Summary:

- UnitedHealth Group stock was struck by fears over its health insurance business, attributed to the recent Humana steep earnings outlook downgrade.

- However, UnitedHealth’s integrated healthcare model helps mitigate the impact of any one segment, improving its resilience.

- Management believes recent uncertainties in the health insurance industry will not have a lasting effect on the company’s outlook.

- I explain why UNH is no longer overvalued, with its recent price action suggesting capitulation has likely occurred.

- I highlight why I’ve decided to turn bullish on UNH, urging investors to capitalize on its recent downside volatility to add more exposure.

Compassionate Eye Foundation/David Oxberry/OJO Images Ltd

UnitedHealth Group (NYSE:UNH) investors have underperformed the S&P 500 (SP500) over the past year, as UNH delivered a 1Y total return of 3.7%. However, it’s still much more impressive than Humana’s (HUM) -27% 1Y total return, as the company suffered a blowout following its recent earnings release, as management offered a significantly lowered 2024 guidance.

Accordingly, UNH wasn’t immune, falling nearly 14% from its late November 2023 highs through its lows last week. As a result, I believe my caution has panned out, as UNH underperformed the market significantly. However, it’s also critical to note that UnitedHealth operates an integrated healthcare model, spanning health insurance, healthcare services, analytics, and a pharmacy benefit manager or PBM. As a result, it helps mitigate the impact from any segment, although UnitedHealthcare is expected to remain a key revenue base driver.

Notwithstanding the recent concerns over the uncertainties emanating from increased utilization in health insurance leading to a higher medical loss ratio, management believes the trends aren’t expected to persist. Accordingly, UnitedHealth highlighted in its Q4 earnings conference that the “recent seasonal activities are not expected to durably affect the outlook for 2024.” Moreover, the company indicated that while utilization increased, affecting its loss ratio, management underscored that “they are positive for healthcare.”

As a result, I believe that it underpins my observation that UnitedHealth’s well-integrated business model is robust enough to mitigate the impact of its health insurance segment, unlike some of its less diversified peers. Moreover, UnitedHealth maintained its confidence in guiding its FY24 loss ratio to “84%, plus or minus 50 basis points,” which doesn’t imply a structural impact. Furthermore, it’s a marked decline from the 85% metric in Q4’23, which exceeded analysts’ estimates “of a lower MLR of 84.1%.”

Consequently, could the recent uncertainty leading to a pullback in UNH over the past week have been overstated? Why? Because UNH is no longer overvalued.

Accordingly, analysts’ estimates align with management’s expectations of its higher-growth Optum-linked businesses in driving growth in the near- and medium-term. Accordingly, Optum Health delivered 34% revenue growth in FY23, while Optum Insight gained 30%. In addition, Optum Rx (UNH’s PBM) posted a 16% topline gain, as these three units outperformed the corporate average growth of 14.6% in 2023. Despite that, the company would likely need to navigate near-term challenges in its health insurance business since it’s expected to be an industry-wide issue. However, its well-diversified business model should help bolster its ability to meet analysts’ estimates over the next two to three years.

Wall Street has penciled in double-digit adjusted EPS growth through FY26. Accordingly, UnitedHealth is projected to deliver an adjusted EPS CAGR of 11.8% from FY23-26. As a result, the growth normalization phase could bottom out in FY24 before potentially inflecting higher. Moreover, UNH’s adjusted EPS multiple has fallen to 18.2x, slightly below its 10Y average of 18.5x. It’s still valued at a marked premium to its healthcare sector (XLV) peers (“D-” valuation grade) and its industry peers’ median (forward adjusted EPS multiple: 13x). However, UNH’s high-quality and resilient earnings growth profile and solid profitability (“A+” profitability grade) suggest that it could weather these near-term challenges resiliently.

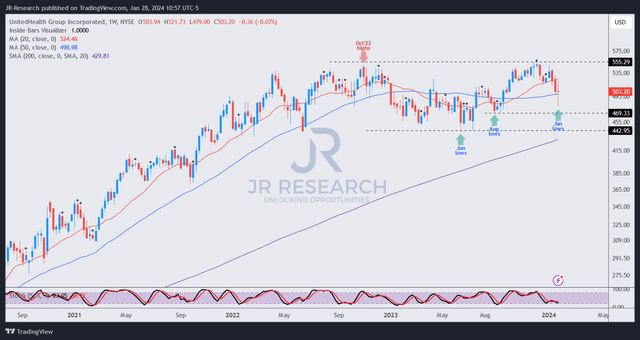

UNH price chart (weekly, medium-term) (TradingView)

As seen above, I assessed dip-buyers returning aggressively as they attempted to help UNH bottom out from last week’s steep selloff. While I didn’t glean a bullish reversal price action, which could have provided a more robust signal, the move down was constructive.

In other words, I assessed that the dip-buying support could help UNH bottom out at its pivotal 50-week moving average or MA (blue line), maintaining its medium-term uptrend bias.

While a possible re-test against its August 2023 lows ($472 level) could be in store, UNH’s dip-buying support from its recent capitulation has helped improve its risk/reward markedly since my previous update.

As a result, I have confidence that the recent uncertainty in the market has likely caused weak holders to give up quickly, providing an opportunity for me to turn bullish at the current levels.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!