Summary:

- Altria Group, Inc. is a dividend king with a market cap of $71 billion.

- Despite its strong fundamentals, Altria yields close to 10%.

- The issue is that the market overlooks the underlying fundamentals because of the declining top-line, which in essence is not what matters to shareholders.

- I plot a bear case and contextualize that with several reasons that have also supported my decision to go long with this stock.

Mario Tama

Introduction

Altria Group, Inc.’s (NYSE:MO) is a well-known dividend king, which has paid growing dividends for already 54 years in a row. It has also a market cap of $71 billion, which means that MO is included in major U.S. equity indices that focus on large-cap and/or dividend-paying stocks.

Despite the remarkable history, strong position in the market, growing earnings, and increasing buybacks, Altria yields close to 10%.

In my opinion, there is a huge disconnect between the underlying fundamentals and MO’s valuations. While there are risks stemming from more restrictive regulations and a declining top line, Altria carries an ample financial buffer that is sufficient to absorb the potential hiccups down the road without impairing the ability to distribute enticing dividends.

Let me now explain why I am currently betting big on Altria.

The story of Altria’s demise

There are several elements that foster negative chatter around MO’s long-term prospects as well as the Company’s ability to accommodate these juicy dividend streams.

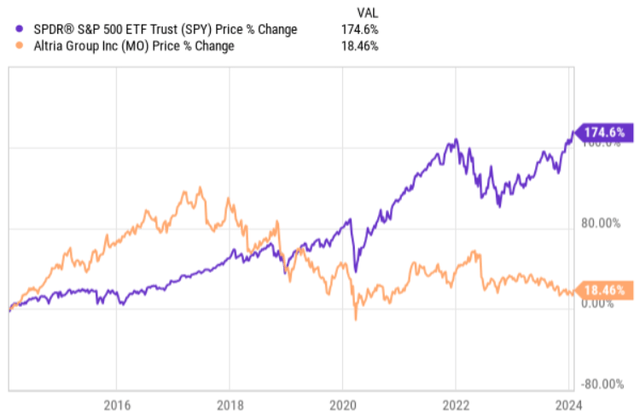

One low-hanging fruit for the bears is the massive underperformance relative to the S&P 500, which has been consistently starting from 2017. Granted, if we included dividends in the equation, the gap would not be as wide, but still, the presence of negative alpha would not disappear.

From the share price perspective, bears can elegantly point to a complete stagnation since 2020, while the overall stock market has gone nowhere but up.

Then, if we couple this with the top-line dynamics, the picture could indeed get at least optically depressing. For instance, MO has experienced several years of a continued sales decline. Plus, starting from 2016, Altria has year by year recorded an erosion of its market share (going from 55% in 2016 to 46.4% in 2022).

To add fuel to the fire, bears could underscore Altria’s external debt, which currently sits at ~ $25 billion. In the context of its already struggling sales profile, loss in market share, and potential “black swan” events from aggressive regulations, such a debt position could eventually destabilize the Company and lead to a dividend cut.

Where the market is wrong

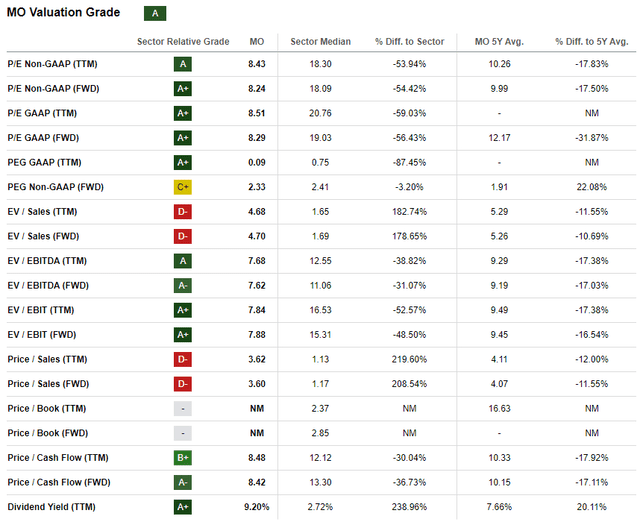

In my opinion, the market is assigning too harsh a discount to Altria’s business. By looking at the valuation table below, we can notice how in almost all metrics, MO stands out as a highly attractive stock.

Areas where MO is relatively poorly positioned are associated with the sales generation component. Namely, the top-line is seemingly too shallow in relation to the current price or enterprise value figure. Plus, this is also a point of struggle for Altria as indicated above. For example, in Q4, 2023 earnings report we can spot a revenue drop of ~4% compared to Q4, 2022.

However, this is not what really matters as long as the Company generates incremental value at the cash or bottom-line level. We have to remember that investors are rewarded in the form of cash and earnings (e.g., via share buybacks, dividends, earnings growth) and not from the results at the top-line level. Theoretically, the top-line could grow 2x but if the cash conversion and margins are not there, no value is created.

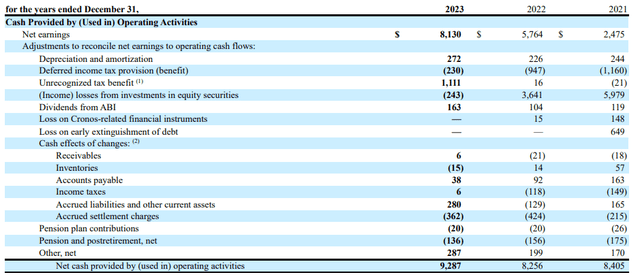

In Altria’s case, we can see this pattern playing out nicely. While the sales have decreased, the cash flows from operations have continued to expand.

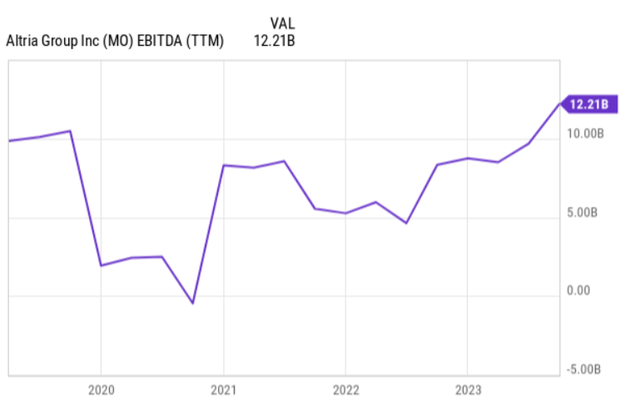

The same situation can be seen in the TTM EBITDA chart below, where currently MO generates a higher EBITDA figure than in 2020 when the share price was marginally lower.

So, from the cash flow perspective, MO is actually progressing well and delivering stable results despite the massive discount that could be implied by an almost double-digit yield.

What is interesting is that the consensus estimate for the next 4 years signals that Altria will be able to deliver 2-4% of EPS growth. Again, this is not what we can typically observe among stocks that provide double-digit yields.

Moreover, in terms of the growth prospects, the Management (Billy Gifford – Chief Executive Officer) gave a very promising picture of NJOY in the recent (Q4, 2023) earnings call:

As far as the NJOY, certainly, you can expect more investment in 2024 than you did in 2023. Some of that’s just the nature of we didn’t close it until June 1, but now we’re in 75,000 stores. And so we’re really looking forward to having that in the stores where consumers are shopping, having it displayed much more prominently than it ever has been we secured, as I mentioned, the great spot on the fixture. But having that in the consideration set, we feel like once we get that in consumers’ hands, consumer research would tell us that they will convert through time for the product because they enjoy it.

Finally, if we look at the financial risk and the level of embedded buffer in Altria’s financials, we will notice a rather sound picture here as well.

First of all, the key leverage and interest rate coverage metrics are extremely healthy (as of Q4, 2023):

- net debt to EBITDA of 1.9x.

- interest coverage TTM of 10x.

- cash flow payout ratio of 57%.

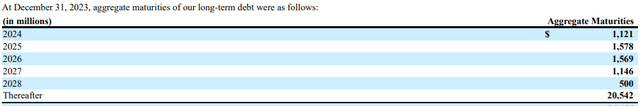

Also, the underlying structure of leverage is healthy embodying well-laddered debt maturity profiles.

Namely, Altria has managed to achieve a perfect combination when it comes to its debt position, where on the one hand most of the debt maturities are fixed at below-market-level interest rates, and on the other hand, their maturity profiles are heavily backend-loaded with ~85% of the total debt stack maturing in years beyond 2028.

The bottom line

Altria is a misunderstood stock. The declining revenues, stagnating share price, and risks of unfavorable regulatory decisions are overshadowing the underlying fundamentals, which have delivered strong cash earnings and support a stable EPS outlook going forward.

The current yield of ~9.8% in conjunction with its robust leverage profile and slightly advancing earnings warrants a clear buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.