Summary:

- Microsoft Corporation reported record quarterly revenue of $62 billion, exceeding estimates and marking 5 consecutive quarters of record revenue.

- Intelligent cloud revenue increased 20% YoY, reaching a record $25.90 billion, with continued growth expected in Q3.

- Price matters even for the best of stocks, and Microsoft is no exception.

- Stock appears technically overbought as well.

FinkAvenue

Microsoft Corporation (NASDAQ:MSFT) recently reported its Q2 numbers as Seeking Alpha has covered here. The stock lost nearly 3% following the report on the market’s worst day since September 2023. Interestingly, my most recent coverage of Microsoft was also back in September 2023 right after the company had announced its annual dividend increase. I had rated the stock a “Hold” citing the market’s struggle for a direction and valuation. Since then, the stock has gone up nearly 21% compared to the market’s 9% run.

How did Mr. Softie do in Q2? Let’s find out in the latest edition of The Good, The Bad, and The Ugly.

The Good

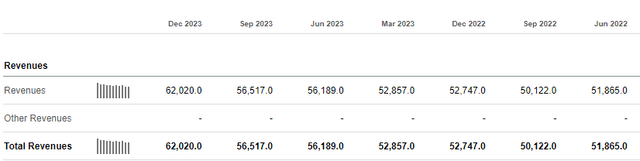

- For the 5th consecutive quarter (dating back to December 2022), Microsoft reported record quarterly revenue with Q2’s revenue coming in at $62 billion, nearly $1 billion above estimates. To put the company’s monstrous growth into perspective, Microsoft’s total revenue in 2014, the year Satya Nadella took over as CEO, was about $86 billion. Equally impressive is the fact that the trailing twelve months’ [TTM] revenue was $227.5 billion with the forecast being double that five years from now.

MSFT Revenue (Seekingalpha.com)

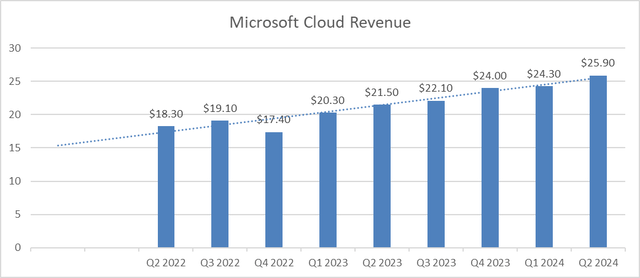

- Microsoft’s intelligent cloud revenue went up 20% YoY to reach a record $25.90 billion. In addition, Q2 marked the 6th consecutive quarter that cloud revenue went up on a QoQ basis. In addition, the company guided for at least $26 billion in Q3 Cloud revenue, indicating 18% YoY growth.

MSFT Azure Rev (Author, data from microsoft.com)

- Microsoft reported that 60% of its customer base is seeking to implement its AI solutions across commercial and enterprise user base. As someone who works in a company that leverages almost all of Microsoft enterprise solutions (Office 365, Teams, Windows 11 etc.) along with Azure, Azure DevOps and Power BI to name a few, I cannot fathom what a monstrous opportunity this is for Microsoft to snowball its fortunes from its own ecosystem. To conclude this section, I am using a quote from Satya Nadella that once again exhibits that the company is way ahead of the field: “We’ve moved from talking about AI to applying AI at scale“.

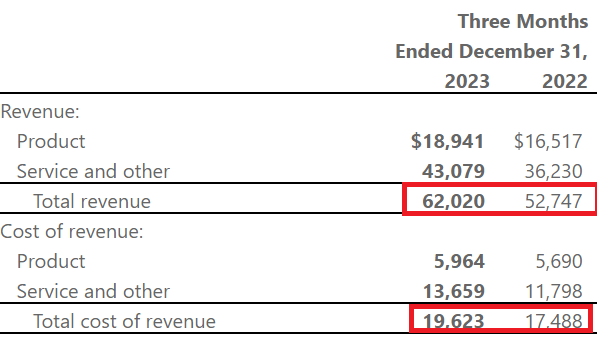

- Gross margin for Q2 was an impressive 68.36%, up 1.50 percentage points YoY. No wonder, Microsoft gets an “A+” from Seeking Alpha quant ratings on profitability as this margin is almost 20 percentage points higher than the sector median. Just to poke a hole as things appear too rosy, Microsoft did say it expects Q3’s Cloud margin to decrease 1% YoY due to capital expenditures needed to scale up to demand.

The Bad and The Ugly

- While Microsoft’s Q2 revenue went up 17% YoY, helping it reach another record quarterly revenue, cost of revenue went up more than 12%. While things are going great for Microsoft right now, it wasn’t long ago (2022 and early 2023) that technology companies faced the brunt for over-hiring and over-expensing at their peaks. Microsoft needs to be careful as its operating expenses went up as well by more than 9% in Q2.

MSFT Rev and Cost of Rev (Microsoft.com)

- In the Q2 report, Microsoft had noted that it “returned” $8.4 billion to shareholders in Q2 in the form of dividends and share repurchases. The company reported 7.432 billion shares outstanding at the end of Q2, which means at 75 cents/quarter in dividends, it returned $5.5 billion to shareholders in tangible form. Where did the other $2.9 billion go? To merely offset dilution as Microsoft reported 7.431 billion at the end of Q1 and total share count has barely budged in the past year.

- Devices (Surface, Xbox etc.) revenue declined 9% YoY, making it the fifth consecutive quarter that this segment declined YoY dating back to FY 2023 Q2. The company recently acknowledged the weakness and over-staffing issues here (post Activision closure) by recently laying off almost 2,000 employees.

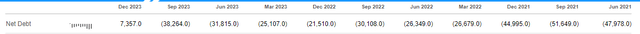

- I’d also like to highlight that for the first-time in quite a while, Microsoft has a positive net debt position (which is actually a negative), thanks to the Activision Blizzard closure. At the end of Q2 2024, Microsoft’s cash and equivalent pile of $81 billion is the lowest since September 2013.

MSFT Net Debt (Seekingalpha.com)

The two points below are not directly related to Q2 but it is impossible to review Microsoft’s stock at $400 and $3 Trillion market-cap without talking about valuation and the law of large numbers.

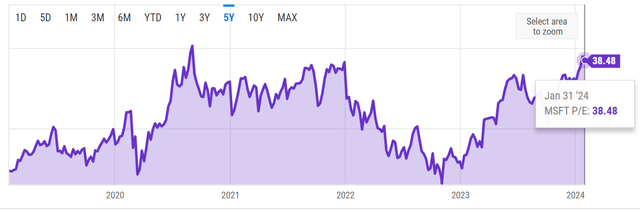

- Microsoft’s stock is trading close to its 5-year high PE of 40. To put that overvaluation into context, even if the stock’s (lofty) 5-year average earnings growth of 16%/yr is met, the stock is trading at a price-earnings/growth [PEG] multiple of 2.50. That’s pricey in my opinion even for an all-weather bellwether like Microsoft.

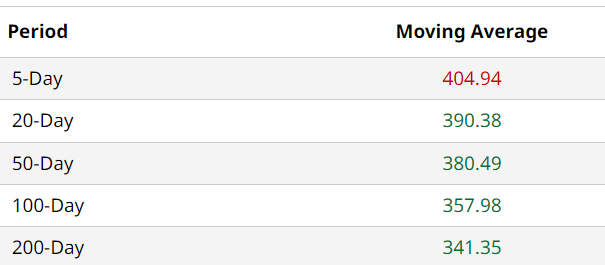

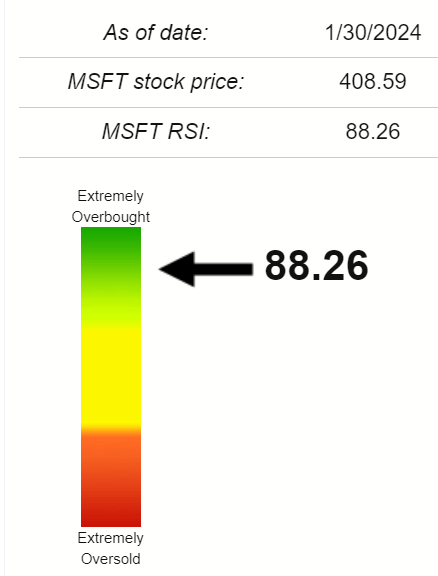

- Microsoft stock went into earnings extremely overbought with a Relative Strength Index [RSI] of nearly 90. With interest rate cuts unlikely to be cut in March after the Federal Reserve’s recent press conference, technology stocks may finally take a breather after the magical run since October 2023. The fact that the stock’s 100-Day and 200-Day moving averages are 10% and 14% below the current market price of $397 means it won’t be surprising to Microsoft stock head further south from here.

MSFT Moving Avgs (barchart.com) MSFT RSI (stockrsi.com)

Other Thoughts, Valuation And Conclusion

The “new” Microsoft under Nadella isn’t afraid to experiment, as evidenced by the earlier aggressive push towards Copilot. This is now reaping rewards as we are not only seeing improvements in developer productivity but also seeing meaningful partnerships and support coming from outside. The company wasn’t afraid to call out its investments (aka increase in expenses) in data centers, cloud, and AI infrastructure during the conference call because the proof is in the pudding. Microsoft has shown time and again that its investments are more likely to pay off than not.

It is hard to slap a price target or even a rating on momentum stocks and technology disruptors. Microsoft happens to be both and I acknowledge that investors may miss out on some gains by not buying here. Case in point, since my previous “Hold” rating, the stock has gone up more than 20%. But I’d argue that majority of those gains were due to the market picking its direction rather than Microsoft improving fundamentally as a company by 20% (in my previous article, I called out that the market was stalling and that being a reason for my “Hold” rating). Acknowledging that Microsoft is one of a kind, I’d be willing to buy the stock at around $340. At $340, the stock would have pulled back around 20% from its all time high of $415 and have a PEG of 1.8. Textbook definition-wise, that PEG would still be pricey but quality rarely comes too cheap.

To conclude, Microsoft delivered the classic “beat and raise” report but the stock did not rise, unsurprisingly. At 35 times forward earnings and a $3 trillion market capitalization, we can’t blame Mr. Market and investors for being cautious about Microsoft here. After a 60% run in the last year and nearly 5 times that in the last 5 years, even the most ardent supporter of the stock would do well to pause here and reevaluate their position in the stock. Given the company’s ecosystem and deep-rooted presence in our personal and professional lives, I won’t dare rating Microsoft stock a “Sell” anytime soon. But, I am very comfortable to say the stock does not deserve to be added at this price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.