Summary:

- Critics ask why buy Altria for its yield when the stock gives it all away to price depreciation.

- The answer is Altria has been hit by an adverse macro environment in 2023 which is about to reverse. This could see Altria turning around and again appreciate.

- I’ve identified a total of 7 drivers of long-term growth, which I believe will serve to prove critics wrong in the long run.

FotografiaBasica

Altria Group, Inc. (NYSE:MO) attracts a lot of interest for its high dividend yield. Many investors – including users here on Seeking Alpha – who don’t already hold it seem at least interested in holding the stock for the yield.

But skeptics have been increasingly asking one question in particular: Why hold a stock for its ~9% yield only to give it away as the share price declines at the same rate?

Certainly, over the past year, this has been precisely what happened.

Investors who bought a year ago will have given their dividend away to price depreciation:

I think the price drop was caused primarily by rising interest rates. As I will discuss further in this analysis, rising interest rates have hurt not just Altria but dividend stocks in general.

In spite of interest rates having risen, now seems a good time to get in and potentially ride the stock up as interest rate conditions appear on the verge of reverting to the mean.

In the following, I’ll explain why I think Altria has at least 7 avenues to grow and reward shareholders. Most of these have to do with the operations of the company and actions taken by management – but the first is the impending rate declines that could help the stock make back what it lost as interest rates were hiked.

The market doesn’t seem to appreciate this: At a forward P/E of ~8.1 and an EV/R ratio of ~4.6, the market isn’t pricing in any growth but rather seems to extrapolate the current unfavorable interest rate environment endlessly into the future. I think that negativity will eventually be proven wrong.

The combination of a low price and several drivers of growth makes for a good investment case: I’m issuing a “Buy” rating for Altria.

Growth driver #1: The expected decline in interest rates

In 2023, interest rates started rising sharply in response to widespread inflation. Rates had in fact gone up for a short while before that but were still historically low.

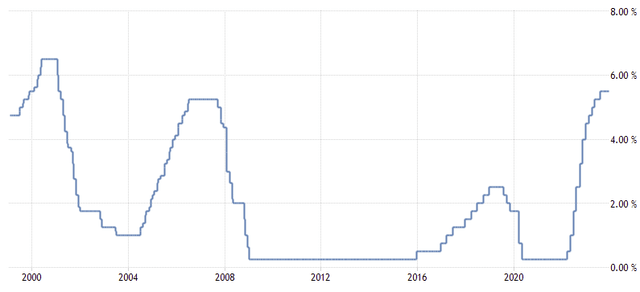

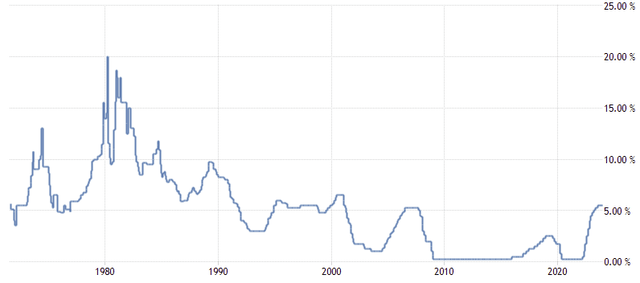

The Federal Funds rate – which effectively determines the cost of money and thereby yields on fixed-income investments – has been kept steady for the third consecutive Fed meeting in December 2023, but is at a very high level in a 25-year context:

Although current interest rates seem high, they are nowhere near rates seen in the 1970s and 1980s when inflation was even worse than what we’ve seen recently:

But current rates are high enough that fixed-income investments became popular again in 2023. This saw an outflow of money from equities into fixed-income. This hurt one class of equities in particular: Dividend stocks.

The reason for this is simple: When interest rates were at an all-time low in the wake of the pandemic, the opposite trend had taken place: Money had flown out of fixed-income which yielded record low returns and into what investors considered proxies of fixed-income: High-yield stocks.

This explains why a stock like Altria did really well in 2021 in spite of revenues having increased only marginally over 2020 with net income even sharply decreasing year-over-year 2021/2020. The stock beat the market by a long distance because it provided a great yield coupled with a sense of capital preservation – something investors just couldn’t get in fixed-income securities at the time.

When interest rates are high, dividend stocks are less attractive. Why run the risk associated with equities when you can get a similar yield guaranteed by contract from a bond? That’s the kind of thinking that enters the market when rates are high enough that you can take no chance with your money and still get decent returns in fixed-income.

Rates are high enough now that pressure is on for the Fed to deliver “a soft landing”, that is to say not rise rates anymore so as to avoid a recession.

As long as the Fed can accomplish its main mission – keeping inflation low – interest rates are unlikely to rise any further.

Recently, it was revealed that Fed officials even expected to cut rates in 2024. According to charting signals, it is expected that rates will fall by 75 basis points in 2024 alone, from 5.4% in 2023 to 4.6% by the end of the year. It’s further expected that we’ll see further rate cuts in 2025.

Why is this important considering Altria for investment? Because if rates come down to near historic lows again, fixed-income will lie “dead in the water” once again. This is going to reinstate the 2021 phenomena of using high-yield stocks as proxies for high-yield bonds.

That’s good if you buy Altria at the kind of price point currently available – one that is heavily influenced by last year’s rate hikes.

There are no guarantees that rates will come down – or stay down. But if you’re willing to run that risk, rates coming down could be the #1 driver that actually sees Altria’s share price appreciate again.

Growth driver #2: Costs are coming down in spite of revenues going up

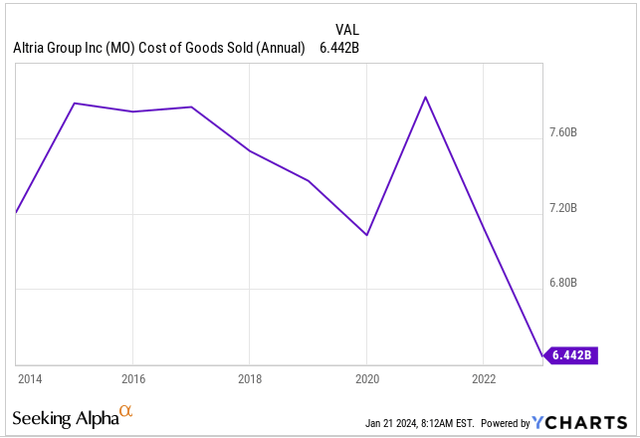

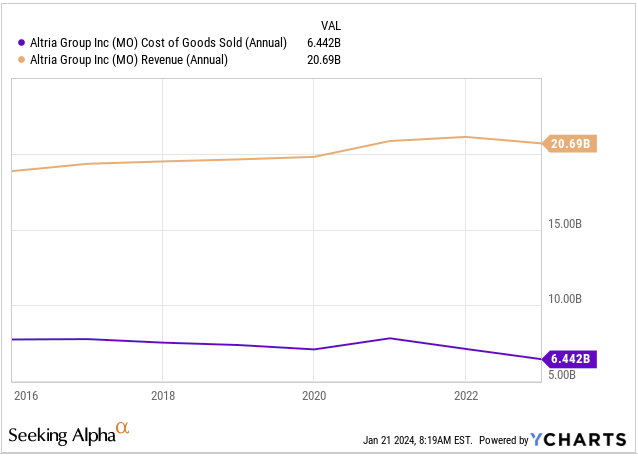

This one I think is often forgotten: Altria sells fewer cigarettes and that hurts sales; but it benefits production costs, because as volumes come down so do the costs of actually making cigarettes. That’s the positive side of lower volumes.

One well-known fact about tobacco and Altria’s business is that demand for cigarettes and other legacy products is coming down as regulation tightens.

Declining demand puts a downward pressure on revenues (this is then partially offset by price increases). But declining demand also has the positive side-effect of lowering Altria’s cost of revenues (direct costs associated with making their products), which has been downtrending in the past decade:

As long as Altria can keep decreasing costs because of lower volumes – while offsetting the downward pressure on revenues from such lower demand by increasing prices – Altria will actually grow its margins or at least remain a very profitable business.

It’s an example of financial engineering working in favor of shareholders. Just check out the graph below – rarely do you see the combination of uptrending revenues made with downtrending costs:

YCharts

It’s worth noting that this is a long-term trend. Not something that just started occurring or has been impacted by other events such as inflation or the rate environment.

This makes the combination of increasing revenue and decreasing costs of revenue my #2 long-term driver of growth for Altria.

Growth driver #3: Share buybacks

Altria’s shareholders are income-oriented. That means many shareholders would probably prefer a higher dividend to share buybacks.

But buybacks are better for long-term investors than dividends. So if you’re in it for the long run with Altria, you should appreciate at least some buybacks.

The reason for this is that buybacks are more tax efficient than dividends. Aside from a small excise tax paid by the company when it buys back shares, buybacks are tax-free for shareholders who don’t sell. On a per-share basis, revenues and earnings increase as shares are bought back.

Buybacks work to help the dividend grow in the long run, too. As the share count comes down, so does the total amount of dividends paid by the company (not on a per-share basis, but in total numbers). That’s good because it then frees up cash to increase the dividend.

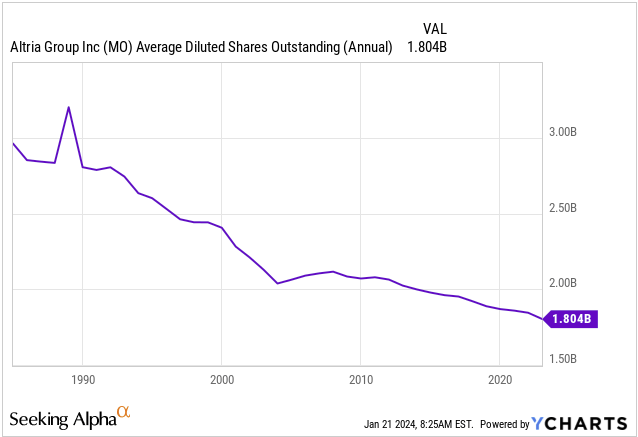

Think of it this way: In 1980, Altria had about 3 billion shares outstanding. The dividend per share is currently $3.92. If Altria still had 3 billion shares outstanding, total dividends would add up to ~$11.8 billion a year. This is more than Altria’s current free cash flow of ~$8.5 billion and would constitute a payout ratio measured against cash free flow instead of earnings of ~139%.

YCharts

A payout ratio of almost 140% is clearly unsustainable, so the dividend would have been lower now had the company not bought back shares. Management knows this, and clearly sees buybacks as a way to reward shareholders who are in it for the long haul.

Altria still has an active share repurchase program. That makes it my #3 driver for long-term growth.

Growth driver #4: The ABI asset

Altria holds a ~10% stake in Belgian brewer giant AB InBev (BUD). That stake is worth ~$12.3 billion.

I did an in-depth analysis on Altria’s ownership of the asset back in May 2023 and as I said then, owning a minority stake in an unrelated business doesn’t seem the most worthwhile investment.

I expect the asset to eventually be sold, not least because Altria used to also own a winery (another unrelated business) which was eventually sold a couple of years ago. The question to me is when the ABI stake is sold.

Suppose the ABI asset doubles in value with time. In that case, it’s worth ~$25 billion or an entire 35% of Altria’s current market cap.

This wouldn’t even be particularly remarkable. It would just require ABI to trade at a price similar to what it did as recently as October 2016.

Altria’s management has repeatedly said it intends to keep the ABI asset for now. I suppose management doesn’t want to sell at ABI’s current price, which is understandable in that it is far lower than its peak.

We’ll have to see what happens – and while we wait, ABI pays a dividend to Altria which could be considered “waiting money” until the price one day might be attractive enough to sell.

Altria holding the ABI asset – which could one day turn into either a special dividend, a major stock buyback, or something else of value to shareholders – is my #4 driver of long-term growth for Altria.

Growth driver #5: The cannabis asset

This one I call the “lottery ticket”: Altria holds a ~45% stake in Canadian cannabis company Cronos Group Inc. (CRON). The stake is worth ~$340 million at current market prices.

This pales in comparison to the ABI asset. But the Cronos stake is different to the ABI asset. At least you can argue that owning a cannabis company is related to operating a tobacco company. What’s more, the cannabis industry is developing and evolving.

I think you can make the argument that Altria got in too early: Altria bought the stake in Cronos for $1.8 billion in 2019. This was at a time when cannabis stocks were hyped. Altria recently made the decision not to make use of warrants that it had obtained in connection with the acquisition of the Cronos stake.

Recently, the regulatory environment for cannabis companies appears to be improving. This comes in the wake of news that the US Department of Health and Human Services (along several state attorneys general) urged the US Drug Enforcement Administration (DEA) to reclassify marijuana as a less dangerous substance. If the recommendation is approved, it could pave the way for increased sales and thereby actually unfold what potential commercial cannabis is deemed by some to hold.

This in turn could see Altria’s investment in cannabis turn around and actually start paying off. It’s a long way, though. At current levels, even a substantial appreciation in the value of the cannabis asset won’t matter much in the greater picture.

But the chance is there – and some commentators remain bullish on the cannabis sector. This makes it my #5 driver of growth for Altria.

Growth driver #6: Sustainably high prices in spite of inflation

One well-known tactic of tobacco firms is to increase prices on their products as demand lowers. Generally, tobacco firms have been able to grow revenues in spite of the secular decline in demand.

In doing so, tobacco firms exploit what is called price elasticity – a measurement of what happens to demand when prices are increased. This is not to say that tobacco products are perfectly inelastic. Demand does respond negatively to higher prices. But if the increase in price is greater than the drop in demand following from that price hike, the company still makes more money – and this additional money will then cover the loss from downtrending demand. It’s about hitting the “sweet spot” between hiking prices and coping with the negative impact it has on demand. Or at least that’s been the “game” played by tobacco firms for several decades.

I expect Altria to keep benefiting from this tactic for several years to come. In fact, it was recently reported that cigarette prices were up 8.0% year-over-year and have tracked slightly higher in four straight months even as prices for many consumer staples categories have not increased as much or have even declined.

This makes it my #6 growth driver.

Growth driver #7: The alternatives portfolio

This is the most strategically important but also the most well-known: Altria is making an effort much identical to that of other tobacco firms in trying to transition from legacy tobacco to alternative products.

This development has been going on for years and is expected to continue at an increased pace. The reasons for wanting to transition are evident: The number of smokers has declined for several decades, and the regulatory pressures on tobacco firms are mounting.

I’ve noticed a tendency in the investment community to label Altria somewhat of a laggard in transitioning. I would rather call them unfortunate. Altria did make a giant splash into transitioning with the acquisition of JUUL Labs. This didn’t work out well, to put it mildly.

A lot has been said of the JUUL acquisition here on Seeking Alpha, so I won’t bother you with more details on that deal. In fact, it’s behind Altria now: The stake in JUUL was exchanged in March 2023 for exclusive rights to certain of JUUL’s heated tobacco intellectual property, and Altria has been looking elsewhere for ways to diversify.

The most recent step was buying NJOY. This gives Altria a strong footprint in the e-vapor category. When Altria last reported earnings it provided an update to its ownership of this business, and a few points I think are worth noting:

- Altria expects volume increase and expects to be able to execute growth without capacity constraints.

- Distribution of ACE (NJOY’s device) is expanding and Altria is expected to reach a total of 70,000 stores by the end of 2023. When Altria entered into a definitive agreement to buy NJOY, Altria said the ACE device was only available in 33,000 stores, underpinning the significant growth potential that Altria has seen in “buying the technology” from NJOY and expanding it through Altria’s vast distribution network.

- This would represent approximately 70% of e-vapor volume in the US.

It’s clear that with these efforts, and with NJOY holding the only pod based e-vapor product approved by the FDA in the US, NJOY takes center stage in Altria’s transition efforts.

But Altria has other efforts in this direction, too. These include:

- A 75% stake in Horizon Innovations LLC, a joint venture with Japan Tobacco (OTCPK:JAPAF). Horizon is responsible for Altria’s efforts into heated tobacco, one component of Altria’s alternatives portfolio.

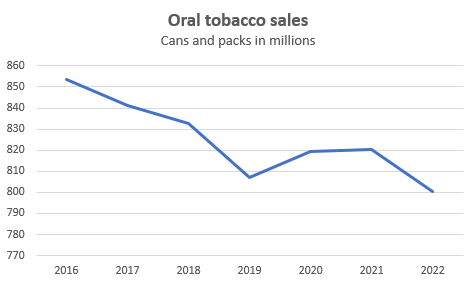

- Altria’s nicotine pouch brand (oral tobacco): on! This brand is produced by Altria’s subsidiary, Helix Innovations. According to Altria’s most recent 10-Q filing, this brand grew significantly throughout the third quarter of 2023 to 32.3% of the US oral tobacco category, an increase of 9.8 share points versus the third quarter of 2022.

- Copenhagen, another oral tobacco brand owned by Altria through U.S. Smokeless Tobacco. This brand showed slightly declining market share in 2023 compared to 2022 as it achieved an oral tobacco category share of 23.1%, a decrease of 3.7 share points measured against the third quarter of 2022.

- Skoal, a brand by U.S. Smokeless Tobacco also in the smokeless tobacco segment.

- Exclusive U.S. commercialization rights to the IQOS tobacco heating system and Marlboro HeatSticks obtained in an agreement with Philip Morris International (PM).

In total, Altria’s alternatives portfolio delivered just 10% of Altria’s total revenues for fiscal year 2022 (the most recent full year reported). That’s a long way to match or surpass the revenue delivered by the legacy products, most notably Marlboro cigarettes. But it’s Altria’s best shot at transitioning its business long term. The trend of sales for Altria’s oral tobacco products (Skoal, Copenhagen, and on!) is under pressure, underpinning how Altria relies on the more recent acquisitions in its alternatives portfolio (NJOY, exclusive commercialization rights to IQOS, rights obtained from JUUL) to eventually deliver the growth.

Altria 10-K filings

We don’t have full-year sales figures for NJOY and the other recent acquisitions (rights to IQOS, rights obtained from JUUL) to show if these efforts are working sufficiently to infuse growth, but this is of course key to monitor going forward. This makes it my #7 growth driver.

Valuation benchmarking

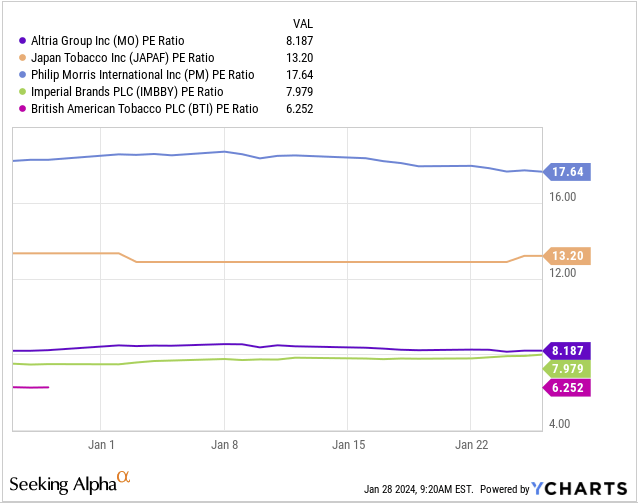

I touched upon Altria’s valuation initially in this analysis. In my opinion, at a forward P/E of just above 8, the stock is not priced to grow.

On a P/E basis, Altria also appears relatively cheap as it trades at a similar P/E to the cheapest issues in the tobacco industry:

YCharts

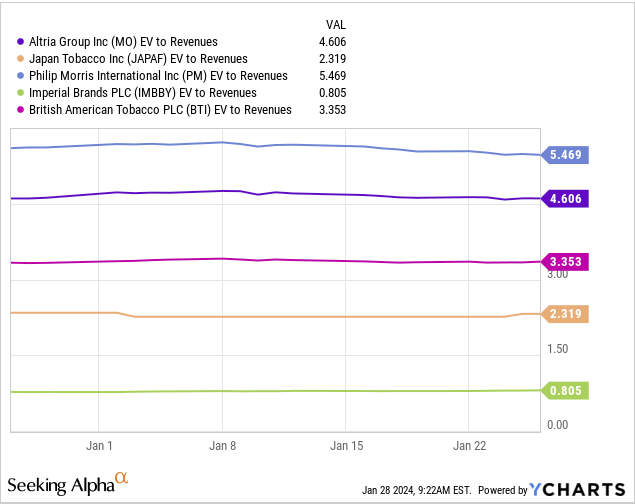

If we turn to an alternative valuation metric – the enterprise value to revenue ratio (EV/R) – the picture changes somewhat. The EV/R ratio measures what a buyer for control would have to pay to buy all equity and bonds at market – thereby assuming control of all assets free of creditor and shareholder claims.

Altria is relatively more expensive on an EV/R basis – but still cheaper than the largest of the tobacco firms, Philip Morris – at an EV/R of ~4.6:

YCharts

Perhaps the relatively higher EV/R ratio explains some of the downward pressure on the P/E. After all, a higher earnings multiple would mean a higher EV/R ratio (all else equal), thereby approaching the highest EV/R ratio among Altria’s peers.

But if Altria is able to get their growth drivers really going for them – including most notably the transitioning to alternatives – I think it would be fair to ascribe a higher P/E and EV/R ratio to Altria, perhaps one approaching that of Philip Morris which has been leading the charge in transitioning to alternatives.

Another way of looking at it is to simply value the stock based on the dividend. One model to carry this out is the H Model which operates with 1) an initial “high dividend growth” stage and 2) a subsequent “perpetual dividend growth rate”. Altria has guided to mid-single digit dividend growth in the coming few years. If we add in buybacks (which is essentially also a dividend that just isn’t paid in cash), I think it’s fair to assume that dividends/cash distributions will grow at a rate around 5% in the coming decade. Assuming a perpetual growth rate after that of 2% discounted at a rate of 9% (which is about in line with the general stock market returns historically), the stock has an H Model value of a little over $65. Trading at about $40, the stock appears undervalued.

Risks

Several risks could hurt Altria in the long run even if management does the best it can. Some are obvious: There are fewer and fewer smokers of legacy products in the US, tobacco regulations are tight and the litigation environment is tough.

Aside from these macro risks, I’d like to highlight a couple more risk that are more concrete and have recently attracted attention:

- The potential menthol cigarette ban and calls for banning flavored e-cigarettes.

- A potential write-down like the one British American Tobacco (BTI) recently did.

A ban on menthol cigarettes has been in the making for more than a decade. A push by the Biden administration to ban the type of cigarette was recently delayed, and it’s uncertain at this point if it will eventually pass. The state of California has already enacted a ban on flavored tobacco. Not long ago, Altria took steps in defending itself against such actions by pointing to a study showing that with such bans in place, illicit markets rise instead. Its subsidiary, NJOY, has also taken legal action against illicit disposable vapor manufacturers.

Further to this, the WHO recently called for a ban of flavored e-cigarettes because of the rise in popularity of such products.

A ban on menthol cigarettes would hurt Altria’s legacy business – and a ban of flavored e-cigarettes would hurt its transitioning efforts. To anyone considering or holding Altria, following these developments is key to managing the risk of the investment.

The other risk I pointed to is one of accounting rather than operations. British American Tobacco recently took a £25 billion impairment charge, mainly relating to brands it had acquired in 2017. The impairment came as management reassessed life expectancy of those legacy brands from an implied indefinite period to a period of 30 years. This of course is a signal to investors in tobacco: Time is running out for legacy brands. On the day British American Tobacco announced the impairment, the stock fell sharply.

This of course has left investors wondering if the same could happen to Altria. An analyst on Seeking Alpha recently discussed whether Altria would potentially take a similar impairment charge and concluded they wouldn’t. I agree with the analysis there that most of Altria’s intangible assets relate to the alternatives portfolio, e.g., goodwill relating to acquisitions made in this field, and not actually the legacy (cigarette) business. With hardly any intangibles relating to the cigarette business, there’s really nothing to write-off through an impairment charge. So while important to consider, I don’t see this risk having a material impact on Altria. This would change of course if the prospects of Altria’s alternatives portfolio suddenly change – there’s a lot to be written off there if bad things happen, just like we saw with the JUUL Labs stake where Altria did previously take a substantial “accounting loss”.

Key takeaways

Altria is famous for its dividend. But in the past year, the stock price has declined by about the same rate as the dividend.

I believe this development is attributable to the adverse interest rate environment. High yields on fixed-income make high yields on equities less attractive.

With the Fed expected to start cutting rates, this is about to reverse. If rates come down, “proxies” for high-yield fixed-income will become attractive again.

Further to this macro driver of potential multiple expansion, Altria’s business has several drivers of growth. These include its ability to lower costs, keep prices high on its products, buy back shares, its investments in ABI and cannabis, and its strategically important alternatives portfolio.

With several growth drivers in place, a P/E of ~8 seems too low as no growth is priced in.

With the combination of a low price and several drivers for growth, I’m rating Altria a “Buy”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.