Summary:

- Pfizer stock is the worst performing among the “Big 8” U.S. pharmaceutical companies across 5, 3, 1 year, and 3m periods.

- PFE released FY23 earnings yesterday – as expected – owing to a fall in COVID franchise revenues – top line revenues fell >40% year-on-year.

- This is a tough comparison to make, however – revenues were >$100bn in 2022 and the market well knew this was a temporary uplift.

- Pfizer’s portfolio ex-COVID actually drove 8% year-on-year growth and the company secured 9 new drug approvals in 2023 – more than twice the number of its closest pharma rival.

- Unless I am missing something, Pfizer is a competitive, cash-rich pharma promising >$45bn in fresh revenue streams by the end of the decade. There is a good news story here, although the market seems to be burying it.

Michael M. Santiago

Investment Overview

Of all the U.S. Big Pharma companies – a group I like to refer to as the “Big 8,” consisting of, in order of market cap, Eli Lilly and Company (LLY), Johnson & Johnson (JNJ), Merck & Co., Inc. (MRK), AbbVie Inc. (ABBV), Amgen Inc. (AMGN), Pfizer Inc. (NYSE:PFE) – the subject of today’s post – and Gilead Sciences, Inc. (GILD) – Pfizer stock is the worst performing on a 5-year, 3-year, 1-year, and 3-months basis.

The Pharma’s share price is down -23% on a 3-year basis, -37% on a 1-year basis, and -10% on a 3-month basis, and the Pharma simply cannot catch a break. Releasing Q4 and FY 2023 earnings yesterday, Pfizer revealed that total revenues of $58.5bn in 2023 represented a 42% year-on-year drop, primarily thanks to its COVID franchise, with the vaccine Comirnaty experiencing a 70% drop in revenues, to $11.2bn, and Paxlovid a 93% drop, to $1.28bn.

Pfizer reported diluted earnings per share (“EPS”) of $0.37 – down 93% year-on-year – and adjusted diluted EPS of $1.84 – down 72% year-on-year, and issues full year 2024 top line revenues guidance for $58.5 – $61.5bn – implying a 3% uplift on 2023 revenues at the midpoint of guidance.

The market’s reaction to earnings and guidance has been lukewarm – in the past year, shares have sunk in value from ~$45, to ~$27, and yesterday’s news suggests that Pfizer shareholders have little to look forward to in 2024, other than a handsome dividend yield, which is presently >6%, based on a quarterly payout of $0.42.

Pfizer’s Fall From Grace – Is The Market’s Negative Sentiment Justified?

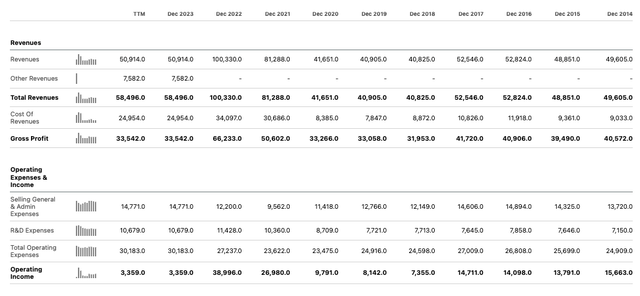

Pfizer’s current share price of ~$27 is its lowest traded price for more than a decade, and arguably, as we can see below, from an earnings perspective, the company looked healthier in 2014 than it did in 2024.

Pfizer income statement historic (Seeking Alpha)

Revenues of ~$50bn in 2024 were almost as high one decade ago as they are today, yet operating income of $15.7bn in 2014 was >4x higher than the $3.6bn reported this year. Based on this factor alone, it’s a straightforward exercise to make the case that the company’s performance has deteriorated.

In reality, however, we should not ignore the years – 2021 and 2022 – in which Pfizer’s COVID franchise allowed the company to double its annual revenues in 2021, and then increase them still further, by 23% year-on-year, to >$100bn, in 2022.

Pfizer’s stock price did reach an all-time high value of $60 in December 2021 – during the height of the pandemic, and when guiding for >$100bn revenues in 2022 – which valued the company at a market cap of close to $350bn, and I believe it is possible to make the case that such a share price would not necessarily flatter Pfizer today.

In 2022, Pfizer became the largest global pharma by revenue, surpassing Johnson & Johnson (JNJ), and although it quickly became clear through 2022 that further mass COVID vaccinations were unlikely, and that has proven to be the case – guidance for Comirnaty revenues in 2024 is for ~$5bn, and for Paxlovid, ~$3bn – but even accepting this, Pfizer has realized a massive cash windfall as a result of booking >$100bn of COVID franchise revenues over the past 3 years, and realizing a high profit margin on these sales.

The extra cash flow the business has realized has allowed Pfizer to go on an M&A spree – as I wrote in a note on the company last September:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late-stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial-stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; a $525m deal for ReViral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”), and a $43bn deal for Seagen – the antibody drug conjugate (“ADC”) specialist with 4 approved drugs which drove ~$2bn of revenues last year.

In short, Pfizer has had the luxury of being able to complete nearly $70bn worth of business development deals with profits secured from an unexpected source – a position most global pharmas could only dream of being in – yet during that period, its share price has fallen by >50%.

It seems an odd situation, especially given that the market must have always known that COVID revenues would provide a temporary uplift to Pfizer’s annual revenues, not a permanent one.

On the Q4 2023 earnings call, Pfizer’s CEO Albert Bourla made several points, underlining potential strengths in Pfizer’s business. He mentioned, for example, that:

despite the decline in revenue from our COVID products, as of the reported results for the first nine months of 2023, we were the number 1 pharmaceutical company in terms of revenues from pharma-only products, a marked improvement from our fourth position in 2019

When we consider some of the competition in the pharmaceutical sector – Merck, with its >$20bn per annum selling cancer drug Keytruda, AbbVie Inc. (ABBV), whose autoimmune drug franchise is worth >$25bn per annum, Eli Lilly and Company (LLY) with its strength in oncology, diabetes, and autoimmune, plus its newly launched GLP-1 agonist drugs Mounjaro and Zepbound – arguably, Pfizer deserves more credit than it has been getting from the market.

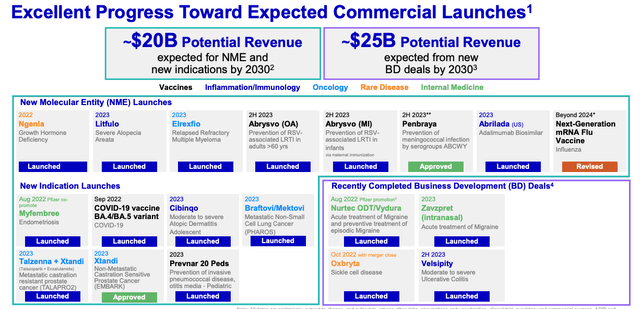

Bourla also pointed out on yesterday’s call that Pfizer secured approval for nine new drug molecules in 2023. Some of these include Velsipity – acquired via the Arena Pharmaceuticals deal – which was approved to treat ulcerative colitis, Zavzpret – acquired via the Nurtec deal – approved to treat migraines, while Elrexfio, approved for multiple myeloma, Ngenla, for growth failure, Litfulo, for alopecia (hair loss), Abrysvo, an RSV vaccine, and Paxlovid were all Pfizer pipeline products.

In terms of FDA approvals, Pfizer outclassed every other major Pharma, achieving twice as many approvals as its closest rival.

Pfizer commercial launch overview (Pfizer earnings presentation)

As we can see above, Pfizer believes it can extract ~$20bn in potential revenue from its recently approved/launched product portfolio, while recently completed BD deals offer hope for an additional ~$25bn of revenues.

Again, these numbers compare favorably to rivals – for example, AbbVie, which expects its autoimmune drugs Skyrizi and Rinvoq to drive ~$25bn of revenues per annum by 2027, but is also dealing with rapidly falling sales of its mega blockbuster Humira – $20bn revenues in 2022 – Bristol Myers Squibb Company (BMY), which is forecasting for ~$25bn of revenues from its new drug portfolio as it fights expiring patents on key drugs. Merck wants to unlock $35 – $40bn from new oncology, cardiometabolic and immunology drugs, although its candidates are further back in terms of the clinical study/approval path than most of Pfizer’s.

In summary, if you consider the key strengths that a Big Pharma ought to have – multiple blockbuster assets, past present and future, good profit margins, plenty of cash for R&D, a healthy dividend, and attractive ratios – Pfizer scores highly across most of these categories.

Admittedly, adjusted EPS of $1.84 in 2023, and forecast $2.05 – $2.25 in 2024 may feel low, but it should be remembered that Pfizer has a massive float of >5.6bn shares – twice as many as any other Pharma – and a current price to earnings of ~14.5 and 13.5x respectively compares favorably with most other large Pharma companies, as does forward price to sales ratio of <3x.

Highlighting Strengths Of Pfizer’s Product Portfolio and Pipeline In 2024

Let’s start by reviewing 2023 performance. Excluding Paxlovid and Comirnaty, Pfizer’s revenues grew by 7% operationally, thanks to a “combination of new product and in line launches and in-line product growth” – another positive sign for the company and a growth rate I suspect many other pharmas will struggle to match this earnings season.

Pfizer has split itself into three divisions – Primary care, Specialty Care, and Oncology. Primary Care includes the Prevnar family of streptococcus pneumoniae vaccines, which earned $6.4bn of revenues in 2023, up 2% year-on-year, plus Nurtec’s episodic migraine treatment, which earned >$900m of revenues, and newly launched Abrysvo racked up nearly $900m of revenues since launch.

Specialty Care includes the Vynqadel family of drugs, targeting cardiovascular disease and polyneuropathy, which earned $3.3bn of revenues in 2023, up >35% year-on-year, autoimmune drug Xeljanz, $1.7bn of revenues, flat year-on-year, and 17 other drugs, plus another $3.2bn of anti-infectives and specialty care revenues not broken down by product.

Oncology is another large division, marketing and selling 20 drugs (including Seagen’s approved cancer drugs), with breast cancer therapy driving $.8bn of revenues in 2023 – down 7% year-on-year, prostate cancer therapy Xtandi, $1.2bn of alliance revenues – flat year-on-year – and Inlyta, $1bn of revenues in the kidney cancer indication.

The blood thinner Eliquis contributed $6.8bn of alliance revenues for the year, although this drug is both subject to government price control going forward, and has key patents expiring in 2026.

Excluding COVID products, Primary Care revenues of $18.1bn were up 11% year-on-year, and accounted for ~31% of total revenues, Specialty Care revenues were up 8%, to $14.9bn, accounting for 26% of revenues, and oncology revenues of $11.2bn fell by 8% year-on-year, and accounted for ~19% of all revenues.

If we factor in the fact that COVID franchise revenues are likely to fall by ~$4bn in 2024, it seems apparent that management expects each of its divisions to grow revenues in 2024, in order to meet its overall guidance for slight growth for the year.

Within oncology, the addition of Seagen and its 4 commercially approved drugs ought to help reverse the fall in revenues experienced in 2023, while Cibinqo and Velsipity are both expected to add “blockbuster” (>$1bn per annum revenues) potential to the specialty care division, with Abrysvo doing the same in Primary Care. Pfizer, which has already shown its mettle in the field of messenger-RNA vaccines with Comirnaty, hopes to have a mRNA flu jab on the market soon too, with peak revenue potential in the multi-billions.

Highlighting Weaknesses In 2024 – And How They May Be Solved

Although I have painted a generally positive picture of Pfizer as we head into 2024, the reality is that the company – and its share price performance – is clearly testing the market’s patience in many ways, which is preventing a period of share price recovery.

Pfizer certainly delivered some downbeat news in 2023 – for example, a non-cash revenue reversal of $3.5 billion recorded in the fourth quarter of 2023, related to “the expected return of an estimated 6.5 million treatment courses of Emergency Use Authorization (EUA)-labeled U.S. government inventory,” its “realistic,” i.e., to the market’s ears, negative assessment of an emergent market for private COVID vaccination, which might have prolonged sales of comirnaty in the double-digit billions for many more years, and the failure of a GLP-1 agonist drug Danuglipron in clinical studies – endpoints were met, but safety data disappointed – and a once-daily obesity pill, lotiglipron, again on concerns around damage to the liver.

These were areas where the market had hoped for a different outcome, and it is easy to understand why – the COVID franchise was a high margin, >$100bn revenue business, and weight loss drugs are perceived to be the most valuable of all pharmaceutical drugs today – witness the incredible rise in the share prices of the two companies to have secured approval for GLP-1 agonists in the diabetes and weight loss settings – Eli Lilly and Company (LLY), and Novo Nordisk.

Pfizer has also run into financial difficulties, making wide-scale redundancies and pledging to realize ~$4bn of operational efficiencies in 2024, and it still has massive debt on its balance sheet, with $31bn of current liabilities, and $62bn of long-term debt reported as of Q423.

Despite all of these issues, again I feel inclined to defend Pfizer’s position somewhat. The company continues to insist it is still moving forward with danuglipron in the clinic – and even if this drug does not make the grade, Pfizer has shown it is not afraid to go out into the marketplace and search for a leading GLP-1 agonist drug developer to acquire. Plus, this sector may be significantly over-hyped, and Pfizer has been very active in other promising fields of therapeutic development.

The Seagen acquisition, barely seems to warrant a mention, but antibody-drug-conjugate drugs – with their ability to essentially deliver targeted chemotherapy inside of cells – are in high demand, and may emerge as the most significant therapeutic development in oncology since immune checkpoint inhibitors. Gaining control of Seagen, responsible for 3 of the thirteen approved ADC drugs, may one day be viewed as a significant coup for Pfizer.

While Pfizer may be laden with debt, it is also flush with cash, too, reporting >$45bn of near tear cash as of October 2023, and total current assets of $74bn. Its strong cash flow has allowed the company to invest >$10bn in R&D in 2023, and pay >$9bn to shareholders through dividends. Many observers have argued that the company should buy back some of its nearly 6bn shares, but I can forgive management for prioritizing other areas – the company has a unique structure that is arguable, if you treat Pfizer stock more like a fixed instrument than a security, as much of a strength as a weakness.

Concluding Thoughts

Unfortunately, as Pfizer closes the curtain on a difficult year, the market has shown little enthusiasm for its FY24 guidance, or its recent performance, or its long-term performance.

Whatever you may of the relative strengths and weaknesses of the company – and as I have discussed in this post, it is possible to list and discuss many strengths, the market’s vote is all-important, and with Pfizer working on launching so many new drugs, the prospects of the company smashing analyst’s quarterly earnings forecasts seem remote, with the focus more on managing costs and bedding in new businesses.

That does not make me optimistic about the prospects for Pfizer stock mounting a strong recovery from its historic lows of $27 this year – as in most people’s eyes, it is still dealing with the end of the COVID era impacting its most lucrative, and most temporary franchise ever.

As discussed, while the market may view Pfizer’s COVID exploits as having weakened the company – as evidenced by the Pharma’s falling share price – I would make the contrarian argument that ultimately it can only really strengthen Pfizer’s business in the long term, as it has afforded the opportunity for the company to future-proof itself through an M&A shopping spree.

Personally, it seems to me that management has spent reasonably well, and for that reason, I would have faith that Pfizer stock can realize long-term growth, and remain front and center in key pharmaceutical markets – oncology, autoimmune, vaccination – for many decades to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.