Summary:

- Disney’s stock is currently 50% below pre-pandemic levels, but fundamental analysis reveals numerous catalysts for growth.

- The video streaming business, including Disney+ and Hulu, is expected to achieve profitability and international expansion could drive further growth.

- The “Experiences” segment, including theme parks and resorts, is gaining momentum as international tourism recovers.

- My target price is $111.

Bill Pugliano/Getty Images News

Introduction

Disney’s (NYSE:DIS) stock currently hovers around 50% below pre-pandemic levels, notwithstanding my fundamental analysis that unveils numerous robust catalysts poised to drive revenue growth and enhance profitability across Disney’s expansive entertainment empire. The promising trajectory of the video streaming business, which is expected to achieve profitability this year, is complemented by the resilience of the “Experiences” cash cow, encompassing the iconic Disney theme parks and resorts. Moreover, my valuation analysis indicates a compelling 16% upside potential. The imminent earnings release, a development I am optimistic about, is likely to further positively affect the fair value estimate. Considering the predominance of positive factors over mitigating ones, I advocate a “Strong Buy” rating for DIS.

Fundamental analysis

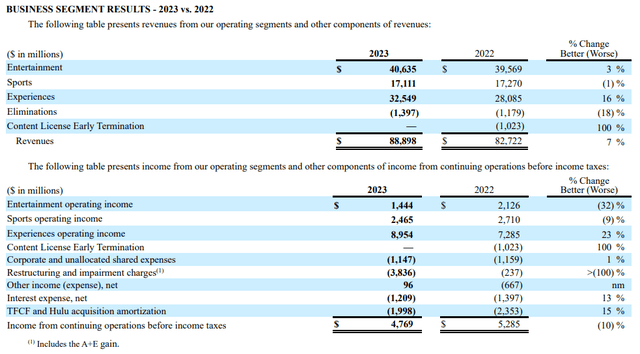

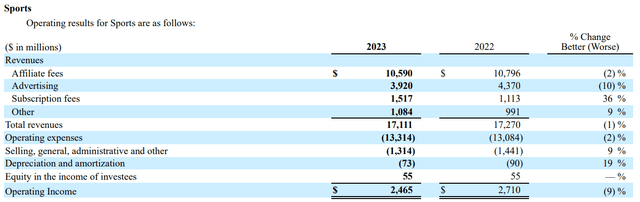

The Walt Disney Company and its subsidiaries are a diversified worldwide entertainment company operating in three segments: Entertainment, Sports, and Experiences.

Readers ought to grasp that these three segments represent a broad-level breakdown, and within each segment, significant subsegments exist, each boasting substantial assets and revenue streams. It would be prudent to delve into a meticulous, forward-looking analysis, segment by segment, to discern the company’s positioning and identify potential growth catalysts.

Let me start with the largest segment, the entertainment segment. This includes subscription-based video streaming services like Disney+ and Hulu, which are called the “Direct-to-customer” segment. The “Linear Networks” segment earns revenue mostly from affiliate fees and advertising and is united under several channels like Disney, the ABC Network, Freeform, and National Geographic. The last but not least subsegment here, “Content Sales/Licensing,” includes Disney’s iconic movie franchises generating revenues via TV/VOD, theatrical, and home entertainment distribution.

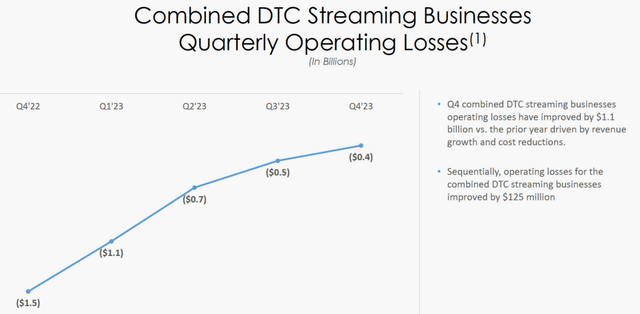

As we can see, the Direct-to-consumer subsegment is by far the largest and the fastest-growing one here, but its operating income is still notably below zero. I consider this subsegment to be the major growth driver not only for the Entertainment segment but for Disney at the consolidated level. There are a few big reasons I am optimistic about the company’s video streaming business because of several solid positive trends. Research and Markets forecast that the global video streaming market will compound at a solid 21.5% CAGR by 2030, which is a strong secular tailwind for Disney’s business unit. The most recent earnings presentation disclosed that Disney+ boasts approximately 66 million subscribers outside North America. Interestingly, approximately 1.5 billion individuals globally speak English as a second language, constituting a substantial potential international target audience. For comparison, Netflix currently commands around 180 million subscribers beyond the U.S. and Canada. Consequently, I believe that an international expansion could serve as a formidable growth catalyst for Disney’s streaming businesses. Lastly, since Bob Iger resumed his role as CEO, Disney has shifted its attention towards achieving profitable growth in its Direct-to-Consumer business, with the operating losses consistently narrowing each quarter at a commendable rate. The management has set a target to render its streaming business profitable by Q4 2024, and the encouraging trends outlined below underscore the management’s steadfast commitment to this objective.

Disney’s earnings presentation

We are currently observing a substantial transition from traditional television to streaming and video on demand, signifying a prevailing and sustained trend. I foresee the Linear Networks business facing stagnation and a gradual decline as demographic shifts, influenced by generational changes, reach completion. Consequently, my outlook for optimism in this context remains relatively cautious. The prosperity of the content sales and licensing business hinges on Disney’s adept utilization of its iconic movie franchises. While the nature of this business may exhibit seasonality based on the annual movie pipeline, the outlook for 2024 appears promising.

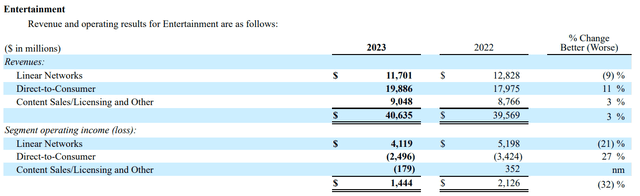

Now, let’s shift our focus to the second-largest segment, Experiences. This category encompasses Disney’s enduring theme parks and resorts, which faced substantial challenges during the COVID-19 pandemic. As international tourism stages a recovery, this segment is gaining momentum, evidenced by a robust 16% year-over-year revenue growth in FY2023. Notably, the segment’s operating income has surged by seven percentage points ahead of the top line. Projections for international tourism in 2024 are highly optimistic, anticipating a 15% growth and a full return to pre-pandemic levels. I foresee this segment as remaining a consistent cash cow for Disney over the long term, attributed to the enduring appeal of the iconic brand and the widespread recognition of Disney’s theme parks as among the most coveted destinations worldwide. This imbues the segment with remarkable flexibility in terms of pricing, as unwavering customer loyalty establishes a robust foundation for formidable pricing power. Like movie franchises, the Experiences business boasts a pipeline of upcoming openings and events that appear particularly promising, especially in light of the anticipated rebound of international tourism to pre-pandemic levels.

Disney’s earnings presentation

Finally, let me discuss the prospects of the “Sports” segment. This segment generally encompasses the company’s sports-focused global television, ESPN, DTC video streaming, ESPN+, content production, and distribution activities. This segment generates revenues from affiliate fees, advertising, subscription fees, sub-licensing, pay-per-view events, etc.

Like the Direct-to-Customer subsegment in Entertainment, I anticipate that subscription revenues will serve as the primary long-term growth driver in this context. While advertising and affiliate fee revenues may experience stagnation, I foresee a complete transition to the subscription-based business model, with cost-effective subscription plans catering to viewers willing to incorporate commercials into their viewing experience. Additionally, the long-term outlook for the sports online video streaming market is notably optimistic, projecting an almost 25% CAGR up to 2030. While the ESPN brand may not possess the same level of iconic status as Disney, it remains a robust and valuable asset for Disney at the consolidated level. Moreover, in this segment, Disney strives to create new cross-selling opportunities by introducing its betting service, espnbet.com. Although this is a relatively nascent business with a considerable degree of uncertainty, it’s noteworthy that the global online sports betting market is anticipated to experience a robust 7.7% CAGR in the coming years. This presents another substantial positive factor, acting as a strong tailwind for Disney in this venture.

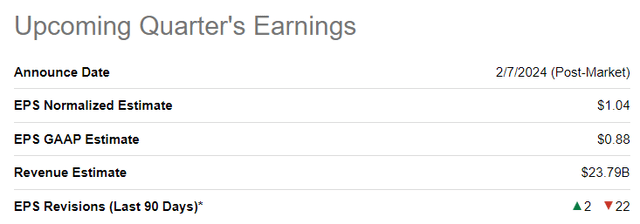

The approaching Q1 FY 2024 earnings release presents a potential positive catalyst for the stock in the near term. My optimism stems from the anticipation that the bottom line is projected to improve from $0.99 to $1.04 despite an expected YoY flat top line. Achieving or surpassing this level of profitability would signify that the company’s transformation initiated under Iger’s return is yielding positive results, likely indicating a continued narrowing of operating losses in the streaming business. The pivotal factor influencing market sentiment toward Disney’s stock post-earnings release is expected to be the dynamics of the Direct-to-Customer business. Consensus estimates predict a modest 4% revenue growth for the full fiscal year 2024, a figure that may prove conservative given the numerous positive catalysts outlined earlier. Consequently, the likelihood of a more optimistic full fiscal 2024 guidance is high. In summary, my overall outlook for the upcoming earnings release is positive, and I anticipate that the management will reinforce this optimism during the earnings call.

In summarizing the fundamental analysis, I identify numerous positive catalysts that are poised to drive revenue growth and enhance profitability for Disney substantially. My optimistic perspective regarding the imminent earnings further bolsters my bullish outlook, instilling added confidence in the company’s prospects.

Valuation analysis

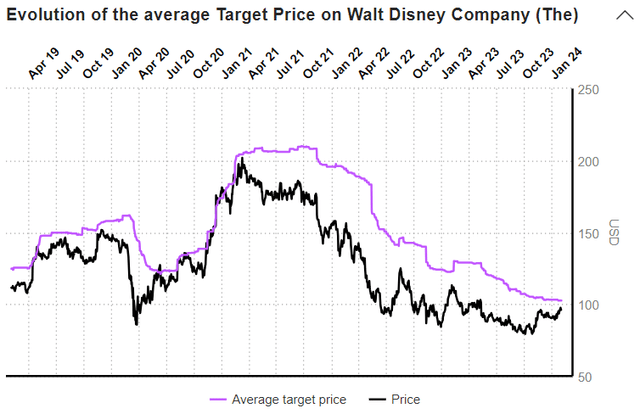

Excluding the period marked by stock market exuberance driven by unprecedented 2020-2021 global quantitative easing, Disney’s stock has been experiencing a secular decline. Presently, at $96, the stock price is approximately 50% lower than its pre-pandemic levels. However, recent momentum has been robust, with a 20% gain over the last three months and a 13% increase over the last six months.

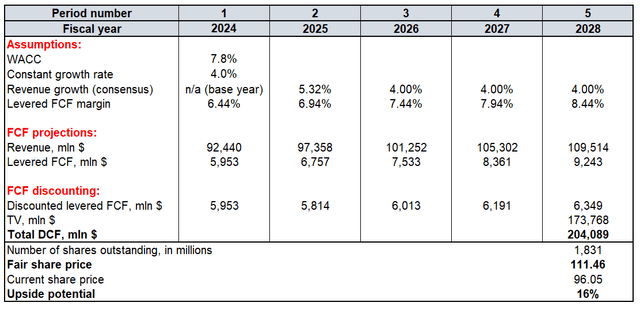

To derive the stock’s fair price, I am conducting the discounted cash flow (“DCF”) analysis with a 7.8% WACC and a 4% constant growth rate for the terminal value (“TV”) calculation. I think this level of constant growth rate is fair because of all the positive catalysts I mentioned in the fundamental analysis, coupled with the strong brand, unlocking the formidable pricing power for Disney. As usual, I consider consensus revenue estimates for the two upcoming years reliable, mostly based on the company’s guidance. For the years after fiscal year 2025, I implemented a 4% revenue growth, which matches the constant growth rate. I use a 6.44% TTM levered free cash flow (“FCF”) margin and expect a 50 basis points expansion annually up to FY 2028. Currently, there are 1.83 billion DIS shares outstanding.

My fair DIS share price estimate is $111, meaning a 16% upside potential. My optimism is grounded in the historical alignment between Disney’s trading patterns and the consensus target price, evident in the pre-pandemic era. The recent trend indicates a return toward this target price. Given these observations, I have high conviction that the 16% upside will be realized soon. Additionally, the potential improved guidance and a longer-term outlook during the earnings release next week will highly likely positively influence valuation. This, in turn, could potentially expand the upside potential further after the earnings release.

Mitigating factors

Disney underwent a challenging CEO transition, when Bob Iger departed from the company for the first time. I see substantial risks of a new CEO transition failure in the foreseeable future, because Bob Iger is expected to step down again at the end of 2026. Even though nearly three more years remain under Iger’s leadership, I anticipate that speculations about the appointment of a new CEO might emerge sooner, potentially causing a degree of unease among investors. On the flip side, there is also a possibility of extending Bob Iger’s term, as has been done before.

While encompassing a diverse array of businesses, it’s crucial to remember that each of them falls under the umbrella of entertainment. Essentially, Disney’s offerings involve discretionary spending by customers, rendering the company’s financial performance susceptible to the overall health of the global economy. Interest rates in the developed world have been at their highest levels since the early 21st century, and simultaneously, the economic powerhouse in the developing world, China, is experiencing its own set of challenges. While these factors could present temporary challenges for Disney’s financial performance, it’s essential to acknowledge the inherent cyclicality in the broader economic environment. Any potential macroeconomic weakness is likely to be succeeded by a new phase of growth.

Conclusion

I firmly believe that Disney’s stock warrants a “Strong Buy” rating. Despite the 16% upside potential, which might seem modest to some, my conviction level is high, and I prioritize reliability over sheer attractiveness. A likely positive outcome in the upcoming earnings release, especially if accompanied by guidance upgrades, can potentially elevate target prices. My confidence stems from many positive catalysts that appear considerably more robust than the potential risks at play.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.