Summary:

- Tesla, Inc.’s near-term outlook looks bleak due to a potential dry spell lasting up to two years.

- The company’s business is sensitive to high interest rates, which could impact sales of EVs and solar panels.

- Competition in the EV market has intensified, with legacy automakers and new entrants launching new models, posing a threat to Tesla’s market share.

Xiaolu Chu

When I last wrote about Tesla, Inc. (TSLA) on October 25, 2023, I recommended aggressive growth investors buy the stock on what I perceived to be a dip based on the company evolving into one of the premier tech companies over the next ten years. If you have a ten-year investing timeline, you probably could still buy the stock at this price and do well. However, after looking at Tesla’s fourth-quarter earnings report on January 24, 2024, I must concede that the company could now be in for a dry spell lasting as long as two more years.

I cannot recommend a buy when the stock could flatline or even drift downward over the next several years before potentially rebounding when other companies with good long-term outlooks have better prospects over the next two or three years. This article will discuss why the company’s near-term prospects look bleak, the company’s fourth-quarter earnings, the stock’s valuation, and why I am downgrading the stock to a Hold. First, let’s look at Tesla’s latest earnings report.

Tesla’s fourth quarter 2023 results

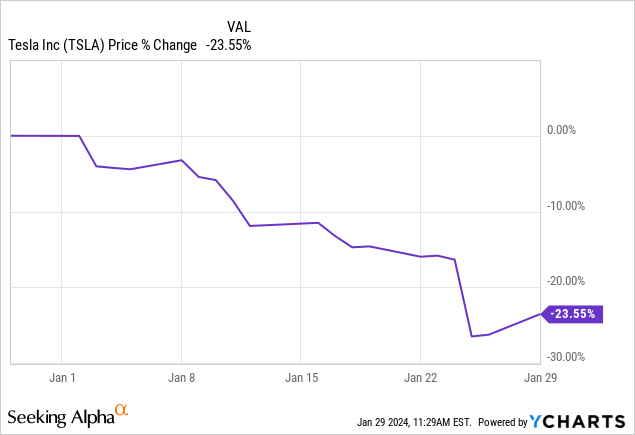

Analysts and investors were disappointed when they first saw the company’s fourth quarter 2023 earnings. Wedbush Securities quickly removed it from its Best Ideas List. Meanwhile, dissatisfied investors exited the stock stage left; the stock dropped 12% the day after earnings and is now down over 20% year-to-date.

Investor dissatisfaction started right at the top. Tesla’s automotive revenue, 86% of total income, only produced 1% growth year-over-year in the fourth quarter of 2023. The company attributed the slow growth to “reduced vehicle average selling price (“ASP”) year-over-year” and “lower FSD [Full Self Driving] revenue recognition.” The vehicle ASP was lower partially due to Tesla slashing its vehicle prices in 2023 in the U.S. and China to stimulate purchases of its EVs and maintain market share in the face of intensifying competition and a market slowdown.

Another factor was “product mix,” meaning the company either sold a higher proportion of lower-priced models (Model 3) or sold a higher proportion of vehicles in regions where buying occurs at lower ASPs. Tesla tries to maintain uniform pricing throughout the world. Still, in practice, that may not be true as the company may adjust pricing to make vehicles eligible for regional tax credits or subsidies in different jurisdictions globally. For instance, in the U.S., the manufacturer’s suggested retail price partially affects whether an EV qualifies for a tax credit. Last, lower full self-drive (“FSD”) revenue recognition may mean fewer people are buying the service as expected.

Tesla Fourth Quarter 2023 Update Deck

The financial summary above shows that the total fourth revenue only grew 3% to $25.167 billion, $596.79 million lower than consensus analysts’ estimates. Also, note how gross profit dropped 23% year-over-year and gross margin declined 612 basis points (“bps”) since the previous year’s comparable quarter to 17.6%. These declines are largely the result of Tesla cutting prices for its vehicles. Additionally, the production ramp-up of the new Cybertruck had costs that negatively impacted gross margins.

Cybertruck is an electric full-size pickup that Tesla first announced in 2019 and launched in late November 2023. Chief Financial Officer Vaibhav Taneja talked about CyberTruck’s impact on gross margins in the company’s fourth-quarter earnings report:

In our vehicle business, we continue to see improvements in our per unit cost despite us being in the early phase of Cybertruck ramp. As a result, our auto gross margin improved sequentially. That said, predicting auto gross margins is extremely challenging since there are many moving parts to this equation, some of which are out of our control like the change in tariffs or local incentives to name a few. While the teams are focused on cost reductions, we are approaching the limits within our current platforms.

Source: Tesla Fourth Quarter 2023 Earnings Call.

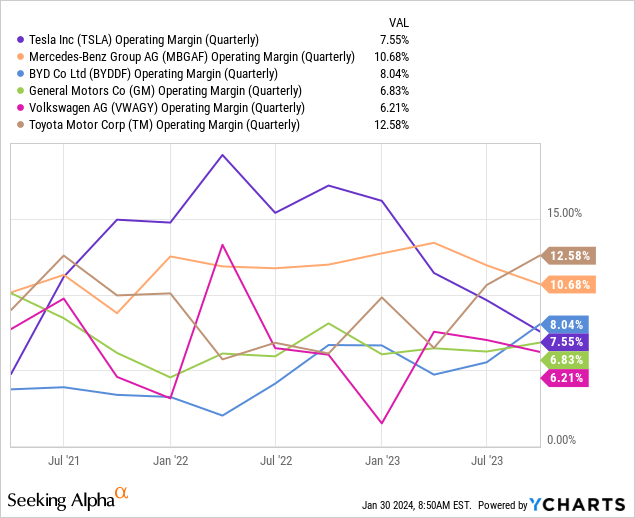

Lower vehicle ASP, Cybertruck production ramp costs, and operating expenses rising 27% higher were responsible for operating margins deteriorating 784 bps year-over-year to 8.2%. The following chart shows the operating margins of some of Tesla’s competitors as of the September quarter of 2023 (not all companies have reported fourth-quarter earnings yet). You can see that at one point, Tesla had the best operating margins in the industry by far, with operating margins as high as 19.2% in the first quarter of 2022. Today, some vehicle manufacturers have operating margins that exceed Tesla’s numbers.

Tesla produced a GAAP (Generally Accepted Accounting Principles) net income of $7.928 billion, up 115% year-over-year due to what Tesla stated in the fourth quarter 2023 earnings deck as “a one-time non-cash tax benefit of $5.9B in Q4 for the release of valuation allowance on certain deferred tax assets.” GAAP earnings-per-share (“EPS”) was $2.27. Non-GAAP EPS was $0.71, missing consensus analyst estimates by $0.03.

Tesla’s balance sheet looks like it is in great shape. At the end of the December quarter, the company had $29.094 billion in cash and short-term investments against $2.682 billion in long-term debt. Free cash flow (“FCF”) was $2.064 billion during the quarter and $4.358 billion annually. The quick ratio is 1.25, meaning the company can pay its short-term obligations.

Analysts wanted more from the report. The earnings misses didn’t help investor sentiment, and management talking about vehicle volume growth in 2024 possibly being “notably lower” was not encouraging.

There are reasons to invest in Tesla for the long term

Investors may not like that margins have shrunk in the near term due to price cuts. Still, that is part of Tesla’s long-term strategic plan. CEO Elon Musk said during the company’s first quarter 2023 earnings call (emphasis added):

We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy. This is an extremely important point.

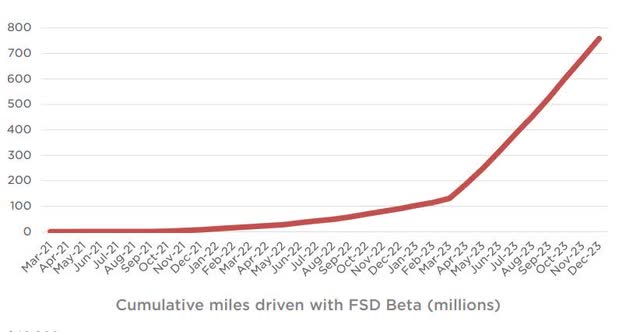

One of the significant advantages that Musk believes Tesla has over other companies attempting to build self-driving cars is data. The company has more vehicles with autonomous technology operating on U.S. roads, collecting real-time data from its cars than its competitors. If you listen to enough Tesla earnings calls, you may hear management brag about the enormous amount of data the company collects to train its AI. This data potentially gives Tesla an advantage in training its AI algorithms on a broader range of driving scenarios and edge cases, leading to safer vehicles, better performance, and faster development than rivals with less data. The following chart shows FSD Beta miles driven. The chart looks like it is going parabolic.

Tesla Fourth Quarter 2023 Update Deck

Musk also believes that more powerful hardware and increasingly sophisticated algorithms combined with more data will eventually produce a version of FSD at the level of human drivers and eventually better than human drivers.

If data does give Tesla an advantage and it becomes the first to crack the nut on developing a self-driving vehicle that can drive any road, at any time, in any weather that a human can navigate, Musk’s past proclamations of Tesla one day becoming the most valuable company in the world might turn into reality. The company already has designs for licensing FSD to other car manufacturers. Musk boldly said on the company’s fourth quarter 2023 earnings call:

I really think lots of car companies should be asking for FSD licenses. And we’ve had some tentative conversations, but I think they don’t believe it’s real quite yet. I think that [FSD’s success] will become obvious probably this year. And I do want to emphasize that if I were CEO of another car company, I would definitely be calling Tesla and asking to license Tesla full self-driving technology. It’s definitely the smart move.

Musk also wants to position the company away from people thinking of Tesla as only an EV manufacturer. Musk said on the earnings call that he wants people to think of Tesla as an “AI robotics company.” The company has poured resources into AI for more than just FSD. The company is also building a general-purpose robot named Optimus, which the company first introduced on AI Day 2021.

Although Musk has designs on Tesla becoming an AI robotics company, he hasn’t forgotten about the EV business. First, gross margins should eventually improve after the Cybertruck completes its ramp to full production. Additionally, Tesla has plans to manufacture a “next-gen vehicle” built with new manufacturing techniques that should eventually improve long-term margins. Musk briefly talked about the next-gen vehicle and new manufacturing system on the recent earnings call:

And we’re very far along on our next-generation low-cost vehicle. This is an earnings call, not a product announcement. So there’ll no doubt be many questions that try to ask us about new product, new products coming. But we reserve product announcements for product announcements not earning calls. So — but we’re very excited about this, and this is really going to be profound, not just in its design of the vehicle itself, but in the design of the manufacturing system. This is a revolutionary manufacturing system significantly, far more advanced than any other automotive manufacturing system in the world, by a significant margin.

The company expects to begin manufacturing this next-gen vehicle in late 2025, potentially boosting revenue and profitability. However, there are reasons to believe the stock could take several years to rebound. Let’s look at a few.

Tesla tends to do poorly in a high-interest-rate environment

Tesla started as Tesla Motors, a manufacturer of electrical vehicles (“EVs”), but changed its name to Tesla as it evolved into a collection of several businesses and became more than solely an EV manufacturer. In addition to manufacturing EVs, the company has the following businesses:

- Artificial Intelligence (“AI”) Software and Hardware.

- Energy Storage.

- Solar.

- Services and Other businesses that include pay-per-use supercharging.

The company’s largest business, manufacturing EVs, and its solar business are interest rate sensitive. Most consumers use loans to finance their Tesla car purchases, and with higher interest rates, the monthly payments become more expensive, potentially discouraging potential buyers. Chief Executive Officer (“CEO”) Elon Musk said during the company’s second quarter 2023 earnings call:

Buying a new car is a big decision for vast majority of people. So, any time there’s economic uncertainty, people generally pause on new car buying at least to see what happens. And then obviously, another challenge is the interest rate environment. As interest rates rise, the affordability of anything bought with debt decreases, so effectively increasing the price of the car. So when interest rates rise dramatically, we actually have to reduce the price of the car because the interest payments increase the price of the car. And this is — at least up until recently, it was, I believe, the sharpest interest rate rise in history. So, we had to do something about that.

The company’s direct-to-consumer solar business has also suffered significantly over the last year as it relies heavily on consumers financing their purchase of solar panels, and high-interest rates have choked off demand. Tesla’s fourth quarter 2023 solar business dropped 59% year-over-year to just 41 MW. Although some of Tesla’s other businesses, like Energy Storage, have done well, none are large enough to offset the negative impact of the EV business on revenue.

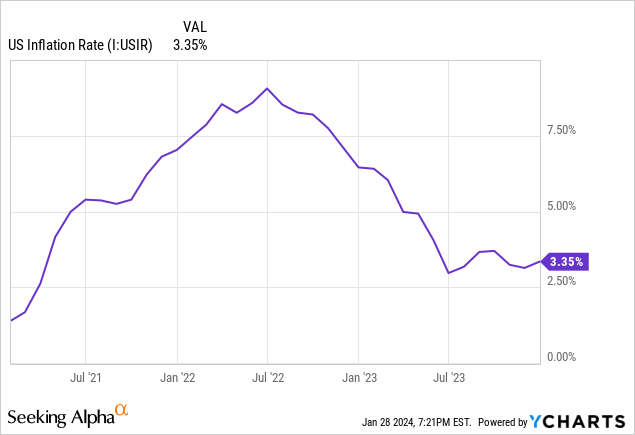

Tesla’s EV and Solar business is unlikely to recover until interest rates decline. Some experts, like Preston Caldwell, a senior U.S. economist for Morningstar (MORN), believe inflation will return to “normal” in 2024. Caldwell thinks the Fed will begin lowering interest rates this year. Consequently, some investors are optimistic that EV sales will soon turn around. However, the Federal Reserve is unlikely to start cutting rates until it has achieved its target inflation rate of 2%. The chart below shows that the current inflation rate hovers around 3%.

Speculating that the Federal Reserve (“Fed”) will lower interest rates soon may be unwise. History suggests that trying to predict the direction of interest rates can be a foolish endeavor. The Fed could raise interest rates in 2024 if inflation reaccelerates, defying economists’ predictions. If you invest in Tesla based solely on interest rates heading lower in 2024 and inflation reaccelerates, forcing the Fed’s hands to raise rates, there could be unhappy times looking at your brokerage statement later this year.

Competition is rising

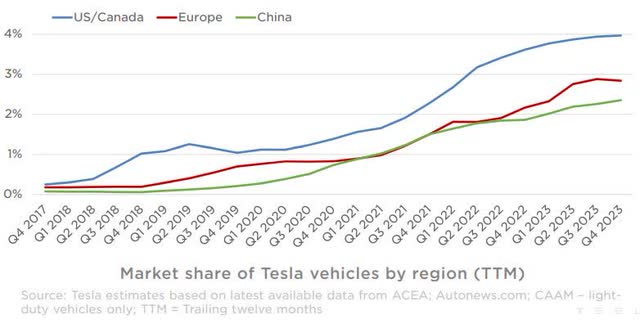

The following chart shows that the rate of Tesla’s EV market share rise has slowed over the last year in North America, Europe, and China.

Tesla Fourth Quarter 2023 Update Deck

Tesla’s market share growth has slowed partially due to competition in the EV market rising over the last two years as traditional automakers like General Motors (GM) and Toyota Motor (TM), alongside new entrants like Rivian Automotive (RIVN), Fisker (FSR), and Lucid Group (LCID) have launched several new EV models in multiple categories, including Luxury Sedan, Sportback, and Sport Utility Vehicle (“SUV”) in the U.S. and Europe. Additionally, many companies are pressuring Tesla in the fiercely competitive Chinese market, with BYD Company (BYDDY) overtaking Tesla in the last quarter of 2023 to become the largest EV manufacturer in the world by sales.

Meanwhile, before Cybertruck, 2020 was the last time Tesla launched a vehicle, the Model Y. Tesla initially planned to introduce Cybertruck in 2021, which would have made it the first to introduce an electric pickup truck. However, after numerous production delays, it only launched Cybertruck in late November 2023, allowing other companies to introduce an electric pickup truck first. For instance, one of the most famous pickup truck companies, Ford (F), beat Tesla to the punch by introducing its first electric pickup truck, the F-150 Lightning, in 2022. Additionally, General Motors and Ford are well-entrenched in consumers’ minds as top companies in the pickup truck category. As cool-looking as the Cybertruck is, it may have a tough time gaining traction in the pickup truck market against these two established players. So, Cybertruck’s long-term impact is up in the air.

FSD and AI robotics is a high-risk investment

Elon Musk has been optimistic about developing a self-driving car for a long time. Since around 2017, Musk has implied that a self-driving vehicle would happen either “this year” or was “a year away.” However, FSD development so far has seen a constant resetting of the goalposts, and there are reasons to disbelieve many of Musk’s optimistic comments about FSD.

Depending on which expert you listen to, a self-driving car capable of driving on any road without human intervention may only be ready for prime time between 2030 and 2040. In addition, some have issues with Tesla’s approach to achieving a fully self-driving car. For instance, Mobileye’s (MBLY) CEO believes Tesla is using a “brute force” approach to iteratively improve its autonomous driving system, a method he believes has an upper limit of effectiveness and may ultimately not achieve Musk’s vision for FSD as there is a high risk of hitting a glass ceiling. Even if FSD eventually succeeds, there is a risk that other companies with different approaches could beat it to the punch and establish a moat around their self-driving businesses that Tesla might find challenging to breach. Mobileye is one of many companies with a solution that might establish a first-mover advantage in this technology. Alphabet’s (GOOGL, GOOG) Waymo, NVIDIA (NVDA), Baidu (BIDU), Amazon (AMZN), and various car companies are actively developing self-driving car technology.

Another risk with FSD is that even if the technology becomes viable, Tesla might find it challenging to monetize it. Musk sometimes lightly mentions subscription plans, licensing the technology to other auto companies, and driverless taxis as ways the company can monetize FSD. However, the devil is in the details, and there is a risk that the execution involved in monetizing FSD could fall short of Musk’s vague outlines of a monetization plan.

Last, Musk’s vision of transitioning from a primarily EV manufacturer to an “AI robotics company” would require significant investments in innovative technologies outside of Tesla’s core area of manufacturing EVs and potentially face different market dynamics than the car industry. Bringing complex robotics technology to the market could have high development costs and may lack clear commercial paths and ways to monetize the business. I am confident that robotics will eventually be a huge business. However, the time it may take for Tesla’s robotics business to generate significant revenue and achieve profitability could be several years to more than a decade away. If you decide to invest in the stock, avoiding believing Tesla’s robotics initiatives will provide immediate returns this year or next would be prudent.

Why Tesla is a Hold and not a Buy

The short answer is that Tesla is valued as a growth company but is not producing revenue or earnings growth, and the prospects for it to produce enticing growth over the next one or two years are bleak. In addition, many of its medium and long-term growth initiatives are speculative. For instance, Tesla’s plans to restore margins in the medium term (next two to four years) involve building a next-generation vehicle with new, unspecified, possibly unproven auto manufacturing techniques. If everything goes right, that may prove the case. However, Musk’s timelines are often wrong. So, although he has talked about introducing the next-gen vehicle in 2025, it could take far longer, and investors should not expect the next-gen vehicle to come riding to the rescue soon. Let’s look at the valuation.

By virtually all traditional valuation ratios, the market has overvalued Tesla. It sells substantially above its sector median’s price-to-sales, price-to-earning, Enterprise Value-to-sales, and other ratios. Seeking Alpha’s quant rates the stock’s valuation an F. If you think the recent downturn post-earnings has improved the valuation to the point of buying the stock, think again. You could justify that the market was undervaluing the stock’s eye-popping valuation in 2021, when the company’s quarterly year-over-year growth rate rose to around 90%, and the EPS growth rate was in the triple digits, but that is no longer the case. Tesla’s reported growth rates for revenue and EPS in the recent earnings release were anemic.

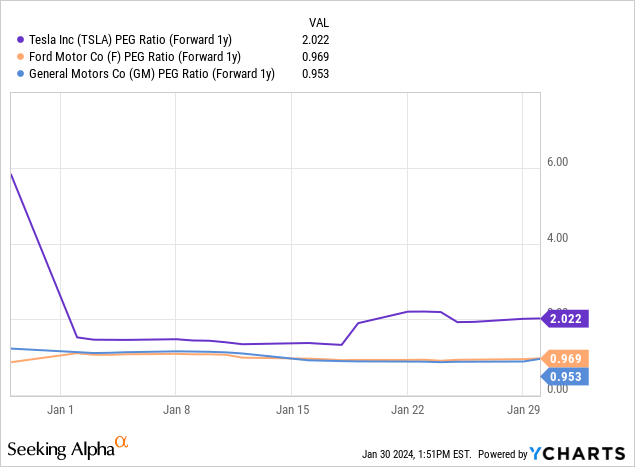

Additionally, even after its stock price collapse in January 2024, the market may be overvaluing today’s historically more subdued valuations. For instance, Tesla’s Price/Earnings-to-Growth (“PEG”) ratio for 2025 is around 2.0, well above Ford and GM. That valuation may be appropriate if the market is confident that Tesla could grow earnings leaps and bounds above Ford and GM in 2025. However, that scenario would not be wise for an investor with an investing horizon of two years or less to bet on. If you don’t already own shares, it might be best to avoid the stock for now.

Let’s look at a reverse discount cash flow, or DCF, to determine what free cash flow (“FCF”) growth rate the stock’s current price implies.

Reverse DCF

|

FCF (Trailing 12 months) margin |

4.5% |

|

The fourth quarter of FY 2023 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$4.358 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 35.3% |

| Current Stock Price (January 30, 2024, mid-day) | $191.68 |

| Terminal FCF value | $91.383 billion |

| Discounted Terminal Value | $440.401 billion |

A 35% FCF growth rate over the next ten years is a steep growth rate. Still, if Tesla, Inc. can successfully diversify into self-driving cars, AI, and robotics, I believe the growth rate is well within the company’s capabilities. The company’s current stock price is around Fair Value for the stock.

If you already own shares, believe in Musk’s vision for the company and are willing to hold the stock long-term, consider keeping your Tesla, Inc. shares. I rate the stock a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.