Summary:

- The tech sector is reaching new highs, with the S&P 500 and Nasdaq Composite being led by mega-cap tech.

- Cisco, a prominent tech stock from the late 90s, is lagging in the current market, however.

- Despite its weak growth prospects, Cisco is undervalued and offers a high dividend yield, making it a potential buy.

- I outline key price levels to watch ahead of its Q2 earnings report due out in February.

Sundry Photography

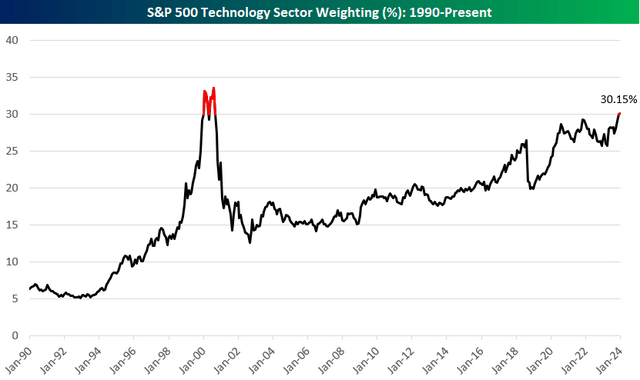

The tech sector has climbed to new heights, leading both the S&P 500 and Nasdaq Composite to fresh all-time highs as the end of January approaches. Bespoke notes that the Information Technology sector is now more than 30% of the SPX, nearly the zenith reached at the peak of the dot-com bubble. Not all stocks are participating, though. In fact, one of the poster children of the late-90s boom remains stuck in neutral.

Still, I see shares of Cisco Systems (NASDAQ:CSCO) as a buy on valuation. I will also highlight what the chart says about where this blue-chip tech name may go.

Tech Leads The Way, But 1999’s Darling, Cisco, Getting Left Behind

According to Bank of America Global Research, Cisco Systems is a provider of data networking products using Internet protocol technology. The Company’s solutions transport data, voice, and video within buildings, across campuses, and around the world. Product offerings fall into several categories: Routing, Switching, Advanced Technologies, Services, and Other Products.

The California-based $213 billion market cap Communications Equipment industry company within the Information Technology sector trades at a low 13.5 forward 12-month non-GAAP price-to-earnings ratio and pays a high 3.0% dividend yield, as of January 24, 2024. Ahead of earnings due out in mid-February, shares trade with a low implied volatility percentage of 24% while short interest on the stock is modest at just 1.1%.

Back in November, Cisco reported a bottom-line beat, but shares plunged post-earnings. Q1 non-GAAP EPS of $1.11 topped the Wall Street consensus estimate of $1.03 while revenue of $14.7 billion, up 8% from year-ago levels, was about in-line. What drove shares lower was a disappointing outlook due to the end of backlog drawdown and weak orders, resulting in lowered FY 2024 guidance.

Despite Q1 revenue growth slightly topping expectations, 2024 revenue guidance was lowered by $3.2 billion, indicative of a year-over-year decline of -4.6%. What’s more, a 20% decline in product orders led to a 6% reduction in this year’s revenue guidance, indicating a shift back to historical levels. Finally, Enterprise orders were down 26%, and Service Provider and Cloud orders decreased by 38%. Despite the weak operational outlooks in some segments, the management team voiced optimism regarding AI orders, so that will be a key spot to watch in the Q2 report in February.

Key risks with Cisco include a weaker enterprise spending environment, particularly in the public vertical where the company is highly exposed. Heightened competition could also drive margins lower, and risks surround some recent M&A moves. Cybersecurity is also something investors must monitor over the coming weeks. On January 26, it was reported that Cisco reported a critical vulnerability in some of its most widely-used software, and the firm urged users to patch their endpoints immediately.

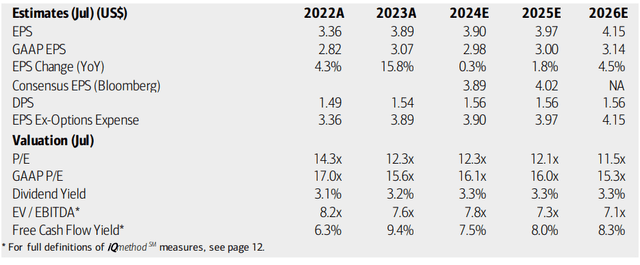

On valuation, analysts at BofA see earnings growth as being about flat this year with only minor acceleration into 2025. By 2026, per-share profits are seen climbing above $4. The consensus forecast, per Seeking Alpha, shows similar growth trends, with the possibility of negative EPS changes this year and out-year growth in the 4% to 5% range. Sales are forecast to dip this FY but then revert to 3% growth in 25-26.

Dividends, meanwhile, are expected to hover at $1.56 annually, still a solid yield compared to the tech sector. Cisco has historically produced robust free cash flow, which easily supports the dividend.

Cisco: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

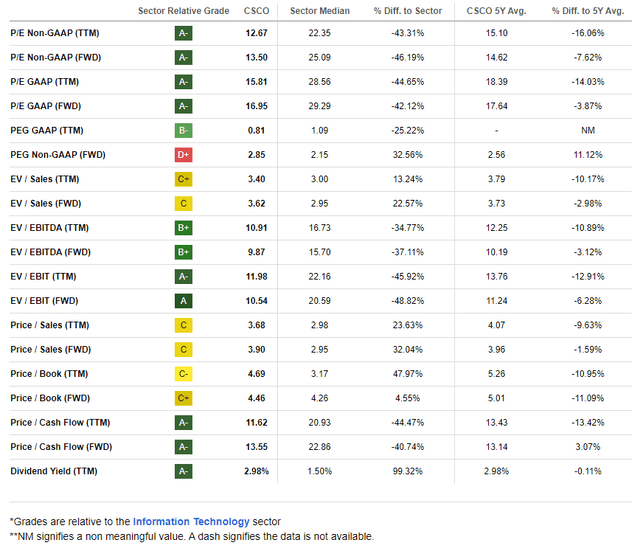

If we assume normalized EPS of $3.95 over the next twelve months and apply the stock’s 5-year historical earnings multiple of 14.6, then shares should trade near $58, making CSCO modestly undervalued today. I assert that a below-market multiple and a P/E about half that of the I.T. sector is appropriate given a slew of EPS downgrades lately and broader sluggish profitability growth in the coming quarters. Still, with a healthy balance sheet, this blue-chip name with recurring revenue should be a lower-risk stock in the industry.

CSCO: Cheap Across Valuation Metrics

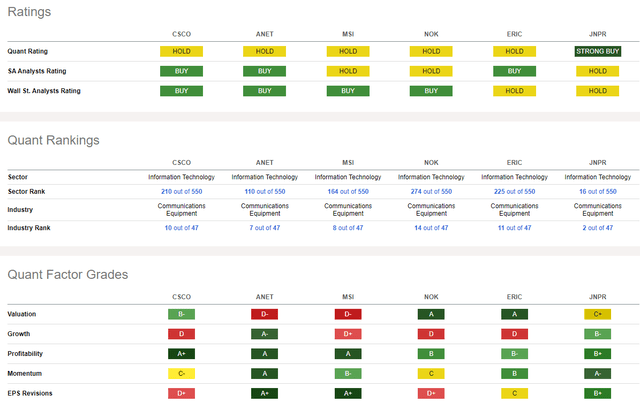

Compared to its peers, CSCO features a low valuation but tepid earnings growth. Profitability trends are healthy, and the second half of 2024 is important to watch in terms of what new orders will be given a somewhat concerning backlog. Share-price momentum is soft, though, and since its last earnings report, there have been a whopping 23 EPS downgrades versus zero upgrades.

Competitor Analysis

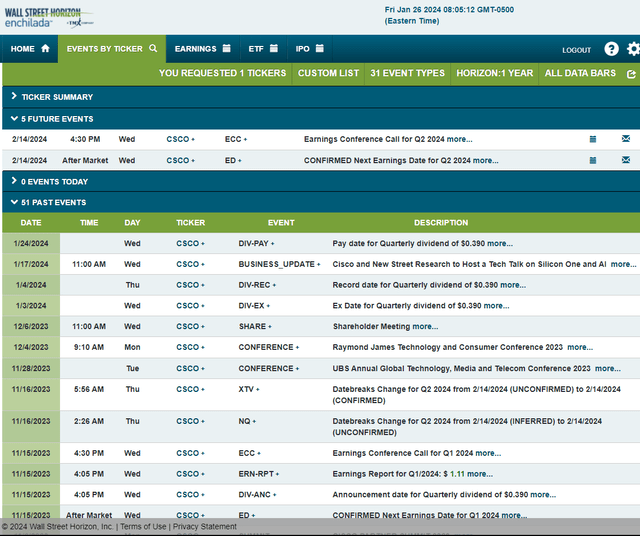

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Wednesday, February 14 AMC with a conference call immediately after the results hit the tape. You can listen live here.

Corporate Event Risk Calendar

The Technical Take

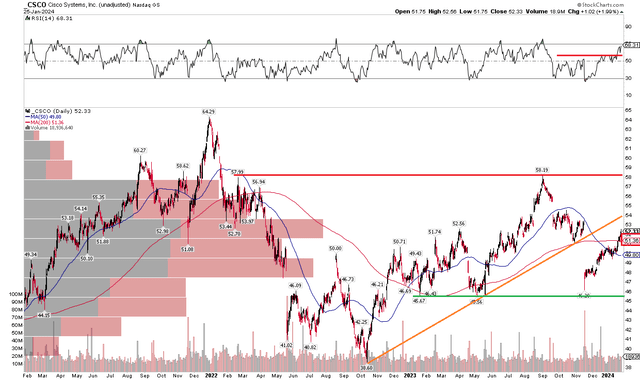

With a decent valuation and weak growth prospects, CSCO’s chart has some work to do if you are a bull. Notice in the graph below that shares fell below a key uptrend support line late last year. While the broader market was in big-time rally mode, Cisco was left behind to an extent. I see resistance at that uptrend line, currently near $54 with another area of probable selling pressure at the September 2023 peak of $58 – that level has confluence with resistance seen in early 2022. On the downside, support is seen between $45 and $47, putting the stock in a bit of a “no man’s land” today.

With a high amount of volume by price up to $57, it may be tough sledding for the bulls over the coming weeks and months. Moreover, take a look at the long-term 200-day moving average – it’s flat in its slope in stark contrast to the uptrend and recent all-time highs for the Information Technology sector. This underperformance is a bearish sign for CSCO shares. Finally, perhaps the lone bright spot is seen in the RSI momentum oscillator at the top of the graph – momentum broke out, which could portent a continued near-term rebound in shares.

Overall, I see resistance on the chart very close to what I consider to be fair value fundamentally.

CSCO: Shares Stuck in Neutral, $58 Resistance

The Bottom Line

I have a buy rating on CSCO. Despite the lukewarm growth picture and lackluster technicals, the stock is undervalued in my view and the high yield is a positive consideration for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.