Summary:

- Microsoft’s fiscal second quarter results are expected to be bullish, with bets in the options market for the stock to climb over $425.

- Investors will closely watch the growth of Microsoft’s Intelligent Cloud unit and Azure business unit.

- The stock’s valuation has climbed back into the COVID bubble range, which could impact its performance post-results.

FinkAvenue

The wagers are being placed around Microsoft’s (NASDAQ:MSFT) fiscal second quarter results, which look very bullish – so bullish that good results may not be good enough. The stock has seen its valuation climb back into the COVID bubble range, while the options market is placing bets for the stock to climb over $425 following the results. It’s all-or-nothing this time around because failure could lead to a pretty big drawdown.

The Bar Is Set

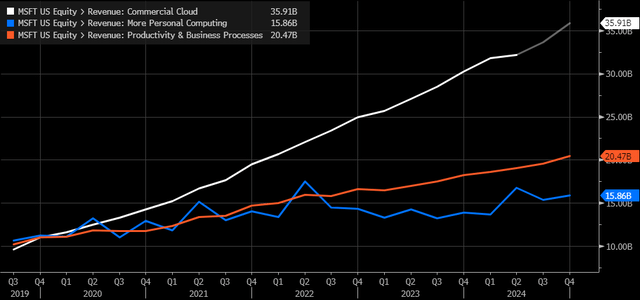

Microsoft is due to report results for its fiscal second quarter on Tuesday, Jan. 30, after the close of trading. Analysts forecast earnings to have grown by 19.6% to $2.78 per share versus last year, on revenue growth of 15.9% to $61.1 billion. The Intelligent Cloud unit and Azure are the big growth drivers for the company as it rolls out its AI suite of products.

The Intelligent Cloud unit is expected to show revenue growth of 17.6% to $25.3 billion, or 16.8% in constant currency. A big part of that revenue growth is expected from its Azure services business, which is forecast to grow by 28.4% to $17.6 billion, or 26.8%, in constant currency. Productivity and Business Processes are expected to grow by 11.9% to $19.03 billion or 11.25% in constant currency, while More Personal Computing is expected to grow by 18.0% to 16.8 billion, or 17.3% in constant currency.

Make no mistake, though; investors will be paying very close attention to the growth of Microsoft’s Intelligent Cloud unit and especially the growth rate of its Azure business unit.

Bloomberg

The big thing for Microsoft, though, won’t come until the conference call because that’s where the company will provide its guidance for its fiscal third quarter, and that guidance is likely to determine where the stock heads post results. For the third quarter, analysts see production and Business Processes growing by 11.9% to $19.6 billion at the mid-point of the range, or 11.7% in constant currency. Forecasts for the Intelligent Cloud are for revenue to grow by 17.2% to $25.9 billion or 17.6% in constant currency. Meanwhile, More Personal Computing is forecast to grow by 16% to 15.4 billion or 14.8% in constant currency. Overall revenue is expected to grow by 15.4% to $61 billion or 14.7% in constant currency.

The most important thing, though, is Azure’s growth rate, and right now, analysts see a modest deceleration in growth to 27.5% or 26.95% on a constant currency basis. Azure’s growth has been decreasing over the last five years as the business unit has grown, but analysts mostly see Azure’s revenue growth leveling off over the next three quarters, which would be a good thing.

Bloomberg

Valuation Has Gotten Stretched

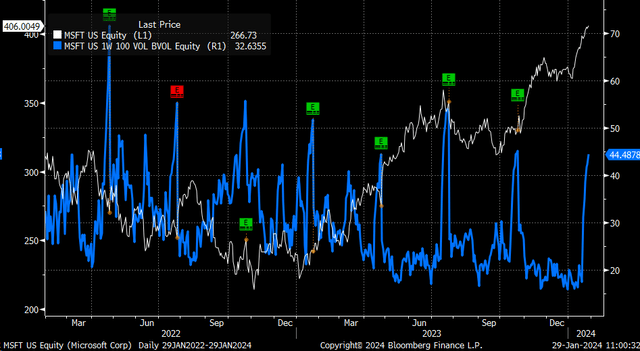

All of the hype around AI and Microsoft’s cloud growth has the stock trading at 32.8 times its next twelve-month earnings estimates, which is certainly not as high as it was during the post-COVID bubble but is back to being within that range. The last time the PE reached these levels since the COVID bubble popped was in July, heading into its fiscal first quarter results.

If the company delivers strong results, one would think that the PE won’t matter as much. If, for some reason, investors are disappointed, then the lofty valuation may play a role in where shares go from here.

Bloomberg

Its All-or-Nothing

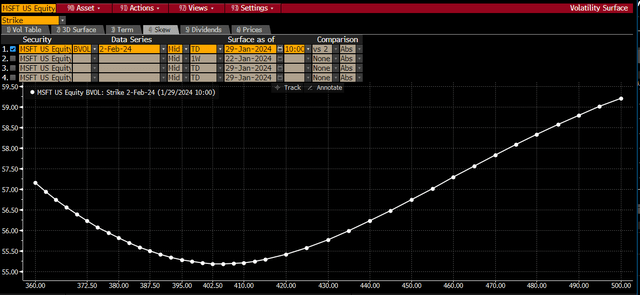

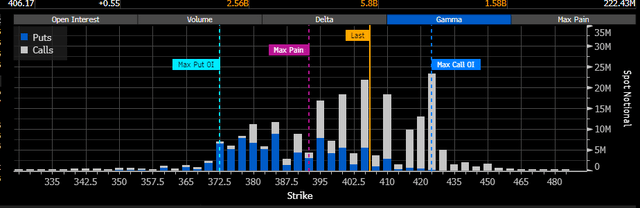

But the options market will play a big role in where the stock goes, perhaps even more so than the actual results and valuation. Because looking at the skew for the options expiring on February 2, saying that the market is bullish on Microsoft could be an understatement. The implied volatility for Microsoft rises dramatically after it gets past the $420 strike price. This suggests a lot of demand to own upside strike prices in the stock.

Bloomberg

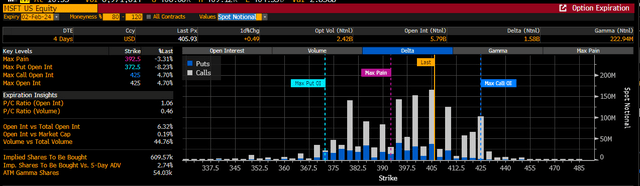

The open interest reflects this as well, with quite a bit of call open interest between the $425 to $450 stirke prices. But more importantly, notional delta values for the calls are also elevated given the stock’s big move higher over the past several weeks and due to the increased value of the calls given higher implied volatility levels.

Bloomberg

However, one problem with this level of bullishness is that after the results, the implied volatility will drop sharply once the event risk has passed, and it is one reason why the stock has fallen so many times after past results.

Otherwise, there’s a good chance once the company reports results, all of the calls betting on the upside could lose a lot of value, resulting in the bets being unwound and creating selling pressure on the stock price.

Given how much the stock has increased over the past couple of weeks and the level of extreme bullishness, results, and guidance must be well beyond expectations to keep the stock moving higher.

Bloomberg

Additionally, as previously noted, Microsoft was a big beneficiary of hedging flows heading into the January 19 options expiration. This could help explain the nearly 9% rally in the shares at the start of the year and why the move in the stock may have slowed in recent days.

Bloomberg

$425 or Bust

But where the stock goes largely depends on whether the company can deliver results strong enough to get Microsoft over $425. That is the big level from an options standpoint that needs to be breached because that is where a big chunk of call gamma is likely to serve as a resistance level. If the stock can clear $425, it could have some further rise, perhaps even up to $450.

Bloomberg

But a failure to surpass $425 likely brings options for sale, which brings stock for sale. Perhaps that is why, at the moment, the market is pricing in about a 4.5% move based on a long straddle options strategy for February 2, which takes the stock up to around $425 or as low as $385.

The stock has had a monster run, and while the shares can move higher, the market at this point has just set expectations high once again, so it is likely going to take more than a beat and raise quarter from the company to send the shares even higher at the moment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Don’t Be Reactive; Gain a Deeper Understanding and Anticipate Future Market Trends

TRY READING THE MARKETS AND GET THE FIRST 2-WEEK FREE *

- Reading the Markets identifies macro trends likely to influence the stock market.

- I utilize economic data and macroeconomic forces to forecast the potential directions of interest rates, the value of the dollar, and commodity markets, along with their possible impacts on stocks.

- These relationships are more crucial than ever when making short- and long-term trading or investment decisions.

- I offer daily videos or podcasts complemented by a written commentary.

*2-week trial not available on Mobile App