Summary:

- Alphabet’s advertising business is normalizing, with an 11% YoY growth in total advertising revenue, validating previous predictions.

- The expansion of Gemini, Alphabet’s largest AI model, into core products like Google Ads has the potential to significantly impact the digital advertising market.

- Alphabet’s cloud business achieved its first operating profits in FY23, with a 5.2% operating margin, and is expected to continue growing due to enterprise digitalization and AI initiatives.

Ole_CNX

Alphabet (NASDAQ:GOOGL) delivered its Q4 FY23 results on January 30, showing solid growth momentum in search and cloud businesses. As mentioned in my previous article, I noted that the advertising business started to normalize. Alphabet is set to include Gemini in its core products, including search, a move that could potentially help the company maintain its leadership position in the search market. I reiterate a ‘Buy’ rating with a fair value of $160 per share for their A shares.

Ads Business Normalization and Gemini in Search

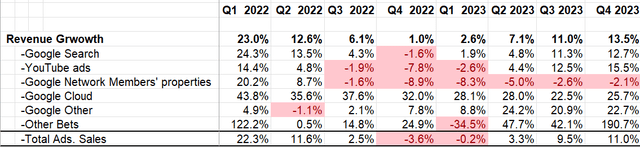

I highlighted in my previous article that the advertising business would begin to recover. In Q4 FY23, Alphabet delivered an 11% year-over-year growth in total advertising revenue, marking a further acceleration from previous quarters, as illustrated in the table below. It validates the accuracy of my earlier thesis.

In January 2024, Alphabet announced the expansion of Gemini, their largest AI model, into core products, including Google Ads. During the earnings call, they highlighted ongoing experiments with Gemini in search, demonstrating a 40% reduction in latency for the Search Generative Experience in English in the U.S. This development has the potential to significantly impact Google Ads in the near future, and its importance for Alphabet’s leading position in the digital advertising market is underscored by several key factors.

Firstly, Gemini has the capability to provide a natural-language conversational experience within Google Ads. Advertisers may leverage Gemini to manage campaigns through chat, with Google AI summarizing preferred landing pages and generating relevant keywords. This approach has the potential to streamline and enhance the effectiveness of digital advertising campaigns.

Secondly, the rise of generative AI poses a long-term risk to Google Search. As alternative AI platforms offer conversational search experiences that may outperform traditional keyword searches, Alphabet must leverage generative AI across all core products to stay competitive.

Finally, Gemini Pro powers Bard, Alphabet’s conversational AI tool complementing search engines. Management has expressed plans to roll out an even more advanced version for subscribers, powered by Gemini Ultra, in the future.

In conclusion, Gemini emerges as mission-critical for Alphabet’s competitive advantage, particularly in traditional search and digital advertising. The integration of generative AI into core products positions Alphabet to stay ahead in the evolving landscape of online interactions and search experiences.

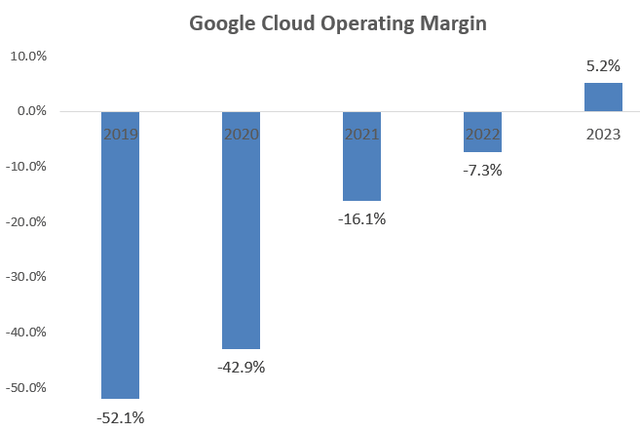

Google Cloud Starts to Generate Profits

In Q4 FY23, Alphabet sustained its growth momentum in the cloud business, achieving a notable 25.7% year-over-year revenue growth. It is worth noting that Alphabet achieved its first operating profits in the cloud business in FY23, attaining a 5.2% operating margin, as illustrated in the chart below.

While Alphabet’s cloud business has a considerable way to go to match Amazon’s AWS, which boasts close to a 30% margin, the encouraging sign is the evident margin expansion in their cloud operations. Several factors contribute to this growth.

Microsoft (MSFT) also reported a robust 19% revenue growth in constant currency for their Intelligent Cloud business in the recent quarter. The overall growth in the cloud industry has been propelled by enterprises’ digitalization and cloud migration projects. Following the global pandemic, there were challenges as some enterprises overspent during that period, prompting them to optimize their cloud workloads. As we move into 2024, it is anticipated that the optimization phase is concluding, and the momentum for cloud migration is expected to continue.

An additional crucial factor is the role of generative AI. Enterprises are racing to enhance their AI capabilities and adopt large-model machine learning. Cloud platforms become a foundational requirement for conducting machine learning, contributing to the growth of Hyperscalers in the cloud industry. This trend is likely to further drive the expansion of Alphabet’s cloud business.

Q4 Review and FY24 Outlook

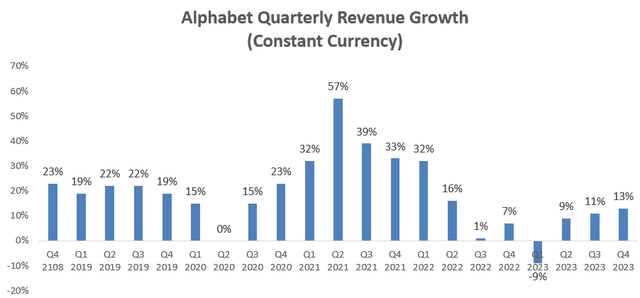

In Q4 FY23, Alphabet sustained its growth momentum by delivering a 13% revenue growth in constant currency. This growth was driven by both the advertising and cloud businesses, as discussed earlier.

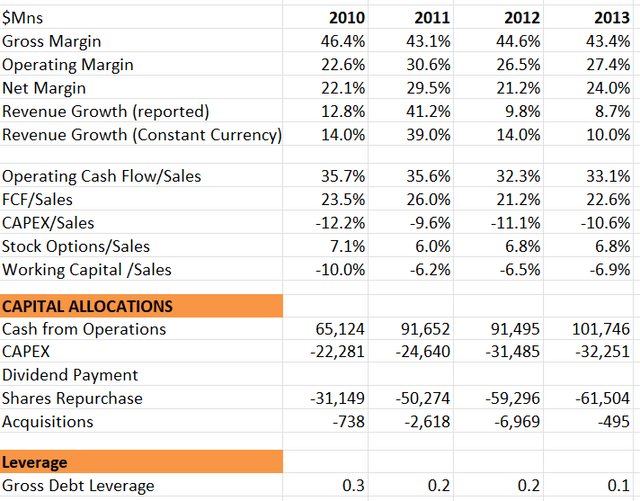

For the full fiscal year, Alphabet generated $69 billion in free cash flow and repurchased $61 billion of its own shares. The balance sheet remains robust, with gross debt leverage standing at around 0.1x, as summarized in the table below.

In FY23, Alphabet’s growth was primarily fueled by subscriptions, cloud services, and the recovery of the advertising business. According to management during the earnings call, subscription-related revenue reached $15 billion in FY23, with significant growth attributed to a surge in subscribers for YouTube offerings.

The cloud business is expected to be a significant driver of Alphabet’s topline growth moving forward. Accounting for 10.8% of group revenue in FY23, the cloud business is poised to continue expanding given the vast addressable market size and additional growth opportunities from AI.

A notable highlight from the earnings call was the announcement of Gemini’s expansion to all core products in the near future, as discussed previously.

Looking ahead to FY24, I anticipate that Alphabet could sustain 20%+ growth in the cloud business, considering the ongoing trends in enterprise digitalization and AI initiatives. Google subscriptions, platforms, and devices are also expected to contribute to another 20%+ growth, with strong momentum seen in YouTube Music and Premium.

Assuming the remaining portion of the search advertising business normalizes at a 7% growth rate, the combined business is expected to grow at a rate exceeding 10% in FY24. Consequently, achieving a 10% type of revenue growth should not pose a significant challenge for Alphabet in the near future.

Valuation

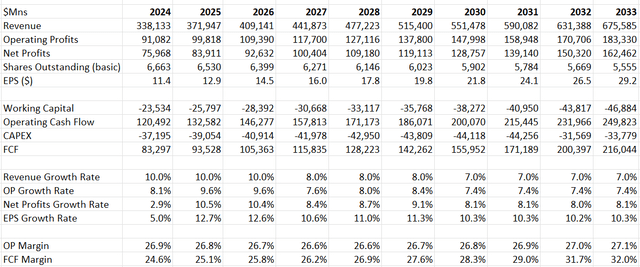

I have revised my model without making changes to the assumptions for revenue growth and margins. As previously discussed, achieving a 10% revenue growth does not necessitate aggressive assumptions, particularly with the continued strong momentum in subscriptions and cloud business. Consistent with the previous model, I do not anticipate margin expansion in the future. Alphabet has increased capital expenditures in recent years, leading to higher depreciation costs expected in the future. Additionally, to remain competitive in the AI landscape, Alphabet must intensify research and development efforts in their AI initiatives, including the Gemini platform.

Alphabet DCF – Author’s Calculations

As Alphabet persists in repurchasing its own shares, the model assumes an annual 2% reduction in shares. The capital expenditures number in the model has been revised, considering management’s indication of a notable increase in capital expenditure levels for FY24 compared to FY23. The assumption is set at 11% of revenue for capital expenditures in FY24, representing an increase from 10.6% in FY23. With all these parameters taken into account, the calculated fair value is $160 per share for their A shares. Currently, Alphabet’s stock price is trading at around 23x of forward free cash flow, a quite reasonable level for a double-digit growth company.

Key Risks

Increasing Capital Expenditures in FY24: Alphabet plans to increase its capital expenditure in FY24, notably higher than its FY23 level. They spent more than $32 billion on capital expenditure in FY23 and $31 billion in FY22. These levels represent more than 10% of their group revenue, a relatively high figure compared to other software companies. However, I acknowledge that Alphabet needs to invest more in the basic infrastructure for their AI machine learning and to meet the increasing demands of cloud computing.

Conclusion

I am encouraged by Alphabet’s growth initiatives in the field of AI, and the strategic decision to apply Gemini to all core products, including advertising, is a smart move. This positions them to maintain a competitive advantage in the evolving AI era. Therefore, I reiterate a ‘Buy’ rating with a fair value of $160 for their A shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.