Summary:

- Amazon will announce its highly anticipated fourth quarter results on Thursday, 2/1, with investors anxiously waiting to see continued margin expansion and sustained growth.

- As one of the big-tech companies with the most variability in terms of results, I believe investors are too cautious ahead of the print.

- I expect Amazon will announce better-than-expected results, which will put the final bolt in Amazon’s transition to its ‘harvest’ stage.

- When investors gain more certainty about Amazon’s profit trajectory, I expect the stock will go higher, and therefore, I rate it a Buy ahead of earnings.

Kevin Winter

Amazon (NASDAQ:AMZN) is set to report its fourth quarter results on Thursday, after market close. Investors will look to see continued consumer strength, market share gains in advertising, and hope for growth acceleration in AWS.

But above all else, the most anticipated focus point is going to be Amazon’s profitability. Following three consecutive quarters of margin expansion, investors anxiously await to find out if 2023 marked the long-awaited gateway into Amazon’s ‘Harvest’ stage.

If 2023 was in fact the turning point, I expect Amazon will be one of the best-performing stocks in the market for the foreseeable future.

So, let’s try to find out if that is the case.

You’re Going To Reap What You Sow, And Amazon Has Been Sowing Alright

Amazon is unquestionably one of the most beloved service providers in the world, led by Jeff Bezos’ mantra “Your Margin Is My Opportunity”. For years, the company invested billions in building a logistics and technological infrastructure, despite the constantly decreasing investors’ patience for its lack of profitability.

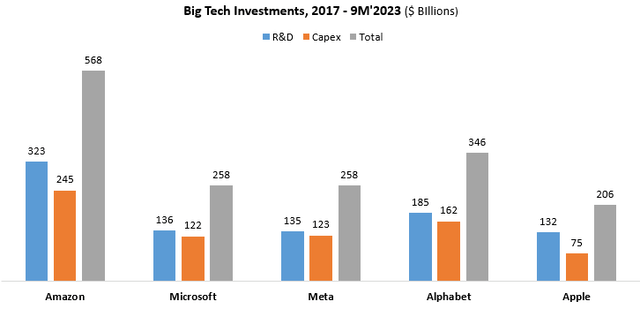

Between 2017 to Q3’23, Amazon invested more than $245 billion in capex, and nearly $323 billion in technology and content. These are by far the highest amounts of investment among big tech (and presumably among any company in the world).

For comparison, Microsoft (MSFT) invested approximately $123 billion in capex and $136 billion in R&D during that time span, Meta (META) is at $123 billion and $135 billion, Apple (AAPL) at $75 billion and $132 billion, and Alphabet (GOOG) (GOOGL) is at second place but still far from Amazon, with $162 billion in capital expenditures and $185 billion in R&D.

Created by the author using data from Seeking Alpha

Now the main difference here is that Amazon has a huge physical business with its logistics infrastructure, which is primarily dedicated to providing fulfillment services to third-party sellers on its website. Still, Amazon’s investments over the past several years are enormous on any scale.

Narratives Change, Investors Want Profits

Many people view Amazon as the embodiment of the growth-at-all-costs era, yet a closer look at its financials tells somewhat of a different story. Amazon has basically been profitable since around 2003, with a few hiccups here and there.

However, leading into Jeff Bezos’ retirement and Andy Jassy’s appointment as CEO, the company laid its eyes on a very ambitious target, which is building America’s largest logistics infrastructure, and continuing the international expansion of Amazon’s retail business.

The combination of those ambitions and a slowdown in AWS growth directed the Jassy-led company onto a costly path, during which free cash flow turned negative for 9 out of the last 10 quarters ahead of Q3’23, and EBIT margins declined.

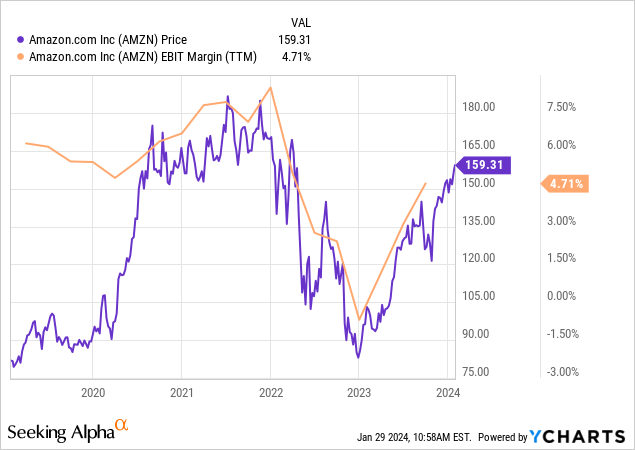

As we can see, the consequence was that profit-seeking investors turned on Amazon, sending the stock to a nearly 55% decline peak-to-trough. In my view, the selloff of 2022 was an important wake-up call for Amazon (as well as plenty of other businesses), which was reminded of its true purpose, which is to generate profits for its investors.

This took the form of extensive layoffs, and many strategic actions aimed at finally reaping the rewards of the hundreds of billions of dollars the company invested.

Amazon doubled down on its advertising business, which is currently one of the fastest-growing ad businesses in the world. In addition, the company’s regionalization efforts enabled an efficient logistic chain that turned the North America business back into the black. Another major profit driver was the efficiency projects in AWS, which recovered operating margins to above 30% once again.

The question now is, are we finally on a linear margin expansion path, or are we just “fooled” into a regression once again.

Is This Finally The Moment Amazon’s Margins Go On A Steady Linear Path?

That is the million-dollar question. As e-commerce continues to take share of overall spending, and demand for AWS is surging amid an AI and cloud computing boom, the main driver for investor returns will revolve around Amazon’s ability to generate profits from its sequentially growing businesses.

In the third quarter, we saw a very positive step in that direction, as each of Amazon’s segments showed a sequential improvement, driven by operational efficiencies and consistent improvement of mix towards higher margin businesses, mainly ads.

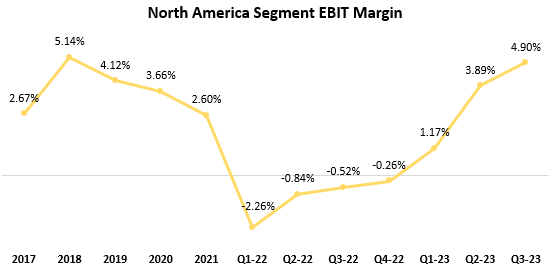

Created and calculated by the author using data from Amazon financial reports.

Starting with the North America segment, EBIT margins reached 4.9%, a threshold the company hasn’t achieved since 2018. Aside from the better mix I mentioned, management discussed the operational improvements in detail:

The third quarter marked the second full quarter of regionalization within the U.S. Regionalization has allowed us to simplify the network by reducing the number of line-haul lanes, increasing volume within existing line-haul lanes and adding more direct fulfillment center to delivery station connections. We have also been focused on optimizing inventory placement in a new regionalized network which when coupled with the simplification mentioned earlier, is helping contribute to an overall reduction in cost to serve. Additionally, in the quarter, we saw benefits from lower inflation, primarily within line haul, ocean and rail shipping rates which were partially offset by higher fuel prices.

— Brian Olsavsky, Senior Vice President & Chief Financial Officer, Q3’23 Earnings Call

Considering the remarkable holiday period e-commerce companies had and the better consumer environment (which helps drive both product sales and higher advertising activity), I’m expecting the third quarter EBIT margin to at least be sustained, if not improved.

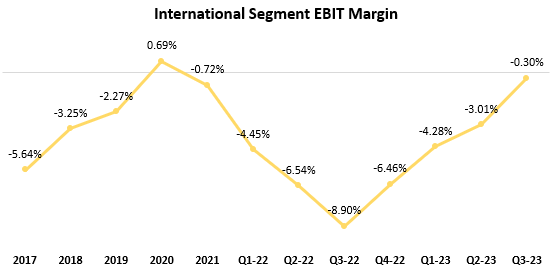

Created and calculated by the author using data from Amazon financial reports.

Transitioning to the international segment, which is still unprofitable, we saw a great improvement in the third quarter. Although it’s a smaller segment, its losses can definitely weigh down on Amazon’s results. In Q1’23, it had a negative effect of 20% on consolidated EBIT. In Q2’23, that improved to 10%, and in Q3’23, it had essentially no impact.

Management sounded much more cautious about the International Segment’s performance in the near term, as they continue to build their presence there. They did mention Amazon is already profitable in its mature international markets, including the UK, Germany, Japan, and France, but scaling into emerging markets will continue to cause a lot of variability with results. In addition, all the operational projects that are driving success in the U.S. are still years away from being relevant internationally.

I estimate the International Segment’s margins will continue to fluctuate, although I’m certain management will do whatever it can to mitigate its impact on consolidated margins in a way that will allow overall margin expansion, as I believe it remains one of their main goals.

Created and calculated by the author using data from Amazon financial reports.

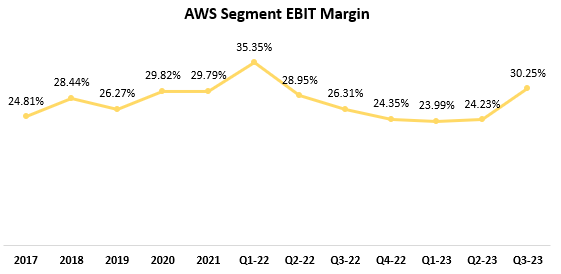

The AWS story is quite simple. After several years of unquestionable domination, AWS sees competition from Google and Microsoft. That being said, it still has more than 50% market share between the big three providers.

On the revenue side, cost optimization trends began to improve in the third quarter, driven by a better economic environment, and of course, AI.

On the profitability side, the majority of the margin improvement is a result of operational leverage on headcount costs, following several rounds of cuts carried over the last two years.

I’m expecting AWS margins will remain in the high-20s to low-30s range, with a decent likelihood for growth acceleration.

Valuation & Investment Thesis

As we saw in the price performance graph, there’s a clear connection between Amazon’s profitability and share performance (that’s not necessarily unique for Amazon of course).

In my view, there’s a very high probability for continued margin expansion and free cash flow leverage in upcoming years, as Amazon fully transitions into harvest mode.

Currently, consensus estimates see Amazon making a little over $8 billion in net income for the fourth quarter, reflecting a 5% profit margin, which is a 190 bps contraction from the third quarter. As a reminder, due to seasonality, the fourth quarter is more weighted toward product sales, which are inherently less profitable.

For 2024, consensus estimates stand at $37 billion in net income, which is a 5.8% profit margin, equaling a 100 bps expansion from 2023.

Taking consensus estimates as they are, Amazon is trading at a 44.5x multiple over 2024 earnings, and a PEG ratio of 1.3x. That is the lowest valuation among big tech except for Meta, with Google at a PEG of 1.45x, Microsoft at 2.5x, and Apple at 3.9x.

In my view, Amazon has the highest probability of generating a significant upside over consensus estimates, as any small improvement in margins contributes immensely to the bottom line with its more than half-a-trillion revenue base.

In addition, Amazon has the highest long-term optionality for margin expansion, as it’s still in the very early innings of the harvest stage.

Conclusion

I find Amazon to be significantly undervalued, mainly because of market uncertainty regarding continued margin improvements.

As we discussed in the article, I estimate margin improvements will continue, and therefore continue to rate the stock a Buy.

I believe a good report will revolve around margins, and a surprise to the upside should send the stock back to its all-time highs (and beyond).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, META, MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.