Summary:

- GameStop’s poor performance and inability to adapt to industry changes make it a risky investment, with a downside risk of 26.21%.

- The company’s sales have declined across all segments, and its outdated business model hinders its ability to compete with online platforms and subscription services.

- GameStop’s attempts to cut costs and enter the NFT space have not been successful in terms of driving growth, as sales in all segments remain down.

Anski

Overview

As someone who’s an avid gamer, it breaks my heart to have this stance on GameStop (NYSE:GME). This analysis is inspired by the Dumb Money movie that just landed on Netflix (NFLX). In the movie, it made Roaring Kitty (the main character) seem like some kind of genius for taking a large bet on the company. The movie hinted that the main character saw some kind of opportunity that Wallstreet missed when in reality, it was a poor decision that simply gained a large amount of hype due to the compelling narrative in my opinion. This is what led me to this analysis and what helped me see for myself just how poor of an investment GME is at these levels, in my opinion.

GameStop is a specialized retail company that distributes gaming and entertainment products across the United States, Canada, Australia, and Europe. The company’s product offerings encompass new and pre-owned gaming systems, accessories like controllers and gaming headsets, virtual reality products, as well as new and pre-owned gaming software. Additionally, GameStop provides in-game digital currency, digital downloadable content, and complete game downloads. The company also features collectibles such as apparel, toys, trading cards, gadgets, and other merchandise tailored for enthusiasts of pop culture and technology.

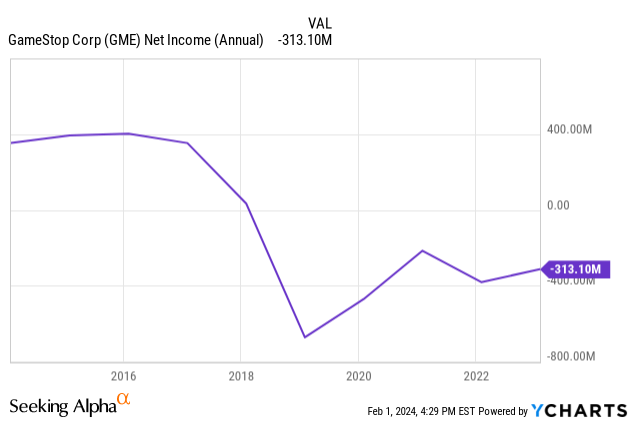

Consistent Poor Performance

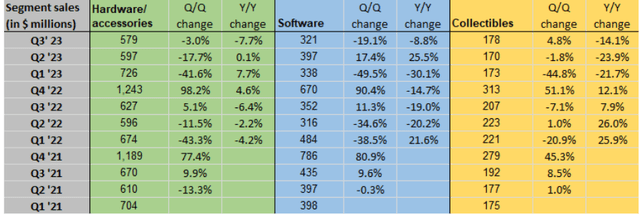

Over the last year period, the price has come down about 35%. We saw shares reach as high as $27.65/share and as low as $11.83/share. This wide range is not for investors that cannot stomach volatility. We can see that sales across all segments decreased year over year. Hardware sales are down -7.7%, Software is down -8.8% and Collectible sales are down -14.1%. Although they may have some quarters that appear to have positive growth, the trend still remains down over time. For reference, the revenue growth year over year is negative at a 5% decrease. I don’t really see any initiatives being taken from GME to improve these results either.

GME experienced a decline in net sales, recording $1.078 billion compared to $1.186 billion in the third quarter of the preceding year. However, at least GME was able to decrease their SG&A (selling, general, and administrative) expenses, which amounted to $296.5 million or 27.5% of net sales. This decrease aligns with the company-wide cost cutting measures that’s been prioritized.

Additionally, the 5-year average revenue decline YoY is -6.6%. They’ve yet to break into a positive revenue growth pattern over the last 5-year period, despite all of the hype, media attention, and buying activity they experienced during the meme stock era. If the financials didn’t improve then, I have no reason to think it will change this year.

Can’t Save Your Way To Wealth

The new CEO, Ryan Cohen, has released a memo for “extreme frugality” back in September of 2023. His tone was serious and rightfully so considering the financial shape of GME.

“Our job is to make sure GameStop is here for decades to come… Extreme frugality is required. Every expense at the company must be scrutinized under a microscope and all waste eliminated. The company has no use for delegators and money wasters. I expect everyone to treat company money like their own and lead by example.” – Ryan Cohen, CEO

To double down on this, Ryan opted to not receive a salary in his new role. While this is a great step in the right direction, it simply isn’t enough. It’s sort of like how the saying goes: “You can’t save your way to wealth”. In addition to focusing on cost cutting measures, management would benefit greatly from increasing operational efficiency. Their business model is simply outdated and they need to move on to something new. There are so many opportunities within media, streaming, and subscription services so they would benefit from trimming the fat.

To their credit, GME did try to get into the NFT space. However, it seems that there hasn’t been an active push in this department. As of 2-weeks ago, it has been reported that they are already closing this NFT marketplace after 18 months. This was a clear case of trying to capitalize on a trend, rather than build upon and innovate amongst their existing business and customer base.

No Incentive To Use GameStop

The golden days of shopping for video games are gone. I vividly remember the last game I stood in line for during a midnight release: Halo 3. While that’s not the only reason to visit a location anymore, it’s worth mentioning that the culture around gaming has changed significantly. Some people still prefer physical copies so I guess that warrants a reason to visit a physical location. Other than that, all gaming products are generally more affordable when ordering online.

As a next layer, we have services such as Microsoft’s (MSFT) Game Pass, which offers customers a library of games for a monthly fee. Some new game launch on this platform from day 1! We also have Sony’s (SONY) PlayStation Plus membership which offers the same kind of service. I honestly would’ve thought that GME would’ve found a way to insert themselves in this space but when each of these platforms have their own offering, it gets difficult to strategize your way in.

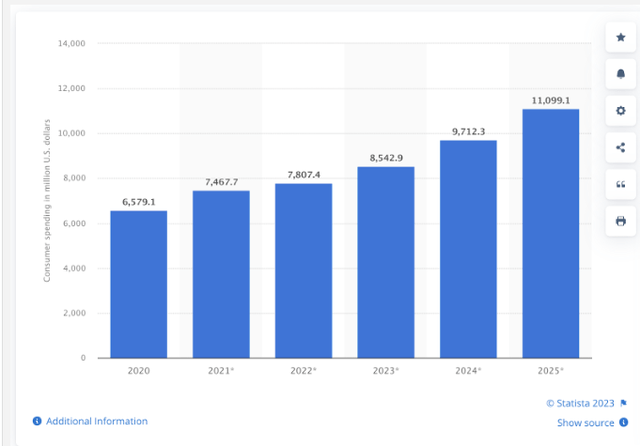

They do offer a ‘Pro” subscription service for only $25/year. However, the rewards and benefits here are not substantial enough for the average gamer. It puts them in a tough spot because if they offer too great of a discount with this Pro subscription, it can severely impact their profitability. As it is, margins on video games can already be razor-thin. A study conducted by Fidelity determined that Sony’s operating margin for new games landed somewhere between 13-15%. The same study also determined that margins can improve if you incorporate reoccurring revenue from live service titles such as Call of Duty. If GME raises the cost of this service, I assume that a lot of people would not see the value in it. GME has consistently been behind the curve on the adaptation to a subscription-based business model and it’s been a huge missed opportunity. For reference, the subscription revenue from video games has only grown over the years. The revenue from these subscriptions is estimated to grow to $11B by 2025.

We’ve seen a slew of companies lose relevance due to their lack of adaptation. I believe GameStop is heading down the same path unless they take measures that make sense. Just to name a few businesses that we’ve witnessed this happen to, we have:

- Blockbuster

- BlackBerry (BB), though still around, it has not captured the same market share as it once had.

- Kodak (KODK)

- Radio Shack

While these businesses aren’t 100% aligned with the business of GME, we do see some related patterns. Patterns such as slow to adjust product inventory, lack of adaption to the growing online demand, poor integration with peers, and surrounded by larger competitors taking over a larger percentage of market share.

Valuation

The average Wall St. price target sits at $10.50/share. This represents a downside risk of 26.21% from the current price level. Over the last 5-year period, the average revenue decline has been -6.6% per year. So even if we assumed a 1% revenue growth estimate for the sake of determining a fair value, I don’t think GME is likely to achieve it based on the current performance. The full year EPS estimate for 2024 is only 0.11. A DCF (discount cash flow) calculation here wouldn’t even make sense because of the low EPS estimate and the results would show us a fair value of $2/share. The price action is currently disconnected from reality and is vulnerable to momentum from any news.

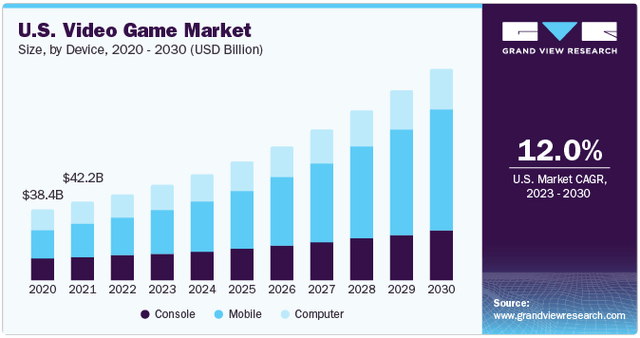

However, the video game market is projected to increase at a CAGR of 12% through 2030. With a current market cap of about $4.3B, GME has failed to capture any of this upward growth as it is. Therefore, I have no reason to believe they will capture any of the future growth since they lack any new initiatives and are already shutting down their NFT marketplace.

Risk

I think it’s highly possible that a good earnings report could send the stock upward. As we all know by now, GME has a core following that wants a comeback story to take place. It’s not hard to see that any indication of revenue growth or positive EPS growth would result in a jolt of buyers.

There is a chance that GME initiates a new recovery effort and it’s successful. They may cut costs, increase efficiencies, and focus on the most profitable part of their business, hardware. We did see net income tick up a bit since 2022. Even though no real net income growth happened yet, signs of optimism is a good motivator here to spark buying. Optimism and heavy buying can fuel the price to shoot back to its previous high of $27.65/share.

Takeaway

In summary, GameStop faces a challenging future in the gaming retail sector, marked by consistent poor performance and a failure to adapt to evolving industry practices. Despite attempts to cut costs through “extreme frugality” and a brief entrance into the NFT space, GameStop’s outdated business model is evident from the declining sales across all segments.

The company’s delayed adaptation of subscription-based models leaves GameStop trailing behind. With a downside risk of 26.21% from the current stock price, a disconnect between valuation and reality, and an inability to capture market growth, GameStop risks following the path of other businesses that succumbed to irrelevance due to a failure to adapt to technological shifts and changing consumer preferences.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.