Summary:

- Cisco reported good Q1 2024 earnings with revenue and EPS growth, but Q2 earnings look less strong.

- The company is focusing on AI and Ethernet technologies to achieve faster network speeds and sustainability.

- Cisco has strong profitability and stable revenue growth, but its balance sheet shows more liabilities than equity.

- As there may be no margin of safety in the share price, and it may not beat the index long term, my rating for Cisco stock is a Hold.

JasonDoiy

Cisco’s (NASDAQ:CSCO) Q2 earnings results are coming up, and while the company looks positioned for a slower financial year as a whole, its strong operational advancements make 2025 and beyond look quite strong. However, its valuation has potentially no margin of safety in it, and some estimates could mean it is overvalued. However, with strong cash flow and good profitability, Cisco is worth holding.

Earnings & Operations

Cisco’s Q2 earnings results will be released on the 14th of February 2024, post-market. In Q1, Cisco reported revenue growth of 8% to $14.7 billion and EPS growth of 37% to $0.89. During that period, the firm made acquisitions to enhance its cloud, network performance monitoring, and broadband network monitoring, among other capabilities. It also stated its intention to acquire Splunk Inc. (SPLK), a leader in security and observability platforms, with a goal of closing the deal by Q3 2024 results.

Throughout 2024, Cisco is focusing on artificial intelligence (‘AI’) and developments in Ethernet technologies and network fabrics. The company wants to achieve faster network speeds, sustainability in IT, and high network visibility. Advances in Ethernet are expected to play an important role in AI training, helping bandwidth reach up to 400G and 800G. As such, data centers should begin to be revolutionized, with higher efficiency to come.

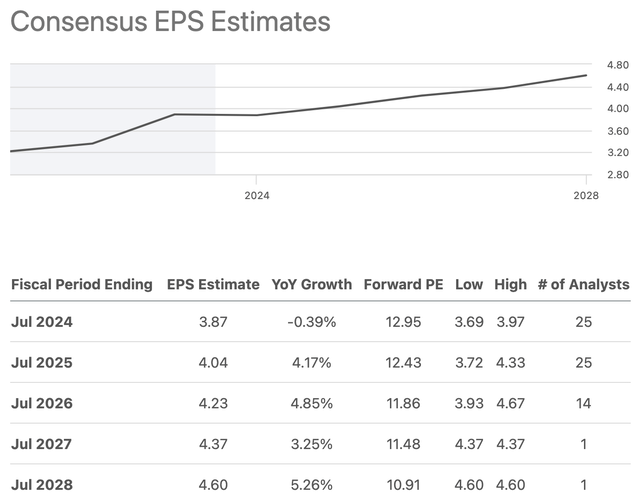

For Q2 2024 results, the consensus EPS GAAP estimate for the firm is $0.65, a YoY 3% decrease from Cisco’s Q2 2023 earnings, and the consensus revenue estimate is $12.71 billion, a YoY 6.54% decrease. While consensus earnings estimates look to be lower for the remainder of the financial year ahead, as macroeconomic factors ease, the company should begin to report more promising results. Additionally, at the same time, its AI and advancements in technology should begin to start bearing more fruit. With the share price down around 13% since September 2023, I think now could be an opportune time to buy.

Financials

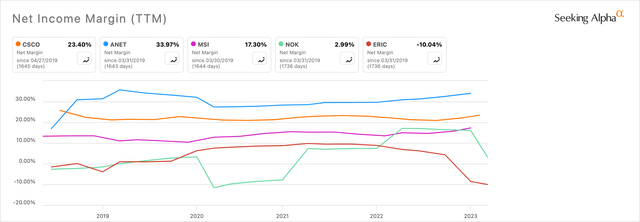

Cisco has strong profitability, with a TTM net income margin of 23.4%, which is an 856.81% lead on the sector median of 2.45%. Its five-year average net margin is 22.3%. This shows considerably strong internal efficiencies, considering its gross profit margin is 63.69%, a 30.81% lead on the sector median of 48.69%. Its five-year gross profit margin average is 63.27%.

Compared to some of its major industry peers, only one company, Arista Networks (ANET), has a higher net income margin at this time:

Its net margin should only continue to get stronger with the advent of AI and its continued development in this area. As a technology firm with a high market cap, the company could be among the first to see its margins expand as a result of a lower employee count resulting from the implementation of automation in operations.

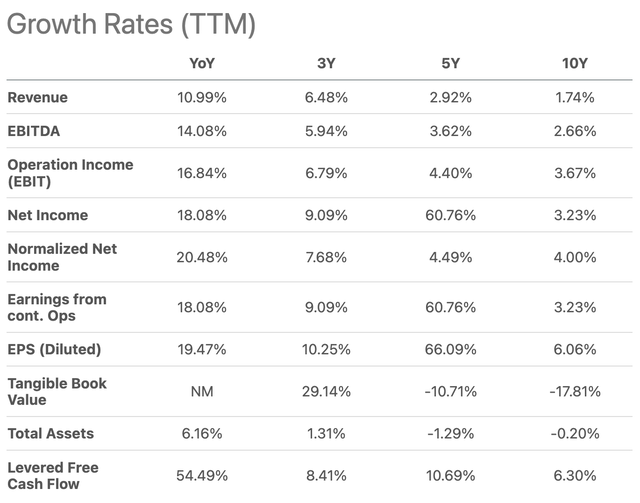

Notably, however, Cisco’s growth is less strong. Its forward EPS GAAP growth is 4.93%, a -23.03% difference from the sector median of 6.41%. Its revenue growth, on the other hand, is 10.99%, a 95.25% lead on a sector median of 5.63%. Its five-year average for YoY revenue growth is 2.58%.

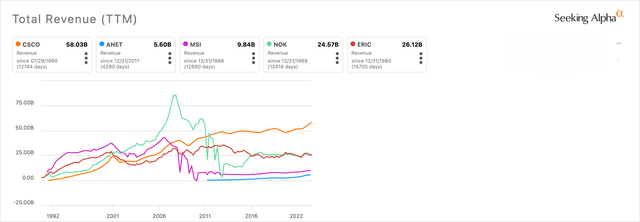

Compared to its major peers, Cisco’s revenue has stably climbed with relatively low volatility over the long term:

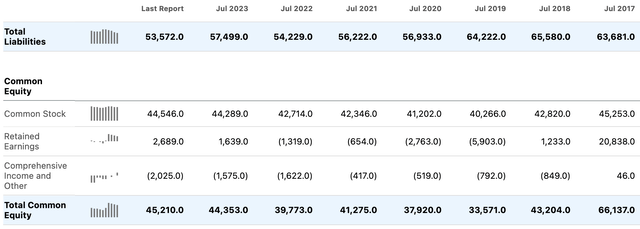

On the other hand, the company’s balance sheet could be better, as it currently has more liabilities than equity, and it has been this way for over five years:

Cisco also has high liquidity as a regular trait, so it is well protected in the event of any macroeconomic difficulties that may occur:

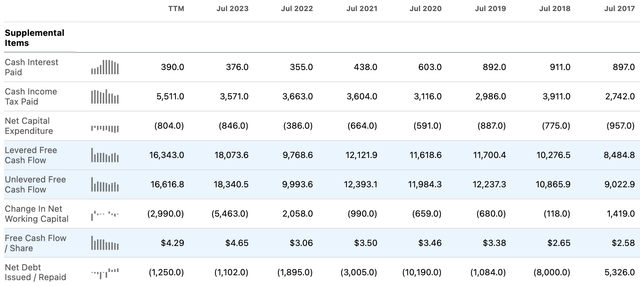

Further evidencing Cisco’s highly agile financial situation is its strong free cash flow at present and as a historical norm, which has only improved over recent years:

Valuation

Cisco’s valuation is also favorable at the moment, considering its historical share prices and sector medians. For example, its TTM P/E GAAP ratio of around 15 is a -45% difference from the sector median of around 27.5. Cisco’s five-year P/E GAAP ratio average is 18.38. Its forward P/E GAAP ratio is only slightly worse at around 16, which is to be expected based on lower earnings predicted for the financial year 2024. The company also has a forward price-to-cash-flow ratio of around 13, a -40.98% difference from the sector median of 22, and a healthy dividend yield of 3.11%, a 103.35% difference from the sector median of 1.53%.

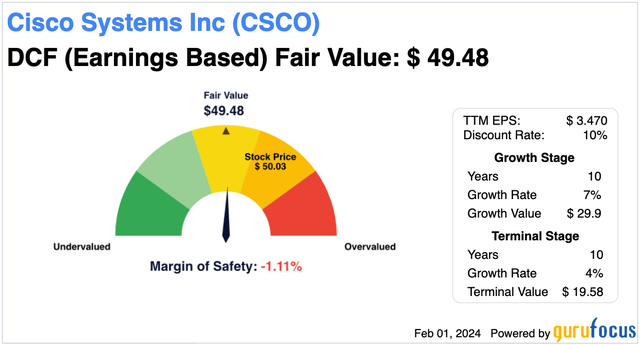

Additionally, if Cisco manages to grow its earnings per share without non-recurring items by 7% annually on average over the next 10 years, which I think is possible due to its integration of AI, it is essentially fairly valued at this time based on discounted cash flow analysis. This takes into account a 4% terminal stage growth rate in line with inflation for 10 years following the growth stage and a 10% discount rate. The fair value estimate I arrived at is $49.50, a 1% difference from the current stock price of $50.

Risks

Cisco may not grow its earnings at 7% per year on average over the next 10 years, and my estimate is higher than other analyst estimates on Seeking Alpha, indicating that the stock could be moderately overvalued right now based on some DCF analyses. Inhibited growth could result from regulatory pressures on AI, a slowdown in technology sales, and macroeconomic factors, including geopolitical risks associated with the US, China, Russia, and the Middle East.

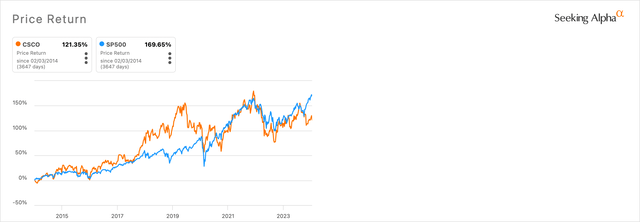

Additionally, even at my present valuation estimate, the stock is arguably unlikely to beat the S&P 500 significantly over the next 10 years in my opinion. As such, I am not looking to add Cisco to my portfolio at this time. It is a good stock to own, but because I think there are better technology shares at the moment, it isn’t promising enough to warrant an allocation.

Conclusion

Cisco’s second-quarter earnings results should begin to represent the slow year expected of the firm, which may begin to pick up in the financial year 2025. While the shares can be expected to grow in price long-term, its odds of beating the S&P 500 look unlikely. Therefore, my analyst rating for Cisco stock is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.