Summary:

- VICI Properties is a popular real estate investment trust with eye-catching dividend metrics and high-quality tenants.

- The lease structure of VICI Properties, with triple net leases and CPI-linked escalation, provides predictable and stable cash flows.

- VICI Properties is undervalued compared to comparable REITs based on AFFO multiples and dividend discount model valuations, presenting a long-term opportunity for investors.

Editor’s note: Seeking Alpha is proud to welcome Dividendology as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

NeoPhoto

Introduction and Background

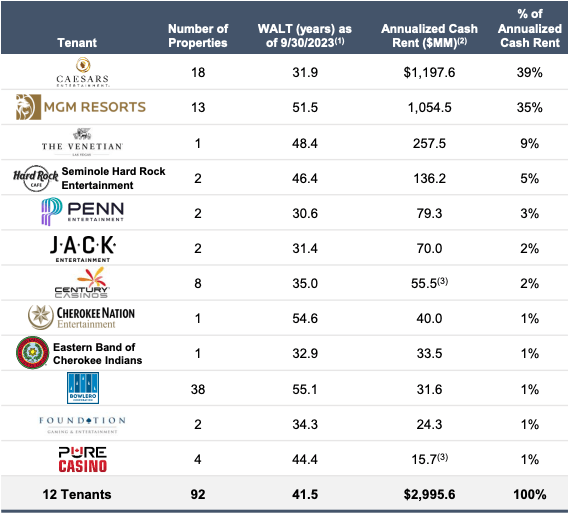

I believe VICI Properties (NYSE:VICI) is poised for long-term growth due to their lease structure, valuation, and quality tenants. VICI Properties is a real estate investment trust that has skyrocketed in popularity over the past few years for a multitude of reasons. The REIT has eye-catching dividend metrics — Yield: 5.46%; 3 YR Dividend CAGR: 9.04%; and AFFO Payout Ratio: 74.88%. Not to mention, the REIT also owns what some consider the highest-quality real estate, located on the iconic Las Vegas Strip including Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas. They say a REIT is only as good as their tenants, and in the case of VICI, their top 3 tenants make up 83% of their annualized rent roll.

VICI Investors Presentation

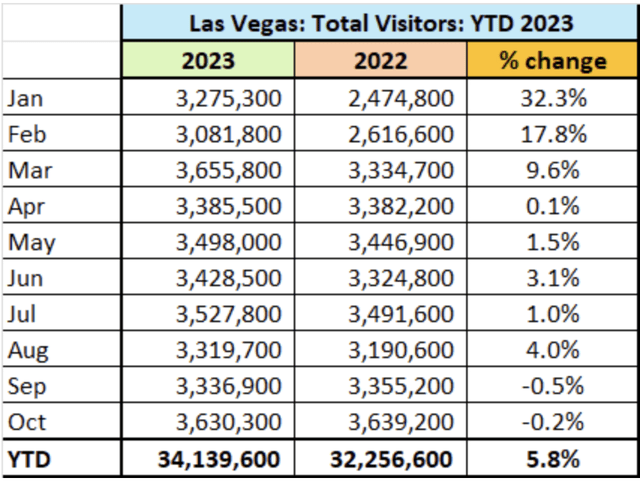

And while some may argue this is a potential risk, I’d argue that having Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas as your top tenants is a strength for VICI. I believe Las Vegas tourism will continue to increase in the coming years. In fact, comparing January through October of 2022 to 2023, we can see Las Vegas has already seen a 5.8% increase in total visitors through 2023. This is an advantage for VICI.

Vegas Tourism (Tourismanalytics.com)

So from a dividend perspective, tenant perspective, and valuation perspective (as we’ll see later), there appears to be a lot to like about VICI Properties. But the magic of VICI Properties isn’t in any of these things. It’s in the lease structure. Let me explain.

Lease Structure

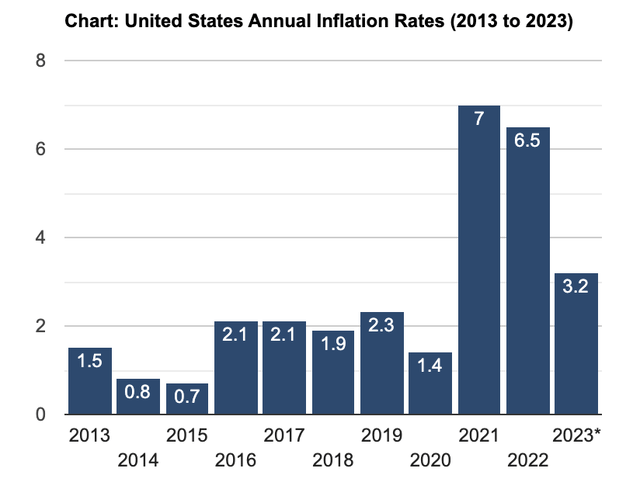

VICI Properties is a triple net lease REIT. Triple net leases are leases in which the tenant is responsible for paying all of the property’s expenses, including real estate taxes, building insurance, and maintenance. This makes the REITs very attractive to investors because they offer a steady stream of income with very little risk. The risk is transferred to the tenants instead. 100% of VICI’s tenants operate under a triple net lease agreement. The makes the cash flows coming from their tenants extremely predictable. The second element of VICI’s lease structure that makes them a great REIT is how they have protected themselves from inflation. And with inflation rates spiking over the last 3 years, it’s becoming more and more clear why this is so important long-term.

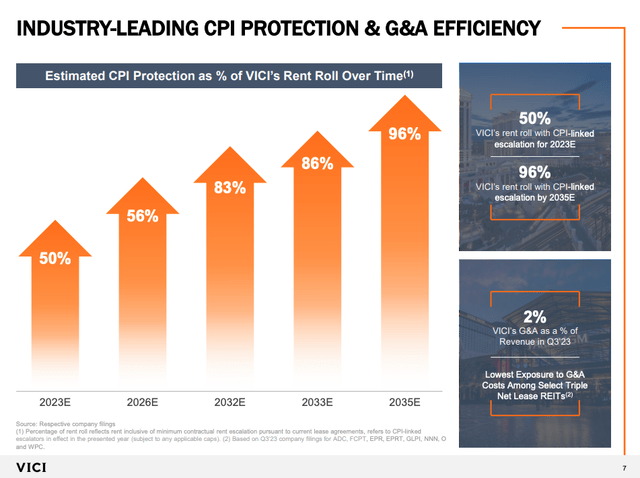

As of 2023, 50% of VICI’s rent roll has CPI-linked escalation. The even better news? By 2035, it’s estimated that 96% of VICI’s rent roll will have CPI-linked escalation.

Not to mention, the remaining lease term (inclusive of all tenant renewal options) for VICI tenants is 42 years. (Wow!) And while, 2020 was a difficult year for REITs as tenants struggled to pay rent, VICI was still able to collect 100% of their tenants rent in 2020.

VICI Investors Presentation

So, for investors looking for a REIT with predictable and stable cash flows, it’s easy to see why VICI is so attractive. Now VICI is currently down 5.82% over the past year, but they aren’t the only REIT bleeding. Vanguard’s real estate index fund VNQ is currently down 0.73% over the past year as well.

There’s no doubt that REIT’s have felt the pain from the rising interest rate environment as investors seek out less risky assets. But in my opinion, this creates long term opportunities. So let’s approach VICI from a valuation perspective.

Growth

VICI recently inked a $432.9 million sale-leaseback agreement with Bowlero, bolstering its portfolio with 38 bowling centers. Bowlero will guarantee $31.6 million in annual rent, generating around a 7.3% cap rate. The lease boasts a 25-year initial term with tenant renewal options extending for 30 more years. This again shows VICI’s focus on ensuring long-term income stability, which continues to make them attractive in my opinion from an investor standpoint.

VICI further secured the right of first offer for future Bowlero acquisitions, unlocking potential for future portfolio expansion.

Risks

The best way to get a better understanding of a company’s risks is to look at their form 10-k.

After carefully reviewing this document, I’ve narrowed down what I believe to be the main risks of the business to 4 key points:

- Because a concentrated portion of their revenues are generated from the Las Vegas Strip, VICI is subject to greater risks than a company that is more geographically diversified.

- VICI is and will always be significantly dependent on their tenants for substantially all of their revenues. An event that has a material adverse effect on any significant tenants’ businesses, could have an adverse effect VICI.

- VICI is somewhat dependent on the gaming industry and may be susceptible to the risks associated with it, including changes in consumer behavior and discretionary spending as a result of an economic slowdown.

- VICI and their tenants face extensive regulation from gaming and other regulatory authorities.

These are the main risks investors need to be aware of when considering VICI. But as someone who is bullish on the company, I also believe that some of the risks listed above, can also be a strength for the company. The real estate is unlike anywhere else, Las Vegas tourism continues to increase, and gaming/gambling continues to become more popular in the United States.

Q3 Earnings

VICI’s Q3 beat was fueled by $0.54 FFO, exceeding expectations by $0.01. Revenues also landed above estimates at $904 million. Their fortress-like portfolio continued its streak, maintaining 100% occupancy and collecting all rent. Notably, AFFO surged an impressive 10.2%, highlighting the enduring strength of VICI’s business model.

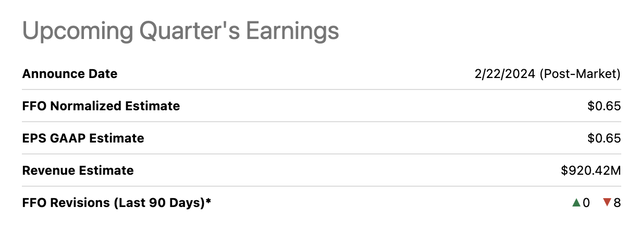

With VICI’s upcoming earnings on February 22, 2024, the FFO estimate is $0.65. Within the last 90 days, 8 analysts have given down revisions with 0 up revisions.

VICI upcoming earnings expectations (Seeking Alpha)

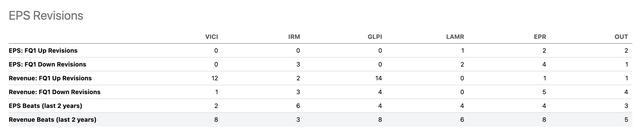

But to be fair, we can see earnings misses have been a somewhat common occurrence for VICI’s peers over the past couple of years. In fact, when it comes to revisions and projections, VICI seems to be the REIT that analysts are most bullish when considering short-term earnings projections. This should come as no surprise, as VICI leads the way (along with EPR) with 8 revenue beats in the last 2 years.

VICI & Peers Earnings Revisions (Seeking Alpha)

One quote from VICI CEO Edward Pitoniak Q3 earnings call that has me especially bullish? Check the following statement: “Finally, in a year in which REIT earnings growth has generally been difficult to come by, VICI’s AFFO per share earnings in Q3 grew 10.7% year-over-year. VICI announced within and subsequent to quarter-end, about $1.1 billion of new capital commitments”. To be fair, he makes it clear that the VICI team is fully aware of market risks at this time as well, when he also said – “And with the market movements of especially the last few weeks, we are sober and cautious about what the market conditions for capital allocation could be from here for how long, no one knows.”

So while I’m not expecting to a short term jump from VICI in part due to the interest rate environment, I still expect to see steady FFO growth in the coming years.

Valuation

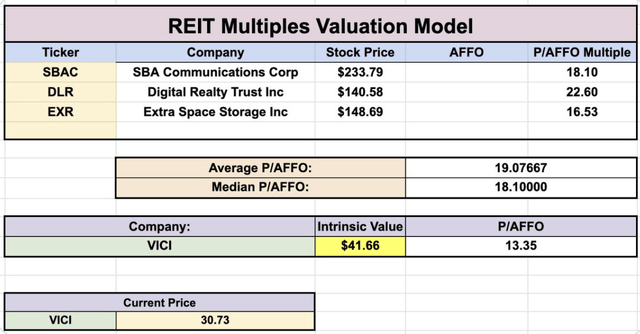

The first valuation we’ll use is an AFFO multiples valuation. We will essentially see how the market is valuing comparable REITs using a price to AFFO multiple. And as we can see below, the median P/AFFO for the comparable REITs is sitting at 18.10 , while VICI’s P/AFFO is currently sitting at 13.35, indicating that it is undervalued. If we apply the median P/AFFO of the comparable companies to VICI, we come to a fair value $41.66 per share.

VICI Multiples Valuation (Dividendology Patreon)

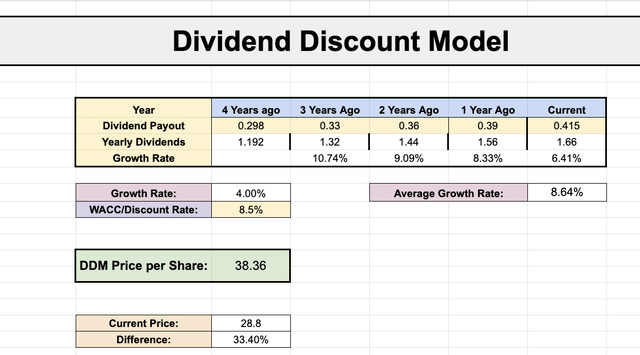

The next valuation we’ll utilize is the dividend discount model. The idea behind the dividend discount model, is we should be able to value a company based on how much they are paying out in dividends, and how much that dividend is projected to grow over time. In this scenario, we’re projecting:

– 4% dividend growth

– 8.5% discount rate

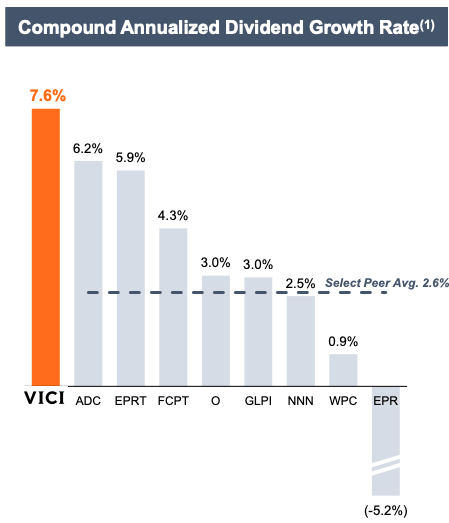

This leaves us with a fair value for VICI of $38.36, according to the dividend discount model. This again leads me to believe that VICI is a victim of the high interest rate environment, creating a solid long-term opportunity for investors looking to start a position in the stock. VICI’s dividend payments and growth continue to attract investors, and rightfully so. Their dividend growth far outpaces the majority of their peers, including the popular Realty Income (O).

VICI Investors Presentation

Final Thoughts

While investors seem to currently be running away from REITs and turning to safer assets due to rising interest rates, this creates a solid long term opportunity for people looking to buy a great REIT at a solid starting price. The dividend metrics are strong, the REIT has stellar tenants, and the price is right. VICI will continue to be a major position that I hold in my portfolio over the next decade as it currently makes up around 3% of my portfolio. It may take time for us to see VICI revert to its fair value, but in the meantime, I’ll be adding shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.