Summary:

- Tesla, Inc. shares have declined by over 20% since November, highlighting concerns about the company’s product roadmap.

- In recent days, CEO Elon Musk’s $55 billion pay package has been deemed excessive by a Delaware judge and voided, raising controversy and potentially leading to Mr. Musk’s exit.

- If Musk leaves and takes his AI and Robotics projects with him, Tesla’s shares could plummet by over 80% as it reverts to automaker valuation multiples.

jetcityimage

To preface, in November, I wrote a cautious follow-up article on Tesla, Inc. (NASDAQ:TSLA), arguing that investors should be wary around the hype surrounding the Cybertruck launch, since Tesla has been notorious for over-promising and under-delivering.

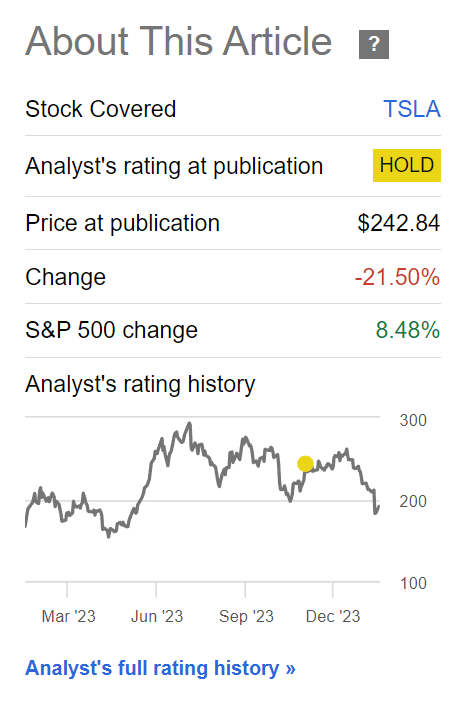

My caution was not misplaced, as Tesla shares have declined by more than 20% since my article, punctuated by an especially poorly received Q4 earnings report (Figure 1).

Figure 1 – Tesla shares have been weak since November (Seeking Alpha)

Since countless other analysts have pored over Tesla’s quarterly earnings, I will not waste everyone’s time by rehashing the details. Instead, I will take some time to discuss Elon Musk’s future with the company.

In recent days, there have been reports that Elon Musk’s gargantuan $55 billion 2018 pay package has been voided by a Delaware judge for being excessive. Mr. Musk has also been very vocal in recent weeks that he would be uncomfortable developing artificial intelligence (“AI”) and robotics at Tesla, unless he has over 25% voting control of the company.

Given Mr. Musk only owns about 13% of the carmaker, there is a very real possibility he may call it quits and focus his attention and fortune on developing his other business pursuits like SpaceX, X, Neuralink, and xAI. So, what might Tesla be worth without Mr. Musk at the helm?

Background On Gigantic Pay Package For Mr. Musk

First, a bit of background on the gigantic pay package that has been at the center of the latest controversy associated with Mr. Musk. While Tesla today is known as one of the most valuable companies in the world based on market capitalization, that was not the case in 2018, when it was just a fledgling auto maker with $50 billion in market cap (Figure 2).

Figure 2 – Tesla’s market cap has grown more than 10x in 5 years (Seeking Alpha)

Therefore, in order to retain and incentivize Mr. Musk, the company’s board of directors crafted the “2018 CEO Performance Award” program. The performance award consisted of 12 vesting tranches of stock options, with a vesting schedule “based entirely on the attainment of both operational milestones and market conditions.”

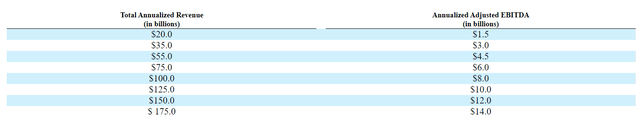

On the market side, the market capitalization milestone for the awards began at $100 billion in market cap (roughly double the company’s market cap at the time) and increases by $50 billion thereafter. Operationally, the company must also attain revenue and adjusted EBITDA milestones as per Figure 3.

Figure 3 – Operational milestones for 2018 CEO Performance Award (TSLA 2018 10K report)

Mr. Musk’s 2018 pay package continues to be the richest CEO pay package in the history of corporate America, with Mr. Musk potentially earning $55 billion in shares if Tesla hits all of its operational goals and the company’s market cap reached $650 billion.

As a reminder, in 2017, Tesla generated $11.8 billion in revenues and $471 million in adjusted EBITDA (defined as net income attributable to common stockholders before interest expense, provision for income taxes, depreciation and amortization and stock-based compensation). However, by the end of 2018, Tesla had already surpassed the first tranche of the revenue and adj. EBITDA targets of the compensation program, with revenues of $21.5 billion and adj. EBITDA of $2.4 billion.

The crux of the lawsuit filed by some aggrieved shareholders was whether Tesla’s board set goals that were too easy to achieve. Furthermore, was the compensation plan even necessary to retain Mr. Musk’s services, given Tesla shares represent the majority of Mr. Musk’s wealth?

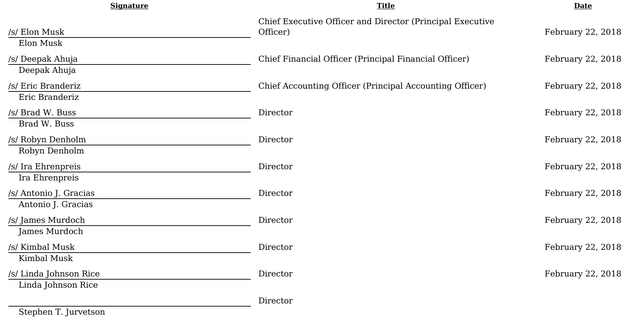

On January 30th, 2024, a Delaware judge ruled that the 2018 CEO Performance Award was indeed too excessive and that the directors who negotiated the pay package had appeared beholden to Mr. Musk (Figure 4).

Figure 4 – Tesla board of directors, 2018 (Tesla 2017 10K report)

Readers should note that Tesla’s board at the time included his brother (Kimbal Musk) and business associates (Brad Buss was the CFO of SolarCity, which was acquired by Tesla; Ira Ehrenpreis and Antonio Gracias were investors in SpaceX).

If the court ruling survive potential appeals by Mr. Musk and Tesla, then Mr. Musk may have to forfeit more than $50 billion dollars worth of vested stock options.

Should Investors Rejoice?

On the surface, investors should rejoice at the court verdict, since if the stock options under the 2018 CEO Performance Award are canceled, then their dilution in Tesla’s ownership is reduced by ~9%.

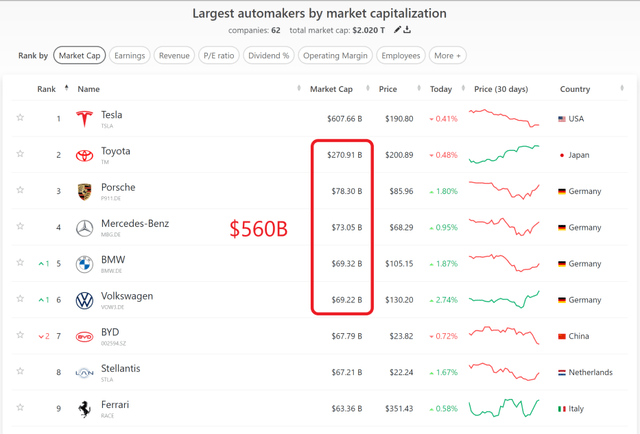

However, the ramifications of this court ruling may be more complicated than a case of simple share dilution. The problem is that to many investors, Elon Musk is the face and soul of Tesla. Mr. Musk’s aura has allowed the company to seemingly defy gravity, achieving a market cap greater than the next 5 largest automakers combined (Figure 5).

Figure 5 – Tesla is worth more than the next 5 largest automakers combined (companiesmarketcap.com)

Unfortunately, Mr. Musk has stated in recent weeks that unless he has more than 25% voting control of Tesla, he is reluctant to develop his AI and robotics ventures inside the company.

Putting aside the potential conflict of interest highlighted by Mr. Musk’s comments, investors in Tesla need to face the remote but very real possibility that Mr. Musk may decide the hassle of dealing with public investors not worth his time and choose to leave the automaker to pursue his other business ventures like X (Twitter), SpaceX, Neuralink, and xAI.

Valuing Tesla As A Carmaker

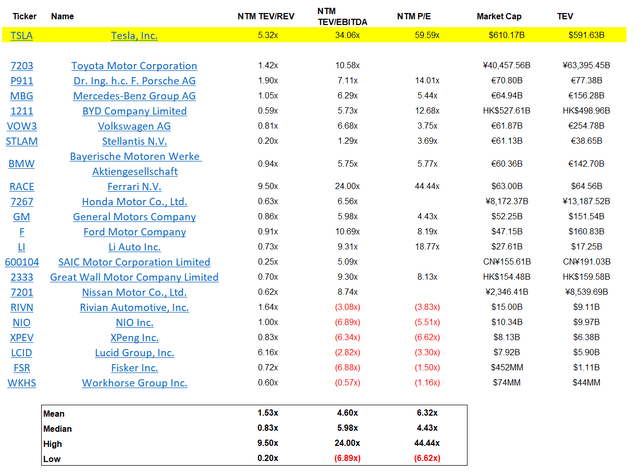

If Mr. Musk does decide to leave Tesla and take his AI and Robotics teams with him, Tesla my lose the valuation premium it currently enjoys. Currently, Tesla is trading at 5.3x Fwd EV/Revenues, and 34.1x Fwd EV/EBITDA. However, the automotive industry trades at a median Fwd EV/Rev of 0.8x, Fwd EV/EBITDA of 6.0x (Figure 6).

Figure 6 – Automotive industry valuations (Author created with tikr.com)

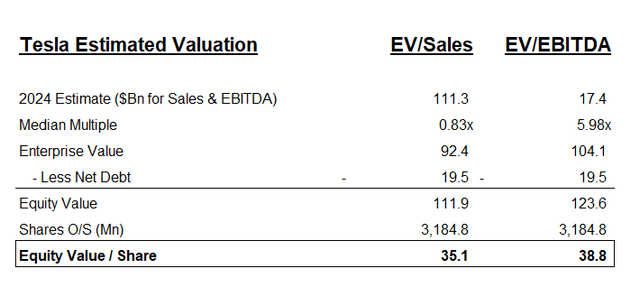

So if I apply industry median multiples to Tesla, I calculate Tesla’s automotive business may be only worth $35 to $39 / share, or a stunning 80%+ downside to Tesla’s current ~$190 share price (Figure 7).

Figure 7 – Tesla’s valuation as an automaker (Author created)

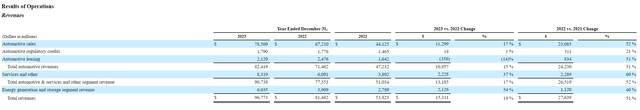

Of course, this is only a rough estimate, as Tesla’s revenues currently include revenues from regulatory credits and the energy generation and storage business (Figure 8). Furthermore, the company may be carrying costs associated with AI and Robotics that can be shed if Elon leaves Tesla and the company retrenches to just manufacturing cars.

Figure 8 – Tesla revenues by segment (TSLA 2023 10K Report)

However, the bulk of Tesla’s revenues and earnings are derived from manufacturing and selling cars, so the truth should not be too far from the $35-39 range.

Risks To Being Cautious

So far, I have only talked about the downside if Mr. Musk decides to leave the company and takes his AI and Robotics growth projects with him. The reality is that, most likely, Mr. Musk and Tesla will come to some sort of amended compensation agreement that is acceptable to the Delaware courts and the whole controversy will blow over in a few quarters. Don’t forget that Mr. Musk remains the largest individual shareholder of Tesla with a 13% stake, so he would not want to see his shares plummet by 80% if he leaves.

On the upside, there is always the possibility that Tesla can introduce new products and even entire business lines like the Tesla Optimus robots, that can deliver tens to hundreds of billions in future revenues.

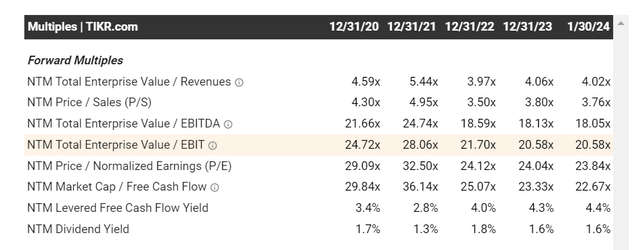

Furthermore, an industrial automation company, Rockwell Automation (ROK), is valued at 4.0x EV/Revenues and 18.0x EV/EBITDA, so any new robotics business from Tesla may be valued at higher than automotive multiples (Figure 9).

Figure 9 – ROK valuation multiples (tikr.com)

However, for now, I believe investors are giving Tesla too much benefit of the doubt for businesses and products that are not even close to commercialization.

Conclusion

Recent controversy regarding Elon Musk’s 2018 compensation agreement has raised a question of whether Mr. Musk stays with Tesla in the long run. Mr. Musk has stated he feels uncomfortable developing AI and Robotics in a company where he controls less than 25% of the voting shares, so his departure is a small, but real possibility.

Looking at Tesla’s businesses, if Mr. Musk departs and takes his AI and Robotics growth projects with him (never mind the legality of doing so), Tesla’s share may have more than 80% downside risk if it is valued like other automotive peers.

I personally do not believe Tesla, Inc.’s unproven “growth” opportunities are worth $150 / share, so I remain cautious on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.