Summary:

- We had lowered Altria Group, Inc.’s fair value to $32.50 due to deteriorating trends and declining revenues.

- The company’s Q4 2023 earnings per share met expectations, but revenues fell short by $60 million.

- We examine how the company did slightly better than what we expected in Q4 2023 and update our thesis.

Liudmila Chernetska

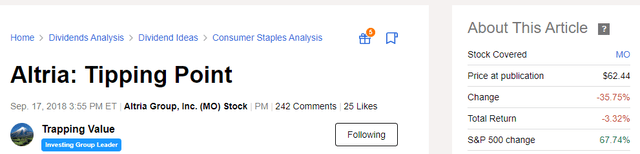

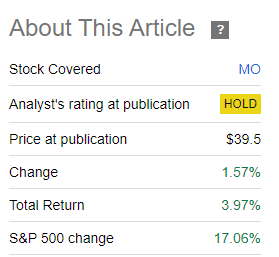

On our previous coverage of Altria Group, Inc. (NYSE:MO) we lowered the fair value as the trends were deteriorating faster than we had previously envisioned. That got us to a price target which was likely not appreciated by the legions of fans who were just one puff away from retirement.

Last time our “fair value” for Altria was $35 and we are now lowering it to $32.50. That represents the maximum price we would pay for Altria stock as it stands today. It also represents a price where discounted cash flow analysis gives it a positive value. Since we use “Sell” ratings only for a short selling opportunity, we continue to rate this as a “hold/neutral.

Source: $35 Is Next, As Discount Segment Gets Obliterated.

The stock has, of course, disappointed the bulls and the bears and stood pat in the interim.

Seeking Alpha

We update our thesis with the just-released Q4 2023 numbers and tell you why we are doubling down on our call.

Q4 2023

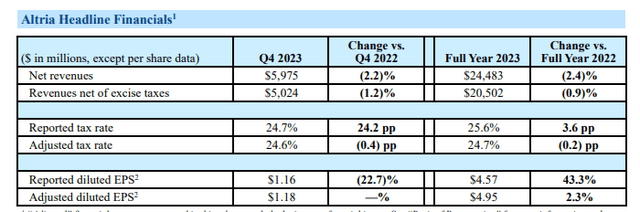

Altria met the adjusted earnings per share number of $1.18 per share, but the revenues came up short by about $60 million. Historically, Wall Street gives me more weight to revenues relative to earnings, especially for companies with very large net margins, like Altria. The stock was still up a bit in the pre-market. What was more interesting though was the fact that Altria’s revenues declined year over year, again.

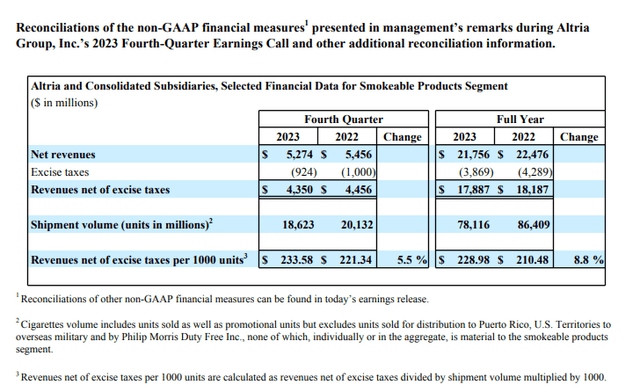

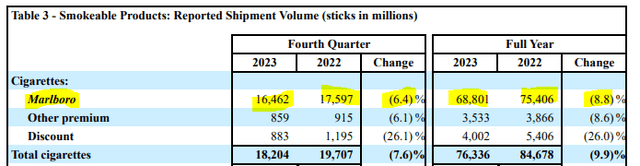

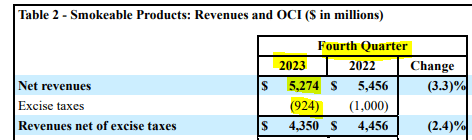

Now, those declines are hardly what anyone would call massive, but it shows that the fundamental forces are completely overwhelming Altria’s usual tactic. What tactic are we talking about? We are referring to the plan to keep raising prices till every last smoker quits. You can gauge this in a couple of ways. The first is just dividing the net revenues by the number of cigarette sticks sold. The second is a better number, where you adjust for excise taxes (which remain relatively constant). Altria provided you with this measure.

So the price per cigarette stick was effectively raised by Altria by 5.5% relative to Q4 2022 and 8.8% when you compare the entire year. It is indeed quite stunning when a company raises prices by 8.8% and sees a net revenue decline, but that is where we are.

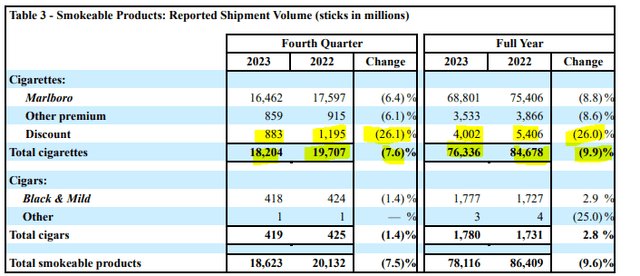

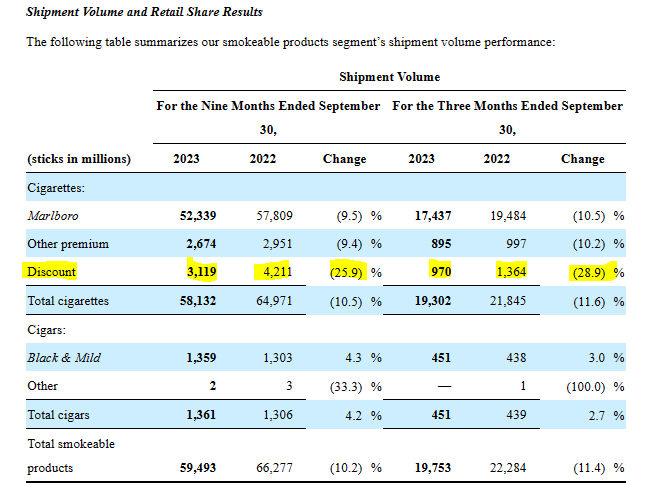

The reason was the large decline in cigarette sticks sold. The more precise reason? The poor cannot afford to smoke any more. If you disagree, then have a look at the absolute bloodbath in the discount segment.

26.1% decline? The full year almost matched that exact number as well. This trend is showing no signs of stopping. In fact, to really see this impact you need to fix your eyes on the 883 million sticks sold in Q4 2023. That is down from 970 million sticks, just one quarter ago.

Altria Q3-2023 Supplemental

In fact, from Q3 2022 to Q4 2023, we have lost 481 million cigarette sticks in sales. If the trend persists, we will be at zero sticks in less than three years. Of course, bulls will argue that the discount segment is small and they are right. The counterargument from us is that this is just a preview of what is coming from the other two areas. Those are declining as well, although this quarter’s percentage decline of “just” 6.4% for Marlboro, was the likely source of relief.

Outlook

Altria’s outlook first included how they did in 2023, relative to their long-term goals. You can see that in the two major areas of their plan, they are not keeping up.

Deliver a mid-single digits adjusted diluted EPS compounded annual growth rate in 2028 from a $4.84 base in 2022. ◦ In 2023, we delivered adjusted diluted EPS growth of 2.3%

Grow U.S. smoke-free volumes by at least 35% from our 2022 base of 800 million units. ◦ Our smoke-free volumes were essentially flat in 2023 when compared to 2022.

Source: Altria Q4 2023 Press Release.

Even the 2024 guidance is rather weak in that regard as the “mid-single digit” growth will be tough.

We expect to deliver 2024 full-year adjusted diluted EPS in a range of $5.00 to $5.15, representing a growth rate of 1% to 4% from a base of $4.95 in 2023. We expect 2024 adjusted diluted EPS growth to be weighted to the second half of the year. Our guidance includes the impact of two additional shipping days in 2024 and assumes limited impact from enforcement efforts in the illicit e-vapor market on combustible and e-vapor volumes.

Source: Altria Q4-2023 Press Release.

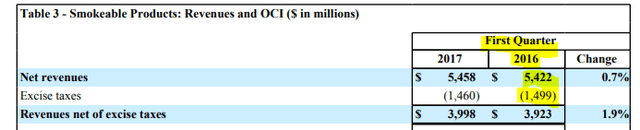

We think this guidance will be tough to pull off as the base decline rates for smokers are accelerating. As fewer people smoke, the more pressure mounts on the remaining to quit. Altria incentivizes people to do the same with its price hikes. On that note, we want to point out the fact that Altria Group, Inc.’s price hikes are becoming more and more effective deterrents. The reason is that the total price for a pack of cigarettes is more and more weighted towards what Altria charges versus what is paid for excise taxes. Have a look at Q1 2016 numbers. Excise taxes were 27.6% of total revenues. This blunted the impact of price hikes (as excise taxes don’t move up when Altria hikes).

Coming to Q4 2023, we see that excise taxes are now just 17.5% of total revenues.

Altria Q4-2023 Supplemental

With each passing quarter, as cigarette stick volumes decline and Altria passes on price hikes, excise taxes should continue to fall in percentage terms. That also means that the newer price hikes will be “felt” more by the consumer.

Verdict

We see no reason to change our price target in this quarter. Discount segment declines continued at a brutal pace, but the premium segment held up a little better. We have previously pointed out how Ozempic and other similar drugs are likely to accentuate these numbers down the line, and that remains the larger risk, especially in the USA. We also think a glide path down to 6.0X earnings is probable when investors accept that this is a royalty stream with a terminal value of zero or near zero. Yes, they can always point to other areas like cigars, wines, and oral tobacco products. We think these are too small to materially change the thesis and oral tobacco is likely to join cigarettes at some point as well. Since we first wrote about Altria and its journey to zero volume, it has functioned almost exactly like a declining royalty stream.

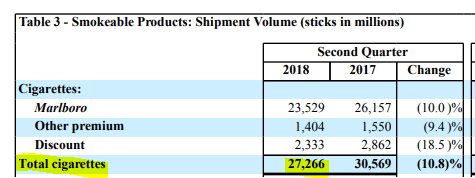

Total cigarette volumes are down from 27,266 million to 18,204 million or about one-third.

Altria Q2-2018 Supplemental

Discount segment volumes are down from 2,333 million to 883 million or about 62%. If in the face of this, you can make your “table pounding” Altria Group, Inc. stock buy based on “high-yield,” “low P/E” and its historical return during an era where 40% of the population smoked, well, Godspeed to you.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

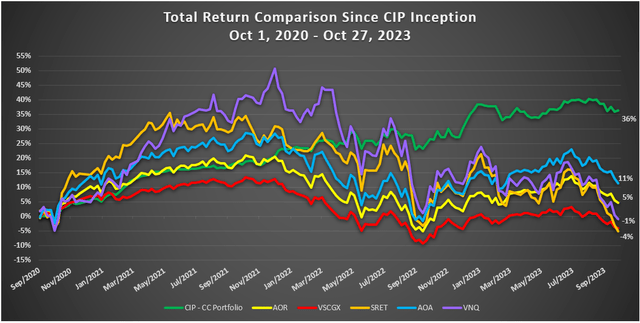

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.