Summary:

- Visa Inc. reported solid Q1 earnings with net revenues increasing 8.9%.

- The company has recently completed a variety of acquisitions and partnerships that should drive growth for years to come.

- Visa’s size, robust profit margins, and ability to capture fees from every transaction contribute to its status as a quality investment.

mgkaya

This article was coproduced with Chuck Walston.

“Stupid Is As Stupid Does.”

Most folks recognize that well-known line from “Forrest Gump.” What many don’t know is that it originated from a phrase that was common during the latter half of the nineteenth century: “Handsome is as handsome does.”

And those familiar with Visa Inc. (NYSE:V) are well aware the stock has a history of providing handsome profits. In fact, Visa’s 440% total return over the last decade is more than double that of the S&P 500 (SP500).

One could easily claim that Visa’s handsome profits are the result of a very high-quality business model. After all, Visa routinely generates double-digit revenue and diluted earnings per share growth. And the company’s robust dividend growth rates, coupled with a low payout ratio and strong balance sheet, are additional signs that Visa and quality are one and the same.

Visa provided Q1 earnings about a week ago, kicking off the new fiscal year with solid results. However, the stock now trades near its 52-week high. Even quality stocks can be overvalued, and one question I seek to answer is whether Visa’s high quality business model warrants the stock’s current valuation.

The Earnings Call

Visa reported its fiscal Q1 2024 earnings last week.

Net revenues increased 8.9% to $8.6 billion. That figure beat analyst estimates by $50 million.

The company reported non-GAAP EPS of $2.41, up 11%, and a $0.07 above consensus.

Q1 payments volume grew by 8% compared to the comparable quarter. International payments volume led the way with an 11% increase, while payments volume in the US grew by 5%.

Those familiar with Visa watch cross-border travel volume closely, as it is often a harbinger of the firm’s growth prospects. Excluding intra-Europe, cross-border volume increased by 16% year-over-year. Cross-border volume is now up 142% over 2019 levels.

One very positive trend lay in the company’s growth in locations that accept their products. Visa reported that areas accepting their debit and credit cards increased by 17%.

Management guidance for FY24 is for net revenue growth in the low double-digits range and EPS to increase at a low-teens rate.

Recent Developments

Visa just completed the $1 billion acquisition of Pismo, described in a company document as “a global cloud-native issuer processing and core banking platform,” and recently closed a deal to gain a majority interest in Prosa, a leading digital payment processor in Mexico.

In 2019, Visa partnered with bKash, the largest mobile financial services player in Bangladesh, to facilitate customers’ ability to transfer funds from debit and credit cards to digital wallets. bKash recently expanded the service to allow Visa’s 15 million plus Bangladeshi cardholders to use an in-app QR code for payments with 550,000 bKash merchants.

Visa also reported several developments with major banks. They included an agreement with Isbank, the largest private bank in Turkey, to serve as an issuer bank. Isbank currently has 33 million cardholders.

Visa just signed a new agreement with PKO Bank Polski, as well as Piraeus Financial Holdings. PKO is ranked first among credit card issuers in Poland and Central Eastern Europe, while the partnership with Piraeus (OTCPK:BPIRF), the largest bank in Greece, has that financial institution serving as Visa’s exclusive payment processor for consumer and commercial credit cards in that nation.

Visa also renewed and expanded their partnership with Shinhan Card (SHG), the number one Korean issuer of consumer and commercial credit and debit cards.

South of the border, Visa renewed its agreement with BBVA Mexico (BBVA) to serve as a Visa consumer, commercial, and debit card issuer. With about a fifth of the market, BBVA is the largest financial institution in Mexico.

I could continue with a variety of deals that Visa has with companies including FedNow, Remitly (RELY), United Overseas Bank and Doxa, a Singapore fintech for contractors, and Worldline, a leading global payment provider and B2B platform, to name but a few.

I enumerated these developments for two reasons. One is to highlight something they have in common: again and again, we see that Visa partners with the largest financial institutions in a given nation or region. In a King of the Hill struggle, it’s nearly impossible to unseat the monarch when he is allied with the largest players.

And secondly, when a company is as big as Visa, one must consider whether it is at the end of its growth runway. It is apparent from this partial list of partnerships and deals that Visa has plenty of irons in the fire to drive growth.

When investigating Visa as a prospective investment, a common bear argument is that the company is vulnerable to the evolution to fintech. However, it is apparent that Visa is both adapting to, and in some cases leading, the fintech movement.

During the earnings call, management provided the following:

Tap to pay grew five percentage points from last year to 77% of face-to-face transactions globally, excluding the US.

In the US, we reached 45% penetration. One highlight from the first-quarter is that Lowe’s has enabled tap to pay acceptance. We believe the tapping provides the best buyer and seller experience in the face-to-face environment and we’ve seen that play-out in the results.

In a recent Visa study in the U.S., we saw on average two more transactions a month and spend lift of $70 a month for those who tap with a Visa debit card versus those who don’t tap.

In fact, Visa offers a variety of fintech services and is partnering with over twenty fintech companies in the tap to pay arena alone. Visa also partners with both Google Pay (GOOG, GOOGL), Apple Pay (AAPL), and Chime.

I think there is a reasonable argument to be made that the fintechs need Visa as much, or perhaps more, than Visa needs fintechs.

Growth Drivers

According to a report by ResearchAndMarkets, the global digital payment market is projected to grow at a 20.5% CAGR from 2022 through 2030.

During the earnings call, Visa’s CEO stated that excluding Russia and China, the company estimates there is a $200 trillion market for business-to-business, business-to-consumer, and peer-to-peer transactions.

He also highlighted opportunities in Mexico, noting that over 50% of personal consumption spending is still in the form of cash or checks in that nation.

Why Visa Is A Cash Machine

Credit card purchases include a fee paid by the merchant. The bank that issued the credit card receives a fraction of the fee. Visa also receives a fee from every transaction.

An assessment fee is the term used to describe the payment made by merchants that accept Visa’s cards. In FY 2023, 45% of Visa’s revenue was generated by assessment fees.

Visa’s Other revenues segment garnered 8% of FY 2023 revenue. A portion of that was derived from license fees for use of the Visa brand or technology and fees for account holder services, certification, and licensing.

I opened this article by describing Visa as a quality investment, a SWAN.

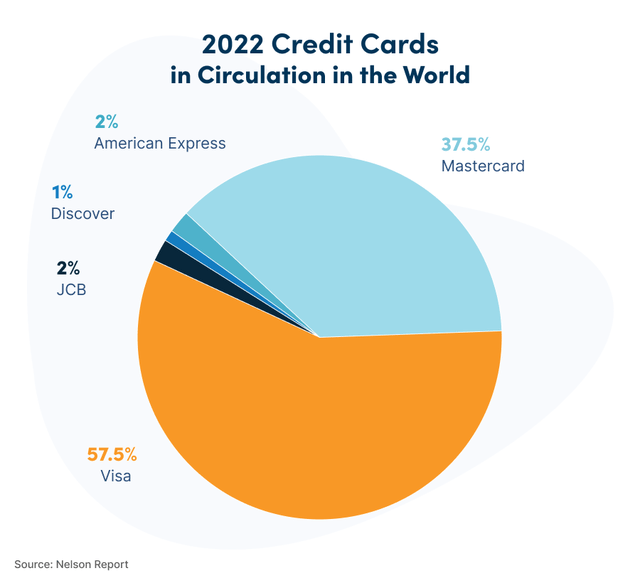

There are three factors that play into Visa’s SWAN status. One is the sheer size of Visa’s merchant network. As of the middle of last year, Visa had 4.3 billion cards in the hands of consumers and over 130 million merchant locations accepting those cards. A rival would have to devote enormous sums to duplicate Visa’s offerings.

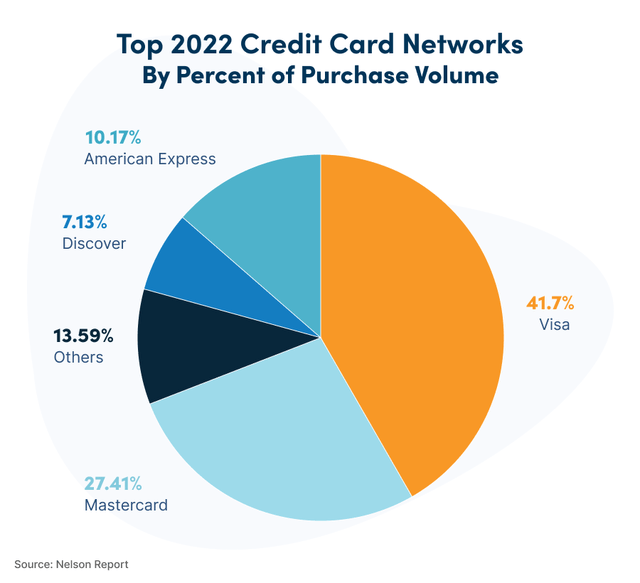

The size of Visa’s network results in Visa harvesting 61% of purchase transactions in the U.S. Simple math tells you that is more than all the other card payments companies combined.

Visa’s payments network is also the largest in the world. It captured 39% of card-based purchase transactions in 2022, and the company is devoting capex to gain share in emerging markets. While this scale presents a high barrier to entry, there is another aspect to Visa’s network that should be considered.

Establishing the network is costly, but it is an asset-light operation that yields very robust profit margins.

The company’s low cost of maintaining its operations resulted in Visa posting an average operating margin of 66% over the past five years. In Q4 of 2023 alone, Visa posted a total payments volume of $3.8 trillion.

The last factor that sports Visa’s SWAN status are the fees the company earns. Think back to the beginning of this segment and my explanation of the fees Visa captures with every transaction.

In one quarter, the company processed $3.8 trillion in payments…and received a cut of each transaction.

In Visa’s case, money grows on fees.

Debt, Dividend, And Valuation

Visa’s credit is rated AA-.

The current yield is 0.76%. The payout ratio is 21.58%, and the 5-year dividend growth rate is 16.27%.

Visa trades for $277.44 per share. The average one-year price target of the 38 analysts that follow the stock is $295.47.

The forward P/E for Visa is 29.44x, versus the average P/E for the stock over the last five years of 32.17x. The 5-year PEG ratio is 1.55x, well below the average PEG ratio of 1.91x for Visa over the last half decade.

Over the last ten years, Visa repurchased 18.5% of shares outstanding.

Is Visa A Buy, Sell, Or Hold?

Aside from a possible economic downturn weighing on the company, there are few negatives associated with the stock, and Visa appears to be poised for years of growth.

Following Q4 results, analysts are projecting revenues of $39.2 billion in 2024, a 7.6% growth rate versus FY 23. Consensus EPS is $9.78, an 11% increase over 2023.

The company’s scale keeps rivals at bay while also generating mind-boggling profit margins.

While there are those that view fintech as a threat to Visa, I see it as another potential growth path. In fact, Visa could use its enormous free cash flow to acquire fintechs and incorporate them into the broader company.

I rate Visa as a Reasonable Buy.

My definition of a reasonable buy is a valuation at which I would be willing to initiate a small position in the company and/or to dollar cost average into a stock.

However, if the share price dropped by as little as 5%, I would upgrade Visa to a Buy.

I own a small position in Visa.

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Chuck Walston owns shares of V.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!