Summary:

- Alphabet/Google’s Q4 earnings disappointed investors with lower-than-expected ad revenues, causing the stock to drop over 5%.

- Despite concerns about Google’s lack of innovation and clear vision, the company still dominates the search market and leverages AI in its products.

- Google’s solid performance, commitment to development, and undervaluation make it a strong investment with long-term potential.

Wirestock/iStock Editorial via Getty Images

Thesis Summary

Alphabet Inc. (NASDAQ:GOOGL) has just reported its Q4 earnings, and the stock is down over 5% after disappointing investors with lower-than-expected ad revenues, even though the company beat on both EPS and overall revenue.

It would seem that many investors have written off Google, since the artificial intelligence (“AI”) mania has taken place. Sure, this presents many challenges but also opportunities.

I see some interesting similarities between Google and PayPal Holdings (PYPL), which I recently covered here. PayPal, too, is a large and established company with reasonable growth, good profitability and a fair valuation.

But like PayPal, investors fear that the company is failing to innovate and that this could lead to its displacement from its core market.

Of course, I strongly disagree with this thesis. GOOGL still holds a firm grip on the market. However, a new sense of direction, or perhaps even just an actual sense of direction, would certainly serve to renew investor confidence.

Overall, I remain of the opinion that GOOGL is still the best of the magnificent seven.

The PayPal Dilemma

In my last article on Alphabet, I discussed the Q3 earnings. Back then, investors also found a reason to sell Google, even though guidance was beat. In Q3, it was the lack of cloud growth, and now it seems to be the slowdown in ad growth.

However, it’s worth mentioning that the stock has outperformed the market since that last report, up over 12%.

The latest earnings and earnings call give us some more clear insights into what’s going on at GOOGL and what the plans are for the future. I remain of the opinion that the coming years will present many opportunities for GOOGL. But will the company be able to capture them?

Ten years ago, PayPal was at the heart of the fintech revolution. It was one of the most innovative companies in the space, but despite steady growth and profitability, the stock and company have not performed as one might have expected.

Indeed, PayPal became entrenched in its ways, and the competition in the space became fierce. GOOGL now runs a similar risk. The company may have become too big for its own good, lacks a clear vision and is under threat from new competitors.

There are certainly some similarities but also some stark differences, but before we get into this, let’s look at the latest earnings.

Latest Earnings

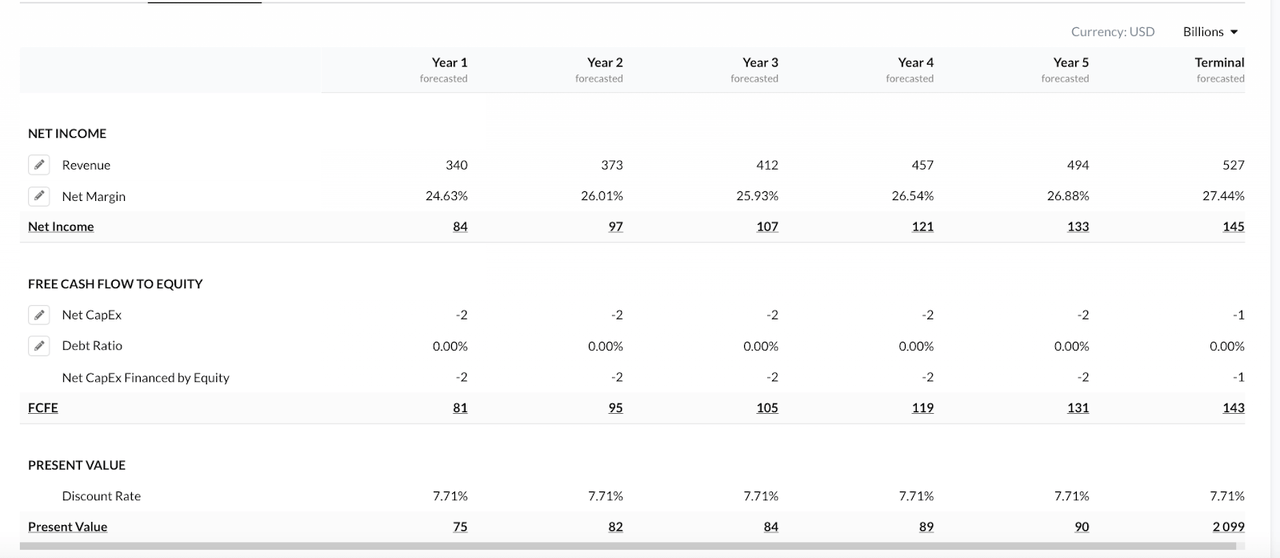

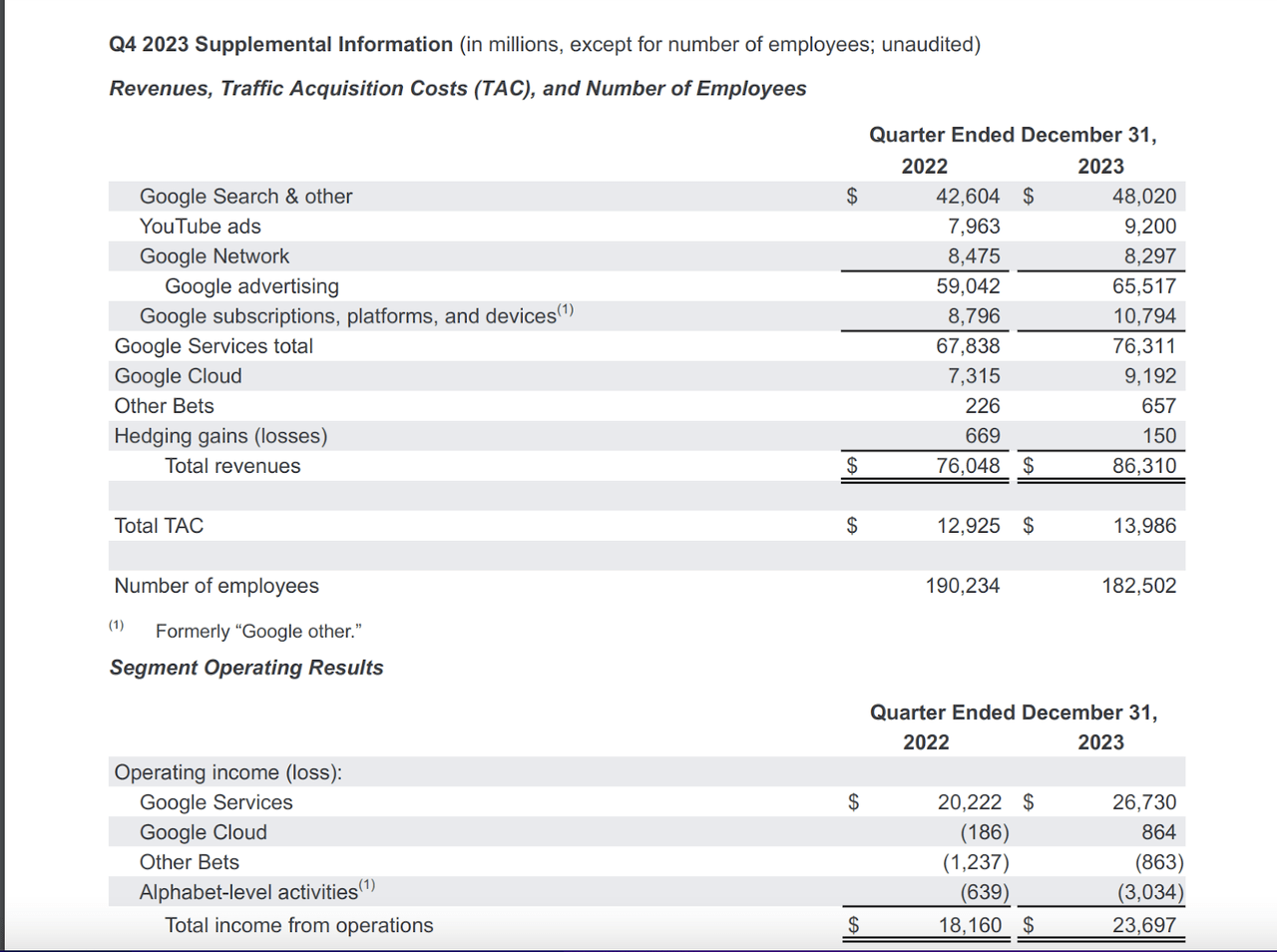

Google beat on revenue and EPS, but the stock is still down over 5%. Let’s look at the breakdown in revenues and operating income to get a better idea of what’s happening.

Google Income Statement (Earnings Release)

As we can see, Search revenues grew by a little under 12% YoY. YouTube ads continued to show strong growth—however, Google Advertising revenues overall came in slightly below what analysts were expecting, $65.5 billion versus $65.8 billion.

Quite surprising was the sudden uptick in Cloud revenues, which, as mentioned above, became a point of concern in the last quarter but, on this occasion, increased over 25% YoY.

Finally, as we can see, GOOGL did even better at increasing its overall income relative to revenues. However, overall income from operations was reduced by the higher than usual costs associated with “Alphabet-level activities”:

Alphabet-level activities included charges related to the reduction in force and our office space optimization efforts totaling $1.2 billion and $62 million in accelerated rent and accelerated depreciation.

Source: Earnings Release.

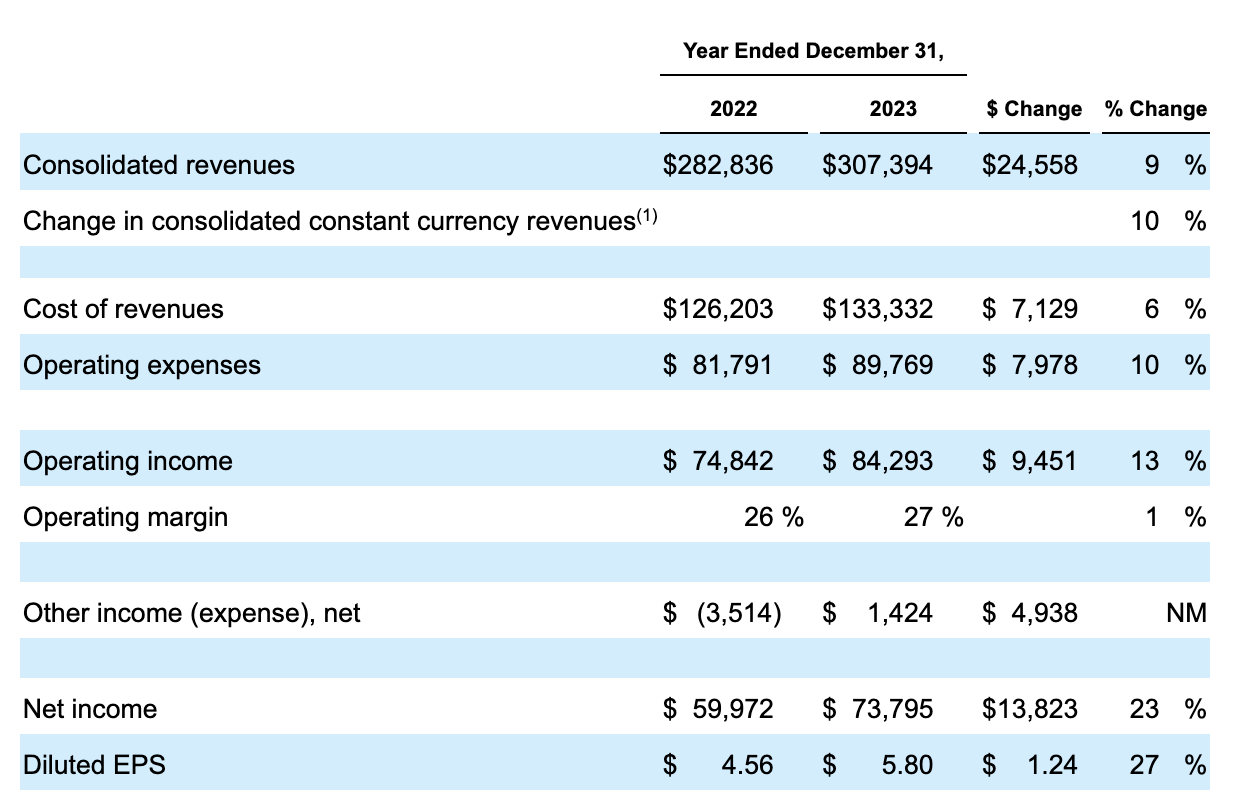

Overall, this is still a pretty solid performance for the company, in which I would highlight the increase in profitability over the year:

Revenues, OI and EPS (10K)

While overall revenues rose 9%, operating income increased 13%, and we saw diluted EPS increase by 27% compared to 2022.

Insights From The Earnings Call

A lot of the issues raised by investors were discussed in the earnings call.

Firstly, over the “concerns” that Google Search may be affected by AI.

Thanks, Justin. First of all, look, we think about effects on Search, obviously, more broadly. People have a lot of information choices. So — and user expectations are constantly evolving. And so we’ve been doing this for a long time. And I think what ends up mattering is a strong, continuous track record of innovation.

Obviously, generative AI is a new tool in the arsenal. But there’s a lot more that goes into Search: the breadth, the depth the diversity across verticals, stability to follow through getting actually access to rich, diverse sources of content on the web and putting it all together in a compelling way.

Source: Earnings Call.

As Sundar Pichai explains here, AI is only one of many factors that can improve and influence search. No doubt, it is a factor that GOOGL will have to strive to introduce, and keep innovating in, but Google’s search, still holds an advantage, so to speak, due to its breadth and depth.

We also got some insight into the re-acceleration of cloud:

Thanks, Mark. On Cloud, let me take that. First of all, a combination of factors. I think definitely excitement around the AI solutions on top of our foundational pillar with data and analytics, infrastructure, security, et cetera. But AI is definitely something which is driving interest and early adoption. And as you saw, that greater than 70% of Gen AI unions are using Google Cloud. And so I think it’s an area where our strengths will continue to play out as we go through ’24, especially when I look at innovation ahead from us on the AI front. And second, I think there are regional variations, but the cost optimizations in many parts are something we have mostly worked through. And I think that was a contributing factor as well.

Source: Earnings Call.

It looks like AI has been directly responsible for helping boost Cloud demand. The implementation of AI tools into Cloud has greatly increased the value offering.

Lastly, here is some good news with other bets:

With regard to Other Bets, we’ve been working to sharpen our investment focus while capturing the upside given compelling technology breakthroughs across the portfolio. For example, last week, Alphabet’s X announced that it would be moving to spin out more projects as independent companies through external capital, giving X the opportunity to bring more focus to the breakthrough technologies it is working on to address some of the world’s most pressing challenges.

Source: Earnings Call.

I like this idea of spinning out more projects into separate companies. Google certainly has enough on its plate with its core offerings. This shows discipline and a commitment to focus on what got the company this far.

Future Outlook

Based on all of this, I continue to be very bullish on the company, and I do not agree at all with those who characterize Google as being a “dinosaur” or those who believe the company is being displaced.

Yes, there are challenges but also many opportunities, and I don’t think it’s fair to compare Google to a company like PayPal, for example.

Firstly, Google still absolutely dominates the search market, with over 83% search volume as of the latest 2023 data. That’s still remarkable and much more than what PayPal ever had in the payment market.

Secondly, the situation with AI is very different here. As it has been made clear, AI is something the company is also leveraging and is already having an impact on Google Cloud and also in the development of Gemini and Search Generative Experience or SGE. Google’s products cannot be undercut, like transaction fees.

And lastly, even though I agree that the company has lacked a clear focus on its innovation strategies, at least it has shown a commitment to developing. Google is still a company that attracts some of the best and most inquisitive minds on the planet. The company has already said it has committed more CapEx for 2024, $11 billion.

I continue to be mystified at these investor reactions to earnings, when Google keeps firing on all cylinders. Nonetheless, as mentioned above, the long-term performance is what matters. Google has outperformed the major indexes over the last 5 years, and my bet is this will continue.

Valuation

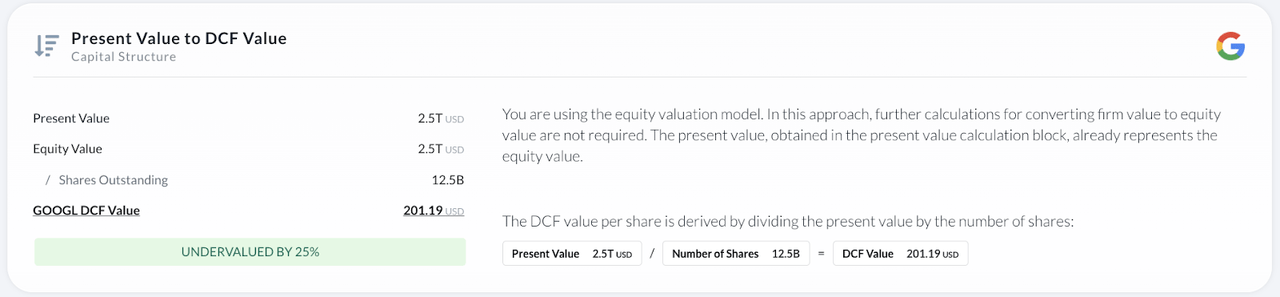

Even after the solid appreciation of the last year, Google has much more to return to investors. As I already wrote about a while ago, this is the best value out of the Magnificent 7. But even using a simple cash flow analysis and analyst estimates, Google should be trading above $200.

The table above reflects analyst revenue estimates over the next five years. I have then applied a discount rate of 7.7%, and a terminal growth rate of 3%. The next margin is expected to improve to around 27%, which is indicative of the higher expectations for EPS growth.

This comes out to an undervaluation of 25%, with a price target of just over $200.

Risks

Google is under threat from many sides, sure, but that just comes with having a wide array of revenues. AI is as much a threat as an opportunity, and I just can’t see how I can price in this threat, when the current evidence doesn’t suggest it.

Yes, there was a slowdown in ad growth, but this was just one quarter. Overall, I am more concerned with how AI and competition could impact margins and also about how continued regulatory pressures could affect future cash flows.

Takeaway

Google continues to fire on all cylinders. The latest earnings report has shown encouraging growth in the cloud, and the earnings call reflects a good commitment from management to focus on improving Google’s core offerings. Perhaps, 10 years down the line, things will be different, but I just don’t see any evidence of that right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video