Summary:

- Nvidia Corporation’s stock price gain of +45% since August makes a steep sell-off in 2024 more likely, not less.

- Overvaluation stats and the cyclical nature of Nvidia’s business model are reasons for serious concern.

- Increasing AI-chip competition and a potential recession should lead to sliding earnings growth rates and a material drop in share pricing.

LittleBee80/iStock via Getty Images

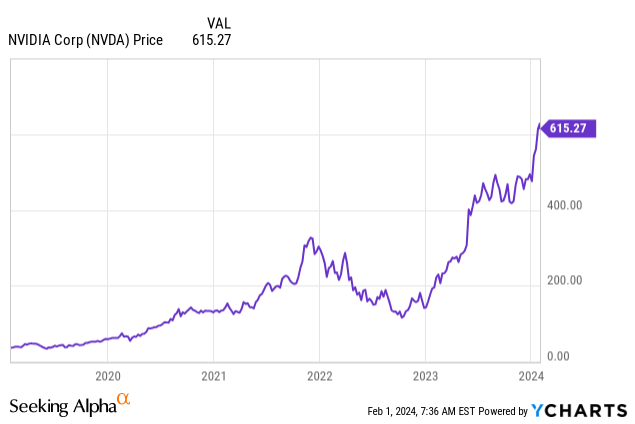

I made a bold call in late summer here that Nvidia Corporation (NASDAQ:NVDA) would crash and burn into the beginning of 2024. Well, I will admit such did not exactly play out for investors. Instead, the share price rose from $423 to $615 yesterday, good for a +45% jump in value. However, my long-term view hasn’t changed that a wicked sell-off in shares is approaching.

YCharts – NVIDIA, 5 Years of Weekly Price Change

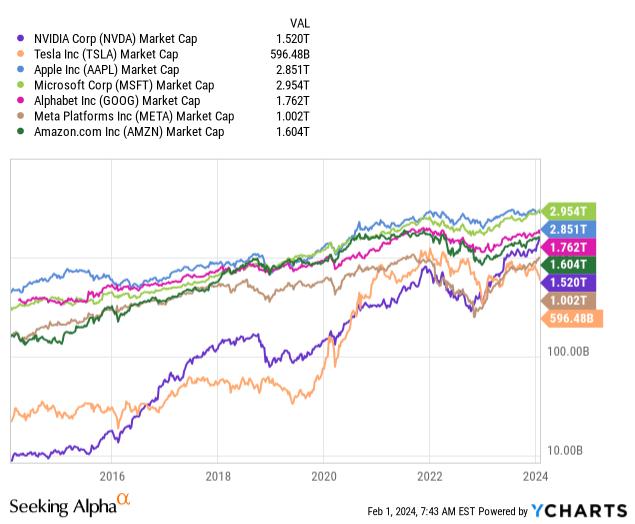

Why? Two factors are part of my thinking. The first is what everyone debates on a daily basis: the overvaluation on trailing fundamentals. The second and equally important reason is Nvidia operates a cyclical semiconductor business. With an equity market capitalization reaching for $1.5 trillion, you have to seriously ask yourself if this AI-chip craze valuation really deserves mention in the same league as less-cyclical Apple (AAPL), Microsoft (MSFT), Alphabet-Google (GOOG) (GOOGL), Meta Platforms (META), and Amazon (AMZN) for total company worth?

YCharts – NVIDIA vs. U.S. Big Tech Leaders, Equity Market Capitalization, Since 2014

Amazingly, believe it or not, Nvidia’s share performance gain over 10 years (150x your investment from early 2014) has far surpassed the previous Big Tech growth darling of Tesla (TSLA), which is already fading markedly for investor returns from mushrooming competition. My argument is Nvidia will soon suffer the same fate, where competition reduces sales growth and crushes future expectations for earnings.

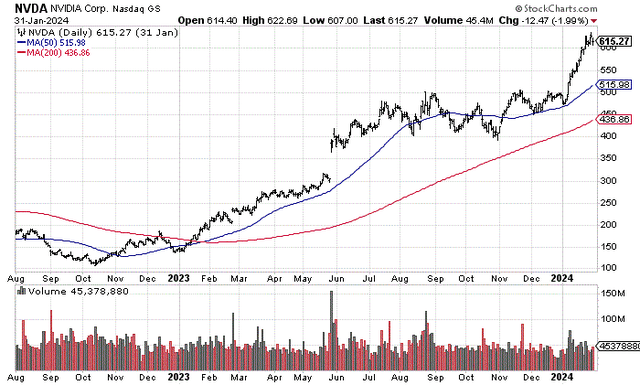

StockCharts.com – NVIDIA, 18 Months of Daily Price & Volume Changes

Crazy Overvaluation

Without a doubt, the +450% Nvidia price gain from October 2022 has everyone questioning how high this stock can go in 2024. For some “gee whiz” stats, Nvidia by itself has increased the S&P 500’s (SP500) total value by +4% and the Wilshire 5000 stocks by +3% over the last 16 months!

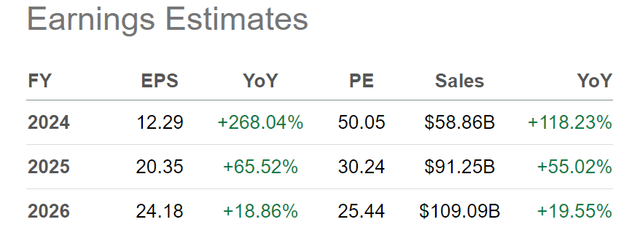

Wall Street analyst consensus estimates FY 2026 will DOUBLE FY 2024 levels (January 2023 to January 2024), which should outline a near TRIPLE of 2022-23 numbers. With all the euphoria floating around this stock, mentioning the fact competition may not allow such a large increase instantly gets booed as impossible. That’s how investors think during the tail-end of an incredible upsurge for a particular stock or industry.

Seeking Alpha Table – NVIDIA, Analyst Estimates for FY 2024-26, Made February 1st, 2024

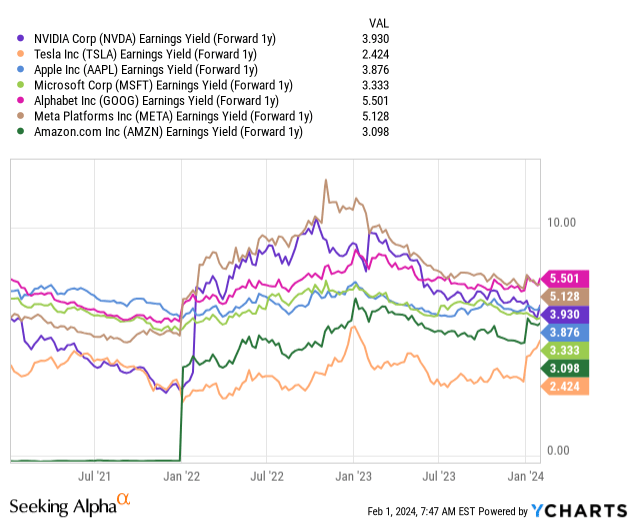

For a forward 1-year valuation on projected earnings yield, bulls point to the fact that 2025-26 numbers should provide a decent 3% to 4% rate for buyers around $600 per share today. I will admit if the current forecast for growth comes to fruition, Nvidia will no longer be wildly overvalued, just mildly so. My gripe is a 2024-25 recession will bring less capital spending by big businesses, even on AI-projects, while other chips with comparable output will come to market. For example, Advanced Micro Devices (AMD) just launched a competing AI chip to meet strong demand in the marketplace. Many techies believe the AMD architecture might even be a better choice in the long run vs. Nvidia’s high-end offerings.

YCharts – NVIDIA vs. U.S. Big Tech Leaders, Forward 1-Year Earnings Yield, Since 2021

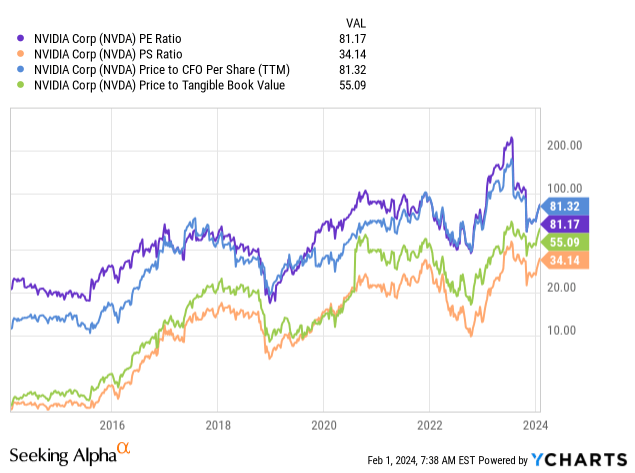

You have to gulp and accept the high-growth Nvidia story as gospel truth, or else the company is insanely overvalued. Let’s look at a 10-year chart of price to trailing fundamentals. Whether reviewing earnings (81x), sales (34x), cash flow (81x), or tangible book value (55x), it’s not hard to understand today’s underlying company valuation metrics are between 4x and 15x the levels of early 2014. The current valuation is unstainable without massive sales and income expansion between 2024-25.

YCharts – NVIDIA, Basic Fundamental Ratio Analysis, Price to Trailing Results Since 2014

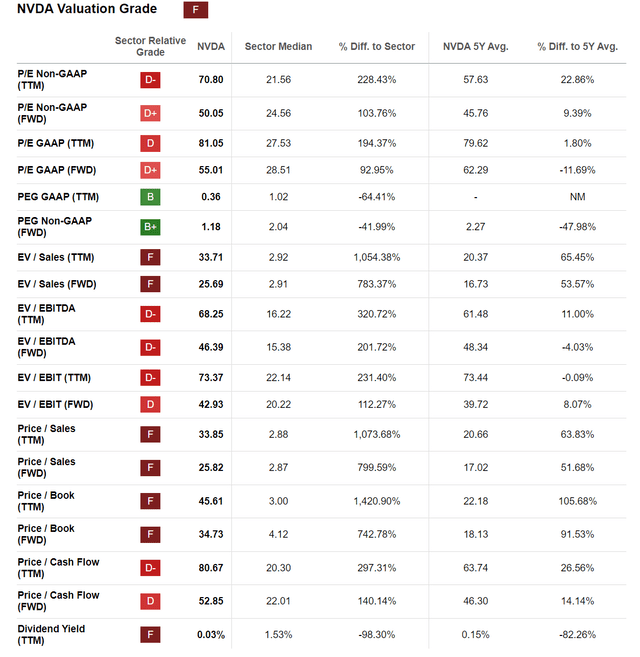

Seeking Alpha’s Quant Valuation Grade system puts an “F” score on Nvidia, and I believe that is being generous. Compared to sector averages or the company’s 5-year history, you are not getting much for your investment dollar upfront. It’s the “promise” and estimates of outstanding growth you are purchasing.

Seeking Alpha Table – NVIDIA, Quant Valuation Grade, February 1st, 2024

Ramping Semiconductor Competition

I wrote an article in September 2022 here explaining Tesla’s near monopoly in global electric vehicle production/demand would be a future risk to consider. Effectively, expanding competition would change its future in a bearish way, as Tesla’s primary “moat” to protect the business disappeared. Today, worries about new EV entrants at the same or lower prices points than Tesla models are starting to sink in. Honestly, extensive competition into 2025 and a recession soon could cause earnings to disappear. Auto price cuts mixed with still rising production costs mean declining sales growth rates on top of sharply reduced operating margins will generate far less cash flow and income than bulls thought possible in late 2021. Truth be told, falling business earnings results/expectations are the end game of competitive market forces.

Over the last six months, all the leading semiconductor names and more have announced the development of inhouse AI chips to compete with NVIDIA. AMD, Google, Amazon, Apple, Qualcomm (QCOM), International Business Machines (IBM), Intel (INTC), and many others have begun spending tens of billions industrywide on research and future production. In the end, Nvidia’s lead may look insurmountable, but it is not from a practical scientific standpoint. My view is that Nvidia stock could be topping as we speak on peak business growth “rates,” much like Tesla did during 2021.

Cyclical History

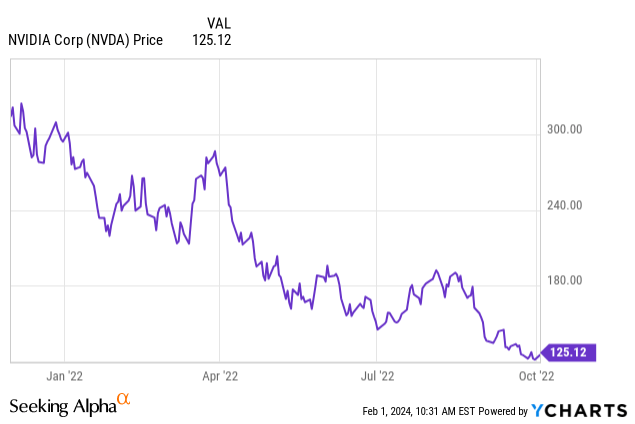

Even worse news for Nvidia cheerleaders is that the company has a track record of booms and busts in its operating results and stock quote. Below I have charted the last bust, where crypto mining chip demand peaked, and an industrywide slowdown smashed the stock quote between December 2021 and October 2022. Over 10 months, the quote fell from $320 to almost $100, good for a -70% investor bloodbath. I will note I correctly called for a drop from $300 in November 2021 here to a price closer to $100 in 2022.

YCharts – NVIDIA, Daily Price Changes, December 2021 to October 2022

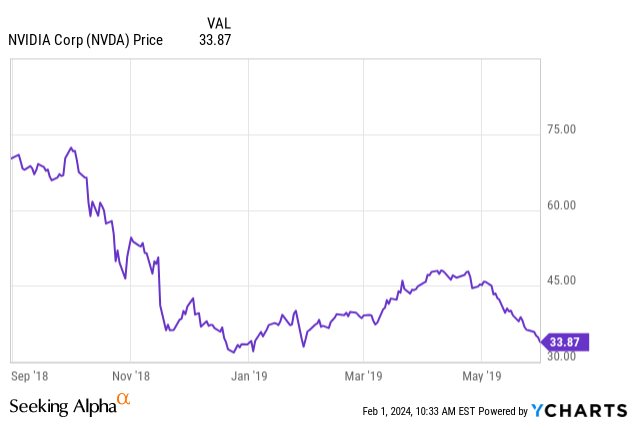

Another oversized dump came in late 2018. Between October and December 2018, Nvidia’s share price plunged by -55%. Somewhat higher interest rates in America and results missing lofty expectations caused the implosion.

YCharts – NVIDIA, Daily Price Changes, September 2018 to May 2019

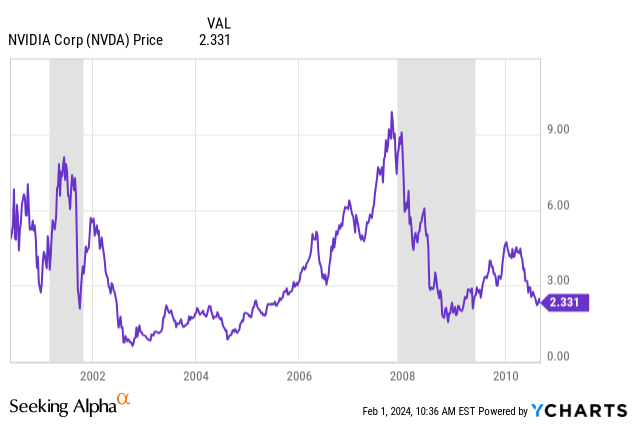

We can also review recession performance during 2000-02 and again in 2007-09. Measured from the middle of the 2000 Dotcom Tech bubble peak, Nvidia fell -80% from both its 2000 and 2001 high trades into late 2002. From late 2007 to late 2008, shares dropped an incredible -75%. Added together, buy-and-hold investors at the bubble peak in the year 2000 lost more than half their money (-65%) into the middle of 2010, a whole decade later!

YCharts – NVIDIA, Weekly Price Changes, Recessions Shaded, June 2000 to August 2010

Final Thoughts

I would rate my August 2023 Nvidia crash call as both wrong and early. If a shocking share price decline under $300 is coming this year, selling now is still clearly the correct course of action for portfolio management.

The investment endgame in booms/manias is the higher a stock rises vs. its underlying long-term worth, the harder they eventually fall in the bust phase. The late-1990s Dotcom Tech bubble is perhaps the greatest example of how this works in modern times. Can bulls make a valuation argument that high growth deserves a high valuation? Sure, but if that growth reverses into minor expansion rates, or heaven forbid negative growth in a severe economic recession with mushrooming competition later in 2024 and all of 2025, Nvidia is a prime candidate for horrific investment returns going forward. I am talking about significant investor losses for those unfortunate individuals buying above $600 per share, stretched out over several years, with the lingering potential for a rapid crash in price of -50% to -60%.

Please don’t say it cannot happen! Tesla’s fall from grace, slipping from $410 a share in November 2021 to $185 currently (-55%) is a testament to the ill effects of losing a near-monopoly position in today’s highly competitive world of technology design and sales.

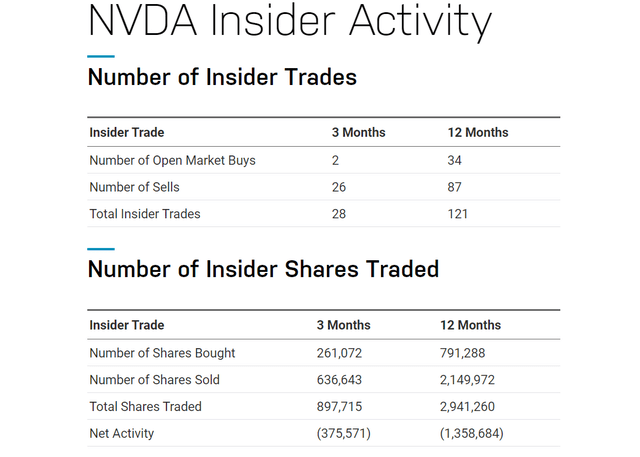

Net insider sales are continuing, which isn’t the best vote of confidence by management for Nvidia shareholders. While insider sales are not screaming to get out of the stock, those running the company are happy to liquidate stakes at extended 2023 and 2024 pricing.

Nasdaq.com – NVIDIA, Insider Transactions, 12 Months

How could Nvidia continue to rise in price during 2024? That’s the question everyone is asking themselves. My view is it will be quite difficult to remain above $600.

A long list of improbable events will have to play out to create any type of meaningful gain in NVIDIA. We need to avoid recession is #1, which I feel may be an inevitable economic bummer for everyone in America from the ongoing credit/bank liquidity contraction taking place since the summertime.

The U.S. stock market and related sentiment about the AI future needs to stay abnormally elevated. I remain worried both of these ingredients are unstainable in January 2024. Any type of black swan event from rising crude oil prices on Middle East war, China getting serious about preparing for an attack on Taiwan, Russia invading a NATO-backed Baltic state, Texas seceding from the Union, are just some examples of potential shakeups in the blind optimism visible on Wall Street today.

Finally, competition cannot under any circumstances invent cheaper and faster AI chips in 2024. If someone does, NVIDIA will crash.

Basically, a “goldilocks” scenario is now the prerequisite to hold up the Nvidia Corporation share quote. Since I am not a fan of fairy tales, I am keeping my Strong Sell rating from August for the stock. Either my bearish viewpoint will be redeemed, or my name will be mud later in the year with Nvidia bulls and long-time shareholders. I will take my chances.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am short Big Tech through PSQ, SH, QID holdings. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.