Summary:

- 3M Company investors suffered a steep post-earnings selloff, falling over 16% from its January 2024 highs.

- The company has made progress in resolving its legal challenges but could still be liable for about $9 billion in remaining legal liabilities.

- Despite a less rosy forward outlook, the stock is undervalued and presents a potential mean-reversion opportunity for patient investors.

- I argue why the worst in MMM is likely over, as the recent selloff could be supported above the $90 level.

- With an attractive forward dividend yield of 6.4%, and more robust price action, don’t overcomplicate 3M’s recovery thesis from its multi-year lows.

jetcityimage

In my pre-earnings update, I turned bullish on 3M Company (NYSE:MMM), as I articulated that the worst is likely over. As a result, I anticipated that the market has priced in significant challenges over 3M Company’s legal challenges at its October 2023 lows. That thesis worked out until MMM topped out in early January 2024. Accordingly, MMM investors seemed to have started to cut exposure three weeks before its fourth-quarter earnings release, as management provided forward guidance below analysts’ estimates.

Am I surprised with the steep selloff, as MMM fell more than 16% from its early January highs through its lows this week? If we consider MMM posted a 5Y and 10Y total return of 0.2% and -9.7%, respectively, we shouldn’t be stunned by the pullback. Accordingly, MMM gained over 30% from its October 2023 lows through its January 2024 highs. Hence, a steep pullback to allow profit-taking is welcomed, helping to shake out recent buyers. The critical question is whether MMM holders awaiting a pullback should pull the buy trigger now?

3M Company has made progress over its legal woes on the PFAS chemicals and combat arms earplugs. Accordingly, the company telegraphed that it has “significant backing from the claimants and broader military community” on the combat earplugs claims. 3M indicated that the parties have moved forward to try to reach a settlement agreement, helping to mitigate the uncertainties. However, 3M hasn’t been assessed to “completely ringfenced its legal exposure.” Consequently, on average, 3M could still be liable for about $9B in remaining legal liabilities.

However, I believe credit must still be attributed to 3M management’s recent execution as it outperformed its outlook on its FY23 adjusted EPS. Recall that 3M posted an adjusted EPS of $9.24, “surpassing the upper limit of the guidance.” In addition, 3M demonstrated its robust free cash flow prowess, achieving a 123% conversion, well above its guidance. Since the market is forward-looking, I assessed it justifies MMM’s October 2023 lows as investors priced in peak pessimism. Therefore, investors shouldn’t determine MMM’s selloff based on the company’s Q4 operating performance (backward-looking information).

Accordingly, 3M Company’s FY24 adjusted EPS guidance of $9.55 (midpoint) is well below analysts’ estimates of $9.9. Therefore, it makes sense for the market to price in 3M’s less rosy forward outlook. Despite that, Bank of America (BAC) analysts suggested that management’s guidance could be “conservative, acknowledging macroeconomic uncertainties.” In addition, it also implies that 3M’s FY23 adjusted EPS of $9.24 could have marked its long-term bottom unless we anticipate significantly higher legal woes that could hurt its near-term earnings profile. Furthermore, the company has not decided whether to issue a $1B equity option, which could affect its outstanding share count. However, if I anticipate MMM to have bottomed out in 2023, I don’t expect a significant impact on its current market cap of $53B. Despite that, the uncertainties surrounding MMM’s legal liabilities, as highlighted earlier, could have a material impact. Consequently, I believe it makes sense to expect MMM to be materially undervalued until these issues are resolved accordingly.

Seeking Alpha Quant assigned MMM an “A-” valuation grade, suggesting highly attractive value relative to its industrials sector (XLI) peers. Its forward EBITDA multiple of 7.2x remains well below its 10Y average of 12x. It’s also significantly below its industrial conglomerates’ peers’ median of 10.1x (according to S&P Cap IQ data), corroborating my observation. In other words, while MMM could remain materially undervalued, patient investors who are willing to out the legal challenges could benefit from a potentially attractive mean-reversion opportunity. Coupled with a robust forward dividend yield of 6.4% and supported by a “B” dividend safety grade, I also expect solid support from income investors.

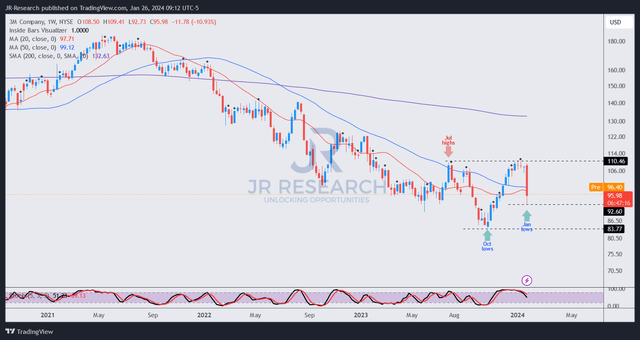

MMM price chart (weekly, medium-term) (TradingView)

MMM bottomed out in October 2023, preceding a remarkable surge toward its July 2023 highs ($110 level). It topped out a few weeks before its Q4 release, with 3M’s weaker-than-expected guidance fueling the steep pullback.

However, the market quickly priced in lowered expectations, as dip-buyers could have returned to defend at the $90 level. As long as MMM’s $90 level holds decisively, it marks a pivotal price action development, forming a higher-low price structure.

As a result, it should help set the stage for MMM’s ongoing recovery as it attempts to regain upward momentum from its multi-year lows. I view the steep selloff constructively, affording patient investors another opportunity to add exposure, notwithstanding the legal woes, which have likely been priced in.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!