of the 2024 fiscal year will be the headline news items that are common for market participants to zero in on. The first such example of this would be revenue. The current expectation set by analysts would be for sales of $23.82 billion. Although this is a large amount of money, it would represent only a modest increase of 1.3% over the $23.51 billion that management reported for the first quarter of the 2023 fiscal year.

In the subsequent sections of this article, I would dig a bit deeper into some of the key parts of the firm that I believe will perform exceptionally well. As you will see, year over year performance in many respects last year ended up being really strong compared to the year prior. I don’t see any reason to expect the overall trend of strong recovery to change. So although I don’t have anything concrete to base this on, I will say that I think this revenue estimate from analysts is on the low side of what the business is likely to report.

We also have the bottom line to consider. This is an area that I happen to agree with analysts on. The current expectation is for the company to report earnings per share of $0.90. That’s well above the $0.70 per share that the company reported for the same quarter one year earlier. If the company achieves this target, it would mean net profits rising from $1.23 billion in the first quarter of 2023 to $1.65 billion in the first quarter of 2024. There are, of course, other profitability metrics then investors should be paying attention to. These can be seen in the table above.

The most notable one that I would like to point to is operating cash flow. Late last year, management announced that they were proving to be very successful when it came to cost cutting initiatives. The original goal was to cut $5.5 billion in expenses over a window of time. That number, per that announcement, has now been pushed up to $7.5 billion. Management even went so far as to say that, from a free cash flow perspective, 2024 should reach pre pandemic levels. If this is true, consider that, adjusted for changes in working capital, operating cash flow totaled $11.63 billion in 2019 while free cash flow was $6.75 billion. Numbers in that range for this year seemed to be realistic. That assumes, of course, a capital expenditure budget of around $4.88 billion for the year.

Streaming is King

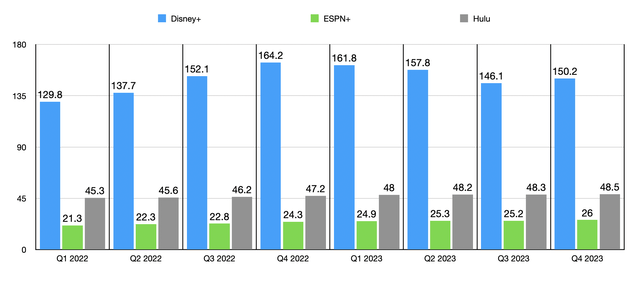

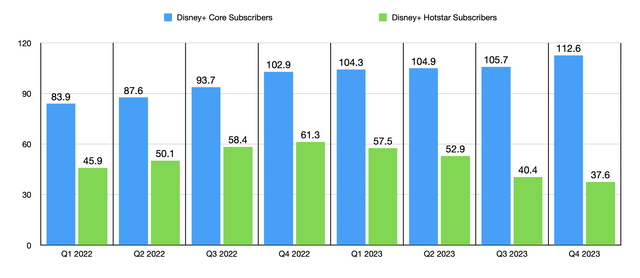

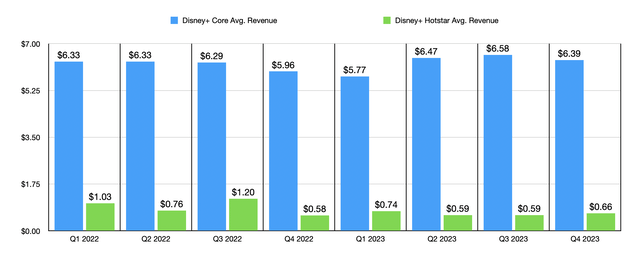

The greatest growth opportunity for Disney in recent years has been its streaming operations. This includes its ownership over Disney+, ESPN+, and Hulu. It’s difficult to tell what the upper end of the potential would be for any one of these services. But in all likelihood, none of them are done growing just yet. Take, as an example, Disney+. In the fourth quarter of the 2023 fiscal year, the company reported 150.2 million total Disney+ subscribers. Although this was down from the 164.2 million peak that the company had seen at the end of 2022, it represented the first sequential increase in subscribers since reporting 146.1 million in the third quarter.

What’s best about this is that all of the losses that the company has seen on this front have come from its low quality Hotstar platform, where the company brings in only an average of $0.66 per month in revenue from each subscriber. Every quarter, without exception, has seen continued growth outside of this. Core subscribers in the final quarter of 2023 totaled 112.6 million. That’s significantly higher than the 105.7 million reported in the third quarter and it was up from the 102.9 million that the company had as of the end of the 2022 fiscal year.

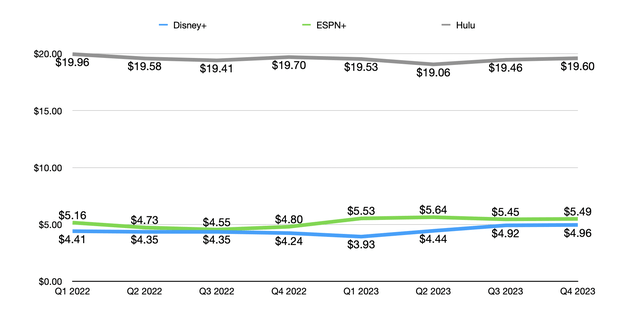

I fully expect Disney+ to continue growing. I also expect continued growth from its other streaming services as well. For context, ESPN+ had 26 million subscribers as of the end of 2023. That was about 800,000 higher than what the company had one quarter earlier. That translates to an extra $52.7 million per year in revenue for the company, with the rise in subscriber revenue per user inching up from $5.45 per month to $5.49 per month adding another $12.1 million in sales on an annualized basis. As you can see, even small changes in either subscriber count or revenue per subscriber can have a big impact on the company.

Author – SEC EDGAR Data Author – SEC EDGAR Data

That’s where we also have to talk about Hulu. As many individuals know, Disney is being required to buy the remaining 33% of Hulu it does not currently own. That is owned by Comcast (CMCSA) at the moment. The two companies are working to find a true fair value for that ownership stake. However, there is a guaranteed floor valuing the firm as a whole at $27.5 billion. That would mean $8.61 billion for Comcast as a guaranteed minimum. The fact of the matter is that Hulu is a fantastic service. It’s not growing rapidly, but it does bring in a lot of revenue. By the end of the 2023 fiscal year, it had 48.5 million subscribers. That was 200,000 more than what it had in the third quarter of last year. It also represented a respectable increase over the 47.2 million reported for the final quarter of 2022. I would be surprised if we don’t see another modest uptick in subscriber count from it.

Pandemic pain

There were a couple of parts of Disney that were severely impacted by the COVID-19 pandemic. At least one of these continues to feel the aftereffects to this day. That would be the theatrical distribution side of the company. The movie theater industry was absolutely decimated by the pandemic. Who knew that sitting in an enclosed room, with little to no ventilation, for two to three hours on end, with 40 strangers around you, all watching the same film, would prove unpopular during a nasty viral outbreak? But I digress.

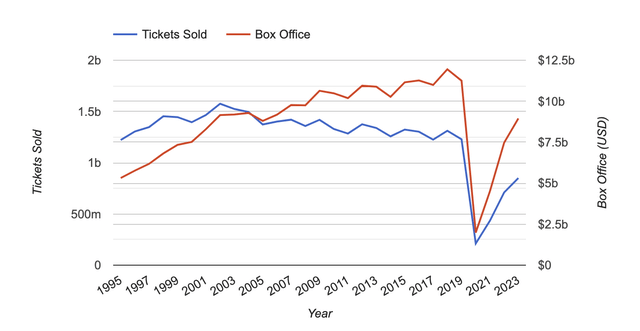

Focusing on just the domestic market for a moment, there were an estimated 1.23 billion tickets sold at movie theaters in 2019. This was actually lower than what it had been in prior years. Ever since peaking at 1.58 billion in 2002, the industry has been in a state of decline. However, overall box office revenue continued to grow because of higher average ticket prices. Unfortunately, in 2020, a little over 211 million tickets were sold nationwide. As the pandemic died down, the industry started to recover. But even in 2023, we saw only 851.7 million tickets sold. That’s still 30.7% lower than what was seen back in 2019. Even with average ticket selling prices climbing from $9.16 to $10.53, total domestic box office revenue of $8.97 billion was well below the $11.25 billion reported for 2019.

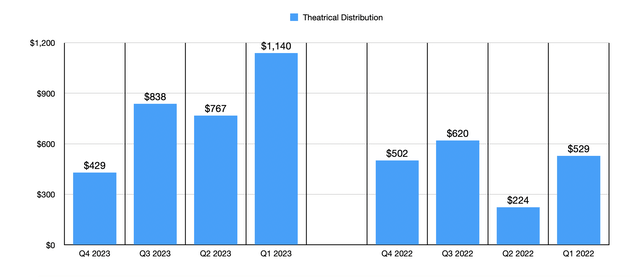

Those who are critics of Disney might point out, accurately so, that the company did not exactly have the best year in 2023. For the first time since 2016, another studio, in this case Universal, beat out Disney, capturing a 20.43% market share. Disney, by comparison, grabbed 16.11% of the market, placing it in second. To be fair, it took 42 movies released by Universal to achieve that feat. By comparison, Disney only had 12 releases for the year. Despite this lackluster showing, 2023 was a year of robust recovery on the theatrical distribution side of things. In the final quarter of the year, for instance, theatrical distribution revenue was $429 million. That was below the $502 million reported the same time of 2022, but for the year as a whole revenue jumped from $1.88 billion to $3.17 billion.

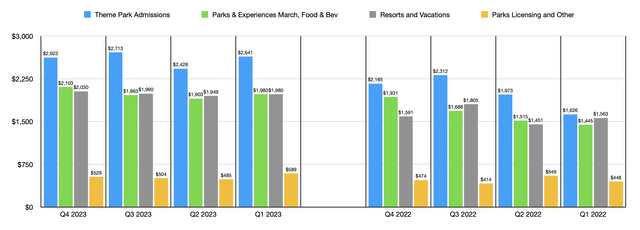

Though not hit as hard, the theme park operations of the company and other similar assets were negatively impacted. But the great news is that those who have been on the mend for some time. As you can see in the chart below, theme park admissions revenue for the company consistently outperformed, on a year over year basis, what was seen back in 2022. In fact, total revenue on that alone was $10.42 billion. That represents an increase of 21.2% over the $8.60 billion reported one year earlier. Increases, though not all seeing the same kind of increase, can be seen by looking at other aspects of the theme parks operations. This includes when it comes to parks and experiences merchandise, food, and beverages, as well as resorts and vacations. Parks licensing and other related revenue also continued to grow. In fact, as a whole, the theme parks operations of the company had their best year ever in 2023. And while economic uncertainty does exist right now, I do not see that trend changing in the near term.

Some odds and ends

There are some other things that investors should be paying attention to for when management reports their results. The most obvious would be what price the company will ultimately have to pay for Hulu. As I mentioned already, there is a floor of $8.61 billion. However, Hulu is likely to end up worth quite a bit more than the $27.5 billion minimum. How much the company has to pay could weigh on the market’s perception of the firm in its entirety. The good news is that the business does have plenty in the form of cash and cash equivalents. Certainly enough to cover the acquisition. But it’s not like the company wants to use all that cash for that objective. So more likely than not, some debt will be assumed to make the transaction possible.

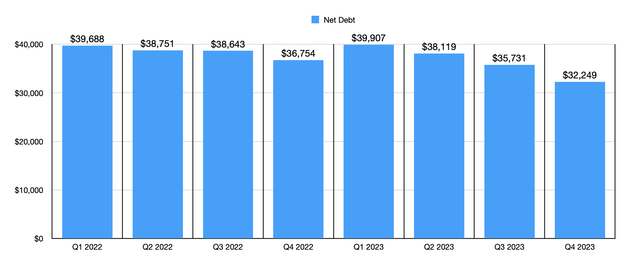

This does bring us to the topic of debt. Management has made a concerted effort over the past year or so to reduce debt. At the end of the first quarter of 2023, the firm had $39.91 billion in net debt. That number was slashed to $32.25 billion by the end of the 2023 fiscal year. Obviously, that number is going to increase once the Hulu acquisition is made, unless Disney can convince Hulu to take shares of the Disney to cover some of the cost. But seeing as how the minimum payment was already made, using cash, in early December of last year, I see this as unlikely.

It’s also possible that the company could make some other big announcements during its earnings release. Last year, it became apparent that the company was looking for strategic alternatives for some of its assets. In early September, I wrote an article discussing the pain that it was seeing when it came to its Linear Networks operations. The prospect of selling off some of its cable networks looks very real. There’s also the possibility of it selling some or all of ESPN and/or finding some partner, whether they would end up owning a piece or not, when it comes to ESPN+. Any of these could be major developments for the company that investors would be wise to pay attention to.

Takeaway

At this moment, I am very bullish on Disney. I think it is the only company that I would feel comfortable putting all of my money into if I knew that I were going into a 20 year coma tomorrow. Management has clearly made some impressive progress when it comes to financial performance. In 2023, EBITDA was 22.6% higher than it was in 2022. Adjusted operating cash flow, meanwhile, was 75.7% higher. I do expect continued growth this year, especially with streaming continuing to expand and theme parks set to report what could be another record year. And when you add into this the aforementioned cost cutting that the company has achieved, I think that we are looking at the start of a blockbuster year for the firm.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!