Summary:

- AT&T had a strong 2023, with growth in its core businesses of 5G and fiber, adding subscribers and increasing revenues.

- The company’s financial earnings showed growth in cash flow and the ability to pay down debt, leading to substantial long-term shareholder returns.

- AT&T’s 2024 guidance shows a continued commitment to driving shareholder returns, with expected increases in wireless and broadband revenues.

jetcityimage

AT&T (NYSE:T) is one of the largest telecom companies in the world. The company has a market capitalization of more than $100 billion, a post-yield cut dividend of more than 6%, and strong cash flow. As we’ll see throughout this article, the company’s impressive asset portfolio and continued commitment to steady returns make it a healthy dividend investment.

AT&T 2023 Accomplishments

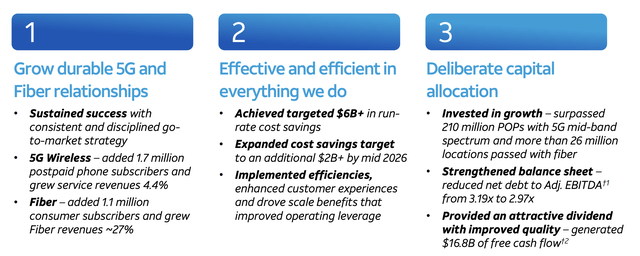

The company has had a strong 2023, showing its financial strength.

The company’s core businesses are 5G and fiber. The company managed to add 1.7 million postpaid phone subscribers, enabling it to grow service revenues by 4.4%. 5G cost cellular companies many $10s of billions, so they need to drive some results here, and generate strong and growing cash flow. Steady growth in a competitive business is key here.

In Fiber, the company’s performance was much more exciting, as it focuses on rapidly growing this business and taking over cable companies stuck in the past. The company managed to grow revenues 27% and added a massive 1.1 million subscribers. The company is continuing to generate strong cost savings and is working to expand them.

The company is continuing to aggressively spend capital and, with net debt to adjusted EBITDA down to 2.97x, it can continue to invest. The company has surpassed 210 million people with 5G spectrum, and more than 26 million locations with fiber.

AT&T 4Q 2023 Segment Results

The company’s individual segments have remained strong, as discussed above.

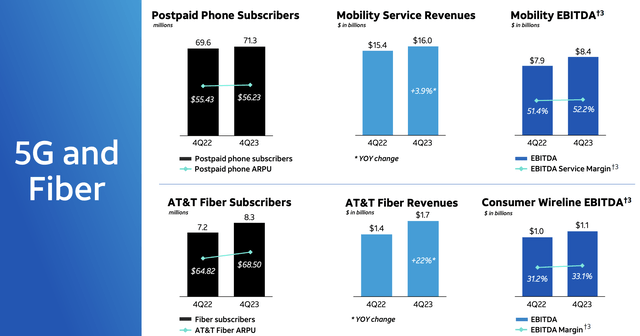

The company’s postpaid phone subscribers have seen ARPU increase slightly, with 71.3 million subscribers. That’s led to improved margins for the company and some of the strongest mobile service revenues and mobility EBITDA growth for a while for the company. That’s translated to success on the company’s bottom line.

One of the company’s largest capital investments and sources of its strength is its fiber business. The company’s ARPU increased by almost 10% and subscriber counts increased dramatically. Fiber revenues grew an astounding 22% supporting higher margins.

We’ve discussed this business before, but the company is both increasing market penetration and increasing its addressable market. It’s hit almost 10% of the U.S. population. Growth here could lead to a revenue earning business almost as big as the company’s mobility services business.

AT&T Earnings

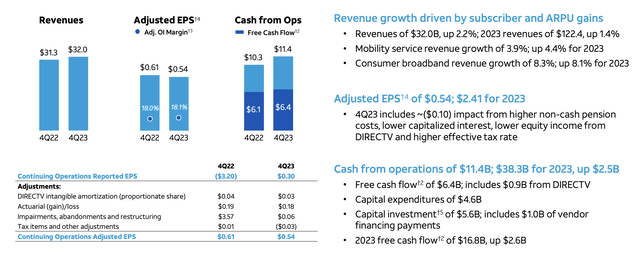

The company’s financial earnings at the end of the day shows how it deploys cash.

The company’s EPS dropped on paper, but its cash flow from operations managed to grow by double-digits. The company managed to grow FCF by 5% and that’s despite capital expenditures annualized at $18 billion, which is fairly close to where they’ll be over the long run. The company managed to earn almost $17 billion in FCF for 2023.

The company has net debt of just under $129 billion, with $137 billion in total debt. The company has already been impacted by rising interest rates. However, its dividend uses less than $8 billion annualized and its FCF is more than double that. The company can pay down its debt quickly, enabling it to generate more substantial long-term shareholder returns.

Shareholder Return Path

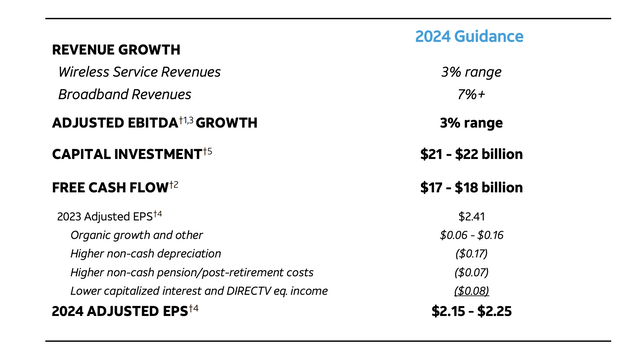

The company’s 2024 guidance shows a continued commitment to driving shareholder returns.

The company expects wireless revenue to increase by 3% and broadband revenues to increase by 7+%. The company expects adjusted EBITDA at the end of the day to increase by 3%. Capital investment will remain hefty at $21.5 billion, but FCF is expected to be $17.5 billion. The company expects EPS to drop slightly because of depreciation and other expenses.

The company has a market cap of $123 billion, a 13% FCF yield, and it can continue paying down debt to improve the conversion of EBITDA to FCF. Subtracting dividends, it has roughly $10 billion in FCF left. Each year it uses that to pay down debt, it saves ~$600 million in interest going forward. That enables returns to increase even further.

Thesis Risk

AT&T’s largest risk is the patience of investors along with its management. The company has a long history of generating shareholder returns, but it was still forced to do a partial dividend cut. Investors eventually need to re-evaluate the company, and it won’t happen until management shows continued improvement.

Conclusion

AT&T is a big company that’s accumulated more than $100 billion worth of debt. The company made a number of bad decisions along the way, however, there’s also some gems in its portfolio such as its fiber investment (where it has no real long-term competition). The company’s revenue is increasing rapidly here, which is helping margins and potential earnings.

Putting all of this together, the company has a path to generate strong shareholder returns. The company can continue to aggressively pay down debt as it has been doing, paying it off as it comes due. Those saved interest expenses will help long-term cash flow, and enable it to avoid higher rates. After all that, the company can utilize its cash flow for other returns, making it a valuable investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.