Summary:

- Amazon.com, Inc. stock has almost doubled in value from its 2022 slump. Yet it remains some way from recovering its July 2021 peak valuation.

- This differs from Amazon’s mega-cap peers that have recently made good previous losses to trade back at their all-time highs, despite Amazon’s consistent delivery of positive progress to its core businesses.

- The continued ramp of higher margin ad and AWS sales, alongside e-commerce regionalization efficiency gains, remain key near-term value-accretive factors to driving Amazon stock back towards its all-time highs.

HJBC

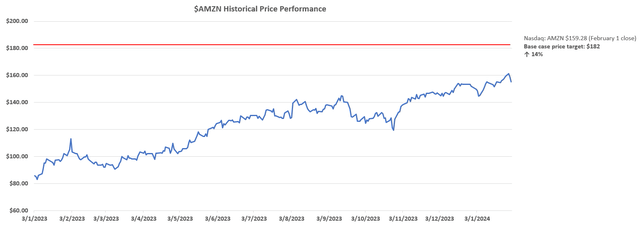

Amazon.com, Inc. (NASDAQ:AMZN) has kicked off 2024 as one of the laggards in the Magnificent Seven. Specifically, its mega-cap Internet peers in the cohort with comparable exposure to impending AI opportunities have recently surged towards all-time highs. Meanwhile, Amazon stock remains 14% from its July 2021 peak despite its persistent recent uptrend.

Yet Amazon’s Q4 outperformance, and management’s optimistic outlook for further growth and margin expansion in the year ahead, reinforces confidence in the stock’s upside potential. The setup is bolstered by full-year improvements expected from Amazon’s recently implemented regionalization strategy for e-commerce, the growing mix of high-margin ad sales, and ramp-up of Amazon Web Services, or AWS, AI opportunities. This is corroborated by a stronger-than-expected revenue guidance for Q1 of $138 billion to $143.5 billion, besting the average consensus estimate of $142.2 billion.

Specifically, we continue to believe that advertising sales, though the smallest mix of Amazon revenues, remain an overlooked factor for catapulting the stock toward new highs this year. In addition to the Summer Olympics and U.S. Presidential Elections, which will drive ad dollar expansion this year for the industry, Amazon is also well-positioned for secular demand trends for digital advertising. These include increasingly cyclical-resistant demand observed for retail media and video streaming formats, which are two channels that Amazon has an expansive reach in. And this reach is complemented by Amazon’s massive trove of first-party (“1P”) data critical to reinforcing measurability and performance for advertisers, making it an industry share gainer ahead.

Taken together with the ramp of AI monetization through Bedrock and CodeWhisperer, alongside the anticipated full-year impact of e-commerce’s regionalization overhaul, 2024 represents a year of idiosyncratic strengths for Amazon. The stock is also trading 44.4x NTM earnings and 2.6x NTM sales, which underperforms Amazon’s historical 10-year average of 57x and the Magnificent Seven’s average on a relative basis.

We believe this combination represents a sufficiently de-risked setup for Amazon’s inherent sensitivity to ongoing macroeconomic uncertainties given its elevated exposure to consumer end-markets. And the idiosyncratic strengths are expected to prevail through the year and usher the stock back to its all-time highs.

Market-Defying Advertising Tailwinds

Similar to its e-commerce business, Amazon’s emerging advertising revenue stream is inherently sensitive to macroeconomic uncertainties. Although inflationary pressures have largely ceded, with the Fed positioned for rate cuts later in the year, uncertainties remain on whether an economic soft-landing has been achieved. Data remains mixed, with relative strength in the labor market and consumer spending being offset by dwindling pandemic-era savings, rising debt, and surging delinquency rates.

However, Amazon shows company-specific strength in overcoming the lingering cyclical risks faced by its advertising business. In addition to secular tailwinds underpinning the broader digital advertising industry, Amazon retains the best-in-class retail media advertising format, which has gained momentum in recent months. This is corroborated by continued acceleration in Amazon’s advertising sales during the fourth and busiest quarter of the year.

Specifically, advertising revenue grew 27% y/y and 22% sequentially to $14.7 billion in Q4, with management remaining optimistic for the business’ outlook in the current quarter despite the typical seasonal slowdown. Key drivers ahead for the emerging pillar of revenue growth include Amazon’s recent rollout of new advertising tools aimed at optimizing return on ad spending (“ROAS”) for customers. They include the integration of generative AI solutions across the campaign creation and deployment process to maximize efficiency gains, access to “sponsored TV” ad formats on Prime Video for Amazon.com. Spend less. Smile more. merchants, and an array of key performance measurement capabilities.

Amazon.com Capitalizes on Retail Media Ad Demand

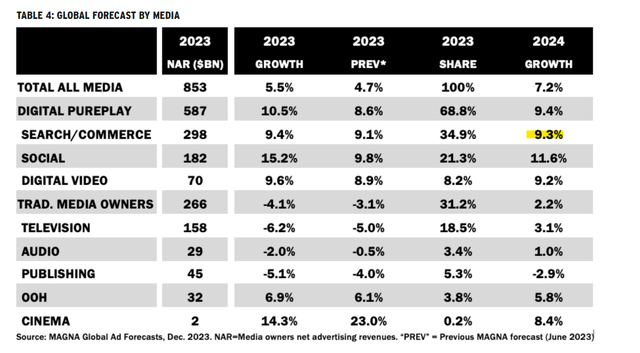

The tailwinds ahead for Amazon’s core search and display ads on its e-commerce storefront are also consistent with current market forecasts. Media intelligence firm MAGNA currently predicts 20% YOY growth (ex-China) in demand for advertising on retail media formats in 2024, leading the search ad segment’s anticipated 9.3% YOY growth.

And Amazon is well positioned to lead this trend, given its organic 1P data advantage generated through the core e-commerce business. Specifically, MAGNA predicts retail media formats to account for close to a fifth of global “search-based” advertising through 2024, up from 15% in 2023. This is consistent with Amazon’s anticipated annual advertising revenue run-rate of almost $60 billion exiting 2023. The amount represents almost a fifth of proxied global search-based ad sales when combined with forecast Google Search (GOOG, GOOGL) ad revenue of about $265 billion this year.

Amazon’s integration of AI-enhanced tools for ad campaign creation also enables productivity gains for advertisers, making it an economically competitive format against those offered by rivals like Google’s Performance Max. This is coupled with consistent improvements to Amazon’s ad targeting and performance measurement capabilities with AI/ML enhancements. The combination effectively reinforces Amazon’s appeal to advertisers and, thus, its share of retail media format opportunities ahead. It also bodes favorably for increasing ad spend optimization trends observed through the past year dominated by industry belt-tightening due to macroeconomic uncertainty.

The ensuing ad cost efficiencies also complement the e-commerce advertising platform’s close proximity to checkout as well, which drives conversion and, inadvertently, improved return on ad spending (“ROAS”) for advertisers.

Prime Video’s Penetration Into SVOD Opportunities

In addition to retail media, Amazon is also breaking into video advertising opportunities through Prime Video. Specifically, Prime Video in the U.S. has started rolling out ads earlier this week as Amazon had previously planned. The ad integration rollout will expand to international regions later this year, including the UK, Germany, and Canada in 1H24, then France, Italy, Spain, Australia and Mexico in 2H24. Prime members have the option of paying an additional $2.99 per month to go ad-free on the streaming platform.

We view this as a timely move by Amazon, as the transition of ad dollars from linear TV to direct-to-consumer streaming accelerates. Specifically, AVOD formats have been relatively resilient when compared to other traditional advertising formats, benefitting from the rapid transition of linear TV ad dollars. MAGNA predicts demand for AVOD formats to accelerate further this year to more than 9% y/y, compared to 6% observed through 2023.

Much of this will be driven from the secular decline in demand for advertising on legacy linear formats, in addition to incremental market share from secular growth in digital advertising. The increasing integration of live sports in streaming platforms, such as Thursday Night Football on Prime Video, is also accelerating the erosion of linear TV ad dollars. With ad engagement and reach being one of the highest during live sport events, this means a boon for Amazon in its initial rollout of ad-supported Prime Video.

And Amazon is likely to quickly emerge as a share gainer, with Prime Video expected to become a critical driver of acceleration in ad revenue growth. The platform currently garners more than 115 million monthly active users (“MAUs”) in the U.S. alone, representing more than three-quarters of its Prime subscriber base in the region. And unlike rival Netflix (NFLX), which has also recently introduced an ad-supported service, Amazon automatically “defaults” its Prime members into the ad-supported tier of the video streaming platform. This accordingly amplifies Amazon’s reach on day one, and bolsters its ability to “compete for eyeballs,” as Netflix puts it, which is a critical consideration for advertisers.

As discussed in a previous coverage, streaming users are also mostly ad-tolerant, regardless of affluence or demographics. Recent findings show little correlation between pricing and subscription preferences in streaming, and that more affluent American households are actually willing to pay less than per month on average for ad-free services. This corroborates durability in the anticipated volume of Prime Video audience that will stay within the default ad-supported tier, and reinforce Amazon’s reach for advertisers. Amazon’s intended strategy of airing less ads than traditional linear TV and rival streaming formats is expected to be another link in keeping Prime subscribers in the default ad-supported tier. The strategy effectively limits the adverse impact on the value proposition that Prime brings to subscribers, which, in addition to fast and free shipping, include other media perks as well.

While expansive reach is a key advantage for Amazon in securing advertisers’ interest, the company also plans to sell Prime Video ad slots at a competitive rate. This diverges from the go-to-market strategy opted by rivals like Netflix, which stormed out the gates by charging advertisers “almost twofold the average market rate”. In addition to reach and pricing, Amazon’s streamlined shopping ecosystem is another competitive advantage in securing ad dollars. As mentioned in the earlier section, Amazon’s services are often at the closest proximity to consumers’ checkout point. This means Prime Video ads are likely to be conveniently integrated with Amazon.com. Spend less. Smile more. to facilitate higher conversion levels and improve ROAS for advertisers. Taken together, Amazon is well-positioned to emerge as an accelerated share gainer in the AVOD advertising market. And this is already corroborated by strong industry sentiment, with industry marketers citing strong demand for Prime Video ad placements across merchants.

In addition to ad dollars, Amazon’s continued roll-out of ad-supported Prime Video is also likely to generate incremental subscription revenue. Although most streaming users show high ad tolerance, a small portion of subscribers are expected to pay the additional $2.99 per month for an ad-free viewing experience. Even if just 10% of Amazon’s U.S. Prime Video MAU base of 115 million opts into the ad-free service, that would represent an additional $400+ million of subscription revenue per year. Although this is nominal when compared to the annual subscription services and advertising revenue run-rate of $40-$50 billion, it complements the value accretive nature of Amazon’s ad-supported Prime Video strategy.

Most of the conversion from Prime Video ads is also expected to benefit Amazon.com. Spend less. Smile more. sales, given expectations that Amazon would keep its ecosystem closely knitted to ensure optimized consumer wallet share. Taken together, the continued rollout of an ad-supported Prime Video in the U.S. and internationally will be critical to Amazon’s efforts in improving monetization of its Prime membership base. This would also mitigate some of the concerns over stalling Prime subscription growth, which has been brewing in recent quarters.

The combination of Amazon’s company-specific advantages in AVOD is also expected to compensate for its less direct participation in the industrywide tailwinds this year stemming from cyclical events. Specifically, Amazon is not expected to offer live streaming of the upcoming Summer Olympics in Paris, unlike in 2020 when Prime members could access the Tokyo games. The company has also barred elections ads, which reduces its participation in relevant incremental ad dollars this year.

Yet the continued ramp of multiple revenue sources coming out of ad integration into Prime Video is a key idiosyncratic strength for Amazon in 2024. They include incremental ad sales, subscription sales, and adjacent commerce sales, which are expected to represent a combined offsetting factor to Amazon’s lower penetration of impending cyclical ad tailwinds.

Generative AI Monetization

In addition to advertising, generative AI represents another emerging opportunity for Amazon’s cloud unit, AWS. The generative AI race for hyperscalers has been primarily focused on Microsoft (MSFT) and Google. This was namely due to Microsoft’s prescient investment in OpenAI, which ushered the era of mass market interest in generative AI, and Google’s self-proclaimed reputation as an “AI-first company.” Admittedly, Amazon had a later start in the generative AI race relative to its hyperscaler peers, despite AWS being the leading cloud service provider. AWS had only started to gain momentum in generative AI in 2H23 after CEO Andy Jassy penned a letter focused on how Amazon plans to embrace the technological shift ahead.

Yet AWS has quietly mobilized its market leading share in public cloud computing services in monetizing impending AI opportunities that span across three major segments – infrastructure, LLM-as-a-service, and end-user application deployment. This includes offering performance- and price-optimized instances enabled by both external and proprietary silicon, compensating for the GPU-constrained environment today. Specifically, the highly coveted H100 accelerators offered by Nvidia (NVDA) remain in shortage after the surge of interest in generative AI. This has accordingly highlighted the mission-critical role of in-house developed silicon like Amazon’s Trainium and Inferentia chips specialized for model training and inferencing, respectively, to accommodate impending capacity demand.

And AWS’ stabilizing growth observed in recent quarters continue to corroborate its prospects in capturing share of impending AI opportunities stemming from incremental cloud demand. Specifically, the unit grew 13% YOY to $24.2 billion in Q4, representing stabilization from the elevated impact of cloud spend optimization trends that have weighed on the industry since late 2022. And the continued ramp of AI-drive cloud total addressable market, or TAM, expansion, stemming from incremental compute needs, is expected to complement post-optimization trends.

While the bulk of AI-driven cloud demand stems from Large Language Model, or LLM, training still, the majority of AI-related workloads in the future are expected to be dominated by inferencing needs. Inferencing, or the process of generating inferences and predictions (e.g., ChatGPT outputs), is expected to prevail as the key driver of AI infrastructure opportunities in the long-run. And related capacity demand is expected to accelerate, as the usage of recently deployed generative AI applications start to scale up. Industry forecasts inferencing activity to represent double the excess cloud computing needs currently driven by training activities approaching mid-decade. And AWS’ market leadership is expected to bode favorably with this emerging secular tailwind by facilitating the unit’s penetration into relevant opportunities within its existing customer base. The deployment of instances based on in-house developed silicon such as the next-generation Trainium2 chips and AWS Graviton3 processors also enables competitive compute performance to support the emerging surge of incremental AI workloads.

In addition to AI opportunities stemming from incremental infrastructure demand, Amazon is also ramping up competition with its foray in LLM-as-a-service through Bedrock. Similar to Microsoft’s Azure OpenAI Service and Google Cloud’s Vertex AI, Bedrock offers customers access to a wide variety of popular LLMs that underpin the development of generative AI solutions. Specifically, the recent general availability of Bedrock provides customers with access to LLMs from Anthropic, Stability AI, as well as Amazon’s very own Titan. This has accordingly reinforced AWS’ capture and monetization of LLM-as-a-service opportunities. It also helps to further its competitive advantage over key rival Microsoft Azure, while Google’s GA of its proprietary Gemini Pro model through Vertex AI remains in limbo.

The continued ramp of CodeWhisperer deployment also bodes favorably for AWS’ share of AI opportunities pertaining to end-user generative AI applications. Although Amazon’s internal integration of generative AI capabilities across its consumer-focused services, such as Alexa, have yet to materialize, CodeWhisperer allows its indirect participation in related application opportunities. Specifically, CodeWhisperer is AWS’ proprietary AI-enhanced coding tool, which unlocks substantial productivity gains for both developers and enterprise customers. Within CodeWhisperer, AWS has also introduced “Amazon Q,” a conversational AI within the platform that specializes in guiding developers through the coding process. CodeWhisperer also supports a wide array of programming languages, improving familiarity to “customers’ proprietary code bases” to unlock incremental efficiencies in the building process. Taken together, CodeWhisperer has enabled 57% faster speeds on average in app development, while improving deployment rates by 27%.

AWS’ suite of solutions in enabling the advent of AI and its pervasive integration across industries is expected to reinforce the unit’s prospects as a key growth and profitability driver for Amazon. The continued ramp of relevant solutions is also expected to preserve AWS’ market leadership from Azure’s erosion, despite the surge of demand momentum for the latter since the debut of ChatGPT. We believe AWS’ strategy in capitalizing on opportunities across the AI value chain effectively reinforces the advantage of its expansive ecosystem in cloud computing services. And the strategy remains critical in addressing growing demands for productivity gains and efficiencies across the enterprise IT fabric.

E-Commerce Regionalization

Amazon’s successful integration of a regionalized fulfilment strategy across the U.S. in 2H23 has largely overshadowed the aftermath of pandemic-era overexpansion for its core e-commerce business. In addition to enabling a better Prime experience through faster delivery speeds in the U.S., Amazon’s newly implemented regionalization strategy has also unlocked internal fulfilment efficiencies. This has accordingly improved the core e-commerce operations’ profitability, unlocking better returns on relevant pandemic-era investments. And robust stores results through Q4 corroborates the extent of incremental synergies stemming from Amazon’s restructured fulfilment strategy.

Specifically, North America revenue grew 13% y/y to $105.5 billion during Q4, representing a two-percentage point growth acceleration from the prior quarter. The results suggest consistent improvements to Amazon’s market share in e-commerce, especially during the busiest season of the year, since the deployment of its regionalized fulfilment strategy.

Admittedly, Amazon’s e-commerce business remains prone to ongoing macroeconomic uncertainties. Although inflationary pressures have eased significantly from peak levels in 2022, with the resilient labor market supporting consumer spending, underlying household savings and debt have surged persistently alongside delinquency rates. While expectations for a Fed pivot to rate cuts later this year are largely set in stone, the extent of which would likely depend on the strength of the economy. Specifically, the anticipated frequency of rate cuts this year have reduced on strong economic data reported earlier in the year. This accordingly encourages an extended “higher for longer” stance on Fed policy. Greater rate cuts are unlikely unless recessionary headwinds increase, which we believe remains a lingering risk for consideration.

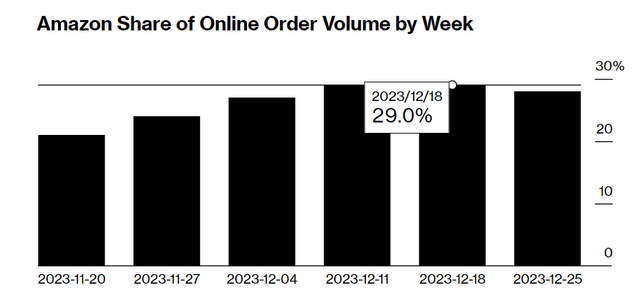

While recession risks would be inherently bad for e-commerce given the ensuing weight on consumers, Amazon demonstrates company-specific advantages that include fast delivery and competitive pricing. These features will be key to salvaging consumer demand and, inadvertently, Amazon’s wallet share on staples purchases, thus mitigating its exposure to recessionary impacts. This is corroborated by Amazon’s strength demonstrated through the Q4 holiday shopping season. The company acquired almost a third of global pre-Christmas online spending, up from a fifth during the Black Friday/Cyber Monday sales.

This continues to highlight the value proposition of fast and free delivery for Prime members, alongside competitive pricing for a diverse range of goods. It also highlights the favorable impact of discounts offered through Prime Big Deal Days, and value-add services at checkout for inherently price sensitive consumers. And the continued ramp-up of Amazon’s regionalized fulfilment strategy nationwide and internationally in the future is expected to reinforce sustained e-commerce and third-party fulfilment business growth against evolving market dynamics.

Looking ahead, Amazon will also be rolling out an online vehicle sales partnership with Hyundai in the U.S. through its marketplace later this year. The company has also introduced “Rufus,” its proprietary conversational AI chatbot for facilitating online shopping support on Amazon.com. Spend less. Smile more. These represent incremental revenue drivers over the longer term that will be additive to recent efficiency gains achieved and complement utilization across Amazon’s core e-commerce and fulfilment business.

Fundamental Considerations

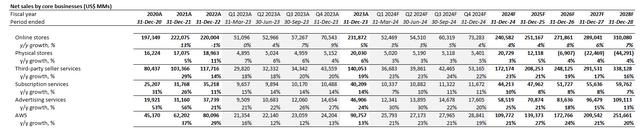

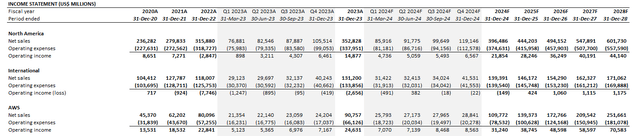

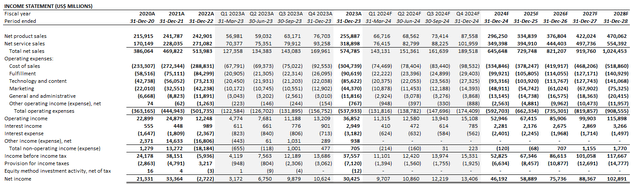

Adjusting our previous forecast for Amazon’s actual Q4 performance and key full year 2024 expectations discussed in the foregoing analysis, the company is expected to grow revenue by 12% YOY to $645.6 billion. Consistent with our analysis, we expect advertising services to see the strongest revenue growth at 25% YOY to $58.5 billion in the current year, underpinned by incremental Prime Video placements. This will be followed by continued acceleration expected in AWS growth as generative AI-related opportunities and related app deployments scale. We also expect stabilization in stores and 3P seller services growth, underpinned by the continued ramp of Amazon’s newly implemented regionalization strategy in the U.S. and beyond.

As a result of anticipated reacceleration through its core e-commerce, cloud and advertising businesses through 2024, Amazon is expected to experience gradual margin expansion driven by improved operating leverage. Specifically, we expect full year 2024 operating margins to improve by two percentage points YOY, which is in line with the 8% exit rate observed in 4Q23.

In addition to improved operating leverage, Amazon is also expected to benefit from a more favorable revenue mix and continued cost efficiencies realized through the regionalized fulfilment strategy in e-commerce. Specifically, the anticipated increase in more profitable AWS and ad sales through 2024 will be accretive to recently implemented cost-savings measures as part of Amazon’s margin expansion efforts. The improved cost outlook is expected to offset the upcoming impact from the $94 million one-time deal termination fee pertaining to the dropped acquisition of iRobot (IRBT).

Amazon_-_Forecast_Financial_Information.pdf.

Valuation Considerations

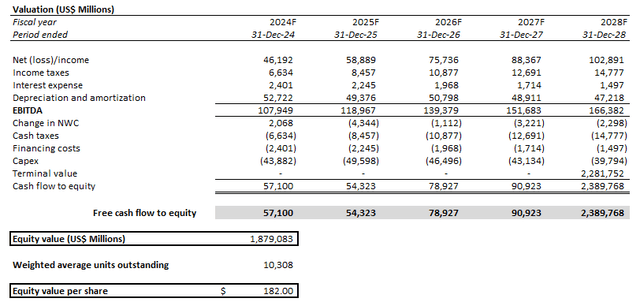

We are increasing our base case price target for Amazon to $182.

The price increase considers Amazon’s delivery of consistently positive progress in recent quarters, underpinned by stabilizing optimization trends, improved utilization, and emerging secular tailwinds in AI and digital advertising. This accordingly reinforces durability to the Amazon stock’s consistent uptrend towards and beyond its previous peak valuation in mid-2021.

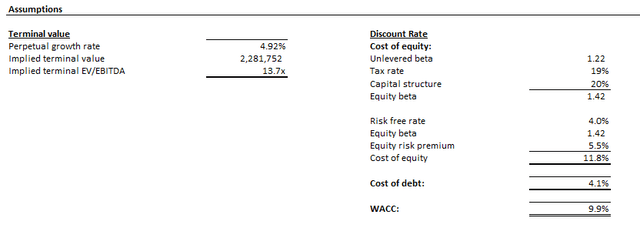

The base case price is computed under the discounted cash flow method. The projected cash flows considered are taken in conjunction with the updated fundamental forecast discussed in the earlier section. A WACC of 9.9% is applied, which is consistent with Amazon’s capital structure and risk profile. The analysis also assumes an implied perpetual growth rate of 4.9% on 2028 EBITDA. This represents a slight valuation premium to the Internet and big tech peer group averages, which is warranted given Amazon’s competitive advantage in key secular trends ahead. The perpetual growth rate applied is also equivalent to 1.5% on projected 2033 terminal EBITDA when Amazon’s growth profile is expected to normalize.

The Bottom Line

The clash between macroeconomic uncertainties and Amazon’s elevated exposure to the inherently sensitive consumer end-market has likely been a key overhang on the stock’s multiple-expansion prospects. However, company-specific strengths have continued to take shape in recent quarters, which improves durability to the stock’s upside potential.

The growing ad sales mix will be accretive to Amazon’s margin expansion efforts, complementing favorable bottom-line contributions from the continued ramp-up of its regionalization fulfilment strategy and AI solutions. Specifically, Amazon’s ad sales strategy is well positioned to benefit from two key secular demand formats. Meanwhile, e-commerce’s value proposition through fast delivery and competitive pricing will gain favor from consumers’ increasing price sensitivity. AWS’ connected ecosystem of cloud computing services and its role as the leading primary cloud service provider also represents competitive advantages in securing share of AI opportunities ahead.

Taken together, the idiosyncratic strengths demonstrated by Amazon make robust compensatory factors to its inherent sensitivity to ongoing macroeconomic uncertainties. This accordingly warrants incremental upside potential to the stock in the near term that should propel its catchup to leading Magnificent Seven peers in the year ahead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!