Summary:

- Walmart is a leading omnichannel retailer with a leading market share in the US grocery industry.

- WMT has performed incredibly well and reached new highs. Management announced a 3-for-1 stock split to improve access for investors and associates.

- Walmart is focused on growth through e-commerce, advertising, and improving its cost base through automation. The company remains an operating leverage growth story.

- I argue why I should have leaned into my bullish instincts in my previous update in June 2022.

- With WMT’s valuation surging well above its 10Y average, investors looking to buy more should consider waiting for a steeper pullback.

Scott Olson

Walmart Inc. (NYSE:WMT) is a high-quality, large-scale, omnichannel retailer with a wide economic moat. As the US’s leading grocery market leader with an estimated “25% market share,” it commands a significant advantage in offering a “wide selection of nondiscretionary goods and perishable foods at competitive prices.” As a result, it helps to sustain the company’s resilience through various economic cycles, justifying its position as a top-five holding in the Consumer Staples Select Sector SPDR ETF (XLP).

In addition, given its market leader in the grocery business, management stressed that it “helps build density for Walmart’s delivery network,” allowing the company to leverage its massive scale and reach. As a result, it affords Walmart substantial advantages in its last-mile delivery, capitalizing on its “extensive physical store network of 4,700 stores within 10 miles of 90% of Americans.”

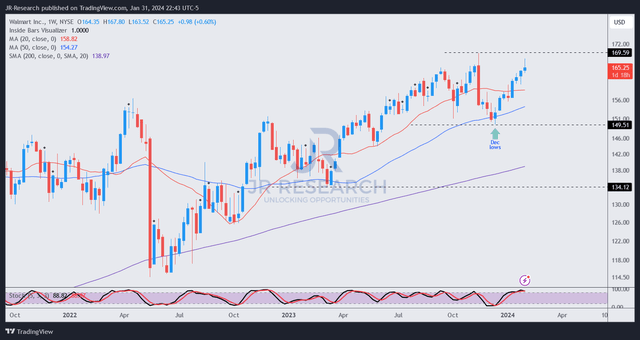

I admit that I was too cautious in my previous update in June 2022, as I assigned it a Hold rating, even though I highlighted that it could bottom out. Therefore, I should have followed my instincts and leaned bullish, as WMT has significantly outperformed the S&P 500 (SPX) (SPY) since then. In other words, WMT has continued its remarkable upward climb, taking out a new high in November 2023. Even though it fell steeply between November and December, dip-buyers returned aggressively, as WMT recovered most of the losses from its previous highs.

The company recently announced a 3-for-1 stock split, which garnered media attention. The primary intent behind the split is to improve the affordability for investors and its associates, encouraging them to own “whole shares, rather than fractions.” Therefore, the company believed it was timely, as the move should allow Walmart’s “associates to participate in the years to come.” Based on the company’s plans, WMT will trade on a split-adjusted basis starting February 26.

Given the recent revival on WMT as it nearly re-tested its November 2023 highs, should investors chase it? Or should investors wait patiently for a steeper pullback, helping to digest some of its recent optimism heading into its stock-split announcement?

In light of the broad market rally, I believe several factors are at play, notwithstanding the increased liquidity and participation emanating from the impending stock split. While investors cheer potentially increased demand from retail investors looking to buy into WMT’s long-term bullish thesis, we must also be wary about not chasing the upside if the risk/reward is no longer as favorable.

Despite the economic uncertainties, Walmart has continued to demonstrate that it could generate consistent topline growth. Accordingly, analysts forecast 6% revenue growth in FY24 (year ended January 2024), although the momentum is expected to decelerate to 3.3% in FY25. Despite that, given its scale, Walmart remains an operating leverage growth story. Consequently, Wall Street expects the company to post an adjusted EPS growth of 9.7% in FY25 and 9.4% in FY26.

Management alluded to its ability to demonstrate that growth profile in the next two years. It’s essential to pay attention to its advertising and e-commerce growth drivers, which have continued to outperform its corporate average. Furthermore, advertising is a higher-margin profitability driver expected to play an increasingly crucial role in Walmart’s long-term plans. Walmart believes that advertising could feature prominently in the next four to five years, potentially accounting for “20% to 25% of Walmart’s profit growth, given its margin profile.”

Notwithstanding the profitability inflection driven by advertising, Walmart is expected to focus on improving its cost base, as management underscored that it’s a “key factor in their plan to grow profits faster than sales over the next several years.” The company has continued to automate its warehouses and distribution centers, “improving supply chain efficiency.” These efforts are targeted to bolster its efforts in lifting its profitability. In addition, Walmart highlighted that “automation allows for twice the merchandise volume in the same footprint.” Moreover, it also “doubles the throughput while achieving a 30% efficiency improvement.” Therefore, I believe the path toward its FY25 adjusted EPS estimates is on track as the company demonstrates its resolve and execution to investors and the Street.

WMT price chart (weekly, medium-term) (TradingView)

As seen above, WMT has recovered remarkably, as it nearly re-tested its November 2023 highs. Its forward EBITDA multiple of 12.9x is also well above its 10Y average of 10.4x.

While WMT is a high-quality play, I assessed that waiting for a steeper pullback could help improve the entry levels. However, current WMT investors should consider holding on to their positions as they ride through potential near-term volatility, as I didn’t glean red flags suggesting the need to cut exposure aggressively.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XLP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!